by Calculated Risk on 11/04/2008 04:46:00 PM

Tuesday, November 04, 2008

Fannie Mortgage Bond Spreads Decline

From Bloomberg: Fannie Mortgage-Bond Spreads Fall to Lowest in Almost Two Weeks (no link yet)

Yields on Fannie Mae, Freddie Mac and Ginnie Mae mortgage bonds tumbled to the lowest in almost two weeks relative to U.S. government notes, potentially lowering home-loan rates.A little more progress.

The difference between yields on Washington-based Fannie's current-coupon 30-year fixed-rate mortgage securities and 10-year Treasuries fell about 23 basis points to about 183 basis points ...

Credit Crisis Indicators: More Progress

by Calculated Risk on 11/04/2008 02:15:00 PM

The three-month rate dropped 15 basis points to 2.71 percent, the lowest level since June 9, according to BBA figures.The rate peaked at 4.81875% on Oct. 10.

Usually the 3 month trades below the target Fed Funds rate by around 25 bps, so this is too low with the Fed funds rate at 1.0%. However, the effective Fed Funds rate is even lower (0.22% yesterday), so a 3 month yield of 0.47% is in the right range.

I'd like to see the spread move back down to 1.0 or lower - at least below 2.0.

Here is a list of SFP sales. No announcement today from the Treasury ... no progress.

NOTE: Once a week I will include the Fed balance sheet assets. If this starts to decline that would be a postive sign.

The Fed is buying higher quality commercial paper (CP) and this is pushing down the yield on this paper (0.97% on Friday!) - and increasing the spread between AA and A2/P2 CP. So this indicator is a little misleading right now. Still, if the credit crisis eases, I'd expect a significant decline in this spread.

NOTE: This decline in the A2/P2 spread could be related to this WSJ article: U.S. Weighs Purchasing Stakes in More Firms

The Treasury Department is considering using more of its $700 billion rescue fund to buy stakes in a broad range of financial companies, not just banks and insurers, after tentative signs of the program's success, according to people familiar with the matter.The LIBOR is down, the TED spread is off again, the A2/P2 spread declined - so there is more progress.

In focus are companies that provide financing to the broad economy, including bond insurers and specialty finance firms such as General Electric Co.'s GE Capital unit, CIT Group Inc. and others, these people said.

UK Construction Activity Declines Sharply

by Calculated Risk on 11/04/2008 12:21:00 PM

From The Times: Job cuts rise amid record construction fall

Construction activity in the UK fell at a record rate last month as demand for new houses and commercial property continued to wane amid the global financial turmoil, according to a key industry survey.Synchronized cliff diving ...

The CIPS/Construction Purchasing Managers' Index measured construction activity at 35.1 in October — the eighth consecutive monthly fall this year.

Demand for new housing again showed the greatest decline, while commercial property also performed poorly, with activity levels declining at a series-record pace.

Hotel Occupancy Rates Decline; Expected to Fall Further

by Calculated Risk on 11/04/2008 10:55:00 AM

A couple of stories ...

From the Birmingham Business Journal:

In projections for 2010, national hotel research firm Smith Travel Research predicts hotels will see a decline in occupancy rates over the next two years ... The firm expects occupancy to drop 3 percent to 61.2 percent by the end of 2008, compared to last year, and said it will slip even further to 58.7 percent by 2010.And from SignonSanDiego.com: Hotel occupancy rates crater in Hawaii

Almost 40 percent of the state's hotel rooms languished empty in September, the highest rate since the Hawaii tourism downturn in the aftermath of the Sept. 11, 2001 terrorist attacks, a research firm said Monday.While the weakening economy is pushing down occupancy rates, a large number of new hotel rooms are still being added.

Average statewide hotel occupancy plunged 11 percentage points to 63.2 percent from 74.2 percent the same month a year ago, research firm Hospitality Advisors said in a report.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows construction spending on lodging (seasonally adjusted annual rate in millions) through September - based on the details in the Census Bureau Construction Spending report released yesterday.

Lodging saw an incredible increase in investment over the last few years.

Falling demand and increasing supply - not a good environment for new hotel investment - and I expect we will see a sharp decline in investment over the next couple of years.

LIBOR Continues to Decline

by Calculated Risk on 11/04/2008 09:23:00 AM

From Bloomberg: Dollar Libor Drops as Central-Bank Cash, Rate Cuts Thaw Lending

The three-month rate dropped 15 basis points to 2.71 percent, the lowest level since June 9, according to BBA figures.This has pushed the TED spread down to 2.22 this morning (from 2.39 yesterday, and 4.63 on Oct 10th). This is still way too high, but shows more progress. More later on credit indicators ...

More on Auto Sales

by Calculated Risk on 11/04/2008 08:57:00 AM

Jim Hamilton at Econbrowser has more: Another bad month for autos.

To say that the U.S. auto sector continues to bleed may be an understatement. Maybe we should start talking about a severed artery.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph from Econbrowser shows the Not Seasonally Adjusted car sales in the U.S. Look at September and October 2008 (dark blue) - sales have fallen off a cliff compared to previous years. See Hamilton's post for truck sales (and more cliff diving).

Sales are grim even for luxury car manufacturers, from Bloomberg: BMW Scraps Earnings Outlook as Quarterly Profit Falls

Bayerische Motoren Werke AG ... lowered its outlook for the second time this year after third-quarter profit plunged 63 percent as the global financial crisis sapped demand.

Vehicle sales will fall below last year's figure, the Munich-based company said ...

"The financial crisis is by no means behind us yet, particularly its impact on the real economy in 2009," Chief Executive Officer Norbert Reithofer said in the statement.

Monday, November 03, 2008

WSJ: Foreclosure Prevention Program Drags

by Calculated Risk on 11/03/2008 10:31:00 PM

From the WSJ: Homeowners Wait as Relief Plan Drags

The FDIC has been developing a proposal, which some estimate could help between two and three million homeowners, designed to encourage banks to rework troubled loans by providing a partial federal guarantee for losses on modified mortgages that meet specific criteria ... The plan would use between $40 billion and $50 billion from the government's $700 billion financial-market rescue fund ... Several officials said the plan is strongly opposed by the White House, though officials there deny killing the idea.It sounded like a plan would be announced last week, but it appears there is strong disagreement on what the plan should look like.

This is a key point:

"Even an ambitious program of mortgage modifications will not prevent a further decline in house prices," said Douglas Elmendorf, a senior fellow at the Brookings Institution and a former Clinton economic adviser. "It might prevent an overshooting of house prices on the downside. But houses still look overvalued relative to people's rents or incomes, and it's going to be very difficult to sustain house prices at their current level."Any attempt to keep house prices artificially high will just postpone the inevitable and delay the eventual recovery.

Summary of Busy Day

by Calculated Risk on 11/03/2008 07:57:00 PM

For the late readers, there were a number of news stories / posts today, so here is a summary:

Construction Spending in September: The Census Bureau reported that private non-residential construction increased slightly in September from August, but spending is still below the peak in June 2008. Residential investment decreased in September.

From MarketWatch: U.S. ISM factory index plunges again in October

Credit Crisis Indicators showed some progress, especially the LIBOR and TED spread.

Auto sales were a disaster in October. From Bloomberg: Auto Sales in U.S. Plunge; October Was the Worst Month Since 1945, GM Says. From the WSJ: Auto Makers Post Sharp Drop in U.S. Sales

U.S. auto sales in October plunged an estimated 31% to about 850,000 vehicles ... It was the first time since February 1993 that auto makers sold fewer than 900,000 cars and light trucks in a month. When adjusted for increases in the U.S. population, October was "the worst month in the post-World War II era," Michael DiGiovanni, the top sales analyst at General Motors Corp., said in an conference call. "This is clearly a severe, severe recession." ... Auto executives warned the worst may still lie ahead ...The Fed reported that lending standards tightened and loan demand declined. See post for graph for commercial real estate (CRE) lending and demand.

And finally, here is my Q3 advance MEW estimate (close to zero).

Funding the National Debt

by Calculated Risk on 11/03/2008 05:45:00 PM

It seems like just yesterday that the National Debt exceeded $10 trillion for the first time. Hard to believe that was just one month ago since the National Debt is now $10.574 trillion (yes, an increase of $574 billion in about one month).

This raises questions about funding the debt. From Bloomberg: U.S. to Borrow Record This Quarter to Finance Deficit

The U.S. Treasury more than tripled its planned debt sales for this quarter to help finance a 2009 budget deficit that bond dealers advising the department estimate may swell to almost $1 trillion.As I noted over the weekend, these huge financing needs combined with foreign governments need to stimulate their domestic economies (and maybe even selling foreign reserves) could lead to higher intermediate to long term rates in the U.S. next year - right in the middle of a recession.

Borrowing needs are expected to rise to $550 billion in the three months to Dec. 31, compared with the $142 billion predicted in July, the Treasury said in a statement in Washington. That follows a $530 billion record in the July-September quarter.

Misc: Wikinvest, Full Feed, and Zombie Ads

by Calculated Risk on 11/03/2008 05:21:00 PM

A few housekeeping notes: there is a link to related articles from Wikinvest at the bottom of most posts. Let me know what you think.

I've also enabled the full RSS feed again (I'm sure the scrapers will return). This may be temporary - sorry.

And for California readers, I've tried to disable some of the political ads, but they keep coming back ... oh well, at least the election is tomorrow and the ads should end.

Best to all.

Advance Q3 2008 MEW Estimate

by Calculated Risk on 11/03/2008 03:48:00 PM

We've been tracking mortgage equity withdrawal (MEW) to estimate when the "Home ATM" has closed. Fed economist Dr. James Kennedy's estimate of MEW is not available until after the Fed's Flow of Funds report is released each quarter. Note: the Q3 Flow of Funds report is scheduled to be released on December 11, 2008.

However it is possible to estimate MEW from supplemental data released with the GDP report. Based on the Q3 GDP data from the BEA, my advance estimate for Mortgage Equity Withdrawal (MEW) is 1.0% of Disposable Personal Income (DPI). This would be slightly higher than the Q2 estimates, from the Fed's Dr. Kennedy, of 0.4% of Disposable Personal Income (DPI). Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph compares my advance MEW estimate (as a percent of DPI) with the MEW estimate from Dr. James Kennedy at the Federal Reserve. The correlation is pretty high, but there are differences quarter to quarter. This analysis does suggest that MEW was at about the same level in Q3 2008, as in Q2 (close to zero). We will have to wait until December to know for sure.

MEW has declined precipitously since early 2006, with a combination of tighter lending standards and falling house prices. The impact of less equity extraction on consumer spending is still being debated, but I believe a portion of the slowdown in personal consumption expenditures can be attributed to less MEW.

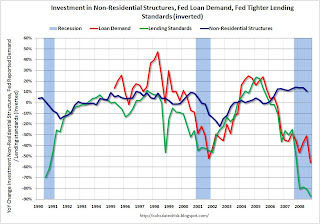

Fed: Lending Standards Tighten, Loan Demand Weakens in October

by Calculated Risk on 11/03/2008 02:34:00 PM

Note: some readers are being swamped with political ads - especially in California. I'm trying to block the ads ... please accept my apology.

From the Fed: The October 2008 Senior Loan Officer Opinion Survey on Bank Lending Practices

In the current survey, large net fractions of domestic institutions reported having continued to tighten their lending standards and terms on all major loan categories over the previous three months. The net percentages of respondents that reported tightening standards increased relative to the July survey for both C&I and commercial real estate loans, as did the fractions reporting tightening for all price and nonprice terms on C&I loans. Considerable net fractions of foreign institutions also tightened credit standards and terms on loans to businesses over the past three months. Large fractions of domestic banks reported tightening standards on loans to households over the same period. Demand for loans from both businesses and households at domestic institutions continued to weaken, on net, over the past three months.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Of particular interest is the increase in tighter lending standards for Commercial Real Estate (CRE) loans. This graph compares investment in non-residential structure with the Fed's loan survey results for lending standards (inverted) and CRE loan demand.

Note that any reading below zero for loan demand means less demand than the previous quarter. This is strong evidence of an imminent slump in CRE investment.

More charts here for residential mortgage, consumer loans and C&I.

GM: "probably worst industry sales month in the post-WWII era."

by Calculated Risk on 11/03/2008 01:51:00 PM

From MarketWatch: GM U.S. October light vehicle sales fall 45.1%

General Motors said Monday that October U.S. light vehicle sales fell 45.1% to 168,719 units from 307,408 a year ago.The WSJ in a headline quoted GM executive Mark LaNeve as saying October was "probably worst industry sales month in the post-WWII era."

Ford: Auto Sales Decline 30% in October

by Calculated Risk on 11/03/2008 12:26:00 PM

From Bloomberg: Ford Motor Says October U.S. Auto Sales Declined 30 Percent (hat tip Justin)

Ford Motor Co. ... said its U.S. sales fell 30 percent in October, the 23rd decline in the past 24 months.Meanwhile, also from Bloomberg: GM, Ford, Chrysler Shut Out of Auto-Bond Market for Fifth Month

The total dropped to 132,838 cars and trucks, from 190,195 a year earlier ...

Ford Motor Co., GMAC LLC and Chrysler LLC were shut out of the market for bonds backed by auto loans for the fifth straight month ... Sales of auto bonds slumped to $500 million last month, compared with $9 billion in October 2007, according to Merrill Lynch & Co. data. ...And Ford is probably in the best shape of the U.S. automakers.

The credit market seizure is forcing automakers to cut back on loans to dealers and customers, contributing to a slowdown that may shrink U.S. auto sales this year to the lowest level since 1993.

Credit Crisis Indicators: Some More Progress

by Calculated Risk on 11/03/2008 11:12:00 AM

The London interbank offered rate, or Libor, that banks charge one another for three-month loans in U.S. currency slid 17 basis points to 2.86 percent today, a 16th day of declines, data from the British Bankers' Association showed. It hasn't been as low since the failure of Lehman Brothers Holdings Inc. on Sept. 15.The rate peaked at 4.81875% on Oct. 10.

Usually the 3 month trades below the target Fed Funds rate by around 25 bps, so this is too low with the Fed funds rate at 1.0%. However, the effective Fed Funds rate is even lower (0.30% yesterday), so a 3 month yield of 0.44% is in the right range. I'd like to see the effective funds rate closer to the target rate.

I'd like to see the spread move back down to 1.0 or lower - at least below 2.0.

Here is a list of SFP sales. The Treasury announced another $30 billion for the Fed today ... no progress.

The Fed is buying higher quality commercial paper (CP) and this is pushing down the yield on this paper (0.97% on Friday!) - and increasing the spread between AA and A2/P2 CP. So this indicator is a little misleading right now. Still, if the credit crisis eases, I'd expect a significant decline in this spread.

The LIBOR is down and the TED spread is off again, so there is a little more progress.

ISM Factory Index Lowest Since 1982

by Calculated Risk on 11/03/2008 10:16:00 AM

From MarketWatch: U.S. ISM factory index plunges again in October

The Institute for Supply Management reported Monday [that the] ISM index fell to 38.9% in October from 43.5% in September. This is the lowest level since September 1982.Ouch.

Construction Spending in September

by Calculated Risk on 11/03/2008 10:00:00 AM

The Census Bureau reported this morning that private non-residential construction increased slightly in September from August, but spending is still below the peak in June 2008. I expect that non-residential investment will decline sharply over the next year or two.

From the Census Bureau: September 2008 Construction at $1,060.1 Billion Annual Rate

Spending on private construction was at a seasonally adjusted annual rate of $751.7 billion, 0.1 percent above the revised August estimate of $751.1 billion. Residential construction was at a seasonally adjusted annual rate of $336.5 billion in September, 1.3 percent below the revised August estimate of $340.8 billion.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The graph shows private residential and nonresidential construction spending since 1993.

Nonresidential spending had been strong as builders completed projects, but there is substantial evidence of a looming slowdown - less lending for new projects, less work for architects - and it appears the expected slowdown in non-residential spending has arrived.

The second graph shows the year-over-year change for private residential and non-residential construction spending.

The YoY change in non-residential spending is starting to slow down and will probably turn negative later this year or early in 2009.

It now looks like investment in non-residential structures will negatively impact GDP in Q4. This had been one of the few bright spots for the economy.

Circuit City Announces Closure of 155 Stores

by Calculated Risk on 11/03/2008 08:56:00 AM

We discussed this yesterday, and here is the announcement from Circuit City: Circuit City Stores, Inc. Provides Update on Liquidity and Announces Store Closing Plan

Due in part to its deteriorating liquidity position and the continued weak macroeconomic environment, the company has decided to take certain restructuring actions immediately, including closing 155 domestic segment stores, reducing future store openings and aggressively renegotiating certain leases.This is another blow to mall owners and will impact new commercial real estate construction. The vacancy rate at malls is already soaring as announced last month:

For strip centers and other open-air shopping venues, the vacancy rate climbed to 8.4% in the third quarter from 8.1% in the second quarter.Here is a list of the stores being closed. The store closings are concentrated in states with serious housing and economic issues: Arizona, California, Georgia, Florida, and more.

...

The vacancy rate at malls in the top 76 U.S. markets rose to 6.6% in the third quarter, up from 6.3% in the previous quarter, to its highest level since late 2001, according to Reis.

China: Owners Deserting Factories

by Calculated Risk on 11/03/2008 08:30:00 AM

Don Lee at the LA Times reports on a growing trend in China: Some owners deserting factories in China

First, Tao Shoulong burned his company's financial books. He then sold his private golf club memberships and disposed of his Mercedes S-600 sedan.Back in March, I spoke with an executive of a U.S. company, and he told me his company was scaling back their Chinese operations because their manufacturing costs in China had increased by 30%. This was due to a combination of the new Chinese labor laws, higher currency exchange, higher material costs and other factors.

And then he was gone.

And just like that, China's biggest textile dye operation -- with four factories, a campus the size of 31 football fields, 4,000 workers and debts of at least $200 million -- was history.

...

Toy makers are among the hardest hit. More than 3,600 such factories have closed -- about half the industry's total, government figures show. Most were small operations, but last month Smart Union Group's three huge factories stopped production, leaving more than 8,700 workers jobless.

Now a global slowdown and the credit crisis has led to a contraction in the Chinese manufacturing sector. China will probably be forced to stimulate their economy - and, as I speculated this weekend, this could lead to higher intermediate and long term interest rates in the U.S.

At least 'decoupling' is officially dead.

Long Line Forms at Bailout Window

by Calculated Risk on 11/03/2008 01:25:00 AM

From the WSJ: Rescue Cash Lures Thousands of Banks

Treasury and banking regulators say as many as 1,800 publicly held institutions could apply for government investments in coming weeks ... thousands more private banks could apply for government capital as well, a Treasury spokeswoman said Sunday.What a surprise ...