by Calculated Risk on 11/06/2008 04:13:00 PM

Thursday, November 06, 2008

Federal Reserve Assets Increase $105 Billion

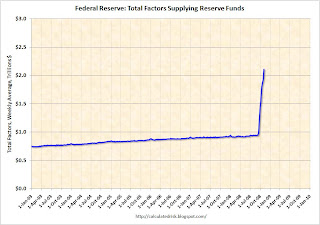

Looking a long time ahead to an economy far, far away ... I think one of the indicators of a recovery will be a shrinking Fed balance sheet. The assets on the Fed's balance sheet have doubled from under $1 trillion at the beginning of 2008 to about $2.075 trillion now.

Dallas Fed President Richard Fisher thinks there is much more to come:

"You can see the size and breadth of the Fed’s efforts to counter the collapse of the credit mechanism in our balance sheet. At the beginning of this year, the assets on the books of the Fed totaled $960 billion. Today, our assets exceed $1.9 trillion. I would not be surprised to see them aggregate to $3 trillion—roughly 20 percent of GDP—by the time we ring in the New Year."Here is the Federal Reserve report released today.

Dallas Fed President Richard W. Fisher, The Current State of the U.S. Economy and the Fed’s Response, Nov 4, 2008

Click on graph for larger image in new window.

The Federal Reserve assets increased from $105 billion this week to $2.075 trillion. Note: the graph shows Total Factors Supplying Federal Reserve Funds and is an available series that is close to assets.

So far the graph shows Federal Reserve assets are still increasing rapidly. Fisher may be right - $3 trillion by the end of the year.

The good news is the Fed marked up the value of the Bear Stearns assets to $26,863 from $26,802 million two weeks ago - an increase of $61 million!

Update: For more, see Dr. Setser's post from last week: Two two-trillionaires

The Fed’s balance sheet just surpassed 2 trillion dollars. It has grown by a trillion dollars over the course of the year. Literally. ... That growth was financed by Treasury bill issuance ($560b from the supplementary financing facility) and a large rise in banks deposits at the Fed ($405b).

Schwarzenegger Calls for Tax Increases, Budget Cuts

by Calculated Risk on 11/06/2008 03:26:00 PM

As the California recession deepens, the state is facing an enormous budget deficit ...

From the LA Times: Schwarzenegger calls for sales tax hike, cuts in services

Gov. Arnold Schwarzenegger unveiled a plan today for a steep sales tax increase, new levies on alcoholic drinks and the oil industry, and deep cuts in services to wipe out a budget shortfall that is expected to swell to more than $24 billion by the middle of 2010.This proposal would push the LA sales tax rate to 10.25% - Yikes!

The linchpin of the plan is the sales tax increase of 1 1/2 cents on the dollar, which could raise $10.8 billion through fiscal 2009-10. ...

The governor also wants a number of significant spending reductions, including cuts of $2.5 billion from schools and community colleges.

Tax increases and budget cuts during a recession usually just make the recession worse. My guess is the next stimulus plan from the U.S. government will include some relief for state and local governments.

UK: Mortgage Lenders Refuse to Pass on Rate Cut as House Prices Plummet

by Calculated Risk on 11/06/2008 02:31:00 PM

Earlier the BofE announced a dramatic rate cut, The Times reports: Bank of England cuts interest rate by 1.5 points to 54-year low

But apparently most lenders are not lowering mortgage rates: Mortgage lenders refuse to pass on base rate cut

Britain's biggest mortgage lenders have ignored calls from the Government to pass on today's cut in interest rates to struggling homeowners.As house prices plummet in the UK: House prices dive 15% in record drop

...

At midday, the Bank of England announced that the cost of borrowing would fall by 1.5 points to 3 per cent in an effort to shore up the economy and stave off a deep recession. The surprise cut took the base rate to its lowest level in more than half a century.

British house prices fell by a record 15 per cent in the year to October as the country's deteriorating economy wiped £30,000 off the value of an average UK home.

On a monthly basis, house prices fell by 2.2 per cent between September and October, according to Halifax, Britain's biggest mortgage lender.

Las Vegas Sands may Default

by Calculated Risk on 11/06/2008 12:50:00 PM

When it comes to overbuilt hotel and commercial space ... and high rise condos too ... Las Vegas is the poster child of bubble credit excess!

From Bloomberg: Las Vegas Sands Plunges on Defaults, Bankruptcy Risk

Las Vegas Sands ... said in a regulatory filing today that it ... doesn't expect to meet a maximum leverage ratio covenant in the fourth quarter ... That would trigger defaults that might force the company to suspend development projects and ``raise a substantial doubt about the company's ability to continue as a going concern.''

...

Las Vegas Strip casino gambling revenue slid 6.7 percent this year through August, on track for its biggest annual decline on record, as airlines cut back capacity and consumers, battling declining home values, job losses and the worst financial crisis since the Great Depression, spent less.

Credit Crisis Indicators: More Progress

by Calculated Risk on 11/06/2008 10:16:00 AM

The U.S. economy is already in a recession, and the employment report tomorrow will probably be grim (Goldman Sachs is estimating 300 thousand in job losses in October). However, as bad as the economy currently is, without some improvement in the credit markets, the current recession will be much much worse.

Fortunately there have been some signs of a thaw in the credit markets over the last couple of weeks. Unfortunately most of the improvement has to do with the Fed intervening in rates and not due to lending between private parties. So there is still a long way to go ...

Three-month LIBOR rates for U.S. dollars fell to 2.3875% from 2.51%, well off the highs of 4.82% reached last month.The three-month LIBOR was at 2.51 yesterday. The rate peaked at 4.81875% on Oct. 10. (Better)

Click on graph for larger image in new window.

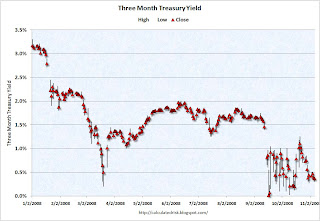

This graph shows the high, low, and the close for the three month treasury bill since the beginning of the year.

A good sign would be if the daily volatility subsides, and the yield moves up closer to the target Fed funds rate, or about 0.75%.

The yield is too low, but the daily volatility has declined.

Usually the 3 month trades below the target Fed Funds rate by around 25 bps, so this is too low with the Fed funds rate at 1.0%. However, the effective Fed Funds rate is even lower (0.23% yesterday), so maybe the 3 month yield of 0.37% is somewhat in the right range. I'd also like to see the effective Fed Funds rate move closer to the target rate (1.0% currently).

This graph from Bloomberg shows the TED spread over the last year.

This graph from Bloomberg shows the TED spread over the last year.The TED spread is almost back to 2.0, but still too high. The peak was 4.63 on Oct 10th.

I'd like to see the spread move back down to 1.0 or lower.

Here is a list of SFP sales. No announcement today from the Treasury ... (no progress).

Note: Once a week I will include the Fed balance sheet assets. If this starts to decline that would be a positive sign.

Graph from the Fed.

Graph from the Fed.This is the spread between high and low quality 30 day nonfinancial commercial paper.

The Fed is buying higher quality commercial paper (CP) and this is pushing down the yield on this paper (0.83% yesterday!) - and increasing the spread between AA and A2/P2 CP. So this indicator has been a little misleading. But it now sounds like the Fed might intervene in other companies and just the talk of possible Fed action is probably pushing down the A2/P2 rates. If the credit crisis eases, I'd expect a significant decline in this spread.

The LIBOR is down, the TED spread is off again, the A2/P2 spread declined - so there is more progress.

Continued Unemployment Claims at Highest Since 1983

by Calculated Risk on 11/06/2008 09:01:00 AM

The DOL reports on weekly unemployment insurance claims:

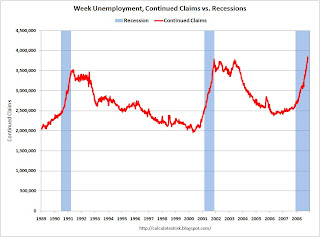

In the week ending Nov. 1, the advance figure for seasonally adjusted initial claims was 481,000, a decrease of 4,000 from the previous week's revised figure of 485,000. The 4-week moving average was 477,000, unchanged from the previous week's revised average of 477,000.

...

The advance number for seasonally adjusted insured unemployment during the week ending Oct. 25 was 3,843,000, an increase of 122,000 from the preceding week's revised level of 3,721,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows weekly claims. The four moving average is at 477,000. This is a very high level, and indicates significant weakness in the labor market.

Continued claims are now at 3.84 million, the highest level since 1983.

The second graph shows continued claims since 1989.

The second graph shows continued claims since 1989.Note: Continued claims hit 4.7 million during the 1982 recession (not shown), although the population was much smaller then. The unemployment rate peaked at 10.8% in 1982 (compared to 6.1% last month).

This suggests a weak payroll report tomorrow.

Rate Cuts in Europe

by Calculated Risk on 11/06/2008 08:47:00 AM

From Bloomberg: Bank of England Slashes Key Lending Rate to Lowest Since 1955

The Bank of England unexpectedly cut the benchmark interest rate by 1.5 percentage points to the lowest since 1955 as U.K. policy makers tried to limit damage caused by the worst banking crisis in almost a century.That is an impressive rate cut.

The ECB cut too: ECB Cuts Interest Rate by Half Point to Counter Economic Slump

The European Central Bank lowered interest rates for the second time in less than a month to counter the euro region's worst economic slump in 15 years.The WSJ reports:

ECB policy makers meeting in Frankfurt reduced the benchmark lending rate by half a percentage point to 3.25 percent ...

Switzerland's central bank joined in, cutting its key rate target by half a percentage point to 2% in an unusual between-meeting move.

Wednesday, November 05, 2008

WSJ: Treasury and FDIC Close to Announcing Mortgage Modification Program

by Calculated Risk on 11/05/2008 11:31:00 PM

This WSJ story on possible additional options for using the TARP suggests that a mortgage modification program will be announced soon:

The report addresses the issue of trying to slow the record levels of foreclosures. "In particular, Treasury will continue efforts to ensure loan modifications are sustainable," said the report. A separate Treasury report detailing minutes of an Oct. 13 meeting of members of the Financial Stability Oversight Board suggested the Treasury is focusing on how to address ailing mortgages.Meanwhile, in California, Governor Schwarzenegger is seeking a 90 day delay on foreclosures - from Bloomberg: Schwarzenegger Seeks to Save Homeowners With Foreclosure Delay

...

[T]he Treasury, the Federal Deposit Insurance Corp. and other government agencies are said to be close to announcing a government program to address residential foreclosures at the root of the crisis.

California Governor Arnold Schwarzenegger proposed a 90-day stay on home foreclosures in California ... Schwarzenegger said he will ask lawmakers to consider delaying foreclosures when he orders them into a special session tomorrow to deal with the state's ballooning budget deficit.

GM Exec says Next 100 Days "critical"

by Calculated Risk on 11/05/2008 09:14:00 PM

From DowJones: GM Executive: Next 100 Days Critical For GM, US Auto Industry

A top General Motors Corp. (GM) executive on Wednesday said the next 100 days could represent the most crucial time in the history of the troubled company and entire U.S. auto industry.GM is expected to release results on Friday.

Troy Clarke, president of GM North America, urged auto industry executives to make the case to Washington leaders that the failure of auto companies would have devastating effects on the economy.

...

"I'd like to say we're done (with restructuring)," he said in a speech to the Original Equipment Suppliers Association. "But once again, market and economic conditions have continued to decline, primarily due to the recent global credit crisis and a steep decline in consumer confidence - both key to the auto business."

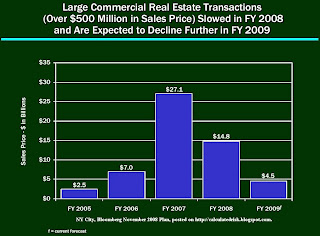

NY City Commercial Real Estate from Mayor Bloomberg Report

by Calculated Risk on 11/05/2008 08:15:00 PM

Mayor Bloomberg released a report on the NY City economy today. Here are a couple of graphs from the report on commercial real estate (CRE). There is much more in the report, especially on the impact of the financial crisis on NYC employment. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the actual and projected (by the NYC OMB) rents and office vacancy rate for NYC Class A buildings.

The vacancy rate is expected to rise from about 7.5% to 13%, and rents are expect to decline by 20% or more from the peak.

This decrease in rents will make many of the recent transactions that were based on overly optimistic pro forma income projections uneconomical. These loans typically included reserves to pay interest until rents increased (like a negatively amortizing option ARM), so these deals will blow up when the interest reserve is depleted - probably in the 2009-2010 period. The second graph shows the total dollar amounts for large commercial real estate transactions in NYC. This is expected to decline sharply next year, although if a number of projects get into trouble then I wouldn't be surprised to see a few more transaction (similar to all the foreclosure sales boosting existing home sales right now).

The second graph shows the total dollar amounts for large commercial real estate transactions in NYC. This is expected to decline sharply next year, although if a number of projects get into trouble then I wouldn't be surprised to see a few more transaction (similar to all the foreclosure sales boosting existing home sales right now).

Goldman Sachs expects one of weakest Employment Reports in 20 years

by Calculated Risk on 11/05/2008 05:46:00 PM

In a research note today, Goldman Sachs changed their forecast (no link):

We have deepened our forecast of the change in payroll employment for October to -300,000 from -250,000. ... The drop in payrolls we are now forecasting would be one of the worst month-over-month declines in the past twenty years. ... Unfortunately, there is no guarantee that the October decline in payroll employment will be the worst of this cycle. Real activity appears to have contracted sharply in October and ... could well bleed into November and cause another large drop in payroll employment ...It sounds like the numbers to be released this Friday will be grim.

Moody's cuts Ambac Rating

by Calculated Risk on 11/05/2008 04:51:00 PM

Ambac and MBIA are back in the news ...

From Bloomberg: MBIA, Ambac Losses Widen on Higher Claims Forecast

MBIA Inc. and Ambac Financial Group Inc., the bond insurers crippled by credit-rating downgrades, posted wider losses than analysts anticipated ...And right on cue from MarketWatch: Moody's cuts Ambac to 'Baa1'; outlook developing

MBIA ... reported a $806.5 million net loss after setting $961 million aside for guarantees on home-equity loan bonds. Ambac fell 41 percent as it recorded a $2.43 billion net loss after reserving $3.1 billion.

"The big issue for bond insurers is their ratings," said Jim Ryan, an analyst with Morningstar Inc. in Chicago. "If the rating agencies pile on, that could create more problems."

Paul Jackson at HousingWire adds: Ambac Posts $2.4 Billion Q3 Loss on “False” MBS Recovery

In an investor presentation, Ambac said that second quarter RMBS trending among private-party transactions it had insured — which had initially turned upward earlier this year — has since proven to be the latest example of a “false positive” in battered mortgage securities markets.I think it is absurd to hope that the TARP will "establish a floor for housing market fundamentals". Hope is not a plan.

...

Ambac expressed hope that the Treasury’s TARP program and capital purchase program would “establish a floor for housing market fundamentals,” according to its investor presentation. The insurer has asked Treasury to consider guaranteeing a portion of its structured securities portfolio, as well.

Note: just to be clear "Hope is not a plan" is a phrase I've used for at least 30 years ... and was not intended as a swipe at President-elect Obama.

Shiller: "Worst Times Ahead"

by Calculated Risk on 11/05/2008 03:24:00 PM

Robert Shiller on forecasting and the economy ...

"This is not a run of the mill recession that we are in. This is a crisis of confidence that we haven't seen since the Great Depression.And many other interesting comments ... "no one really knows what to do", "we are getting into Ben's nightmare scenario" ... "and then we try some other heterodox monetary policies":

...

Ultimately I think economic forecasting is more guess work than people realize. In times when you don't have a fundamental change, you can exrapolate curves, and people do that pretty well. But right now I don't trust extrapolation. It also - forecasting - depends on how the new government, how the new president, what he does, how he shapes confidence - and those are also unknowns at this point."

Credit Crisis Indicators: More Progress

by Calculated Risk on 11/05/2008 12:01:00 PM

The London interbank offered rate, or Libor, for three- month loans fell to 2.51 percent today, from 4.82 percent on Oct. 10.The three-month LIBOR was at 2.71 yesterday. The rate peaked at 4.81875% on Oct. 10.

Usually the 3 month trades below the target Fed Funds rate by around 25 bps, so this is too low with the Fed funds rate at 1.0%. However, the effective Fed Funds rate is even lower (0.23% yesterday), so maybe the 3 month yield of 0.44% is somewhat in the right range.

It is nice to be back near 2.0, and I'd like to see the spread move back down to 1.0 or lower.

Here is a list of SFP sales. No announcement today from the Treasury ... no progress.

Note: Once a week I will include the Fed balance sheet assets. If this starts to decline that would be a positive sign.

The Fed is buying higher quality commercial paper (CP) and this is pushing down the yield on this paper (0.97% on Friday!) - and increasing the spread between AA and A2/P2 CP. So this indicator has been a little misleading. But it now sounds like the Fed might intervene in other companies and just the talk of possible Fed action is probably pushing down the A2/P2 rates. If the credit crisis eases, I'd expect a significant decline in this spread.

The LIBOR is down, the TED spread is off again, the A2/P2 spread declined - so there is more progress.

The Treasury Secretary Speculation

by Calculated Risk on 11/05/2008 10:36:00 AM

There is plenty of speculation this morning about possible nominees for Treasury Secretary. Bloomberg mentions former Clinton Treasury Secretary Lawrence Summers and NY Fed President Tim Geithner:

Summers, 53, is favored to return to the Treasury post that he held under President Bill Clinton because Obama values his experience and familiarity with markets and global leaders ... Still, people close to the president-elect stress no final decision has been reached and that Timothy Geithner, president of the New York Federal Reserve, is also a strong contender.Another person frequently mentioned is JPMorgan Chase CEO Jamie Dimon.

Goldman Sachs conference call this morning on impact of election (my notes):

President-elect Obama will face a significantly deteriorating economy. The risks are to the downside of Goldman forecast of -2.0% GDP in Q4 and -1.0% in Q1 2009, and upside risk to Goldman unemployment forecast (peak of 8.0%).

Currently expect $200 billion in stimulus. Now, with Democratic control of government, expect to see a larger economic stimulus package of at least $300 billion, maybe as high as $500 billion. It's possible there will be a smaller stimulus package this fall, and then a 2nd bill early next year (late January or February).

Also expect to see more emphasis on mortgage modifications. Expect something similar to the FDIC proposal - also might see 90 day foreclosure moratorium.

Healthcare reform and tax policy discussions will probably be pushed out for a year or two - unless some of the tax proposals are part of the stimulus package.

Expect significantly larger budget deficits over the next two years.

Other issues will probably be pushed out (healthcare reform, energy and environmental policies).

Q&A: Hatzius says the probability of depression is 'very low' unless we see phenomenal mistakes from Fed and Government - and he doesn't expect those mistakes.

ISM Services Index Declines Sharply in October

by Calculated Risk on 11/05/2008 10:07:00 AM

From the Institute for Supply Management (ISM): October 2008 Non-Manufacturing ISM Report On Business®

The report shows the service sector contracted sharply in October.

"The NMI (Non-Manufacturing Index) registered 44.4 percent in October, 5.8 percentage points lower than the 50.2 percent registered in September, indicating contraction in the non-manufacturing sector after two consecutive months of growth."There were a couple of interesting comments on discretionary spending:

Anthony Nieves, chair of the Institute for Supply Management

"Uncertainty is having the usual effect on business. Our response is traditional — stop all discretionary spending."This is exactly how businesses (and consumers) react to uncertainty - halt all discretionary spending. This is usually a temporary reaction until the business can adjust to changes in economic conditions.

"Business down significantly! Discretionary spending disappearing."

D.R. Horton Warns

by Calculated Risk on 11/05/2008 08:44:00 AM

“Market conditions in the homebuilding industry deteriorated during our fourth fiscal quarter and October, characterized by rising foreclosures, high inventory levels of both new and existing homes and reduced liquidity in the mortgage markets. In addition, consumer confidence has been eroded by a weakening economy, higher unemployment and record volatility in the capital markets."From D.R. Horton press release:

Donald R. Horton, Chairman, D.R. Horton, Nov 4, 2008

Home sales revenue for the fourth quarter of fiscal 2008 totaled $1.5 billion on 6,961 homes closed, compared to $3.0 billion in the same quarter of fiscal 2007 on 11,733 homes closed.Horton's home sales were half (in dollars), and about 40% lower in units, compared to the same quarter in 2007. Ouch.

...

The Company’s net loss for the fourth quarter is estimated to be in the range of $800 to $900 million ...

GMAC: $2.5 Billion Loss

by Calculated Risk on 11/05/2008 08:22:00 AM

From Bloomberg: GMAC Posts Quarterly Loss, ResCap Unit Faces Doubt on Survival

GMAC ... third-quarter net loss widened to a record $2.52 billion from $1.6 billion a year earlier ...The story mentions that GMAC will only lend to car buyers with the highest credit ratings - and that contributed to the dismal sales auto sales in October.

GMAC's results were crushed by slumps in the housing market, where foreclosures are running at record levels, and in auto sales, which GM labeled the worst since 1945 when it reported October results this week.

Also GMAC is considering converting to a bank holding company to gain more access to capital. Currently GM owns 49% of GMAC, and entities (like GM) with more than 25% ownership in a bank holding company are subject to strict capital requirements and other regulations. That is why a conversion of GMAC to a bank holding company would probably be part of a GM-Chrysler merger, with Cerberus swapping Chrysler for enough of GM's stake in GMAC to lower GM's ownership below 25%.

Tuesday, November 04, 2008

More on Commercial Real Estate

by Calculated Risk on 11/04/2008 08:39:00 PM

Not much happening tonight (except some sort of election) ... but here are a couple of interesting articles on commercial real estate (CRE):

From Bloomberg: NYC Commercial Property Sales Plunge in Credit Freeze

New York City commercial real estate transactions plunged 61 percent in 2008 through October as the global credit crisis roiled lending and sidelined buyers.From the WaPo: Financial Crisis Hits Commercial Real Estate Market

About $17 billion of transactions have closed so far and the market is headed for its worst year since 2004 ...

PricewaterhouseCoopers and the Urban Land Institute concluded in a recently report released that "U.S. commercial real estate faces its worst year since the wrenching 1991-1992 industry depression."

The report said that nationwide, rents are stagnant and likely to drop. Vacancy rates at offices, shopping malls and hotels are expected to rise and billions of dollars of loans are coming due next year.

DTCC Releases Credit-Default Swap Info

by Calculated Risk on 11/04/2008 06:11:00 PM

From Bloomberg: Credit-Default Swaps Top $33 Trillion, Depository Trust Says

Credit-default swaps totaling $33.6 trillion are outstanding on companies, governments and asset- backed securities worldwide, the Depository Trust & Clearing Corp. said in a report ... released on its Web site today.Knock yourselves out ... tons of data.