by Anonymous on 8/15/2008 11:39:00 AM

Friday, August 15, 2008

Another Reporter Gets Pwn3d*

I'm beginning to think this kind of thing could be a regular feature: gullible (or just lazy) reporter writes some article on some housing-bust related topic which ends up being mostly free publicity for some hustler, who is treated reverently as an "expert." Earlier examples of the genre are here and here.

Today's embarrassment comes via reader Alan, who sent me this link to the San Francisco Chronicle:

Homeowners are flooding City Hall with so many requests to reduce their property values that the tax assessor said Wednesday his office may not be able to meet the demands.After having noted that the assessor's office is so deluged with requests it probably won't get to any more of them--and after noting that many people won't get a reduction because while home prices are dropping, they are still higher than the assessed values--we get to the obligatory "expert":

So far, Assessor-Recorder Phil Ting's office has received about 1,000 requests for informal re-evaluations - three times the number filed last year. Friday is the deadline to request an informal property re-evaluation from the assessor.

"I'm worried that because we have such a huge influx we'll not be able to get back to everyone," Ting said. So far, San Francisco assessors have responded to informal requests from 285 property owners.

Due to the growing number of these requests, some people have started businesses to help property owners appeal for a lower valuation.My, but that dot-org name seems to imply that this is some kind of nonprofit organization, doesn't it?

Joshua Carnes, vice president of operations for the Sacramento-based Prop8.org, said anyone who bought a home in the past few years should expect the assessed value of the property to decrease. The company is named after Proposition 8, the 1978 voter initiative that allowed home values to be reduced when there is a dip in market values.

"If you're a homeowner in California, you lost value on your property this year," Carnes said. "Unless you don't mind overpaying property taxes, there is no reason you should not file for a reduction."

Not hardly. Prop8.org is a for-profit little firm that wants to charge you to handle your re-evaluation requests for you. And you must not, under any circumstances, miss the picture of Joshua Carnes on this page (is that a zoot suit? A wedding tux? Do you Californians actually dress like that to leave the house on a normal day? Just askin'.) Nor do you want to miss the officer bios. Nor do you want to fail to ask yourself why a reporter thought a buncha guys who also run outfits called "Cashout Options" and "Equity Flips" and "Bailout Help" are really just kind of objective consumer advocates who have no self-interest in knowing what your property might currently appraise for.

Reporters and editors: I'm going to keep this up until it stops. So I really suggest you make it stop. If you don't bother to evaluate your sources before you publish, I will do it after you publish.

*Old farts who need help with "pwn3d" go here.

WSJ Survey: GSE Backstop Will Be Used

by PJ on 8/15/2008 10:20:00 AM

A WSJ survey found that a bunch of those faceless, nameless types known as economists think the Treasury will use one or both of its new-found abilities to prop up Fannie Mae and Freddie Mac:

Which makes me think that 16 of the 53 economists surveyed had the last name of Greenspan. Call it a hunch.On average, the 53 economists polled in the survey put the probability at 59% that the Treasury Department will have to step in to bail out Fannie or Freddie.

"Blank checks almost always get filled in and cashed," said Stuart Hoffman of PNC Financial Services Group.

The majority of respondents hope that it doesn't come to that. When asked how the government should handle the situation with Fannie Mae and Freddie Mac, 68% said the lenders should be pushed to raise capital privately and hope a recovering housing market will keep them from needing government money.

However, nearly one in three said the companies should be nationalized now, and then split into smaller companies when the housing market recovers.

Industrial Output Up 0.2 Percent

by PJ on 8/15/2008 09:32:00 AM

The Fed's industrial production numbers for July are out. I'm pretty much a housing guy, myself, but I'm told these numbers are important by a few economists I know (CR being one of them!). From Bloomberg:

Output at factories, mines and utilities rose 0.2 percent last month after a 0.4 percent gain in June ... Capacity utilization, which measures the proportion of plants in use, increased to 79.9 percent from 79.8 percent.

Demand for autos increased for a third month, reflecting a continued rebound from a strike at an auto-parts supplier. Gains elsewhere signal demand from overseas continued to boost orders even as U.S. consumer and business spending weaken...

Output was forecast to be unchanged according to the median estimate of 79 economists surveyed by Bloomberg News after a previously reported gain of 0.5 percent in June. Projections ranged from a decline of 0.5 percent to a gain of 0.4 percent.

I'll let you guys sort out why we're seeing overseas demand boost orders (ahem, dollar, anyone?). Also, this morning was the Empire State Manufacturing Survey, which found manufacturing gains during August for the first time in four months.

Stocks appear to be headed for a higher open today, but I think that's mostly due to falling oil prices (below $114 this morning) and growing concern that the rest of the world is finally catching our (the U.S.') cold. Which probably brings us right back to the dollar, doesn't it?

Downey Sees Deposits Shrink $507M in July

by PJ on 8/15/2008 09:04:00 AM

Downey Financial's latest monthly stats are out, and some interesting trends pop out. Deposit outflows, for one, and the company's decision to advertise to get deposits, for another:

Although, as previously reported, Downey experienced elevated levels of deposit withdrawals in July, deposit flows so far in August have stabilized. In fact, deposit balances have increased, recovering about 45% of the net deposit outflow that occurred in July. The bulk of the inflow is in certificates of deposit with 6 to 18 months duration. This increase was due, in part, to management's decision to reinstitute deposit advertising following a long period of not doing so.

Deposits declined by $507 million in July to $9.4 billion at month end, with the majority of the decline related to uninsured deposit amounts. Management believes this occurred as a result of depositor concern over deposit insurance coverage following the failure of a large California financial institution as well as publicity and speculation regarding Downey and the performance of its loan portfolio. [emphasis added]

Also, the first drop in NPAs relative to assets in at least a year:

Non-performing assets increased 3% during July, the lowest monthly increase this year. Due to an increase in total assets during July, the ratio of non-performing assets to assets declined from 15.50% at June 30, 2008, to 15.08%.

My own feeling here is that the July results are better than expected. Not that Downey's out of the woods, by any stretch...

Thursday, August 14, 2008

WSJ: World Economy Shows New Strain

by Calculated Risk on 8/14/2008 09:13:00 PM

From the WSJ: World Economy Shows New Strain

The global economy -- which had long remained resilient despite U.S. weakness -- is now slowing significantly, with Europe offering the latest evidence of trouble.The decoupling argument - that the rest of the world would remain healthy while the U.S. was in recession - is proving wrong. Exports have been a bright spot for the U.S. and the key is that any slowdown in exports is offset by falling oil prices. Interesting times.

On Thursday, the European Union's statistics agency said gross domestic product in the euro zone contracted 0.2% in the second quarter, the equivalent of a 0.8% annual rate of decline. It marked the first time since the early 1990s that GDP has fallen overall in the 15 countries that use the euro.

...

For the U.S., economic sluggishness abroad is both blessing and curse. Weak growth is tempering the torrid rise in prices of commodities such as oil, copper and corn ... But weaker foreign economies also undercut one of the few remaining bright spots in the U.S. economy: exports.

Note: I'll be out hiking the next two days. Tanta and Paul Jackson of Housing Wire will be handling the posts. Best to all.

On Greenspan, What Krugman Says

by Calculated Risk on 8/14/2008 06:25:00 PM

From Paul Krugman: Greenspan: not a mensch Click on graph for larger image in new window.

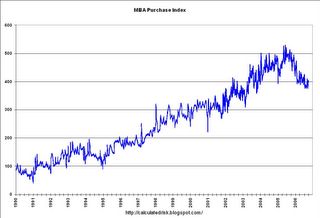

Click on graph for larger image in new window.

This graph shows the MBA Purchase Index as of when Greenspan claimed this was flattening out. On a long term scale, I didn't see any significant "flattening out".

And how could Greenspan think this was "the most important series"? That was absurd and is probably why Greenspan was consistently wrong on housing.

Wachovia's BluePoint Insurance Files BK

by Calculated Risk on 8/14/2008 05:36:00 PM

From Bloomberg: Wachovia's BluePoint Insurance Unit Files Bankruptcy

Wachovia Corp.'s BluePoint Re Ltd. unit, which insures structured finance and municipal transactions, filed for bankruptcy protection, citing defaults on securitized mortgages.This is a small reinsurer, but it's interesting that Wachovia has decided not to provide additional funding.

S&P: Junk Bond Default Rate Increases

by Calculated Risk on 8/14/2008 03:13:00 PM

From Reuters: Global junk bond default rate rises to 1.79 pct-S&P

The U.S. default rate rose to 2.37 percent in July from 1.92 percent in June ...S&P is forecasting the U.S. default rate will to 4.9 percent over the next year.

Altig: What the Fed did during macroblog's vacation

by Calculated Risk on 8/14/2008 01:03:00 PM

Dr. David Altig, now director of research at the Federal Reserve Bank of Atlanta, returns to blogging. Welcome back!

From Macroblog: What the Fed did during macroblog's vacation

To state the very obvious, it has been quite an eventful twelve months since I last committed fingers to laptop. I might well have titled this post "Four Fed programs that did not exist one year ago." Over the four months from December to March, the Federal Reserve Board of Governors and the Federal Open Market Committee, or FOMC, introduced an alphabet soup of new lending programs to address acute stress in financial markets, some of which required the invocation of emergency powers based on "unusual and exigent circumstances."Much more at the link.

I know that in some quarters—maybe the one where you reside—all this activity had a certain frenetic, whack-a-mole feel to it. But I think it appropriate to view the Fed's actions over this period as what I believe them to be: A measured and logical sequence of steps to address very specific liquidity distress in financial markets.

On a personal note, when I first started blogging (a long time ago!), Dr. Altig gave Calculated Risk some wider exposure, especially on housing. Altig wasn't as pessimistic as me at the time, but he was very open to the possibilities of a major housing correction. Thanks Dave and Welcome Back!

S&P Downgrades Downey Financial

by Calculated Risk on 8/14/2008 11:06:00 AM

From S&P: Downey Financial Corp. Downgraded To 'B+/C'; Still On CreditWatch Negative

... deposit outflows in July and the recent drawing down of most of its FHLB lines have reduced Downey's liquidity and available lines of credit. ... We are concerned that depositors in Downey's footprint (think California and Arizona) have a heightened sensitivity to potential bank failures after recent experience and publicity (think IndyMac), which increases the possibility that Downey could experience further material deposit outflows.S&P also suggests withdrawals could "overwhelm Downey's liquidity" and possibly trigger an "adverse regulatory action" (FDIC?). S&P is also concerned that further NPA growth may "overwhelm" Downey.

Housing: Huge Shadow Inventory?

by Calculated Risk on 8/14/2008 10:08:00 AM

Sacramento Real Estate Statistics has some excerpts from a Deutsche Bank research report by research analyst Nishu Sood: "An inventory overhang builds in the shadows" (no link)

Peter Viles at the LA Times covers the story: Bank sees huge "shadow inventory" of foreclosed houses

This is interesting data, and worth reading the excerpts. In the report, Sood argues: "MLS listings do not fully reflect distressed inventory." and then he provides some tables (see the above link).

But it's not as bad as it first seems. I've chatted with Max at Sacramento Real Estate Statistics (thanks Max!), and in the notes, Nishu Sood writes:

Source: Realtytrac, Housingtracker, Deutsche BankSo these are not all REOs; in fact most of these homes are probably in the foreclosure process.

Note: Foreclosure inventory includes pre-foreclosures, auctions and REO. 2/3 of pre-foreclosures are assumed to become foreclosures.

Yes, Sood makes a good point - there are many homes not listed that are probably future foreclosures. And I'd add, there are many homeowners waiting for a "better market" to list their homes. So inventory will probably stay elevated for some time.

But, just to be clear, Sood's stats are not unlisted REOs held by some bank in the shadows.

Consumer Prices Increase Sharply

by Calculated Risk on 8/14/2008 08:57:00 AM

From MarketWatch: Consumer prices jump 0.8% in July

U.S. consumer prices jumped a greater-than-expected 0.8% in July, marked by big increases in energy, food, clothing and cigarettes, the Labor Department reported Thursday.

The core consumer price index - which excludes volatile food and energy prices - rose 0.3% for the second straight month.

...

Consumer prices are up 5.6% in the past year, the biggest year-over-year increase since January 1991. The CPI has surged at a 10.6% annualized rate in the past three months.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the year-over-year change in inflation, both CPI and Core inflation (less food and energy). Using CPI, inflation is at the highest level in 17 years.

Also note that CPI has persistently been running ahead of Core for most of the last 5+ years. This is mostly due to the huge increase in energy prices (and food too).

The good news is inflation should slow as energy prices fall (if they continue to decline). And inflation helps with real house prices too!

RealtyTrac: Foreclosures Up 55% from July 2007

by Calculated Risk on 8/14/2008 02:15:00 AM

From AP: US foreclosure filings surge 55 percent

The article quotes RealtyTrac as reporting more than 272,000 homeowners received foreclosure notices in July, up 55% from July 2007. And up 8% from June 2008.

Also, according to RealtyTrac, there are more than 750 thousand foreclosed homes for sale in the U.S., or 16.7% of the 4.49 million total U.S. homes for sale.

Wednesday, August 13, 2008

Hummer Dealer Out, Smart Dealer In

by Calculated Risk on 8/13/2008 10:06:00 PM

Check out this photo sequence from the Shnapster: Hummer Dealer Out, Smart Dealer In. Times change quickly ...

Homebuilder Cautions Buyers on Foreclosed Properties

by Calculated Risk on 8/13/2008 04:54:00 PM

From Andrew Galvin at the O.C. Register Mortgage Insider: Homebuilder warns foreclosure shoppers

“A foreclosure may appear to offer the best deal on a home, but there are numerous hidden costs,” [ John Laing Homes, an Irvine-based builder] said in a press release. “A foreclosed house is sold ‘as-is.’ At times there will be a lot of time and skill involved to undertake major renovations as well as financial costs, which should be considered if you value your leisure time.”Do you think they are feeling the pain from all the distressed properties for sale?

1,300 Foreclosures Per Day in California

by Calculated Risk on 8/13/2008 02:12:00 PM

It seems like just yesterday we passed the 1,000 per day mark, but that was way back in April.

From Peter Viles at the LA Times: Estimate: 1,300 foreclosures every business day in California

Banks and lenders have now foreclosed on $100 billion worth of California homes over the past two years, and are foreclosing at the rate of 1,300 houses every business day, according to a new report from ForeclosureRadar.com.Note that the decline in defaults is related to changes at Countrywide.

The report, covering foreclosure activity in California in July, notes that new mortgage defaults are declining, but foreclosures are continuing to rise sharply. "It is clear that far fewer homeowners are finding a way out of foreclosure," the company reports.

The pace of foreclosures in California -- 1,300 every business day -- has more than tripled from the year-ago rate of 415 per day, ForeclosureRadar estimates.

U.S. Miles Driven Declines 4.7% from June 2007

by Calculated Risk on 8/13/2008 01:04:00 PM

Please don't miss Tanta's Reset Vs. Recast, Or Why Charts Don't Match

More demand destruction for oil ...

From the DOT: American Driving Reaches Eighth Month of Steady Decline

New data released today by the U.S. Department of Transportation show that, since last November, Americans have driven 53.2 billion miles less than they did over the same period a year earlier – topping the 1970s’ total decline of 49.3 billion miles.

...

Americans drove 4.7 percent less, or 12.2 billion miles fewer, in June 2008 than June 2007. The decline is most evident in rural travel, which has fallen by 4 percent – compared to the 1.2 percent decline in urban miles traveled – since the trend began last November.

Click on graph for larger image in new window.

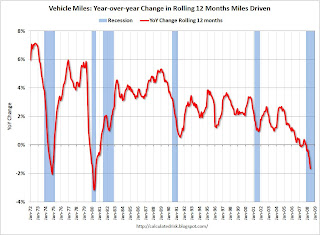

Click on graph for larger image in new window.This graph shows the YoY change in the rolling 12 month total miles driven. The rolling 12 months total is off 1.7% compared to a year ago, and with the June 2008 vs June 2007 change off 4.7%, this will probably fall significantly more.

The decline in miles driven is similar to the two oil crisis of the '70s.

Of course oil prices are falling (up a little today), and this will lead to lower gasoline prices and probably a few more miles driven.

Countrywide Option ARMs Deteriorate

by Calculated Risk on 8/13/2008 10:41:00 AM

From Reuters: Countrywide option ARM home loans deteriorate more (hat tip Brian and Branden)

Countrywide Financial Corp said thousands of borrowers with $25.4 billion in option adjustable-rate mortgages (ARMs) owe almost as much as their homes are worth ...Here is the CFC 10-Q filed with the SEC.

Another sign of borrower distress: One in eight is at least 90 days late on payments.

As of June 30, the typical borrower owed 95 percent of the value of his home, up from 76 percent when the loan was made ...

Seventy-two percent of borrowers were making less than full interest payments, and 12.4 percent were at least 90 days delinquent.

Click on table for larger image in new window.

Click on table for larger image in new window.This is the Option ARM table from the CFC 10-Q. Notice that 83% of loans were stated income.

From Reuters:

"People still don't understand what a catastrophe this is," said Christopher Whalen, senior vice president and managing director at Institutional Risk Analytics of Torrance, California. "The guys who are really on the hook are Bank of America shareholders."I think it's the CFC bondholders who are "on the hook" since BofA hasn't guaranteed the CFC debt.

Real Retail Sales

by Calculated Risk on 8/13/2008 09:21:00 AM

From the WSJ: Retail Sales Fall on Soft Auto Demand

Retail sales decreased by 0.1%, the Commerce Department said Wednesday. ... The last time sales fell was in February, when demand tumbled 0.5%.This graph shows the year-over-year change in nominal and real retail sales since 1993.

Pulling down overall retail sales were U.S. sales of automobiles and parts, which plunged 2.4% in July, Wednesday's data showed. June sales fell 2.1%. ...Sales of all other retailers excluding auto and parts dealers rose in July by 0.4%

Click on graph for larger image in new window.

Click on graph for larger image in new window.To calculate the real change, the monthly PCE price index from the BEA was used (July PCE prices were estimated based on the increases for the last 3 months).

Although the Census Bureau reported that nominal retail sales increased 2.7% year-over-year (retail and food services increased 2.6%), real retail sales declined slightly (on a YoY basis).

Despite the stimulus checks, YoY real retail sales have remained negative all year.

My How Time Flies

by Anonymous on 8/13/2008 08:17:00 AM

The Washington Post has a lengthy article up this morning on bank failures:

First the borrowers. Now the banks.Um, did we like take a Rip Van Winkle nap in late 2006 and just now wake up? As I recall the last two years, it was first the borrowers, then all the wacky securities, then the GSEs, then the banks.

Federal and state regulators have closed eight banks this year, four since the start of July, as rising borrower defaults on residential and commercial real estate loans start to push some lenders into default, too.

In fact, as I recall things, we were once pretty much encouraged not to worry too much about the banks, because the storyline was that all the risky lending involved selling and securitizing loans, not stuffin' them on the old balance sheet. Here's a blast from the past, which I fondly remember as the day the NYT editorial board first learned about this thing called securitization. From September of 2006:

The housing boom would never have lasted as long as it did if mortgage lenders had to worry about being paid back in full. But instead of relying on borrowers to repay, most lenders quickly sell the loans, generating cash to make more mortgages.Back in 2006, the fashionable thing to say was that if banks had only held their loans rather than securitizing them, they would have controlled credit risk better because they had skin in the game.

For the past few years, the most voracious loan buyers have been private investment banks, followed by government-sponsored housing agencies, like Fannie Mae. The buyers carve up the loans into mortgage-backed securities — complex i.o.u.’s with various terms, yields and levels of risk. They then sell the securities to investors the world over, at breathtaking profit. The investors earn relatively high returns as homeowners repay their mortgages.

I guess it was a bit more complicated than that.