by Calculated Risk on 11/13/2008 05:25:00 PM

Thursday, November 13, 2008

Charlie Rose: A conversation with Bill Ackman

A half hour converstion with Bill Ackman of Pershing Square Capital Management:

Federal Reserve Assets Increase $139 Billion this Week

by Calculated Risk on 11/13/2008 04:36:00 PM

Some day the Fed's balance sheet will shrink ... hopefully ... but for now the assets are increasing rapidly. The assets on the Fed's balance sheet have more than doubled from under $1 trillion at the beginning of 2008 to about $2.214 trillion now.

Dallas Fed President Richard Fisher commented last month that he expects the assets to grow to $3 trillion by the end of this year.

"I would not be surprised to see them aggregate to $3 trillion—roughly 20 percent of GDP—by the time we ring in the New Year."Here is the Federal Reserve report released today.

Click on graph for larger image in new window.

The Federal Reserve assets increased $139 billion this week to $2.214 trillion. Note: the graph shows Total Factors Supplying Federal Reserve Funds and is an available series that is close to assets.

So far the graph shows Federal Reserve assets are still increasing rapidly. Fisher may be right - $3 trillion by the end of the year.

The good news is the Fed marked up the value of the Bear Stearns assets to $26,949 from $26,863 million last week - an increase of $86 million!

Record Spreads between 30 Year Corporate and Treasury Yields

by Calculated Risk on 11/13/2008 02:30:00 PM

Here is another measure of credit stress. The following graph shows the spread between 30 year Moody's Aaa and Baa rated bonds and the 30 year treasury.

The Moody's data is from the St. Louis Fed:

Moody's tries to include bonds with remaining maturities as close as possible to 30 years. Moody's drops bonds if the remaining life falls below 20 years, if the bond is susceptible to redemption, or if the rating changes.

Click on table for larger image in new window.

Click on table for larger image in new window.There are periods when the spread increases because of concerns of higher default rates (like in the severe recession of the early '80s), but the recent spread is unprecedented.

Credit Crisis Indicators: LIBOR Rises Slightly

by Calculated Risk on 11/13/2008 12:15:00 PM

As economic activity falls off a cliff, here is the daily look at a few credit indicators ...

The London interbank offered rate, or Libor, that banks say they charge each other for such loans increased almost 2 basis points to 2.15 percent today, according to British Bankers' Association data. The last time the rate climbed was Oct. 10.The three-month LIBOR was 2.13% yesterday so this isn't much of a change. The rate peaked at 4.81875% on Oct. 10. (unchanged)

This is just plain ugly, but with the effective Fed Funds rate at 0.29% (as of yesterday), this is probably somewhat in the right range. At some point, I'd like to see the effective Fed funds rate close to the target rate (currently 1.0%) and the 3 month yield within 25 bps of the target rate.

The TED spread is under 2.0, but still too high. The peak was 4.63 on Oct 10th. I'd like to see the spread move back down to 1.0 or lower. A normal spread is about 0.5.

Here is a list of SFP sales. It has been a few days without an announcement from the Treasury... (no progress).

So far the Federal Reserve assets are still increasing rapidly. It will be a good sign - sometime in the future - when the Fed assets start to decline.

This is the spread between high and low quality 30 day nonfinancial commercial paper.

The Fed is buying higher quality commercial paper (CP) and this is pushing down the yield on this paper (0.65% yesterday!) - and increasing the spread between AA and A2/P2 CP. So this indicator has been a little misleading. Also the recession is creating concern for lower rated paper. Still, if the credit crisis eases, I'd expect a significant decline in this spread.

Mostly a "no progress" day for these indicators ... there is a long way to go. I'm looking forward to seeing the Fed's balance sheet (to be released at 4:30PM ET).

Campbell Survey: Home Sales to Fall Sharply in October

by Calculated Risk on 11/13/2008 11:00:00 AM

From Campbell Surveys: Survey of Real Estate Agents Shows 19% Drop In Home Sales From September to October (no link)

Stresses in the real estate market caused U.S. home sales to fall sharply between September and October, according to a national survey of more than 2,500 real estate agents conducted November 1-8.The most recent Pending Home Sales report from the NAR indicated a decline in pending sales in September, but this survey suggests pending sales fell off a cliff in October.

According to the survey firm, Campbell Communications, buy-side agents responding to the survey indicated a 19% drop in completed transactions between the months of September and October. Declines were especially severe for sales of non-distressed properties in states where home prices have fallen rapidly during the past year, agents indicated. For example, buy-side agents indicated a 22% decline in non-distressed sales in Florida, a 32% drop in California, and a 51% drop in Michigan.

Another Day, Another Bank Holding Company

by Calculated Risk on 11/13/2008 10:54:00 AM

Rumor has it Petco is applying to become a bank holding company (just kidding - from BR!).

From the WSJ: CIT Looks to Transform Into Bank

Commercial lender CIT Group Inc. said it has applied to become a bank holding company, looking to access part of the Federal Reserve's $700 billion in funds being pumped into financial companies and to participate in the Treasury Department's $250 billion capital-infusion program.

Trade Deficit Declines to $56.5 Billion in September

by Calculated Risk on 11/13/2008 09:03:00 AM

A few points from the trade report:

The Census Bureau reports:

[T]otal September exports of $155.4 billion and imports of $211.9 billion resulted in a goods and services deficit of $56.5 billion, down from $59.1 billion in August, revised. September exports were $9.9 billion less than August exports of $165.3 billion. September imports were $12.5 billion less than August imports of $224.4 billion.

Click on table for larger image in new window.

Click on table for larger image in new window.This graph from the Census Bureau shows that both imports and exports are declining.

Although the trade deficit is declining - and will decline more in coming months because of the decline in oil prices - growth in export related business will probably no longer be a positive for the U.S. economy as the global economy slides into recession too.

This graph shows the U.S. trade deficit through September. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products. The current recession is marked on the graph.

This graph shows the U.S. trade deficit through September. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products. The current recession is marked on the graph.The oil deficits is starting to decline and will decline much further in October and November. Note that the trade deficit ex-petroleum is really a China problem now (the trade deficit with China was a record $27.8 billion in September).

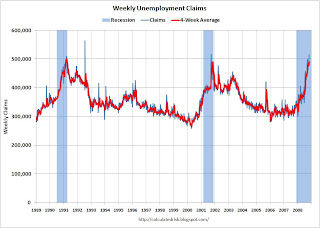

Initial Unemployment Claims over 500 Thousand

by Calculated Risk on 11/13/2008 08:39:00 AM

Initial unemployment claims of 516,000 were the highest since Sept 2001; just after the attacks of 9/11. Continued unemployment claims are at the highest level since 1983.

The DOL reports on weekly unemployment insurance claims:

In the week ending Nov. 8, the advance figure for seasonally adjusted initial claims was 516,000, an increase of 32,000 from the previous week's revised figure of 484,000. The 4-week moving average was 491,000, an increase of 13,250 from the previous week's revised average of 477,750.

...

The advance number for seasonally adjusted insured unemployment during the week ending Nov. 1 was 3,897,000, an increase of 65,000 from the preceding week's revised level of 3,832,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows weekly claims. The four moving average is at 491,000. This is a very high level, and indicates significant weakness in the labor market.

Continued claims are now at 3.897 million, the highest level since 1983.

The second graph shows continued claims since 1989.

The second graph shows continued claims since 1989.Note: Continued claims hit 4.7 million during the 1982 recession (not shown), although the population was much smaller then. The unemployment rate peaked at 10.8% in 1982 (compared to 6.5% currently).

This suggests that Novemeber will be another very weak month for employment.

Mervyn King: UK Worst Economic Downturn in 30 years

by Calculated Risk on 11/13/2008 01:06:00 AM

From The Times: Economy faces sharpest downturn for 30 years

The British economy faces its toughest year in almost three decades, the Governor of the Bank of England said yesterday. Mervyn King gave warning of “very difficult times” ahead and an even sharper recession than that of the early Nineties.

...

In a dire forecast, the Bank predicted that the economy would shrink next year by up to 2 per cent. A slump on this scale would outstrip even the brutal downturn of 1991, when GDP fell 1.4 per cent. It would mark the economy’s gravest year since 1980 ...

The report said that the slowdown could be deeper and longer lasting if banks continued to curb their lending, if consumers and businesses had to cut spending even more sharply and if unemployment climbed even more rapidly than is feared.

Wednesday, November 12, 2008

ABX and CMBX Cliff Diving

by Calculated Risk on 11/12/2008 09:37:00 PM

Check out the ABX-HE-AAA- 07-2 close today. More Cliff Diving!

Note: The ABX indices are based on credit default swaps (CDS) for various tranches of subprime mortgage-backed securities (MBS). For some background, here is a post at the Cleveland Fed back in March, 2007.

All of the CMBX indices are setting new record lows again.

Check out the CMBX-NA-BB-4 close today. To the moon, Alice!

The CMBX is a CMBS (Commercial Mortgage-Backed Securities) credit default index just like the ABX - except up is down for the CMBX indices. The CMBX is quoted as spreads, whereas ABX is quoted as bond prices. When the spreads increase - chart going up - the bond prices are going down.

Tim Duy's Fed Watch

by Calculated Risk on 11/12/2008 08:09:00 PM

Professor Duy writes a regular column at Economist's View called Fed Watch - it is definitely worth reading (as is Economist's View).

From Fed Watch: Misguided Policies

From the wires:Dr. Duy offers some suggestions for policy makers:15:30 *PAULSON SAYS MARKET TURMOIL WON'T ABATE UNTIL HOUSING REBOUNDSSuch comments always leave me with a sick feeling in my stomach – if policymakers are waiting for the housing market to rebound, they had better be prepared for a long wait. ... I think the biggest potential for policy error lies in maintaining the delusion that preventing housing, and by extension, consumer spending, from adjusting is central to fixing the nation’s economy. Policy would be best focused on supporting the inevitable transition away from debt-supported consumer dependent growth dynamic.

Housing prices are falling because fundamentally the price of housing became unaffordable.

emphasis added

Policymakers need to come clean with the American public: Future patterns of growth will simply be less dependent on consumer spending. We are entering a period of structural adjustment, and it will be painful. We spent decades pretending that the relentless focus on producing nontradable goods and relying on a ballooning current account deficit to hide our lack of productive capacity was an appropriate policy approach. But ultimately, those policies have failed us, with stagnant income growth for median income families and the deepest recession since the 1980’s (or even worse).Investment in infrastructure makes sense, especially since construction (and construction employment) is one of the hardest hit sectors of the economy. And with the commercial real estate slump picking up steam (and more construction job losses to come), what better area to invest than in the infrastructure of the U.S.A.?

This admission, however, in no way, shape, or form means policy options are limited. The admission simply defines your policy. In the short term, policy can cushion the transition by expanding the social safety net. In the medium term, if consumption is falling, and private investment is unable to compensate, then the federal authority should fill the gap. There is no shortage of sectors of the economy that offer opportunities for investment. In so many ways, we are running on the fumes of the infrastructure investment made by the last generation. Roads, bridges, channels, etc. – you name it, there is an opportunity. Or human capital, via education?... Reasonable policymakers free from ideological constraints can develop a host of potential projects without relying on bridges to nowhere.

Intel Warns "Fourth-Quarter Below Expectations"

by Calculated Risk on 11/12/2008 05:17:00 PM

Press Release: Intel's Fourth-Quarter Business Below Expectations

The company now expects fourth-quarter revenue to be $9 billion, plus or minus $300 million, lower than the previous expectation of between $10.1 billion and $10.9 billion. Revenue is being affected by significantly weaker than expected demand in all geographies and market segments. In addition, the PC supply chain is aggressively reducing component inventories.That is a huge cut in guidance.

Whitehead: "Worse than the Depression"

by Calculated Risk on 11/12/2008 04:40:00 PM

Upping the ante on JPMorgan's CEO Dimon and Merrill's CEO Thain (see previous post), former Goldman Sachs chairman John Whitehead is quoted as saying the current slump will be worse than the Great Depression!

From Reuters: Whitehead sees slump worse than Depression (hat tip Rex Nutting)

The economy faces a slump deeper than the Great Depression and a growing deficit threatens the credit of the United States itself, former Goldman Sachs chairman John Whitehead ...So far most of the Great Depression discussions have been phrased in terms of "worst since". Whitehead has taken the next step - however I think "worse than" is extremely unlikely.

"I think it would be worse than the depression," Whitehead said. "We're talking about reducing the credit of the United States of America, which is the backbone of the economic system. ... I see nothing but large increases in the deficit, all of which are serving to decrease the credit standing of America. ... I just want to get people thinking about this, and to realize this is a road to disaster. I've always been a positive person and optimistic, but I don't see a solution here."

Dimon: Recession may be worse than Credit Crisis

by Calculated Risk on 11/12/2008 04:17:00 PM

From Bloomberg: Dimon Says Recession May Be Worse Than Credit Crisis

``We think the economy could be worse than the capital- markets crisis,'' [JPMorgan Chase & Co. Chief Executive Officer Jamie] Dimon said. ``You really need to separate them because they have completely different effects on our businesses and on most businesses.''Not to be outdone, John Thain, chairman and chief executive of Merrill Lynch compared the current contraction to the Great Depression, from the Financial Times: Merrill chief sees severe global slowdown

“Right now, the US economy is contracting very rapidly. We are looking at a period of global slowdown,” [Thain] told investors. “This is not like 1987 or 1998 or 2001. The contraction going on is bigger than that. We will in fact look back to the 1929 period to see the kind of slowdown we’re seeing now.”

...

"There is no such thing as decoupling. ... Each individual economy will be more or less affected, depending on reliance on global trade and commerce.”

GE, GM: Bailout News

by Calculated Risk on 11/12/2008 03:22:00 PM

Update: From the WSJ: GE Says Government Will Guarantee Debt

General Electric Co. said Wednesday the government will insure up to $139 billion of debt issued by its financing arm, GE Capital Corp., under a new program.From Bloomberg: Frank's Plan Gives GM, Ford, Chrysler $25 Billion

The conglomerate announced on its Web site that GE Capital has been approved to participate in the new Temporary Liquidity Guarantee Program operated by the Federal Deposit Insurance Corporation.

General Motors Corp., Ford Motor Co. and Chrysler LLC would get $25 billion in additional aid from the Treasury's financial-rescue plan under a proposal by House Financial Services Committee Chairman Barney Frank.It's hard to keep up ...

Legislation is needed to authorize the Treasury to use part of its $700 billion rescue fund for the auto industry, Frank said today. He scheduled a hearing on the measure for Nov. 19.

``The consequences of a collapse of the American automobile industry would be particularly troublesome,'' Frank, a Massachusetts Democrat, told reporters in Washington.

Video: Paulson on TARP

by Calculated Risk on 11/12/2008 02:20:00 PM

Here is the press conference from CNN:

Credit Crisis Indicators: A little Progress

by Calculated Risk on 11/12/2008 12:57:00 PM

As economic activity falls off a cliff, here is the daily look at a few credit indicitors ...

The 3-month Libor rate fell to 2.13% from 2.18%, according to Dow Jones, the lowest level for the rate since Oct. 27, 2004.The three-month LIBOR was 2.18% yesterday. The rate peaked at 4.81875% on Oct. 10. (Better)

With the effective Fed Funds rate at 0.27% (as of yesterday), this is probably somewhat in the right range. At some point, I'd like to see the effective Fed funds rate close to the target rate (currently 1.0%).

The TED spread is under 2.0, but still too high. The peak was 4.63 on Oct 10th. I'd like to see the spread move back down to 1.0 or lower. A normal spread is about 0.5.

Here is a list of SFP sales. It has been a few days without an announcement from the Treasury... (no progress).

So far the Federal Reserve assets are still increasing rapidly. It will be a good sign - sometime in the future - when the Fed assets start to decline.

This is the spread between high and low quality 30 day nonfinancial commercial paper.

The Fed is buying higher quality commercial paper (CP) and this is pushing down the yield on this paper (0.65% yesterday!) - and increasing the spread between AA and A2/P2 CP. So this indicator has been a little misleading. Also the recession is creating concern for lower rated paper. Still, if the credit crisis eases, I'd expect a significant decline in this spread.

The LIBOR is down and the TED spread is slightly lower - so there is a little progress today, but there is still a long way to go.

Macy's Sharply Reduces 2009 Planned Capital Expenditures

by Calculated Risk on 11/12/2008 12:10:00 PM

From an 8-K SEC filing this morning:

"In recognition of the weak economy, we reduced our budget for 2009 capital expenditures from approximately $1 billion to a range of $550 million to $600 million, compared with approximately $950 million in 2008."This significant reduction in 2009 capital expenditures appears widespread (many companies are announcing reduced CapEx for 2009) - and this will hit non-residential investment in both structures and equipment. This is another blow for commercial real estate.

Terry J. Lundgren, Macy's, Nov 12, 2008

Paulson: Buying Troubled Assets Not Effective Use of TARP

by Calculated Risk on 11/12/2008 10:47:00 AM

How things have changed ...

Here are Paulson's prepared remarks on the progress of the TARP.

Priorities for Remaining TARP FundsThere a couple of new wrinkles. First the Treasury is exploring ways to have private matching funds:

We have evaluated options for most effectively deploying the remaining TARP funds, and have identified three critical priorities. First, we must continue to reinforce the stability of the financial system, so that banks and other institutions critical to the provision of credit are able to support economic recovery and growth. Although the financial system has stabilized, both banks and non-banks may well need more capital given their troubled asset holdings, projections for continued high rates of foreclosures and stagnant U.S. and world economic conditions. Second, the important markets for securitizing credit outside of the banking system also need support. Approximately 40 percent of U.S. consumer credit is provided through securitization of credit card receivables, auto loans and student loans and similar products. This market, which is vital for lending and growth, has for all practical purposes ground to a halt. Addressing these two priorities will have powerful impacts on the overall financial system, the strength of our financial institutions and the availability of consumer credit. Third, we continue to explore ways to reduce the risk of foreclosure.

Over these past weeks we have continued to examine the relative benefits of purchasing illiquid mortgage-related assets. Our assessment at this time is that this is not the most effective way to use TARP funds, but we will continue to examine whether targeted forms of asset purchase can play a useful role, relative to other potential uses of TARP resources, in helping to strengthen our financial system and support lending.

emphasis added

Any future program should maintain our principle of encouraging participation of healthy institutions while protecting taxpayers. We are carefully evaluating programs which would further leverage the impact of a TARP investment by attracting private capital, potentially through matching investments. In developing a potential matching program, we will also consider capital needs of non-bank financial institutions not eligible for the current capital program; broadening access in this way would bring both benefits and challenges.And the Treasury is also looking at supporting some securitization:

Second, we are examining strategies to support consumer access to credit outside the banking system. ... With the Federal Reserve we are exploring the development of a potential liquidity facility for highly-rated AAA asset-backed securities. We are looking at ways to possibly use the TARP to encourage private investors to come back to this troubled market, by providing them access to federal financing while protecting the taxpayers' investment. ... While this securitization effort is targeted at consumer financing, the program we are evaluating may also be used to support new commercial and residential mortgage-backed securities lending.

Fed to Banks: Lend!

by Calculated Risk on 11/12/2008 10:12:00 AM

At this critical time, it is imperative that all banking organizations and their regulators work together to ensure that the needs of creditworthy borrowers are met.

...

[The Department of the Treasury, the Federal Deposit Insurance Corporation, and the Federal Reserve] expect all banking organizations to fulfill their fundamental role in the economy as intermediaries of credit to businesses, consumers, and other creditworthy borrowers. Moreover, as a result of problems in financial markets, the economy will likely become increasingly reliant on banking organizations to provide credit formerly provided or facilitated by purchasers of securities. Lending to creditworthy borrowers provides sustainable returns for the lending organization and is constructive for the economy as a whole.

It is essential that banking organizations provide credit in a manner consistent with prudent lending practices and continue to ensure that they consider new lending opportunities on the basis of realistic asset valuations and a balanced assessment of borrowers' repayment capacities. However, if underwriting standards tighten excessively or banking organizations retreat from making sound credit decisions, the current market conditions may be exacerbated, leading to slower growth and potential damage to the economy as well as the long-term interests and profitability of individual banking organizations. Banking organizations should strive to maintain healthy credit relationships with businesses, consumers, and other creditworthy borrowers to enhance their own financial well-being as well as to promote a sound economy.

emphasis added