by Calculated Risk on 10/27/2008 10:00:00 AM

Monday, October 27, 2008

September New Home Sales: Lowest September Since 1981

According to the Census Bureau report, New Home Sales in September were at a seasonally adjusted annual rate of 464 thousand. Sales for August were revised down slightly to 452 thousand.

Note that the most recent wave of the credit crisis started in mid-September. Since New Home sales are reported when the contract is signed, September sales were only partially impacted by the credit crisis. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Notice the Red columns for 2008. This is the lowest sales for September since 1981. (NSA, 36 thousand new homes were sold in September 2008, 28 thousand were sold in September 1981).

As the graph indicates, sales in 2008 are substantially worse than the previous years. The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

Sales of new one-family houses in September 2008 were at a seasonally adjusted annual rate of 464,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development.And one more long term graph - this one for New Home Months of Supply.

This is 2.7 percent above the revised August rate of 452,000, but is 33.1 percent below the September 2007 estimate of 694,000.

"Months of supply" is at 10.4 months.

"Months of supply" is at 10.4 months. Note that this doesn't include cancellations, but that was true for the earlier periods too. Sales are falling quickly, but inventory is declining too, so the months of supply is slightly lower than the peak of 11.4 months in August 2008.

The all time high for Months of Supply was 11.6 months in April 1980.

And on inventory:

The seasonally adjusted estimate of new houses for sale at the end of September was 394,000. This represents a supply of 10.4 months at the current sales rateInventory numbers from the Census Bureau do not include cancellations and cancellations are falling, but are still near record levels. Note that new home inventory does not include many condos (especially high rise condos), and areas with significant condo construction will have much higher inventory levels.

As I noted a couple of months ago, I now expect that 2008 will be the peak of the inventory cycle for new homes, and could be the bottom of the sales cycle for new home sales. But the news is still grim for the home builders. Usually new home sales rebound fairly quickly following a bottom (see the 2nd graph above), but this time I expect a slow recovery because of the overhang of existing homes for sales (especially distressed properties).

This is a another very weak report.

Capital One, Sun Trust Sell Preferred to Government

by Calculated Risk on 10/27/2008 09:06:00 AM

From the WSJ: Capital One, SunTrust to Sell Government Preferred Stock

A host of financial firms announced they will sell preferred stock and warrants to the federal government ...

The biggest morning disclosure was Capital One Financial Corp.'s $3.55 billion sale of preferred stock and warrants to the Treasury Department, followed by SunTrust Banks Inc. at $3.5 billion. ...

Other firms announcing their participation included Fifth Third Bancorp at $3.4 billion, Ohio-based regional bank KeyCorp at $2.5 billion, investment bank and asset manager Northern Trust Corp. at $1.5 billion and Huntington Bancshares Inc. at $1.4 billion.

Global Cliff Diving Continues

by Calculated Risk on 10/27/2008 08:43:00 AM

Hang Seng off 12.7%

Nikkei 225 off 6.4%

FTSE 100 off 3.4%

DAX off 3.9%

S&P futures off 20 points.

Another interesting day ...

Sunday, October 26, 2008

Report: IMF and Hungary Reach Bail Out Agreement

by Calculated Risk on 10/26/2008 08:36:00 PM

From Bloomberg: IMF Says Hungary to Receive `Substantial Financing Package'

The International Monetary Fund said it will announce a "substantial financing package" for Hungary ... "in the next few days" ...

Progress: Nothing Blows up on a Sunday

by Calculated Risk on 10/26/2008 07:53:00 PM

Nothing blew up today ... at least so far ... I guess that is progress.

This will be a heavy news week, especially for housing with New Home sales released on Monday, and homeownership and vacancy rates released on Tuesday. The FOMC will announce a rate cut on Wednesday, and advance Q3 GDP will be released on Thursday (the investment numbers will be especially interesting). And much more ...

I expect most of the economic news will be bad. So far the futures are basically flat.

Bloomberg Futures.

Index Futures from Barchart.com (active futures have a time not a date)

CBOT mini-sized Dow

Should be another interesting week.

IMF to Bail Out Ukraine

by Calculated Risk on 10/26/2008 02:04:00 PM

From the WSJ: IMF to Lend $16.5 Billion to Ukraine (hat tip Lyle)

The International Monetary Fund Sunday announced its second national rescue plan in a matter of days, saying it would lend $16.5 billion to Ukraine.

The announcement follows Friday's a $2.1 billion loan to Iceland ... Pakistan and Hungary are also talking to the IMF.

Fed Funds Rate Cut

by Calculated Risk on 10/26/2008 11:42:00 AM

How much will the Fed reduce the Fed Funds rate on Wednesday? And does it matter?

First, here are the latest Fed Fund probabilities from the Cleveland Fed. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Market participants expect a 50 bps rate cut to 1.0%, however there is some expectation of a 75 bps cut (to 0.75%).

Earlier this month, I speculated about an intermeeting rate cut: Will there be an Intermeeting Fed Rate Cut?. Sure enough the Fed cut the Fed Funds rate four days later - but market participants were disappointed with what was perceived as a feeble 50 bps effort.

Remember Bernanke wrote in 2004: What Explains the Stock Market’s Reaction to Federal Reserve Policy?

The most direct and immediate effects of monetary policy actions, such as changes in the federal funds rate, are on the financial markets; by affecting asset prices and returns, policymakers try to modify economic behavior in ways that will help to achieve their ultimate objectives.Bernanke can probably add the Oct 8th 50 bps rate cut to his list of "disappointing cuts" since the market sold off about 10% over the two days following the Fed action.

...

The unexpected 50-basis-point intermeeting rate reductions on 3 January [2001] and 18 April [2001] were both greeted euphorically, with one-day returns of 5.3% and 4.0% respectively. The 50-basis-point rate cut on 20 March [2001] was received less enthusiastically, however. Even though the cut was more or less what the futures market had been anticipating, financial press reported that many equity market participants were “disappointed” the rate cut hadn’t been an even larger 75 basis point action. Consequently, the market lost more than 2%.

Of course the FOMC just sets the target rate. The effective Fed Funds rate has already been at or under 1% for the last couple of weeks. So the Fed will just be making this official.

And does it even matter? Probably not much at this point. But I suspect market observers will be focused on the economic outlook.

Note: Dr. Krugman is updating his book "Return of Depression Economics". I think this 1998 paper from Professor Paul on the Japanese experience might be of interest to some readers: It's BAAACK! Japan's Slump and the Return of the Liquidity Trap.

Saturday, October 25, 2008

The Oil Cushion

by Calculated Risk on 10/25/2008 11:03:00 PM

How much will the decline in oil prices cushion the U.S. recession? That seems like a key question.

Here is an excerpt from Time: What's Behind (and Ahead for) the Plunging Price of Oil

If gasoline drops $1.50 the $900 [the average driver] saves would amount to a big stimulus package. According to Ed Leamer, director of the UCLA's Anderson Forecast, the current price slide could drop another $200-to-$250 billion into consumers' pockets, given that as of the second quarter personal spending for gas fuel oil and other energy was about $442 billion on an annualized basis.The following graph shows the monthly personal consumption expenditures (PCE) at a seasonally adjusted annual rate (SAAR) for gasoline, oil and other energy goods compared to the U.S. spot price for oil (monthly).

Click on graph for larger image in new window.

Click on graph for larger image in new window. At current oil prices, it appears oil related PCE will fall to $300-$350 billion SAAR, from close to $500 billion SAAR in July. This is a savings of $12 to $15 billion per month compared to July. And that would be helpful and definitely provide some cushion for consumers. This might show up as more savings, as opposed to other consumption, but rebuilding savings is probably a necessary step towards rebuilding household balance sheets.

Data sources:

PCE from BEA underlying detail tables: Table 2.4.5U. Personal Consumption Expenditures by Type of Product line 117.

Oil prices from EIA U.S. Spot Prices.

Excess Housing Units

by Calculated Risk on 10/25/2008 03:12:00 PM

Christopher Thornberg of Beacon Economics recently estimated the excess housing units in the U.S. at 3 to 4 million.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

Credit: Dr. Thornberg. See this presentation at the California Self Storage Association (CSSA).

Note: the entire presentation is interesting!

The underlying data is available from the Census Bureau.

It makes sense that there are more housing units than households due to the normal frictions of households moving, normal vacancy rates, and second homes. As an example, according to the Census Bureau, there were 1.145 million housing units rented or sold in Q2 but not yet occupied. This is normal as households move.

Some of the recent increase in the ratio of housing units to households is due to excess housing units (overbuilding), and apparently Dr. Thornberg believes this ratio should decline from about 1.17 to 1.14 or so. With approximately 111 million households in the U.S., and a ratio of 1.14, the U.S. only needs 127 million housing units compared to the almost 130 million housing units currently in the U.S.. That gives 3 million excess housing units.

However I think Thornberg's estimate is too high. In an earlier post, Q2: Homeownership and Vacancy Rates, I estimated the excess rental units, vacant homes, and new home inventory, and calculated that there were "about 1.75 million excess housing units in the U.S." at the end of Q2. I think this is a better estimate.

The Q3 numbers will be released this week.

Volvo Truck Sales (story changed)

by Calculated Risk on 10/25/2008 12:30:00 PM

Initially I posted a story about a significant plunge in truck sales for Volvo. However the details were misleading because of cancellations.

Here is a story from Bloomberg: European Heavy-Truck Sales Drop 4.8% as Economic Growth Wanes

European heavy-truck sales fell 4.8 percent last month as the credit crisis and concern that a recession is coming deterred companies from expanding fleets.

Manufacturers sold 28,947 trucks weighing 16 metric tons or more in September compared with 30,403 a year earlier, the Brussels-based European Automobile Manufacturers Association said in a statement today. Nine-month deliveries rose 3.5 percent to 250,580 vehicles.

Bank: Your Credit Rating is Better Than Ours!

by Calculated Risk on 10/25/2008 09:08:00 AM

| Click on cartoon for larger image in new window. Used with permission from cartoonist John Ambrosavage at Ambrotoons.com email for ambrotoons |  |

Friday, October 24, 2008

Greenspan and The Simpsons

by Calculated Risk on 10/24/2008 11:47:00 PM

Life Imitates Art (hat tip John) ... only 20 seconds.

Update: Greenspan and Casablanca "Shocked" 19 seconds

The Global Meltdown

by Calculated Risk on 10/24/2008 09:25:00 PM

Tom Petruno at the LA Times Money & Co. breaks it down: Many world stock markets now off 50% or more from peaks

Here's a club no country wants to join, yet its ranks are swelling: The 50%-Off (Or Worse) Stock Market Club.Petruno has more. By comparison, the U.S. is holding up OK - so far. I guess we could call this global synchronized cliff diving!

...

Here’s a sampling (not meant to be all-inclusive):

Markets down more than 70%: Vietnam (-70.5%), Peru (-73.2%), Ireland (-73.4%), Russia (-73.9%), Iceland (-88.7%).

Markets down between 60% and 70%: Hong Kong (-60.1%), Poland (-62.6%), China (-69.8%).

Charlie Rose: A Conversation with Paul Krugman

by Calculated Risk on 10/24/2008 07:37:00 PM

This is from yesterday (Oct 23rd). 36 minutes 15 seconds.

If the player doesn't work, here is the link.

Fed Researchers on Predicting PCE

by Calculated Risk on 10/24/2008 06:29:00 PM

I've been using a two month method to predict PCE. This estimate suggests real PCE will decline by 2.4% in Q3.

Fed economists Riccardo DiCecio and Charles S. Gascon have used real time data to estimate PCE and check the reliability of this approach: Predicting Consumption: A Lesson in Real-Time Data (November 2008)

Whereas I used revised data for historical comparisons, the Fed economists only used data that was available for analysts at the time of the estimate (a much better test of the approach). The economists found that using the change in the second-month of each quarter (over the second-month of the previous quarter) was very reliable. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The chart plots the approximated (second-month) and actual growth rates of PCE since 1991 using real-time data: That is, the growth rates at each point on the chart are computed using only the data that would have been available to a researcher at the time of the estimate. The approximated measure for 2008:Q3 is –2.3 percent, suggesting the first decline in PCE since the fourth quarter of 1991.Since PCE accounts for almost 71% of GDP, this also suggests the change in real GDP in Q3 might be negative. This depends on exports, changes in inventories and government spending (investment will certainly be negative in Q3).

Bank Failure: Alpha Bank & Trust, Alpharetta, GA

by Calculated Risk on 10/24/2008 04:11:00 PM

From the FDIC: Stearns Bank, National Association Acquires the Insured Deposits of Alpha Bank & Trust, Alpharetta, GA

Alpha Bank and Trust, Alpharetta, Georgia, was closed today by the Georgia Department of Banking and Finance, and the Federal Deposit Insurance Corporation (FDIC) was named receiver.This is a pretty small bank, but it is amazing that this will cost the Deposit Insurance Fund $158 million.

...

As of September 30, 2008, Alpha Bank & Trust had total assets of $354.1 million and total deposits of $346.2 million. Stearns Bank did not pay the FDIC a premium for the right to assume the failed bank's insured deposits.

At the time of closing, there were approximately $3.1 million in uninsured deposits held in approximately 59 accounts that potentially exceeded the insurance limits.

...

In addition to assuming the failed bank's insured deposits, Stearns Bank, N.A. will purchase approximately $38.9 million of Alpha's assets. The FDIC will retain the remaining assets for later disposition.

The transaction is the least costly resolution option, and the FDIC estimates that the cost to its Deposit Insurance Fund will be $158.1 million. The last bank to fail in Georgia was Integrity Bank, Alpharetta, on August 29, 2008. Alpha Bank & Trust is the sixteenth FDIC-insured institution to be closed this year.

Port Traffic Declines Sharply in September

by Calculated Risk on 10/24/2008 02:29:00 PM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

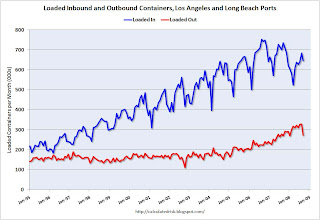

This graph shows the combined loaded inbound and outbound traffic at the ports of Long Beach and Los Angeles in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container). Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported.

Inbound traffic should be peaking for the year as retailers prepare for the holiday season. Inbound traffic is off from August, and about 12% below last September.

Outbound traffic fell off a cliff in September, and is 17% below August 2008, and at about the same level as a year ago.

From the WSJ: Reliance on Exports Hurts Asia

The meltdown in Asian stock prices on Friday stemmed in part from the growing realization that the heavy reliance on exports that has driven Asia's powerful growth is now turning into the its worst enemy.So much for decoupling. It's hard to believe this comes as a surprise ...

The evaporation of consumer spending in the U.S. and Europe is starting to hit deeply at Asian manufacturing titans that thrive on sales to the rest of the world, and that are now rapidly scaling down their capital spending.

Credit Crisis Indicators: mostly worse

by Calculated Risk on 10/24/2008 01:48:00 PM

From Bloomberg: Libor for Overnight Dollars Rises as Recession Concern Mounts

The London interbank offered rate, or Libor, that banks charge for such loans climbed 7 basis points to 1.28 percent today, British Bankers' Association said. It gained for the first time in 10 days yesterday. The comparable rate for U.K. pounds jumped 19 basis points to 4.75 percent. The Libor-OIS spread, a measure of cash scarcity, widened by the most since Oct. 10.

The Fed is expected to lower rates next week by anywhere from 25 bps to even 75 bps, but I'd still like to see the three month treasury closer to 1.0% (or whatever the Fed Funds rate is next week). The effective Fed Funds rate is aoubt 0.80%, so this isn't horrible.

Here is a list of SFP sales. Three days without an announcement, so maybe the Fed is easing up a little. possible progress.

During a recession, this spread usually increases because the risk of default for lower quality paper increases. However the recent values (over 400 bps) are far in excess of normal. If the credit crisis eases, I'd expect a significant decline in this spread.

Another disappointing day in the credit markets.

DOT: U.S. Vehicles Miles Driven Off Sharply in August

by Calculated Risk on 10/24/2008 11:54:00 AM

The Dept of Transportation reports on U.S. Traffic Volume Trends:

Travel on all roads and streets changed by -5.6% (-15.0 billion vehicle miles) for August 2008 as compared with August 2007. Travel for the month is estimated to be 253.7 billion vehicle miles.

Click on graph for larger image in new window.

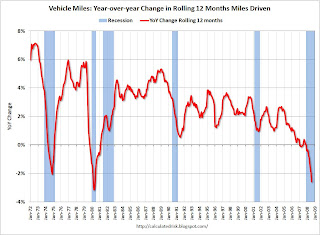

Click on graph for larger image in new window.This graph shows the annual change in the rolling 12 month average of U.S. vehicles miles driven. Note: the rolling 12 month average is used to remove seasonality.

By this measure, vehicle miles driven are off 2.6% YoY, and the decline in miles driven is worse than during the early '70s oil crisis - and almost as bad as the 1979-1980 decline.

From the WSJ: Oil Prices Drop, Despite OPEC Cut

Crude-oil futures Friday fell to their lowest point since May 2007, with concerns of a global recession overwhelming an Organization of Petroleum Exporting Countries decision to trim output.This is clear demand destruction.

Light, sweet crude for December delivery was recently down $4.38, or 6.5%, at $63.46 a barrel on the New York Mercantile Exchange. Brent crude on the ICE Futures exchange fell $4.19 to $61.73 a barrel.

Nymex crude is off more than $80 from July's record highs. Oil's speedy reversal pushed OPEC to convene an emergency meeting in Vienna early Friday, where the cartel pledged to cut 1.5 million barrels a day from its production quota of 28.8 million barrels a day, effective Nov. 1.

Existing Home Sales, NSA

by Calculated Risk on 10/24/2008 11:11:00 AM

Here is another way to look at existing homes sales - Not Seasonally Adjusted: Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows Not Seasonally Adjusted (NSA) existing home sales for 2005 through 2008. Sales were higher in September 2008 than in September 2007 - the first time the year-over-year sales have increased since November 2005.

However sales in September 2007 were impacted by the credit crisis that started in August 2007. The current wave of the credit crisis will probably impact sales reported in October and November (existing homes sales are reported at the close of escrow).

There have been 3.82 million sales so far in 2008, and sales are currently on pace for about 4.9 million total this year - the lowest annual sales since 1997. The second graph shows inventory by month starting in 2002.

The second graph shows inventory by month starting in 2002.

Inventory levels were flat for years (during the bubble), but started increasing at the end of 2005.

Inventory levels increased sharply in 2006 and 2007, but have only increased slightly in 2008. In fact inventory for August and September 2008 are slightly below the levels of last year. This might indicate that inventory levels are close to the peak for this cycle (and have peaked for 2008), however there is probably a substantial shadow inventory – homeowners wanting to sell, but waiting for a better market - so existing home inventory levels will probably stay elevated for some time.