by Calculated Risk on 11/09/2008 04:42:00 PM

Sunday, November 09, 2008

The Commercial Real Estate Bust

Since investment in non-residential structures is slowing (especially malls, hotels, and offices), a key question is how did the commercial real estate (CRE) investment boom compare to the residential housing bubble? And how did the CRE boom compare to previous CRE booms?

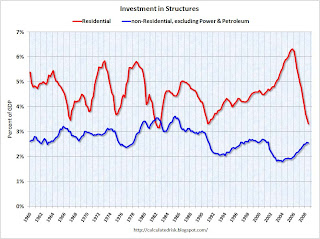

The following graph shows residential investment compared to investment in non-residential structures as a percent of GDP since 1960. All data from the BEA.

Note: Residential investment is primarily single family structures, multi-family structures, commissions, and home improvement. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The recent housing boom and bust is very clear (in red).

Residential investment was 3.3% of GDP in Q3 2008, the lowest level since 1982 (just under 3.2%).

Non-residential investment in structures increased to almost 4% of GDP in Q3. This investment is slowing down right now (the Census Bureau has reported declines in non-residential investment for the last two months), and investment in non-residential structures will almost certainly be negative in Q4.

The current non-residential boom was greater than the late '90s boom, but much less than the non-residential boom in the '80s.

However much of the recent boom in non-residential investment is energy related. The second graph compares residential investment to non-residential investment in structures excluding Power and Petroleum exploration as a percent of GDP since 1960. With this comparison, the recent boom is less than the late '90s boom, and far less than the S&L related '80s boom. This clearly shows that the recent boom in non-residential investment (ex power and petro) was not as excessive as the housing bubble.

This clearly shows that the recent boom in non-residential investment (ex power and petro) was not as excessive as the housing bubble.

Residential investment has declined by 3% of GDP so far from the peak. Non-residential investment would have to decline to about 1% of GDP (see first graph) to match the impact of GDP from the residential bust so far. And excluding power and petroleum, non-residential investment would have to be below zero to match the impact on GDP from the residential bust!

In percentage terms, residential has collapsed by about 50% (compared to GDP). Non-residential would have to decline to less than 2.0% of GDP (1.3% of GDP ex-power and petroleum) - the lowest level in history by far - to match the residential collapse in percentage terms.

Also, the recent boom for CRE was much less than the S&L related boom in the '80s, and even less than the late '90s CRE boom.

Some areas of non-residential investment have been overbuilt, and I've forecast significant declines for investment in offices, malls, and lodging. But those looking for a collapse in CRE investment comparable to the current residential investment bust are wrong.

WSJ: $586 Billion Stimulus Package in China

by Calculated Risk on 11/09/2008 10:49:00 AM

From the WSJ: China Announces $586 Billion Stimulus Package

China's government announced a two-year stimulus exceeding a half-trillion dollars to offset the impact of slowing global growth ...Professor Roubini cautioned last week about a hard landing in China (Note: Roubini argues that China's economy needs to grow at more than 6% per year to absorb the about 24 million workers joining the labor force every year): The Rising Risk of a Hard Landing in China: The Two Engines of Global Growth – U.S. and China – are Now Stalling

Just a year ago, China had adopted an unprecedented "tight" monetary policy, a step up in its three-year effort to keep the fast-growing economy from barreling out of control because it was expanding too quickly.

In conclusion the risk of a hard landing in China is sharply rising; a deceleration in the Chinese growth rate to 7% in 2009 - just a notch above a 6% hard landing – is highly likely and an even worse outcome cannot be ruled out at this point. The global economy is already headed towards a global recession as advanced economies are all in a recession and the U.S. contraction is now dramatically accelerating. The first engine of global growth – the U.S. on the consumption side – has now already shut down. The second engine of global growth – China on the production side – is also on its way to stalling. Thus, with the two main engines of global growth now in serious trouble a global hard landing is now almost a certainty. And a hard landing in China will have severe effects on growth in emerging market economies in Asia, Africa and Latin America as Chinese demand for raw materials and intermediate inputs has been a major source of economic growth for emerging markets and commodity exporters. The sharp recent fall in commodity prices and the near collapse of the Baltic Freight index are clear signals that Chinese and global demand for commodities and industrial inputs is sharply falling. Thus, global growth – at market prices – will be close to zero in Q3 of 2008, likely negative in Q4 of 2009 and well into negative territory in 2009. So brace yourself for an ugly and protracted global economic contraction in 2009.

Saturday, November 08, 2008

Some in Congress push for TARP Aid for Automakers

by Calculated Risk on 11/08/2008 08:11:00 PM

From the WSJ: Pelosi, Reid Press for TARP Aid for Auto Industry

House Speaker Nancy Pelosi and Senate Majority Leader Harry Reid sent ... a letter to Treasury Secretary Henry Paulson urging him to assist the Big Three auto makers by considering broadening the $700 billion Troubled Asset Relief Program to help the troubled industry.Everyone wants a piece of the TARP.

...

Though the administration is reluctant to widen the program to cover autos, there has been discussion among Bush officials of expanding use of the $700 billion to buy equity stakes in a range of financial-sector companies, moving beyond just banks and insurers. The focus would be on assisting companies that provide financing to the broad economy, such as bond insurers and specialty finance firms ...

Franklin Bank Failure and Commercial Real Estate

by Calculated Risk on 11/08/2008 04:27:00 PM

From Bloomberg:Ranieri Becomes Victim of Crisis as Franklin Seized

Lewis Ranieri, who helped create the mortgage-securities market in the 1980s while at Salomon Brothers Inc., became a victim of its collapse after his Houston-based bank was seized.This is a key point: Many of the bank failures will not be directly from residential, but from Construction & Development (C&D) and commercial real estate (CRE) loans.

...

``The residential side was not their problem, it was clearly the commercial side,'' said David Lykken, co-founder of Mortgage Banking Solutions, an Austin, Texas-based consulting firm. ``The reason it took a little longer is because that trailed residential,''

Restaurant Outlook Grim

by Calculated Risk on 11/08/2008 06:35:00 AM

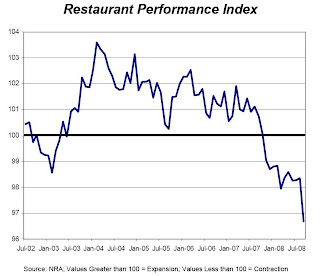

From the National Restaurant Association: NRA research finds majority of operators report sales and traffic declines; expectations at an all-time low level. (hat tip Lyle)

“The September decline in the Restaurant Performance Index was the result of broad-based declines across the index components, with both the Current Situation and Expectations indices falling to record lows,” said Hudson Riehle, senior vice president of Research and Information Services for the Association. “Nearly two out of three restaurant operators reported negative same-store sales and traffic levels in September, while 50 percent expect their sales in six months to be lower than the same period in the previous year.”

“The rapid deterioration in economic conditions is reflected in operator sentiment, with a record 42 percent of restaurant operators saying the economy is currently the number-one challenge facing their business,” Riehle added. “Operators aren’t optimistic about the economy looking forward either, with 50 percent expecting economic conditions to worsen in six months.”

Click on graph for larger image in new window.

Any reading below 100 suggests contraction. This index doesn't have a long history, so it is not surprising that the index is at a record low.

Still the index is between below 100 for 13 consecutive months. It is typical in a recession for consumers to pull back on discretionary spending, and restaurants usually feel the pain acutely.

Note that this was for September. It appears October consumer spending was much worse.

FDIC: Two More Bank Failures Numbers 18 and 19 this year

by Calculated Risk on 11/08/2008 12:44:00 AM

Prosperity Bank Acquires All the Deposits of Franklin Bank, S.S.B., Houston, Texas

Franklin Bank, S.S.B., Houston, Texas, was closed today by the Texas Department of Savings and Mortgage Lending, and the Federal Deposit Insurance Corporation (FDIC) was named receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Prosperity Bank, El Campo, Texas, to assume all of the deposits, including those that exceeded the insurance limit, of Franklin Bank.Pacific Western Bank Acquires All the Deposits of Security Pacific Bank, Los Angeles, California

...

As of September 30, 2008, Franklin Bank had total assets of $5.1 billion and total deposits of $3.7 billion. Prosperity Bank agreed to assume all the deposits, including the brokered deposits, for a premium of 1.7 percent. In addition to assuming all of the failed bank's deposits, Prosperity Bank will purchase approximately $850 million of assets. The FDIC will retain the remaining assets for later disposition.

...

The FDIC estimates that the cost of today's transaction to its Deposit Insurance Fund will be between $1.4 billion and $1.6 billion.

Security Pacific Bank, Los Angeles, California, was closed today by the Commissioner of the California Department of Financial Institutions, and the Federal Deposit Insurance Corporation (FDIC) was named receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Pacific Western Bank, Las Angeles, California, to assume all of the deposits of Security Pacific.

...

As of October 17, 2008, Security Pacific had total assets of $561.1 million and total deposits of $450.1 million. Pacific Western agreed to assume all the deposits for a two percent premium. In addition to assuming all of the failed bank's deposits, Pacific Western will purchase approximately $51.8 million of assets. The FDIC will retain the remaining assets for later disposition.

...

The FDIC estimates that the cost to the Deposit Insurance Fund will be $210 million.

Friday, November 07, 2008

The Slowdown in China

by Calculated Risk on 11/07/2008 07:31:00 PM

This is interesting from Bloomberg: China Minister Xie Leaves Peru Early to Fix Economy

China's Finance Minister Xie Xuren was called back from an international economic conference in Peru before the meeting began, following orders from Beijing to help resolve problems at home, an organizer of the event said.From Bloomberg: China's Economic Growth May Slump as Spending Comes Too Late

...

``They told him he has to resolve an economic problem and that he's the only one who could do so,'' de Swinnen said. ``He was complaining because he had to fly 32 hours to get here and then he had to fly another 32 hours to get back.''

Gross domestic product may advance 7.5 percent or less, the weakest since 1990, according to estimates by Credit Suisse AG, UBS AG and Deutsche Bank AG. Royal Bank of Scotland Plc predicts the economy will grow 8 percent next year, while 5 percent ``can't be ruled out.''And what happens to U.S. intermediate and long rates when China tries to stimulate their own economy? That could have a serious negative impact on the U.S.

...

``The golden years have shuddered to a dramatic halt,'' said Stephen Green, head of China research at Standard Chartered Bank Plc in Shanghai. Green is reviewing his 7.9 percent forecast for next year because a ``big fiscal policy package'' hasn't arrived.

Moody's Cuts MBIA Rating

by Calculated Risk on 11/07/2008 05:57:00 PM

From Reuters: Moody's cuts MBIA Insurance to "Baa1"

Moody's Investors Service on Friday cut its ratings on MBIA insurance arm and also sent ratings on the holding company's debt into junk territory, citing diminished business prospects and a weaker financial profile.This follows a rating cut for AMBAC earlier this week.

Bloomberg Sues Fed to Force Disclosure

by Calculated Risk on 11/07/2008 04:15:00 PM

From Bloomberg: Bloomberg Sues Fed to Force Disclosure of Collateral

Bloomberg News asked a U.S. court today to force the Federal Reserve to disclose securities the central bank is accepting on behalf of American taxpayers as collateral for $1.5 trillion of loans to banks.Seems like information that should be available. The "confidential commercial information" argument seems weak.

The lawsuit is based on the U.S. Freedom of Information Act ...

``The American taxpayer is entitled to know the risks, costs and methodology associated with the unprecedented government bailout of the U.S. financial industry,'' said Matthew Winkler, the editor-in-chief of Bloomberg News ...

Construction and Retail Employment

by Calculated Risk on 11/07/2008 03:51:00 PM

A couple more graphs on employment ...

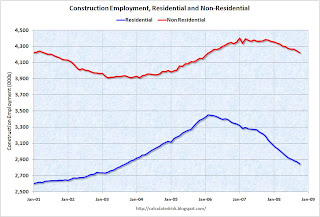

Click on graph for larger image in new window.

The first graph shows employment for residential and non-residential employment. Note: the y-axis doesn't start at zero to better show the change.

Residential construction is off about 600 thousand from the peak, but that doesn't include cash workers (many illegal immigrants) and some construction workers work in both residential and non-residential areas and are included in the non-residential category.

Non-residential construction employment is off 180 thousand from the peak. With the coming slump in commercial real estate (CRE), we will probably see some significant construction job losses over the next year. The second graph shows the year-over-year employment for retail. Retail employment growth has been sluggish in recent years (probably because of internet sales and more efficiency).

The second graph shows the year-over-year employment for retail. Retail employment growth has been sluggish in recent years (probably because of internet sales and more efficiency).

YoY employment is off 1.8% - close to the slump in 2001/2002. In 1991, YoY retail employment slumped by 2.5%.

A few weeks ago, the LA Times reported: Retailers cutting back on holiday hiring

A recent survey of more than 1,000 managers responsible for hiring hourly workers found that each manager planned on hiring an average of 3.7 seasonal employees this year, roughly 33% less than the 5.6 workers they hired during last year's holiday period.Retail employment could be really grim over the holiday season.

President-Elect Obama to Speak on the Economy at 2:30PM ET

by Calculated Risk on 11/07/2008 02:32:00 PM

The Obama news conference is scheduled for 2:30 PM.

Here is the CNBC feed.

Report: Commercial Vacancies for NYC to rise to 17.6%

by Calculated Risk on 11/07/2008 01:38:00 PM

From CrainsNewYorkBusiness.com: Report: Metro area vacancy rate to hit 17.6% (hat tip Brian)

In the next year, commercial vacancies for the New York metropolitan area will surge to 17.6%, up from today’s 12% rate, according to a revised forecast issued Monday by Property & Portfolio Research Inc.This forecast is for all commercial property, and not just Class-A office space.

...

“Our expectations changed, considering the events of the last few months, which are pretty much unprecedented,” said Andy Joynt, a real estate economist at the firm. “It’s a pretty severe downturn that we’re expecting.”

Just this week, Mayor Bloomberg's office projected Class-A vacancies to rise sharply:

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the actual and projected (by the NYC OMB) rents and office vacancy rate for NYC Class A buildings.

The vacancy rate is expected to rise from about 7.5% to 13%.

All those layoffs on Wall Street are adding up.

Pending Home Sales Decline in September

by Calculated Risk on 11/07/2008 11:30:00 AM

From the NAR: Pending Home Sales Down on Tight Credit and Economic Slowdown

The Pending Home Sales Index, a forward-looking indicator based on contracts signed in September, declined 4.6 percent to 89.2 from an upwardly revised reading of 93.5 in August, but is 1.6 percent higher than September 2007 when it stood at 87.8.Existing home sales are reported at the close of escrow, pending home sales are reported when contracts are signed. The Pending Home Sales index leads existing home sales by about 45 days, so this suggests existing home sales will decline in November (from October).

This data shows some of the impact of the credit crunch. October Pending Home sales will probably be much worse. Also it is very possible that many of these pending sales will drop out of escrow due to tighter lending standards.

Also many of these sales are for distressed sales. Last month NAR economist Yun suggested that "distressed sales are currently 35 to 40 percent of transactions". Distressed sales include foreclosure resales and short sales.

For some graphs comparing existing home sales to pending home sales, see: Do Existing Home Sales track Pending Home Sales? The answer is yes - they do track pretty well.

GM: Liquidity to "fall significantly short" of necessary minimum in 2009

by Calculated Risk on 11/07/2008 11:23:00 AM

Even if GM implements the planned operating actions that are substantially within its control, GM's estimated liquidity during the remainder of 2008 will approach the minimum amount necessary to operate its business. Looking into the first two quarters of 2009, even with its planned actions, the company's estimated liquidity will fall significantly short of that amount unless economic and automotive industry conditions significantly improve, it receives substantial proceeds from asset sales, takes more aggressive working capital initiatives, gains access to capital markets and other private sources of funding, receives government funding under one or more current or future programs, or some combination of the foregoing.

emphasis added

Ford Burns Through $7.7 Billion in Cash

by Calculated Risk on 11/07/2008 11:10:00 AM

From the WSJ: Ford Plans More Job Cuts as Sales Slump Erodes Cash Position

Ford Motor Co. announced wide-ranging cost cuts after burning through $7.7 billion in cash in the third quarter, as revenue plunged in a rapidly deteriorating auto market.Meanwhile GM shares are halted for pending news ...

...

"Ford's actions are based on the expectation that the global auto industry downturn will be deeper, broader and longer than was previously assumed," the company said. Ford said volume declines in 2009 are expected to be comparable with this year's steep declines, and that the company "will continue to adjust its production in line with the lower demand."

Credit Crisis Indicators: TED Spread Below 2.0

by Calculated Risk on 11/07/2008 10:34:00 AM

The London interbank offered rate, or Libor, that banks say they charge one another for loans fell 10 basis points to 2.29 percent today, the lowest level since November 2004, the British Bankers' Association said. The overnight rate held at a record low of 0.33 percent and the TED spread, a gauge of bank cash availability, dropped under 200 basis points for the first time since the day before Lehman Brothers Holdings Inc. collapsed.The three-month LIBOR was at 2.39% yesterday. The rate peaked at 4.81875% on Oct. 10. (Better)

Usually the 3 month trades below the target Fed Funds rate by around 25 bps, so this is too low with the Fed funds rate at 1.0%. However, the effective Fed Funds rate is even lower (0.23% yesterday) at 0.305%. I'd like to see the effective Fed Funds rate move closer to the target rate (1.0% currently) and the three month treasury yield increase.

The TED spread is slightly below 2.0, but still too high. The peak was 4.63 on Oct 10th. I'd like to see the spread move back down to 1.0 or lower.

Here is a list of SFP sales. No announcement today from the Treasury ... (no progress).

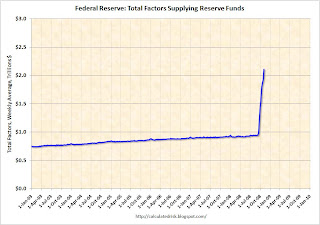

Click on graph for larger image in new window.

The Federal Reserve assets increased $105 billion this week to $2.075 trillion. Note: the graph shows Total Factors Supplying Federal Reserve Funds and is an available series that is close to assets.

So far the Federal Reserve assets are still increasing rapidly. It will be a good sign - sometime in the future - when the Fed assets start to decline.

This is the spread between high and low quality 30 day nonfinancial commercial paper.

The Fed is buying higher quality commercial paper (CP) and this is pushing down the yield on this paper (0.82% yesterday!) - and increasing the spread between AA and A2/P2 CP. So this indicator has been a little misleading. But it now sounds like the Fed might intervene in other companies and just the talk of possible Fed action is probably pushing down the A2/P2 rates. If the credit crisis eases, I'd expect a significant decline in this spread.

The LIBOR is down and the TED spread is off again - so there is a little more progress - however most of the progress is coming directly from Fed intervention and increases in the Fed balance sheet, so there is still a long way to go.

Unemployment Rate Jumps to 6.5%, Employment Off 240 Thousand

by Calculated Risk on 11/07/2008 08:33:00 AM

From the BLS:

Nonfarm payroll employment fell by 240,000 in October, and the unemployment rate rose from 6.1 to 6.5 percent, the Bureau of Labor Statistics of the U.S. Department of Labor reported today. October's drop in payroll employment followed declines of 127,000 in August and 284,000 in September, as revised. Employment has fallen by 1.2 million in the first 10 months of 2008; over half of the decrease has occurred in the past 3 months.

Click on graph for larger image.

Click on graph for larger image.This graph shows the unemployment rate and the year over year change in employment vs. recessions.

Nonfarm payrolls decreased by 240,00 in October and September was revised down to a loss of 284,000 jobs. (Note: September was orginally announced as 159,000 in job losses, so this is a huge downward revision).

The unemployment rate rose to the highest level in 14 years at 6.5 percent.

Year over year employment is now negative (there are 1.1 million fewer Americans employed in Oct 2008 than in Oct 2007). This is another very weak employment report.

Queen Baffled by Credit Crisis

by Calculated Risk on 11/07/2008 12:08:00 AM

From the Sydney Morning Herald: Queen baffled at delay in spotting credit crunch (hat tip Martin)

The origins and effects of the crisis were explained to [the Queen] by Professor Luis Garicano, director of research at the LSE's management department ...Yeah! Hey, Hoocoodanode?!

Prof Garicano said afterwards: "The Queen asked me: 'If these things were so large, how come everyone missed them? Why did nobody notice it'?"

Thursday, November 06, 2008

Fed's Warsh: Fundamental Reassessment of Every Asset Everywhere

by Calculated Risk on 11/06/2008 07:18:00 PM

"[Policymakers] should be steady when financial market participants are fearful, and fearful when markets appear steady."Yes, the Fed was not properly fearful when markets appeared steady. As Paul Volcker said in Feb 2005:

Governor Kevin Warsh, Nov 6, 2008

"Under the placid surface, at least the way I see it, there are really disturbing trends: huge imbalances, disequilibria, risks – call them what you will. Altogether the circumstances seem to me as dangerous and intractable as any I can remember, and I can remember quite a lot."Too bad the policymakers didn't listen then.

Here are few excepts from Fed Governor Kevin Warsh's speech: The Promise and Peril of the New Financial Architecture

There are some notable signs of improvement. Short-term funding spreads are retreating from extremely elevated levels. Funding maturities are being extended beyond the very near term. Money market funds and commercial paper markets are showing signs of stabilization. And credit default swap spreads of banking institutions are narrowing significantly.And on the causes of the credit crisis, Warsh argues it is not just housing and definitely not contained:

Nonetheless, financial markets overall remain strained. Risk spreads remain quite high and lending standards appear strict. Indications of economic activity in the United States have turned decidedly negative. The economy contracted slightly in the third quarter, and the recent data on sales and production suggest that the fourth quarter will be weak.

Still, the depth and duration of this period of weak economic activity remain highly uncertain.

Many observers maintain that the boom and bust in the housing market are the root cause of the current turmoil. No doubt housing-related losses are negatively affecting household wealth and spending. Moreover, the weakness in housing markets and uncertainty about its path have caused financial institution balance sheets to deteriorate. This situation has further accelerated the deleveraging process and tightened credit conditions for businesses and households.

When liquidity pulled back dramatically in August 2007, housing suffered mightily. ...

While housing may well have been the trigger for the onset of the broader financial turmoil, I have long believed it is not the fundamental cause. Indeed, recent financial market developments strongly indicate that housing, as an asset class, does not stand alone. Indeed, the problems associated with housing finance reveal broader failings, including inadequate market discipline, excessive reliance on credit ratings, and poor credit and liquidity risk-management practices by many financial firms.

During the past several months, this domestic housing-centric diagnosis has also been subjected to a natural experiment. Among U.S. financial institutions, asset quality concerns are no longer confined to the mortgage sector. At the same time, non-U.S. financial institutions--including some with relatively modest exposures to the United States or their own domestic housing markets--appear to be suffering substantial losses. Equity prices of European banks declined more on average during 2008 year-to-date than their U.S. counterparts. Moreover, economic weakness among our advanced foreign trading partners is increasingly evident, even among economies with more modest exposures to the housing sector.

... I would advance the following: We are witnessing a fundamental reassessment of the value of virtually every asset everywhere in the world.

emphasis added

The Tech Slowdown

by Calculated Risk on 11/06/2008 05:02:00 PM

"As a result of the credit crisis and the economic uncertainty, our guidance reflects slower end- market device growth for 2009 than previously anticipated and a significant contraction in channel inventory in the first and second fiscal quarters. While we are estimating strong growth for CDMA-based devices in calendar year 2009, driven by a shift to emerging markets, this growth is meaningfully less than we would have forecast just a few weeks ago."Note: just using Qualcomm as an example (hat tip Brian)

Dr. Paul E. Jacobs, CEO of Qualcomm, Nov 6, 2008 emphasis added

From Saul Hansell at the NY Times: Cheerful Gloom From Mary Meeker:

In the first session of the Web 2.0 conference in San Francisco, Ms. Meeker terrified the audience with the prospects of the coming recession, then offered a vision of ultimate redemption. (You can see her slides here.)Investment in equipment and software has been negative for the last three quarters according to the BEA. And it appears the tech investment slump is about to get worse.

Her main point was that advertising and sales of technology products are very closely correlated to economic activity. And since both gross domestic product and consumer spending have started falling, the prospects for both don’t look good.

Click on graph for larger image in new window.

This graph shows the year over year change for residential investment vs. investment in equipment and software. Note that residential investment is shifted 3 quarters into the future because changes in residential investment usually lead changes in equipment and software by about 3 quarters. This relationship isn't perfect, but I expect equipment and software investment to decline for the next several quarters.

And a YouTube favorite ... Here Comes Another Bubble by The Richter Scales