by Calculated Risk on 10/29/2008 09:08:00 AM

Wednesday, October 29, 2008

LIBOR Slowly Declines

From Bloomberg: Libor Declines on Central Bank Cash Funding, Fed Rate Outlook

The London interbank offered rate, or Libor, that banks charge each other for three-month loans in dollars fell 5 basis points today to 3.42 percent, its 13th straight decline, according to the British Bankers' Association.But the TED spread has increased slightly because the 3 month treasury yield has declined - perhaps because traders think the Fed might cut the Fed Funds rate by 75 bps today.

...

"The strains in money markets are beginning to ease, but only at a glacial pace," said Nick Stamenkovic, a fixed-income strategist in Edinburgh at RIA Capital Markets.

Mathew Padilla at Google Talk

by Calculated Risk on 10/29/2008 01:59:00 AM

I frequently link to Mathew Padilla's outstanding writing at the Orange County Register.

Matt co-authored a book on the mortgage crisis: "Chain of Blame".

His blog, "Mortgage Insider" is available at: www.ocregister.com/mortgage

This is 45 minute talk. Matt knows his stuff, but he was a little nervous at the beginning of this talk ...

Tuesday, October 28, 2008

NY Times: Lenders Begin to Curb Credit Cards

by Calculated Risk on 10/28/2008 10:42:00 PM

From Eric Dash at the NY Times: As Economy Slows, Lenders Begin to Curb Credit Cards

Lenders wrote off an estimated $21 billion in bad credit card loans in the first half of 2008 as more borrowers defaulted on their payments. With companies laying off tens of thousands of workers, the industry stands to lose at least another $55 billion over the next year and a half, analysts say. Currently, the total losses amount to 5.5 percent of credit card debt outstanding, and could surpass the 7.9 percent level reached after the technology bubble burst in 2001.

“If unemployment continues to increase, credit card net charge-offs could exceed historical norms,” Gary L. Crittenden, Citigroup’s chief financial officer, said.

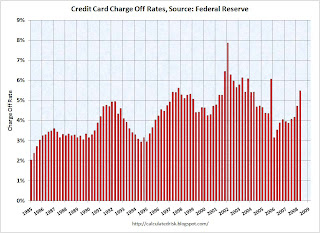

Click on graph for larger image.

Click on graph for larger image.This graph shows the consumer credit card charge-off rate by quarter starting with 1985.

Note the spike in 2005 was because of the change to the bankruptcy law (Bankruptcy Abuse Prevention and Consumer Protection Act of 2005).

The record charge-off rate was 7.85% in Q1 2002 according to the Fed and a new record will probably set during this recession.

To add to the story, here is a comment from the Capital One conference call two weeks ago:

We have tightened underwriting standards across the boar. In our US card business we have gotten more conservative. We have begun to reduce credit lines. We have continued to tweak our underwriting models and to the recalibrate models this may be unstable. We have adapted our models and approaches as the economic environment has changed and we are intervening judgmentally even more than our models would indicate.No Home ATM. No credit cards. What is a debt addicted U.S. consumer to do?

S&P Case-Shiller: Real Prices for Selected Cities

by Calculated Risk on 10/28/2008 07:10:00 PM

Earlier today I posted the following graph showing the price declines from the peak for each city included in S&P/Case-Shiller indices. Click on graph for larger image in new window.

Click on graph for larger image in new window.

In Phoenix and Las Vegas home prices have declined about 36% from the peak. At the other end of the spectrum, prices in Charlotte and Dallas are only off about 3% from the peak.

For the most part, the size in the percentage price decline is related to the size of the price bubble for each area. The second graph shows real prices for cities at the extremes - Las Vegas and Charlotte, and Chicago in the middle. This shows real prices (adjusted with CPI less Shelter) for three cities. Las Vegas had a huge price increase in the early '00s, and now prices are falling rapidly.

This shows real prices (adjusted with CPI less Shelter) for three cities. Las Vegas had a huge price increase in the early '00s, and now prices are falling rapidly.

Charlotte had a small price bubble, and prices have only declined a few percent. It appears prices in the bubbly areas (like Las Vegas) are still too high, but prices are already close to normal for Charlotte.

WSJ: Bailout might Include Privately Held Banks

by Calculated Risk on 10/28/2008 06:02:00 PM

From the WSJ: Treasury May Expand Financial Rescue to Non-Publicly Traded Banks

Treasury Department officials ... met with representatives from the banking industry Tuesday to discuss expanding the Troubled Asset Relief Program to make mutually held, family-owned and other private banks eligible for federal funds.The line is getting longer ...

...

Non-public banks are typically more conservatively run and may be more ready to lend money back into the financial system ... The banking industry's trade group estimates that as many as 6,500 closely held financial institutions aren't eligible for the capital program under the current rules ... because their structure doesn't permit them to issue preferred shares that the Treasury would buy.

The Fed Starts Buying Commercial Paper

by Calculated Risk on 10/28/2008 03:54:00 PM

From Bloomberg: Fed Spurs Record Surge in Longer-Term Commercial Paper Issuance (hat tip Scott)

Companies yesterday sold more than 1,500 issues totaling a record $67.1 billion of the debt due in more than 80 days, compared with a daily average of 340 issues valued at $6.7 billion last week, according to data published by the Fed. Most of the difference was probably absorbed by the Fed ... The Fed began buying commercial paper from companies yesterday to reduce rates, lure back investors and unlock the market ...

SL Green on CRE

by Calculated Risk on 10/28/2008 03:09:00 PM

From the SL Green conference call today (SL Green is a REIT focusing on commercial office and retail properties):

Analyst: Based on your estimation, when should we expect some of the [distressed property] to potentially start to enter the market?The CRE version of stated income loans involved lending on overly optimistic pro forma income projections (aka wishful thinking), and the NegAM feature was called "interest reserves".

SL Green: I think you'll certainly see more in 2009 than we did in 2008 as interest reserves run short. And then the real forced selling to the extent that there's not a replacement debt market and to the extent, depending on where cap rates shake out will be in '10, '11 as you start getting floating rate maturities. There are unlikely to be a lot of final maturities next year without extension options. But we'll see the stress where people burn their interest reserves and don't come up with cash.

Analyst: In the last few leases that you've actually signed, if you were to do those deals or look at those same deals a year ago, how far off are the economics on the deals you just signed versus what they would have been say at the peak on a percentage basis.

SL Green: They are probably down 10% on nominal rent with slightly bigger concession packages than we would have offered a year ago. So I think squarely within the ten to 15 that we've been referencing in the past. Some less, not many more. Not many more on a net [effective] basis ... we do costs dozens and dozens of leases per quarter it's hard to generalize but I think we've been taking most of those rents down by 10% what have we would have gotten earlier in the year.

Just last month, chief economist at REIS, Sam Chandan noted:

"Even a modest slowdown, as we have already observed in the New York market, confutes the underwriting assumptions that prevailed in the period leading up to the last year's investment peak."And Michael Slocum, executive vice president at Capital One Bank, added:

"The key issue is what happens to the overleveraged properties purchased and financed in the past three years. In many cases, the financial projects were based on rising rents and debt markets remaining stable. Many of the loans required the borrowers to provide interest reserves, but they will likely exhaust over the 2009-2010 time frame." ... "It always comes back to cash flow on commercial real estate. Properties financed on true cash flow should be fine."At least everyone sees the problem coming!

Real Case-Shiller Composite Indices

by Calculated Risk on 10/28/2008 02:09:00 PM

Here is a look at the real (inflation adjusted) Case-Shiller Composite 10 and 20 city indices. Nominal prices are adjusted using CPI less shelter, and Jan 2000 is set to 100. Click on graph for larger image in new window.

Click on graph for larger image in new window.

In real terms, prices have fallen close to 30% from the peak, and have fallen by about 2/3 of the way back to January 2000 real prices.

Of course there is nothing magical about 2000 prices, and prices could fall more or less than to 100 on the graph. I don't have much to add, but I think real prices are a better gauge than nominal prices as to how far prices will probably fall. I expect these real indices to decline for some time.

Credit Crisis Indicators: Mostly Unchanged

by Calculated Risk on 10/28/2008 12:15:00 PM

The 3 month yield was close to zero for a few days, so this is a significant improvement from the worst of the credit crisis. With the pending Fed Funds rate cut it is hard to guess just how high the 3 month should rise. Usually the 3 month trades below the Fed Funds rate by around 25 bps, so the current yield might be reasonable.

I'd like to see the spread move back down to 1.0 or lower - at least below 2.0.

Here is a list of SFP sales. No announcement today. no progress.

During a recession, this spread usually increases because the risk of default for lower quality paper increases. However the recent values (over 400 bps) are far in excess of normal. If the credit crisis eases, I'd expect a significant decline in this spread. The high for the A2P2 spread was around 4.6 (I don't have the exact number)

This is another day with little progress.

Consumer Confidence Hits Record Low

by Calculated Risk on 10/28/2008 10:32:00 AM

From MarketWatch: U.S. consumer confidence plunges to record low

U.S. consumer confidence plunged in October, reaching an all-time low in the series' 41-year existence, the Conference Board reported Tuesday. ... Despite falling gasoline prices, the October consumer confidence index fell to 38 from an upwardly revised September reading of 61.4.I usually don't post consumer confidence numbers because they are mostly coincident indicators - they tell you pretty much what you already know - but a new record low is hard to overlook.

Q3: Homeownership and Vacancy Rates

by Calculated Risk on 10/28/2008 10:00:00 AM

This morning the Census Bureau reported the homeownership and vacancy rates for Q3 2008. Here are a few graphs and some analysis ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

The homeownership rate decreased slightly to 67.9% and is now back to the levels of the summer of 2001. Note: graph starts at 60% to better show the change.

Here is an excerpt from a piece I wrote earlier this year on the impact of the change in homeownership rate (with a hat tip to Jan Hatzius):

As the graph shows, the homeownership rate increased from 64% in 1994 to 69% in 2004, or about 0.5% per year. With 110 million total households in the U.S., this change in the homeownership rate would mean an increase of about 550 thousand new homeowners per year during that period – even with no population growth.The second graph shows the homeowner vacancy rate since 1956. The homeownership vacancy rate was steady at 2.8% (down from a record 2.9% in Q1).

The U.S. population has been growing just under 3 million people per year on average, and there are about 2.4 people per household. Assuming no change in these numbers, there would be close to 1.25 million new households formed per year in the U.S.

Since about two thirds of all households are owner occupied, an increase of 1.25 million households per year would imply an increase in homes owned of about 800K+ per year.

So we could add the 550K from the increasing homeownership rate, to the 800K due to the increase in households (due to population growth), and the U.S. would have needed 1.35 million additional owner occupied homes per year during the period from 1995 to 2004. If the homeownership rate now stabilized, the U.S. would only need 800K additional units per year.

And if the homeownership declined – as it has been for the last 2+ years – at a rate of around 0.5% per year, the U.S. would need 800K minus 550K new units per year, or only 350K additional owner occupied units per year!

This number can't be compared directly to the Census Bureau housing starts and new home sales. There are many other factors that must be accounted for, but this does show the homebuilders had a tailwind behind them for a decade, and are now flying into a headwind.

Even when the homeownership rate stabilizes, the U.S. would only need 800K new owner occupied homes per year – far below the level of 1995 to 2004.

This means the builders have two problems over the next few years: 1) There is too much inventory, and 2) demand will be significantly lower over the next few years than from 1995 to 2004.

Why did the homeownership rate increase?

A 1007 research paper by Matthew Chambers, Carlos Garriga, and Don E. Schlagenhauf (Sep 2007), "Accounting for Changes in the Homeownership Rate", Federal Reserve Bank of Atlanta, suggests that there were two main factors for the increase in homeownership rate between 1994 and 2004: 1) mortgage innovation, and 2) demographic factors (a larger percentage of older people own homes, and America is aging). The authors found that mortgage innovation accounted for between 56 and 70 percent of the recent increase in homeownership rate, and that demographic factors accounted for 16 to 31 percent. Even as we unwind some of the excesses of recent years, not all innovation is going away (securitization and some smaller down payment programs will stay). And the population is still aging, so the homeownership rate will probably only decline to 66% or 67%, not all the way to 64%.

In summary: For as long as the homeownership rate declines – probably for at least another couple of years - this means the need for new owner occupied units will stay depressed, and even when the homeownership rate stabilizes and the inventory is reduced, demand will only be about 2/3 of the 1995-2004 period.

A normal rate for recent years appears to be about 1.7%. There is some noise in the series, quarter to quarter, so perhaps the vacancy rate has stabilized in the 2.7% to 2.9% range.

A normal rate for recent years appears to be about 1.7%. There is some noise in the series, quarter to quarter, so perhaps the vacancy rate has stabilized in the 2.7% to 2.9% range.This leaves the homeowner vacancy rate almost 1.1% above normal, and with approximately 75 million homeowner occupied homes; this gives about 825 thousand excess vacant homes.

The rental vacancy rate decreased slightly to 9.9% in Q3 2008, from 10.0% in Q2. The rental vacancy rate had been flat or trending down slightly for almost 3 years (with some noise).

It's hard to define a "normal" rental vacancy rate based on the historical series, but we can probably expect the rate to trend back towards 8%. According to the Census Bureau there are close to 40 million rental units in the U.S. If the rental vacancy rate declined from 9.9% to 8%, there would be 1.9% X 40 million units or about 760,000 units absorbed.

It's hard to define a "normal" rental vacancy rate based on the historical series, but we can probably expect the rate to trend back towards 8%. According to the Census Bureau there are close to 40 million rental units in the U.S. If the rental vacancy rate declined from 9.9% to 8%, there would be 1.9% X 40 million units or about 760,000 units absorbed. This would suggest there are about 760 thousand excess rental units in the U.S.

There are also approximately 200 thousand excess new homes above the normal inventory level (for home builders) - plus some uncounted condos.

If we add this up, 760 thousand excess rental units, 825 thousand excess vacant homes, and 200 thousand excess new home inventory, this gives about 1.8 million excess housing units in the U.S. that need to be absorbed over the next few years. (Note: this data is noisy, so it's hard to compare numbers quarter to quarter, but this is probably a reasonable approximation).

These excess units will keep pressure on housing starts and prices for some time.

S&P Case-Shiller: House Prices Decline in August

by Calculated Risk on 10/28/2008 09:12:00 AM

S&P/Case-Shiller released their monthly Home Price Indices for August this morning. This includes prices for 20 individual cities, and two composite indices (10 cities and 20 cities). Note: This is not the quarterly national house price index. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the nominal Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 22.0% from the peak.

The Composite 20 index is off 20.3% from the peak.

Prices are still falling, and will probably continue to fall for some time.  The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.

The Composite 10 is off 17.7% over the last year.

The Composite 20 is off 16.6% over the last year.

The following graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices. In Phoenix and Las Vegas, home prices have declined about 36% from the peak. At the other end of the spectrum, prices in Charlotte and Dallas are only off about 3% from the peak.

In Phoenix and Las Vegas, home prices have declined about 36% from the peak. At the other end of the spectrum, prices in Charlotte and Dallas are only off about 3% from the peak.

This shows the difference between the bubble areas (Krugman in 2005 called the "Zoned Zones") and the "Flatland" areas.

There was a bubble in Flatland too caused by the rapid migration from renting to buying - facilitated by loose lending - that pushed up Flatland prices. But those bubbles were small compared to the bubbles in the Zoned Zones.

Now that the bubble has burst, prices in the more bubbly Zoned Zones are falling much more than in Flatland.

Detroit is an exception with prices off 27% from the peak, even though Detroit never had a price bubble. The reason is Detroit has a weak economy and a declining population. Since housing is very durable, there is excess supply in Detroit, and prices for existing homes are below replacement costs.

Another exception is New York. Prices in New York are only off 10.6% even though New York is part of the Zoned Zone. New York had a price bubble, but until recently prices had held up pretty well.

S&P Case-Shiller: Home prices off 16.6% in past year

by Calculated Risk on 10/28/2008 09:10:00 AM

From Rex Nutting at MarketWatch: Home prices off record 16.6% in past year, Case-Shiller says

Home prices in 20 major U.S. cities dropped 1% in August compared with July and had fallen a record 16.6% from the previous year ... Prices have fallen in all 20 cities compared with a year ago.More - plus graphs - as soon as the data is available online.

First Fed: Over 22% of Loan Portfolio to Underwater Households

by Calculated Risk on 10/28/2008 12:02:00 AM

The 8-K filed by First Fed with the SEC today has some interesting information on current LTVs. (hat tip Brian) Click on table for larger image in new window.

Click on table for larger image in new window.

This table shows the original LTV of First Fed's $4.5 billion loan portfolio, and the current LTV using OFHEO House Price Index for price declines.

This shows that about 22.3% of First Fed loans (by dollar) are underwater. It would be a larger percentage using the Case-Shiller price index.

Approximately $1.0 billion in loans are underwater out of $4.5 billion in loans. Using the above table, and the delinquent loans by LTV on page 8, we can determine the percent delinquent by LTV category.

Using the above table, and the delinquent loans by LTV on page 8, we can determine the percent delinquent by LTV category.

As expected, the higher the current LTV, the larger the percentage of delinquent loans. Probably most of the loans listed as 90% to 100% LTV are also currently underwater too since First Fed uses OFHEO (and Case-Shiller is probably worse and I believe more representative of actual price changes).

Also see the bottom of page 7 for delinquencies by borrower documentation type. For Verified Income/Verified Assets loans, 5.7% of loans are delinquent. For Stated Income (and no income) loans, around 20% of loans are delinquent. Not exactly a surprise ...

This is important for the entire industry: the higher the LTV, the higher the delinquency rate. As house prices continue to fall, and more and more households have negative equity - Moody's Economy.com estimates 12 million households currently are underwater, and this will probably increase to 20+ million by the time housing prices bottom - the delinquency rate (and foreclosures) will continue to increase.

Monday, October 27, 2008

BofE Report: Britian Banks May Need More Capital

by Calculated Risk on 10/27/2008 08:22:00 PM

From The Times: Banks may need further support from taxpayers as recession bites

Britain's banks may need to raise capital above and beyond the £50 billion of taxpayer-underwritten money already earmarked for them.The U.S. GDP is about five times the U.K, and that would suggest the eventual cost of the U.S. bailout might be over $1 trillion.

The Bank of England's report into financial stability today suggests that a recession as severe as that of the early 1990s would lead to credit losses of £130 billion for Britain's six biggest financial institutions and possibly wipe out the entire government-backed funding package.

Note: £130 billion X 5 / exchange rate 0.646329 = $1 trillion.

That is less than the number Professor Krugman speculated about over the weekend:

Do the math ... these numbers seem to suggest that an eventual outlay of $2 trillion is in the realm of possibility.But more might be required.

WSJ: GM may get $5 Billion Government loan

by Calculated Risk on 10/27/2008 05:31:00 PM

From the WSJ: GM May Get Loan for Chrysler Deal

The Department of Energy is working to release $5 billion in loans to General Motors Corp. ... The funds would come from a pool of $25 billion in low-interest loans approved by Congress to help Detroit retool its plants to meet new fuel-efficiency standards. It's not clear how quickly the money could be made available or whether it would come with strings attached.And from Reuters: US Treasury working on aid for GM, Chrysler merger

The U.S. government is considering direct financial assistance to facilitate a possible merger between General Motors Corp and Chrysler ... The Treasury Department is weighing aid of at least $5 billion, which could include capital injections and government purchases of bad auto loans ...It looks more and more likely that GM will acquire Chrysler.

Also of interest, just last week Daimler wrote the value of their Chrysler holdings down to zero according to a report in the Free Press: Daimler: Chrysler worth nothing

The German automaker has depreciated its stake in Chrysler to zero from $268 million at the end of June, the company said Thursday. A little over a year ago, the company valued its 19.9% stake in Chrysler at $2.2 billion.

Non-Residential Investment: WalMart Spending to Decline

by Calculated Risk on 10/27/2008 03:44:00 PM

From MarketWatch: Wal-Mart U.S. to add remodels, trim new store growth

Capital spending for Wal-Mart U.S. is expected to decline to $5.8 billion to $6.4 billion for fiscal 2009 from $9.1 billion last year. For fiscal 2010, capital spending is pegged at $6.3 billion to $6.8 billion ...Just more evidence of the imminent non-residential construction downturn.

New Home Sales: Annual and Through September

by Calculated Risk on 10/27/2008 01:17:00 PM

New home sales in 2008 might be at the lowest level since 1982. However adjusted for changes in owner occupied units, the current year is the worst on record.

The following graph shows both annual new home sales (from the Census Bureau) and sales through September. Click on graph for larger image in new window.

Click on graph for larger image in new window.

In 2008, sales through September (before revisions) have totaled 402 thousand. This is slightly ahead of the pace in 1991 (391 thousand sales through September).

However sales have slowed in the 2nd half of 2008, and it appears that annual sales might be below the 509 thousand in 1991. It will probably be close, but if sales are below the 1991 level, this would mean sales would be the lowest since 1982 (412 thousand).

Of course the U.S. population and the number of households were much lower in 1982. In 1982 there were 54.2 million owner occupied units in the U.S., in 1991 there were 61.0 million, and there are approximately 76 million today.

If we use a ratio of owner occupied units to compare periods, the low in 1982 was 412 thousand X (76/54.2) = 578 thousand units (based on the number of owner occupied units today).

The calculation for 1991 gives 634 thousand units (to compare to today).

By this measure, 2008 is the worst year for new home sales since the Census Bureau started tracking new home sales (starting in 1963).

Credit Crisis Indicators: Progress

by Calculated Risk on 10/27/2008 11:37:00 AM

[LIBOR was] 3.5075%, according to Monday's daily Libor fixing by the British Bankers Association. That's down from 3.51625% Friday ...

The Fed is expected to lower rates this week by anywhere from 25 bps to even 75 bps, but I'd still like to see the three month treasury closer to 1.0% (or whatever the Fed Funds rate is this week). The effective Fed Funds rate is about 0.93%, so the three month yield is still a little low.

Here is a list of SFP sales. The Treasury announced another $40 Billion for the Fed this morning - no progress.

During a recession, this spread usually increases because the risk of default for lower quality paper increases. However the recent values (over 400 bps) are far in excess of normal. If the credit crisis eases, I'd expect a significant decline in this spread.

The progress is slow, but this is a positive day in the credit markets.