by Anonymous on 8/03/2008 09:38:00 AM

Sunday, August 03, 2008

Freddie Mac Foreclosure Timelines

I had intended to write a follow-up to CR's post the other day on Freddie Mac's changes to its foreclosure timelines, but . . . I had to extend my timeline. So sue me instead of Freddie Mac.

I was going to suggest that my friend P.J.'s (of Housing Wire fame) use of the term "whopping" to describe those timeline changes is a little hyperbolic. But it takes some major UberNerdity to show why that is. As I was winding up to a major Nerdfest on the subject, I see that Mish and Aaron at Implode-O-Meter have seen P.J.'s "whopping" and raised it to "doubling" in the great game of GSE Scold 'Em. I have no idea where "doubling" came from, although it appears that Mish just misread the original sentence from the Housing Wire report:

The mortgage finance giant also said that it was increasing its allowable foreclosure timeline in 21 states to a whopping 300 days from last of date payment, and 150 days from initiation of foreclosure, effective on Friday.This is not saying that the total FC timeline used to be 150 days in these states and is now 300, and you cannot make the English language make it say that. It says that the total allowable (which word does not rhyme with "required") timeline is 300 days in total from last payment made to FC sale. Within that total 300 days, the allowable time from actual referral to an FC attorney to the FC sale is 150 days. Which means that the allowable time from date of last payment to referral to an FC attorney is 150 days. 150 plus 150 equalling 300 in base ten.

But what does all this really mean? Is it significant? Why? Are these measures expressed in terms you are used to seeing, or in rather specialist terms that may mislead the unwary? And why would only 21 states be affected? Can we have some context, Tanta?

********

The first thing we need to clear up is the question of what a "foreclosure timeline" is and why Freddie Mac (and Fannie Mae) have them.

Foreclosure law is made by the states, and there are 50 different sets of state FC law out there, plus one for DC and three for the territories Freddie Mac buys loans in, giving them a total of 54 sets of laws. It is very hard to generalize about FC law, given that many different approaches, but you can basically say that all jurisdictions set a minimum timeline for completing a foreclosure (meaning, from the original filing to the FC sale) by virtue of the requirements that the law makes for various steps in the process and when they must be initiated and what has to happen before they are completed. For example, most states have some requirement that notice of the FC sale be published for three consecutive weeks prior to the actual sale date. Obviously this cannot happen until the FC sale is scheduled, which may take a long time (in a judicial FC state) or a fairly short time (in a non-judicial or "deed of trust" or "statutory FC" state). Therefore, the "timeline" always has a matter of 21 days or so added after one thing happens (sale is scheduled) and before another thing can happen (sale is held). If a given state lacked this requirement, or had a much longer or much shorter publication requirement, that state's minimum legally allowable timeframe would be longer or shorter.

I know of no state or jurisdiction that legislates "maximum" timeframes. By this, I mean that the law might say you cannot hold an FC sale less than 21 days after the sale date is determined (to allow for publication), but that doesn't mean you cannot hold the sale more than 21 days afterwards. The law might say you cannot initiate FC filings until a borrower is at least 30 days past due, but that doesn't mean you have to do that, and in reality few servicers initiate FC until a borrower is at least 90 days past due.

It helps, then, to think of FC laws as a matter of setting the shortest possible timeline for foreclosures. This will never be equal to the actual average timeline in a given state, nor will it be equal to the "optimal" or "best practices" timeline for a given state. What Freddie Mac and other investors care about is an "optimal" FC timeline.

Before we talk about this issue of what is "optimal," we also need to clear up the issue of when FC is initiated. Most states do not legislate a minimum number of days of delinquency before an FC action can be filed; there must simply be a legal default under the note and security instrument. Theoretically, in most states you can start FC when a borrower is only one month down, but it is very rare to see servicers do that, and in fact most of us would probably call such a practice "predatory servicing." FC is your last resort for resolving a delinquency, not your first resort.

On the other hand, no investor wants a servicer who dorks around and doesn't commence FC filing until the borrower is a whole year down. Therefore, investors like Freddie Mac set maximum timelines for servicers to commence FC. That deals with the dorking around problem. They do not set minimum timelines for commencing FC other than the statutory minimum, on the whole. The way they deal with the problem of a servicer foreclosing too quickly is by compensating servicers for successful foreclosure avoidance: they pay up in bonuses to servicers who resolve modest delinquencies with collection efforts, repayment plans, or other workouts, and they penalize servicers whose FC rates are much higher than they should be (since that costs investors money).

In order to establish investor timelines, there must be some definition of the starting point. Freddie Mac's rules on this subject are and have always been based on the time elapsed from "Due Date of Last Paid Installment," or DDLPI. There are very good reasons for this; it's a more dependable number than days of delinquency, and given that mortgage interest is always paid in arrears, a number of days since DDLPI will tell you exactly how many days of past-due interest have accrued on a loan. But you do not want to confuse it with days of delinquency. If a borrower makes his May payment, skips his June payment, and today is June 30 or July 1, depending on how you calculate these things, the borrower is 30 days delinquent and 60 days from DDLPI. Thus, if Freddie Mac says that a servicer must initiate FC by 150 days from DDLPI, that means by no later than the 120th day of delinquency.

It does not mean that a servicer may not initiate FC before 150 days DDLPI/120 days DQ. "No later than" means "no later than." I remarked earlier that in general servicers initiate FC around the 90th day of delinquency on average. This is true. Freddie does not require the servicer to wait until the 120th day; it allows the servicer to wait that long and still be considered acceptable to Freddie Mac.

The fact of the matter is that Freddie's timeline for DDLPI-to-initiation has been 150 days on most first lien loans since more or less forever. This is not something new. Freddie did just "standardize" this so it is now true for all loans. It used to be that second liens and some weirder first liens (like previously modified loans) had a 120 day DDLPI rule (90th day of DQ). For that small group of loans, the timeline has extended by 30 days. For the overwhelming majority of Freddie-owned loans, the pre-filing timeline has not changed.

What has changed, for 21 states, is the maximum acceptable timeline for initiation of FC to completion of FC. In Freddie-speak, "initiation" means "referral to FC attorney" and "completion" means FC sale completed. (In some states, it isn't over on the day of sale; there may be a "validation" period afterwards before title actually transfers, or there may be a post-sale redemption period. So a foreclosure sale is "completed" on or sometimes after the "sale date," but never before.)

Again, we need to bear in mind that there are three timelines floating around here: the statutory minimum (the quickest a foreclosure can be in a given state under the law), the real-world average (which is always greater than the statutory minimum, given backlogs and bottlenecks and holidays and other real-life stuff), and the recommended maximum (which is best understood as how high your "average" can get until your investor considers you inefficient or not trying hard enough).

Freddie has always published for its servicers a table of timelines for each state. They vary by state because some states have very short statutory minimums and some have very long ones. The idea was that servicer expectations would take into account those legal limits. I assume this idea is uncontroversial.

According to a very important paper published earlier this year by Freddie Mac economists Amy Crews Cutts and William A. Merrill, Interventions in Mortgage Default: Policies and Practices to Prevent Home Loss and Lower Costs, the national average "optimal statutory timeline" from FC referral to completion as of 2007 was 120 days from FC referral to sale date; taking into account post-sale issues like redemption or confirmation periods, and adding pre-referral days since DDLPI, the national average optimal statutory total timeline was 292 days. The actual average (real world) number of days was 355. ("Optimum statutory" here is a kind of hybrid of statutory minimums and practical additions; the authors calculate a plausible number of days for certain steps in the process to take that aren't controlled by law. For instance, in calculating these timelines they provide for five days for title work to be completed. The law simply requires that title work be completed; it doesn't say how long that will take.)

But nobody works to national averages; everybody works to a timeline for a given state. Per Cutts and Merrill, the longest timeline belongs to Maine, with "optimal statutory" days from FC referral to completed sale of 209 days, "optimal" total number of days from DDLPI to completion of 359 days, and "actual average" of 598 days DDLPI to completion. (Freddie Mac's current allowable maximum for Maine is 505 days, which means that on average servicers are not doing that well in Maine.)

The shortest timeline belongs to Tennessee, with "optimal statutory" days from FC referral to completed sale of 33 days, "optimal" total number of days from DDLPI to completion of 183 days, and "actual average" of 248 days DDLPI to completion. I do not know what Freddie's old timeline used to be for TN, because the current online Servicing Guide has now been updated and I don't have access to the old version. But TN is one of the 21 states that just got changed to 300 days total (150 days from referral to completion), which means the old timeline for TN was less than 300 days.

Since TN had the shortest timeline, I think we can conclude that of the 21 states that got an increase to 300 days, TN got the biggest increase. California, for instance, per Crews and Cutts had a "statutory" total timeline of 266 days and an average total, again as of last year, of 268 days. Freddie's new timeline for CA is 300 days. Given that it is possible that the average has increased markedly since 2007 with record numbers of foreclosures, it seems possible to me that CA's actual average as of mid-2008 is now pretty darned close to 300 days, or even more than that. This provides some context for how "whopping" the increase in the allowable timeframe for CA is.

So now we can think about why it might be that Freddie decided to increase the timelines in the fast-foreclosure states. Obviously, the main rationale is to allow servicers to continue to make workout efforts during the FC process, which will in the nature of things increase the time a loan spends in the FC process, without penalizing them for failing to meet Freddie's standards.

Perhaps, though, the better question is why Freddie upped the limit on these 21 states to only 300 days. Why not give everyone 400 days? Or 505 days, like Maine gets? What's so special about 300 days?

I suspect the answer to that is found in the research that Cutts and Merrill did on foreclosure timing:

[T]he costs associated with foreclosure rise significantly with the length of the foreclosure timeline, by as much as 12 percent for every 50 days added to the timeline. Perhaps more importantly, we find that the likelihood a borrower will reinstate her loan out of foreclosure falls as the length of time in the legal foreclosure process increases – by our estimates, states with excessively long legislated foreclosure timelines could increase the probability of successful reinstatement of delinquent borrowers by 3 to 9 percentage points by shortening their statutory timelines to match the national median timeline. Timelines that give the borrowers too much time in the legal foreclosure process tip the balance from the threat of imminent home loss from perfected foreclosure towards the benefit of “free” rent for the duration of the process, providing an incentive for borrowers to forego reinstatement of the loan even if they have the means to do so. By the same reasoning, some very short timeline states may find that lengthening their legal foreclosure timelines may improve cure rates out of foreclosure by giving delinquent borrowers enough time to cure the delinquency once the formal legal foreclosure process has been initiated.The authors posit that the "sweet spot" for foreclosure timelines--long enough to allow borrowers to cure, short enough to correct incentives and control costs to investors--is "roughly 270 days" from DDLPI to completion.

It looks to me like Freddie just rounded up "roughly 270" to 300. In other words, for the states with a too-short statutory timeline, Freddie set its timeline into the "sweet spot." Because it is not really possible for Freddie to set the too-long states into the "sweet spot," they are unchanged. Only state legislatures can shorten the statutory process; Freddie Mac can't.

But why have this distinction between pre-filing (150 days from DDLPI in the "short states") and post-filing (another 150 days)? Well, any investor wants servicers to focus their loss mitigation efforts early in the delinquency process. In Freddie Mac's view, if you make the FC referral too early in the process, you are incurring unnecessary legal expenses for a lot of loans that will "cure" short of foreclosure. You may also be putting too much pressure on borrowers. That's a fine line to hold: if you don't threaten some borrowers with FC, they'll never do anything about the problem they have. On the other hand, if you start the judicial machinery too soon, some borrowers who could cure will give up because they think it's hopeless. Economically and psychologically, it's a delicate balance.

I realize that for a lot of people (like Mish), nothing any of the GSEs do will ever be anything except wrong. But still. It would be helpful to try to understand what they are actually doing before going off on doomsday scenarios. I am not claiming that the Freddie Mac changes were just a "nothingburger," but they are hardly anything to freak out over in my view. If you want to freak out, you need to at least read the reporting correctly.

Saturday, August 02, 2008

Barrons: Roubini interview

by Calculated Risk on 8/02/2008 06:00:00 PM

From Barron's: Yes, That's $2 Trillion of Debt-Related Losses A few excerpts:

Barron's: Unfortunately for the rest of us, you have a pretty good track record. How much more misery lies ahead?I think $2 trillion is too high, but the number will definitely be huge.

Roubini: We are in the second inning of a severe, protracted recession, which started in the first quarter of this year and is going to last at least 18 months, through the middle of next year. A systemic banking crisis will go on for awhile, with hundreds of banks going belly up.

...

The taxpayer's bill is going to be huge. I estimate this financial crisis will lead to credit losses of at least $1 trillion and most likely closer to $2 trillion. When I made this analysis in February everybody thought I was a lunatic. But a few weeks later the International Monetary Fund came out with an estimate of $945 billion, Goldman Sachs (GS) estimated $1.1 trillion and UBS (UBS) $1 trillion. Hedge-fund manager John Paulson recently estimated the losses would be $1.3 trillion, and late last month Bridgewater Associates came up with an estimate of $1.6 trillion. So, at this point $1 trillion isn't a ceiling, it's a floor. And the banks, as I've said, have written down only about $300 billion of subprime debt.

from 2007:

"Some estimates are in the order of between $50 billion and $100 billion of losses associated with subprime credit problems."Of course that was only subprime losses, and the problem was "contained".

Chairman Bernanke, July 19, 2007

FHA Personal Accounts

by Anonymous on 8/02/2008 09:01:00 AM

It took approximately twelve minutes for some of the bigger economic illiterates in Congress to sponsor a bill to reauthorize FHA DAPs--a form of money-laundering in which property sellers can inflate their sales prices by funneling money to a "non profit" which then "gifts" the funds to the buyer of the property.

Not content merely to pander to the most naive of their constituents by lining first-time homebuyers up to face foreclosure at three times the rate of those who don't get these generous "gifts," the sponsors of this bill, Representatives Al Green (TX-09), Gary Miller (CA-42), Maxine Waters (CA-35), and Christopher Shays (CT-4), would also like to redefine the very nature of the FHA mortgage insurance program, so that insurance premiums paid by those borrowers who do not default are not used to cover the losses on those who do default. Presumably, the funds to cover the losses on those borrowers who do not make their payments would come from the premiums that people who do not make their payments are not paying. Here's the draft bill:

Section 2133 of the FHA Modernization Act of 2008 is amended by adding at the end the following new subsection:Apparently, it's not good enough for Congress that any borrower who makes two years or so worth of on-time mortgage payments (and, um, isn't upside down) can qualify for a

(c) AUTHORIZATION FOR RISK-BASED PRICING.—

(1) AUTHORITY. —Notwithstanding subsections (a) and (b), the Secretary of Housing and Urban Development may implement a risk-based premium product for borrowers with lower credit or FICO scores, to facilitate the availability of insurance for mortgages for such borrowers, through the establishment and collection of adequate premiums to cover the risks of such loans.

(2) REFUND OF PREMIUMS. —The Secretary shall provide for a refund of a portion or all of the higher premiums paid at the time of insurance by borrowers with lower credit or FICO scores as a result of risk-based pricing pursuant to this subsection, except that such refund shall be limited to only borrowers with a history of at least a specified number of years of on-time mortgage payments. Such refund shall be made upon payment in full of the obligation of the mortgage.

This is certainly a curious view of what "insurance" is. Apparently the sponsors of this bill think of mortgage insurance premiums as a kind of escrow: what you pay in is "dedicated" to covering only your own potential default, and if you don't default you get it back. Of course, there's no provision here for requiring deficiency judgments against borrowers who do default, in the highly likely event that the premiums those borrowers paid from inception to default isn't enough to cover FHA's loss. So you know who's going to pay for that.

But don't let me give you the impression the bill proposes no safeguards against risk: the bill requires that these DAP programs offer optional "homebuyer counseling" to all borrowers prior to closing, and it requires that if the borrower opts for counseling, the DAP must provide that counseling. If the borrower blows you off, you just close the loan. I suppose it is obvious to Congress that a borrower who declines counseling knows what he or she is doing. Now that I think about it, though, a borrower who scorns being counseled by the seller's money launderer is probably smarter than a box of rocks.

Perhaps the FDIC could ignore bloggers for a while and just keep its eyes on Congress.

(Thanks, Chad!)

Friday, August 01, 2008

Goldman: "Second Half Slowdown Ahead"

by Calculated Risk on 8/01/2008 10:38:00 PM

Goldman Sachs put out a research note late today lowering their projections for the second half.

"[W]e are on the cusp of a renewed deceleration in growth."I think others will follow and the 2nd half recovery will be cancelled.

There is always next year!

Your Friday Bank Failure

by Anonymous on 8/01/2008 06:22:00 PM

FDIC:

First Priority Bank, Bradenton, Florida, was closed today by the Commissioner of the Florida Office of Financial Regulation, and the Federal Deposit Insurance Corporation (FDIC) was named receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with SunTrust Bank, Atlanta, Georgia, to assume the insured deposits of First Priority.

The six branches of First Priority will reopen on Monday as branches of SunTrust Bank. Depositors of the failed bank will automatically become depositors of SunTrust. Deposits will continue to be insured by the FDIC, so there is no need for customers to change their banking relationship to retain their deposit insurance coverage. For the time being, however, customers of both banks should use their existing branches until SunTrust can fully integrate the deposit records of First Priority.

Over the weekend, customers of First Priority can access their money by writing checks or using ATM or debit cards. Checks drawn on the bank will continue to be processed. Loan customers should continue to make their payments as usual.

As of June 30 2008, First Priority had total assets of $259 million and total deposits of $227 million.

Report: NY to Sue Citigroup regarding Auction Rate Securities

by Calculated Risk on 8/01/2008 04:20:00 PM

From MarketWatch: New York Attorney General Cuomo to sue Citi units: reports (hat tip crispy&cole)

Apparently the NY State AG plans to sue Citigroup alleging material misrepresentations regarding Auction Rate Securities (ARS) "including assuring customers that these securities were as liquid as cash".

I know people that claim they were told the same thing about ARS - "liquid as cash" - by other institutions. I've also been told that at least one institution is offering interest free loans to people with their money locked up in ARS.

Your Ownership Society In Action

by Anonymous on 8/01/2008 04:17:00 PM

OK, it's Friday afternoon. Snark away over this:

A landlord who was apparently upset at his tenants because they were behind on their rent crashed his Hummer into their home – his property – and then attempted to kick the door down, according to police.

Lenders Change Tactics, Now Discounting at Foreclosure Sale

by Calculated Risk on 8/01/2008 03:32:00 PM

For the last few years lenders have been bidding the amount they were owed at foreclosure sales on the court house steps. Since the lenders were usually owed far in excess of the current property value, almost all foreclosure sales went to the lender. This is a typical court house steps sale (just 37 seconds):

However, recently, some lenders have changed tactics and are now bidding less than what they are owed. Realtor Jim Klinge presents these recent examples:

2629 Wilson St., Carlsbad $647,785 owed, $394,273 opening bid (39% off) HSBCUnfortunately the lenders aren't publishing these lower bids in advance, but this will definitely attract more investors to the court house steps! Jim writes:

2916 Rancho Brasado CSB $868,112 owed, $690,914 opening bid (20% off) U.S. Bank

7071 Cordgrass, Carlsbad $1,541,249 owed, $880,000 opening bid (43% off) WaMu

3570 CallePalmito, CSB $1,756,702 owed,$1,425,500 opening bid (19% off) Wachovia

[If] banks publicized their opening bids weeks in advance, they could build some momentum at the court house and blow out their inventory with very little in closing costs, and no liability.This is definitely bringing out some investors (flippers). In the following video, Jim's client purchased this house for $444,125 and sold it for $525,000 in about one month. The lender was owed $631,523.

This property was purchased at the steps of the county court house on 6/19/08, put back on the market for sale the next day, and closed on 7/29/08 for $525,000.

This is a significant change in lender tactics.

Auto Sales Decline in July, 2nd Half Expected to be Worse

by Calculated Risk on 8/01/2008 02:11:00 PM

Headline from the WSJ:

General Motors reports 26% decline in light-vehicle sales in the U.S. for July.From the WSJ: Ford, Toyota Sales Slide

U.S. auto sales tumbled in July, kicking off the second half of a dismal year, with Ford Motor Co. posting a 15% drop and Toyota Motor Corp. recording an 12% decline.Sales will probably be dismal in the 2nd half of 2008 as the recession deepens, and credit markets tighten. It won't help sales that all three U.S. automakers are cutting back or eliminating their lease programs.

"We expect the second half of 2008 will be more challenging than the first half as economic and credit conditions weaken," said Ford marketing executive Jim Farley.

Construction Spending in June

by Calculated Risk on 8/01/2008 10:15:00 AM

Construction spending declined in June for residential, but increased slightly for non-residential private construction.

From the Census Bureau: June 2008 Construction at $1,081.9 Billion Annual Rate

Spending on private construction was at a seasonally adjusted annual rate of $780.6 billion, 0.4 percent below the revised May estimate of $783.9 billion.

Residential construction was at a seasonally adjusted annual rate of $372.5 billion in June, 1.8 percent (±1.3%) below the revised May estimate of $379.1 billion.

Nonresidential construction was at a seasonally adjusted annual rate of $408.1 billion in June, 0.8 percent above the revised May estimate of $404.8 billion.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The graph shows private residential and nonresidential construction spending since 1993. Private non-residential construction spending has now passed residential construction spending for the first time (since the Census Bureau started tracking spending).

Nonresidential spending has been strong as builders complete projects, but there is substantial evidence of a looming slowdown - less lending for new projects, less work for architects - and the expected slowdown in non-residential spending will happen in the 2nd half of 2008.

Unemployment Rate Rises to 5.7%

by Calculated Risk on 8/01/2008 09:24:00 AM

The BLS reported:

The unemployment rate rose to 5.7 percent, and nonfarm payroll employment continued to trend down in July (-51,000), the Bureau of Labor Statistics of the U.S. Department of Labor reported today. Employment continued to fall in construction, manufacturing, and several service-providing industries, while health care and mining continued to add jobs.

Click on graph for larger image.

Click on graph for larger image.This graph shows the unemployment rate and the year over year change in employment vs. recessions.

The unemployment rate has risen to 5.7 percent.

Year over year employment is now negative (fewer American employed in July 2008 than July 2007).

IndyMac Holding Company Files BK

by Anonymous on 8/01/2008 09:19:00 AM

This is not helpful reporting:

Aug. 1 (Bloomberg) -- IndyMac Bancorp Inc., the second- largest U.S. independent mortgage lender before it was seized by federal bank regulators three weeks ago, filed to liquidate its remaining assets under bankruptcy protection.FDIC did not "seize" IndyMac Bancorp, it seized IndyMac Bank, F.S.B., which is owned by IndyMac Bancorp. Rather than continuing to write things that just sound contradictory, perhaps Bloomberg can help us understand the implications of this legally important distinction? I'm just askin' . . .

IndyMac's liabilities are between $100 million and $500 million, according to the Chapter 7 filing yesterday in U.S. Bankruptcy Court in Los Angeles. The bank holding company said it has less than 50 creditors, which it didn't list.

IndyMac was seized by U.S. regulators on July 11 after a run by depositors left the mortgage lender strapped for cash. The Federal Deposit Insurance Corp. is running a successor institution, IndyMac Federal Bank, and regulators have said they intend to eventually sell the seized bank.

The FDIC ``has been in sole possession custody and control of all of the books and records of'' IndyMac Bancorp and the court filing was made without access to information that bankruptcy laws typically require, Chief Executive Officer Michael W. Perry said in court papers.

While banks are prohibited from filing for U.S. bankruptcy protection, bank holding companies aren't. Perry is Pasadena, California-based IndyMac Bancorp's sole remaining employee, according to the filing. The company has $50 million to $100 million in assets.

GM: $15.5 Billion Loss

by Calculated Risk on 8/01/2008 09:14:00 AM

From the WSJ: GM Swings to $15.5 Billion Loss Amid Write-Downs, Sales Slump

General Motors Corp. recorded a stunning $15.5 billion second-quarter net loss, slammed by sinking auto sales, money lost on bad lease deals and costs tied to its North American restructuring.

Thursday, July 31, 2008

FT: Fears Growing Concerning CMBS Defaults

by Calculated Risk on 7/31/2008 09:09:00 PM

From the Financial Times: Real estate sector fears huge increase in CMBS defaults (hat tip Raymond)

Defaults on [recent] commercial mortgage-backed securities ... will more than quadruple from their current levels under conditions in the US economy expected by the commercial real estate industry, according to a report from Fitch Ratings.Higher defaults and lower property values is one side of the commercial real estate (CRE) bust; this is the impact on existing CRE.

...

Borrowers would default on an average of 17.2 per cent of securitised commercial mortgages over 10 years if the US economy dips into a recession ... compared with current very low default rates of 4 per cent ...

[The problem is] inflated property values and weaker underwriting standards. .. in 2006 and 2007, as well as the weaker economy. Those bonds make up about 49 per cent of the outstanding CMBS market of more than $800bn.

As discussed this morning, the CRE bust will also result in less new investment in non-residential structures, especially hotels, malls and office buildings (since those were the most overbuilt).

Freddie Mac Changes Servicer Guidelines

by Calculated Risk on 7/31/2008 06:09:00 PM

HousingWire has the story: Freddie Mac Pushes Out Foreclosure Timelines

Perhaps the boldest move by Freddie Mac on Thursday — and one that won’t get much press attention — was its decision to eliminate foreclosure timeline compensation altogether for servicers, effective immediately. In other words, servicers will no longer earn a bonus based on how quickly they can foreclose.There is much more.

If that doesn’t scream “modify more loans,” then the GSE’s decision to double compensation for servicers in completing workouts certainly will. Freddie said it will now pay servicers $800 for a loan modification, $2,200 for a short payoff or make-whole preforeclosure sale, and $500 per repayment plan. Deeds-in-lieu of foreclosure didn’t get Freddie’s same endorsement, however, and will remain at the current incentive level of $250, the GSE said.

The decision to eliminate timeline compensation, however, was only part of a much broader program change rolled out by Freddie; the mortgage finance giant also said that it was increasing its allowable foreclosure timeline in 21 states to a whopping 300 days from last of date payment, and 150 days from initiation of foreclosure, effective on Friday.

CA Governor Orders Layoffs, Pay Cuts

by Calculated Risk on 7/31/2008 04:36:00 PM

From the SF Gate: Governor orders layoffs, steep pay cuts for thousands of state workers (hat tip Hernan)

Gov. Arnold Schwarzenegger ... today ordered the layoffs of thousands of state workers and steep pay cuts for most other state employees ... Cutting the pay of about 200,000 state workers to the federal minium wage of $6.55 an hour would save California as much as $1.2 billion a month, the governor's office said. Such workers would get regular pay plus back pay once a new budget is approved.Many states are struggling, but California is in especially deep trouble because of rapidly falling house prices and a weakening economy.

The layoffs of nearly 22,000 temporary, seasonal and student workers would save the state as much as $28.5 million a month, the governor's office added.

The Coming Hotel Bust

by Calculated Risk on 7/31/2008 12:17:00 PM

From Abha Bhattari and Fred Bernstein at the NY Times: Terrible Timing for a Hotel Boom

A record number of hotels are opening this year, and the timing could not be worse.Back in May I relayed a conversation I had with well known hospitality attorney Jim Butler. At that time it was clear that financing for hotels was becoming significantly tighter (see earlier post for his comments). For anyone interested, Jim writes a blog on hotel legal issues: Hotel Law Blog

...

Until recently, the industry was in the midst of a major boom, and it was during those good times that the hotel companies made plans to build many of the new rooms. ... Nationwide, hotel occupancy levels have been hovering around 65 percent, down about 5 percentage points from last year, according to Smith Travel Research.

...

The industry now has about 6,000 new hotels, with nearly 800,000 rooms, under development, a 27 percent increase from last year, according to Lodging Econometrics ...

I also posted this graph comparing investments in lodging vs investments in other non-residential structures:

Click on graph for larger image in new window.

Click on graph for larger image in new window. This graph shows the strong growth in lodging in recent years (from the BEA supplemental tables). I'll have an update soon for Q2.

Clearly lodging investment has been in a quite a boom (as the NY Times story noted). But occupancy

Lodging is one of the three key components of non-residential investment that I expect to decline sharply. The other two are office buildings and multimerchandise shopping (malls!).

GDP and Investment

by Calculated Risk on 7/31/2008 10:09:00 AM

The BEA reported that GDP increased 1.9% in Q2 2008 at a seasonally adjusted annual rate (SAAR). But the underlying details - especially for investment - are weak.

Residential investment (RI) declined at a 15.6% (SAAR).

Investment in equipment and software declined 3.4% (SAAR).

The lone bright spot for investment was non-residential investment in structures. Non-RI structure investment increased at a 14.4% SAAR. But all evidence suggests this investment is about to slow sharply. Click on graph for larger image in new window.

Click on graph for larger image in new window.

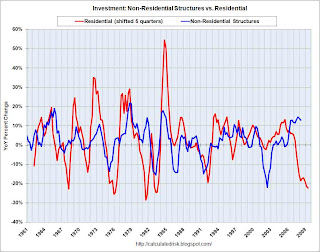

This first graph shows the typical relationship between residential investment and non-residential investment in structures. Note that residential investment is shifted 5 quarters into the future on the graph (non-residential investment usually follows residential by about 4 to 7 quarters).

The current non-residential boom has gone on a little longer than normal, probably for two reasons: 1) there was a slump in investment following the bursting of the tech bubble, and 2) loose lending standards kept non-residential investment lending strong until mid-year 2007, and it takes time to build non-residential structures.

All signs suggest that the bust is now here, and non-residential investment will probably be a drag on GDP for the next year or more. The second graph shows non-residential investment as a percent of GDP. This shows the current boom is even greater than the boom in the late '90s.

The second graph shows non-residential investment as a percent of GDP. This shows the current boom is even greater than the boom in the late '90s.

Some of the current investment boom is energy related, and I'll break out the three key areas that will soon go bust - office buildings, multimerchandise shopping, and lodging - as soon as the underlying detail tables are available. The third graph shows residential investment (RI) as a percent of GDP.

The third graph shows residential investment (RI) as a percent of GDP.

RI as a percent of GDP is at 3.5%, just above the cycle lows in 1982 and 1991. It is possible that RI, as a percent of GDP, will bottom later this year (or possibly in early 2009) since inventory is finally declining (housing starts are now below housing sales).

When RI finally bottoms, the good news is RI will no longer be a drag on GDP, but the bad news is RI will probably not recovery quickly because of the huge overhang of inventory. Unfortunately, by the time RI bottoms, non-residential investment will probably have taken over as a significant drag on GDP - suggesting the recession will linger.

Investment is usually the key to the economy, and investment remains weak.

Recession May Have Started in Q4, 2007

by Calculated Risk on 7/31/2008 09:52:00 AM

From Bloomberg: U.S. Recession May Have Begun in Last Quarter of 2007

The U.S. economy may have tipped into a recession in the last three months of 2007 ... The world's largest economy contracted at a 0.2 percent annual pace in the fourth quarter of last year compared with a previously reported 0.6 percent gain ...I've been showing Dec 2007 as the start of the recession on most of my graphs.

The revisions now reinforce measures such as employment and production that already signaled the economy was shrinking.

News of the Weird: Credit Union Failure

by Anonymous on 7/31/2008 09:05:00 AM

The failure of New London Security FCU the other day rather got lost in the news shuffle. This is probably because it had 365 members and reported assets of $12.7 million, which means it doesn't rank very high on the "systemic risk to the banking system" hot news alert scale. I must say, however, that for sheer weirdness this story delivers.

From The Day of New London, Connecticut:

A former manager of the credit union, who retired last year after decades and spoke on condition of not being identified, admitted Wednesday to being “computer illiterate.” She had been posting information manually for decades, she said.I feel that as a public service I should point out that a sound financial institution cannot "just basically sit on" a "lot of money" and still pay interest rates that are "better than what banks are offering." When you "just basically sit on" money, you get warm, flattened piles of money that retain the imprint of your buttocks. What you do not get is a competitive rate of return.

Edwin F. Rachleff, the 82-year-old broker who handled the credit union's investments and who committed suicide on the day the institution was declared insolvent, also reportedly did not feel comfortable with computers.

Members seemed to view manual postings as part of the charm of the tiny credit union, which had only 365 members and $12.7 million in assets.

”It was a little hole in the wall,” said Jim Mallove, owner of Mallove Jewelers in Waterford, who opened accounts there several years ago for his two children. “But the deposits earned very good interest ... better than banks were offering.”

A quirk of the institution, Mallove remembers, is that the credit union would not accept monthly deposits of more than $100 per account. He had little idea why the credit union would limit deposits.

”My impression at the time was that they had a lot of money and were just basically sitting on it,” said Mallove, who received annual statements as a credit union member.

So what was New London Security doing with those miserly deposits it allowed its members to make?

Emerson added that its ratio of assets to loan amounts was extremely low. He said many credit unions have loans totaling 50 to 80 percent of their assets, though some are as low as 20 percent; New London Security, by comparison, had only about 2 percent of its assets in loans.Of course no one at this point is quite sure what these investments actually were, what with the suicide of broker and all the records being apparently handwritten on green ledger paper. It is hinted that they may be mortgage-backed securities, although for all we know it could be time-shares in the Poconos. Or postal coupons.

New London Security had more than $10 million of its assets in various investment vehicles, Emerson pointed out.

”They were into investments,” Emerson said, adding that he “wouldn't disagree” with the notion that New London Security had turned into a kind of investment club, a notion that was seconded by another credit union official who didn't want to be named.

I feel that as a public service I should point out that an institution that does not make loans to its members in the normal course of business can be many things, but a "credit union" it is not. No matter how charming and small-town cute those hand-written passbook entries are.

(Thanks, Matt!)