by Calculated Risk on 10/31/2008 12:29:00 AM

Friday, October 31, 2008

Quotes on Possible Treasury Mortgage Plan

A few quotes from David Streitfeld's piece in the NY Times: Mortgage Plan May Aid Many and Irk Others

“Why am I being punished for having bought a house I could afford? I am beginning to think I would have rocks in my head if I keep paying my mortgage.”

Todd Lawrence, homeowner, outside Norwich, Conn.

“If the lunch truly is free, the demand for free lunches will be large.”

Paul McCulley, PIMCO

“If the government says, ‘Prove that you can’t afford your house and we’ll redo your mortgage,’ then people are going to try to qualify.”

Peter Schiff, President of Euro Pacific Capital

“I guess they are forcing me to deliberately stop paying to look worse than I am. Crazy, don’t you think?”

Anonymous Countrywide borrower, Los Angeles

Thursday, October 30, 2008

Report: Almost Half of Nevada Homeowners Underwater

by Calculated Risk on 10/30/2008 09:32:00 PM

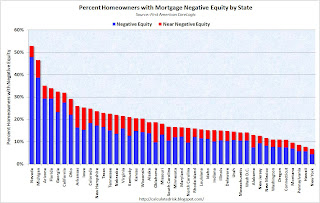

The WSJ reports on a new report from First American CoreLogic that estimates 48% of homeowners with a mortgage in Nevada owe more than their homes are worth. The WSJ reports that First American CoreLogic estimates 18% of homeowners with a mortgage nationwide are underwater.

Using the Census Bureau 2007 estimate of 51.6 million households with mortgages, 18% would be 9.3 homeowners with negative equity. This is less than the recent estimate from Moody's Economy.com of 12 million households underwater. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the percent of homeowners with mortgages underwater by state (data from First American CoreLogic via the WSJ)

Note: there is no data for Maine, Mississippi, North Dakota, South Dakota, Vermont, West Virginia and Wyoming.

It's interesting that the two worst states are Nevada and Michigan - one a bubble state, the other devastated by a poor economy. That pattern continues - everyone expects the bubble states of Arizona, Florida and California to be near the top of the list, and Ohio too because of the weak economy - but what about Arkansas, Iowa and even Texas?

The housing problems are everywhere.

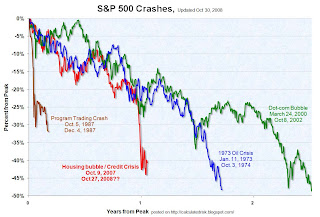

Comparing Stock Market Crashes

by Calculated Risk on 10/30/2008 07:22:00 PM

Fed Holds $145.7 Billion in Commercial Paper as of Oct 29

by Calculated Risk on 10/30/2008 04:47:00 PM

The Fed released the weekly balance sheet report today. The Fed reported that the Commercial Paper Funding Facility LLC holds $145.7 billion in 16 to 90 day commercial paper.

From Bloomberg: Fed Buys $145.7 Billion of Commercial Paper in Start of Program

The Federal Reserve bought commercial paper valued at $145.7 billion in the first days of the program aimed at backstopping the market, indicating the central bank is generating most of this week's record gains in short-term corporate borrowing.

The central bank extended $144.8 billion of loans as of yesterday to a unit that paid $143.9 billion for the debt, the Fed's weekly balance-sheet report said today.

Fed's Yellen: "Economy Contracting Significantly"

by Calculated Risk on 10/30/2008 03:57:00 PM

From San Francisco Fed President Dr. Janet Yellen: The Mortgage Meltdown, Financial Markets, and the Economy. Excerpt on the economic outlook:

[R]ecent data on the economy have been deeply worrisome. Data released this morning reveal that the economy contracted slightly in the third quarter. For the fourth quarter, it appears likely that the economy is contracting significantly. Mainly for this reason, inflationary risks have diminished greatly."It appears likely that the economy is contracting significantly". Strong words from a Fed president. Q4 is going to be ugly.

...

For consumers, the credit crunch is one of several negative factors accounting for the decline in spending in recent months. Consumer credit is costlier and harder to get: loan rates are up, loan terms are tougher, and increasing numbers of borrowers are being turned away entirely. This explains, in part, the exceptional weakness we have seen in auto sales. In addition, of course, employment has now declined for nine months in a row, and personal income, in inflation-adjusted terms, is virtually unchanged since April. Furthermore, household wealth is substantially lower as house prices have continued to fall and the stock market has declined sharply.

Business spending, too, is feeling the crunch in the form of a higher cost of capital and restricted access to credit. ... Some of our business contacts report that bank lines of credit are more difficult to negotiate, and many indicate that they have become cautious in managing liquidity, in committing to capital spending projects that can be deferred, and even in extending credit to customers and other

counterparties. Nonresidential construction also is headed lower largely because of the financial crisis; the market for commercial mortgage-backed securities, a mainstay for financing large projects, has all but dried up.

...

Until recently, weakness in domestic final demand was offset by a major boost from exporting goods and services to our trading partners. Unfortunately, economic growth in the rest of the world has slowed noticeably. ... As a result, exports will not provide as much of an impetus to growth as they did earlier in the year.

emphasis

added

PCE: Worse in September

by Calculated Risk on 10/30/2008 03:12:00 PM

Just a quick note: Real Personal Consumption Expenditures (PCE) declined 3.1% (annualized) in Q3 according to the BEA Q3 Advance GDP report. This was the first decline since 1992, and real PCE was less in Q3 2008 than in Q3 2007!

This also suggests that spending declined sharply in September (or that earlier months were revised down).

My "two month" estimate for PCE in Q3 was -2.4%, and two Fed researchers proposed another method that forecast PCE of -2.3%.

Either way, the quarterly decline of -3.1% suggests that the decline in consumer spending was even worse in September than for July and August, and assuming no downward revision for the previous months, this indicates a decline of -4.4% (annual rate) for September compared to June.

Note: when comparing months, the headline number will be to the previous month (August in this case), but the better comparison - for comparing to the quarterly data - is to compare to the monthly data of the same month of the previous quarter (third month in Q2 or June).

The BEA will release the numbers for September tomorrow morning, and they will probably be ugly.

Cliff Diving du jour: Insurance Companies

by Calculated Risk on 10/30/2008 02:07:00 PM

From MarketWatch: Hartford Financial loses over half its market value

The company reported a big third-quarter loss late Wednesday and said that it couldn't gauge the amount of extra capital it has because of market volatility.Harford is off 51%

Assurant Inc is off 25%

Prudential Financial is off 22%

CIGNA Corp is off 22%

Office Vacancy Rate vs. Unemployment

by Calculated Risk on 10/30/2008 12:27:00 PM

One of the key components of non-residential structure investment is construction of new offices. When the supplemental data is released for Q3 GDP, I expect it will show that office investment started to decline in the most recent quarter - and I expect office investment will decline significantly over the next year.

The following graphs show office vacancy rate vs. unemployment (hat tip Will). Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the office vacancy rate vs. the quarterly unemployment rate and recessions.

Changes in the unemployment rate and the office vacancy rate are highly correlated. As the unemployment rate continues to rise over the next year or more, we'd expect the office vacancy rate to rise too. And this will discourage investment in new office structures - and put significant pressure on office rents and prices. The second graph shows the relationship between the office vacancy rate and the unemployment rate using data starting in Q1 1991. The unemployment rate is from the BLS and the office vacancy rate is from REIS.

The second graph shows the relationship between the office vacancy rate and the unemployment rate using data starting in Q1 1991. The unemployment rate is from the BLS and the office vacancy rate is from REIS.

I've added the polynomial trend line (with R^2 of 0.88). The two most recent quarters are marked in red.

This suggests that office vacancy rates are currently below the expected level, and vacancy rates will probably increase sharply over the next year.

Credit Crisis Indicators: Mixed

by Calculated Risk on 10/30/2008 10:56:00 AM

According to data from the British Bankers' Association, three-month U.S. dollar Libor fell to 3.1925% from Wednesday's fixing of 3.42%. The rate peaked at 4.81875% on Oct. 10.

The 3 month yield was close to zero for a few days, so this is still some improvement from the worst of the credit crisis. Usually the 3 month trades below the target Fed Funds rate by around 25 bps, so this is too low with the Fed funds rate at 1.0%. Update: however, the effective Fed Funds rate is even lower (0.67% yesterday), so a 3 month yield of 0.48% is in the right range.

I'd like to see the spread move back down to 1.0 or lower - at least below 2.0.

Here is a list of SFP sales. No announcement today. no progress.

During a recession, this spread usually increases because the risk of default for lower quality paper increases. However the recent values (over 400 bps) are far in excess of normal. If the credit crisis eases, I'd expect a significant decline in this spread. The high for the A2P2 spread was 4.66, and there has been no progress here.

The LIBOR is down and the TED spread is off a little, but the A2P2 spread is at a record high - so there is some progress in some areas, and none by other measures.

Investment in Structures: Residential vs. Non-Residential

by Calculated Risk on 10/30/2008 09:09:00 AM

The following graph shows residential investment compared to investment in non-residential structures as a percent of GDP since 1960. All data from the BEA.

Note: Residential investment is primarily single family structures, multi-family structures, commissions, and home improvement. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The recent housing boom and bust is very clear (in red).

Residential investment was 3.3% of GDP in Q3 2008, the lowest level since 1982 (just under 3.2%).

Non-residential investment in structures increased to almost 4% of GDP in Q3. This investment is slowing down right now (the Census Bureau has reported declines in non-residential investment for the last two months), and investment in non-residential structures will almost certainly be negative in Q4.

The positive contributions to GDP were exports, government spending, and investment in non-residential structures. Non-residential structures will be negative in Q4, and exports are slowing - so Q4 GDP will probably be much worse than Q3.

Note: I'll have much more on non-residential investment in offices, malls and hotels when the underlying details are released in a few days.

Q3 GDP Declines 0.3%

by Calculated Risk on 10/30/2008 08:30:00 AM

From the BEA: GROSS DOMESTIC PRODUCT: THIRD QUARTER 2008 (ADVANCE)

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- decreased at an annual rate of 0.3 percent in the third quarter of 2008 ...PCE declined -3.1% (annualized). This is the first decline in consumer spending since 1991.

The decrease in real GDP in the third quarter primarily reflected negative contributions from personal consumption expenditures (PCE), residential fixed investment, and equipment and software that were largely offset by positive contributions from federal government spending, exports, private inventory investment, nonresidential structures, and state and local government spending. Imports, which are a subtraction in the calculation of GDP, decreased.

Private investment declined -1.9%. I'll have some graphs on investment shortly.

IMF Creates $100 Billion Fund

by Calculated Risk on 10/30/2008 01:00:00 AM

From the WSJ: IMF Creates $100 Billion Fund to Aid Crisis Fight

The International Monetary Fund will offer as much as $100 billion in a new kind of loan to countries that are battered by the financial crisis ... The new three-month loans, aimed at economies the IMF judges to be troubled but basically sound, wouldn't require countries to make the often severe changes in their policies that the IMF has demanded for decades.The IMF has always required painful, some would argue too painful, changes to a country's fiscal policies in exchange for help. This is apparently true for the bailouts of Hungary and the Ukraine. This lending facility would not come with as many strings attached and might be useful for recapitalizing banks - but I'm not sure about the "defending currency" idea since that usually doesn't work.

...

The IMF's new program, called the Short Term Liquidity Facility, would be used largely to pad a country's reserves, which could help the recipient defend its currency. But the funds could also be used to help recapitalize banks or cover import bills.

The IMF plan is its clearest recognition that its insistence on tough conditions is driving away potential borrowers that might need its help. But the new plan also puts the IMF in the position of deciding who can have money with few strings attached, and who can't.

Wednesday, October 29, 2008

Wells Fargo Issues Shares to TARP for $25 Billion

by Calculated Risk on 10/29/2008 06:20:00 PM

Press Release: Wells Fargo Issues Shares in U.S. Treasury Capital Purchase

Wells Fargo ... announced today it has issued to the U.S. Department of the Treasury 25,000 shares of Wells Fargo’s Fixed Rate Cumulative Perpetual Preferred Stock, Series D without par value. The shares have a liquidation amount per share equal to $1,000,000, for a total price of $25 billion. This issuance is part of the Treasury Department’s Troubled Asset Relief Program (TARP) ...Now they have the money. Will they lend it?

As an aside, the National Debt has increased $880 billion since the beginning of September - that isn't a typo - almost $1 trillion in less than two months as the Treasury raises cash for the TARP and for the Fed's liquidity initiatives.

The National Debt is now $10.53 trillion. Remember when the debt passed $10 trillion? That was on September 30th ... less than one month ago.

Roubini: S&P500 May Decline Another 30%

by Calculated Risk on 10/29/2008 05:49:00 PM

Here is an interview with Professor Roubini this morning on Bloomberg:

Treasury, FDIC Considering Plan to Rework Millions of Mortgages

by Calculated Risk on 10/29/2008 03:49:00 PM

From the WaPo: Treasury, FDIC Crafting Plan to Rework Millions of Mortgages

Officials with the Treasury and the Federal Deposit Insurance Corp. are crafting a plan under which the government would guarantee the mortgages of as many as 3 million homeowners now struggling to avoid foreclosure ...

Under the program being discussed, the lender would agree to reduce borrowers’ monthly payments, for example by lowering the interest rate or principal of a mortgage loan, based on the homeowner’s ability to pay. ... the government would then guarantee to repay the lender for a portion of its loss if the borrower defaulted on the reconfigured loan.

More Swap Lines from the Fed

by Calculated Risk on 10/29/2008 03:34:00 PM

Today, the Federal Reserve, the Banco Central do Brasil, the Banco de Mexico, the Bank of Korea, and the Monetary Authority of Singapore are announcing the establishment of temporary reciprocal currency arrangements (swap lines). These facilities, like those already established with other central banks, are designed to help improve liquidity conditions in global financial markets and to mitigate the spread of difficulties in obtaining U.S. dollar funding in fundamentally sound and well managed economies.Next up, $30 billion for the Bank of CR & Tanta.

...

These new facilities will support the provision of U.S. dollar liquidity in amounts of up to $30 billion each by the Banco Central do Brasil, the Banco de Mexico, the Bank of Korea, and the Monetary Authority of Singapore.

These reciprocal currency arrangements have been authorized through April 30, 2009.

The FOMC previously authorized temporary reciprocal currency arrangements with ten other central banks: the Reserve Bank of Australia, the Bank of Canada, Danmarks Nationalbank, the Bank of England, the European Central Bank, the Bank of Japan, the Reserve Bank of New Zealand, the Norges Bank, the Sveriges Riksbank, and the Swiss National Bank.

Fed Funds Rate Cut 50 bps to 1.0%

by Calculated Risk on 10/29/2008 02:15:00 PM

FOMC statement:

The Federal Open Market Committee decided today to lower its target for the federal funds rate 50 basis points to 1 percent.

The pace of economic activity appears to have slowed markedly, owing importantly to a decline in consumer expenditures. Business equipment spending and industrial production have weakened in recent months, and slowing economic activity in many foreign economies is damping the prospects for U.S. exports. Moreover, the intensification of financial market turmoil is likely to exert additional restraint on spending, partly by further reducing the ability of households and businesses to obtain credit.

In light of the declines in the prices of energy and other commodities and the weaker prospects for economic activity, the Committee expects inflation to moderate in coming quarters to levels consistent with price stability.

Recent policy actions, including today’s rate reduction, coordinated interest rate cuts by central banks, extraordinary liquidity measures, and official steps to strengthen financial systems, should help over time to improve credit conditions and promote a return to moderate economic growth. Nevertheless, downside risks to growth remain. The Committee will monitor economic and financial developments carefully and will act as needed to promote sustainable economic growth and price stability.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; Timothy F. Geithner, Vice Chairman; Elizabeth A. Duke; Richard W. Fisher; Donald L. Kohn; Randall S. Kroszner; Sandra Pianalto; Charles I. Plosser; Gary H. Stern; and Kevin M. Warsh.

In a related action, the Board of Governors unanimously approved a 50-basis-point decrease in the discount rate to 1-1/4 percent. In taking this action, the Board approved the requests submitted by the Boards of Directors of the Federal Reserve Banks of Boston, New York, Cleveland, and San Francisco.

emphasis added

Report: GM-Chrysler Major Acquisition Issues Resolved

by Calculated Risk on 10/29/2008 01:16:00 PM

From Reuters: Major issues resolved in GM-Chrysler talks-sources

General Motors and Cerberus Capital have resolved the major issues in a proposed GM-Chrysler merger but the final form of any deal will depend on the financing and government support available ... As GM seeks some $10 billion in U.S. government aid to support the deal, Chrysler owner Cerberus is in its own set of intense discussions with banks to refinance $9 billion of Chrysler debt ...This deal will make GM the number one auto maker again - at least for a little while. GM has fallen further behind Toyota, see WSJ: GM's Vehicle Sales Fell 11% in 3rd Quarter

GM ... sold 2.11 million vehicles in the [third] quarter. That pushed GM, until recently the world's largest auto maker by sales, further behind Toyota Motor Corp., which last week reported third-quarter global sales of 2.24 million vehicles ...

Credit Crisis Indicators

by Calculated Risk on 10/29/2008 12:51:00 PM

While we wait for the Fed ...

The 3 month yield was close to zero for a few days, so this is still a significant improvement from the worst of the credit crisis. Usually the 3 month trades below the Fed Funds rate by around 25 bps, so this is reasonable if the Fed cuts rates to 0.75%, but the yield is too low if the Fed cuts 50 bps to 1.0%.

I'd like to see the spread move back down to 1.0 or lower - at least below 2.0.

Here is a list of SFP sales. No announcement today. no progress.

During a recession, this spread usually increases because the risk of default for lower quality paper increases. However the recent values (over 400 bps) are far in excess of normal. If the credit crisis eases, I'd expect a significant decline in this spread. The high for the A2P2 spread was 4.66, and there has been little progress here.

No thaw today.

New Home Sales: Shift to FHA Financing

by Calculated Risk on 10/29/2008 10:08:00 AM

According to the Census Bureau, 17% of new homes sold in Q3 2008 were financed with FHA loans. This is up from an average of 4% in the 2005 through 2007 period.

This huge percentage increase in FHA loans was partially driven by Downpayment Assistance Programs (DAPs). These programs allowed the seller to provide the buyer with the downpayment by funneling the money through a charity.

DAPs have been eliminated (finally!) as of Oct 1st.

Eliminating DAPs is a positive for the economy and housing. FHA loans using DAPs had significantly higher default rates than when the buyers actually made a down-payment, and DAPs encouraged appraisal fraud.

Although good for housing and the economy in the long term, eliminating DAPs might impact new home sales in the fourth quarter of 2008. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows new home sales by percent financing type. The percent of FHA loans increased dramatically in 2008, and this was probably driven by DAPs.

The second graph shows the same information but by the number of units sold. Of the 118,000 homes sold in Q3 2008, 20,000 were bought using FHA financing.

Of the 118,000 homes sold in Q3 2008, 20,000 were bought using FHA financing.

This compares to 7,000 FHA financed homes in Q3 2007 out of 181,000 new homes sold.

The number and percent of FHA loans will probably decline in Q4 2008, and this will probably impact about 10% of potential home buyers.