by Anonymous on 7/01/2008 10:02:00 AM

Tuesday, July 01, 2008

When In Doubt, Blame the Accountants

New-Old meme: FAS 157 is ruining the financial industry. Barry Ritholtz knocks this point of view around, as reported in the New York Times:

Some blame the rapacious lenders. Others point to the deadbeat borrowers. But Stephen A. Schwarzman sees another set of culprits behind all the pain in the financial industry: the accountants.You see, the magic of securitization during the boom was that it created obscure instruments like CDOs that were "worth" more than the underlying collateral (absurd mortgage loans). Now that the magic of securitization during the bust is that it has left behind obscure instruments--those pesky CDOs--that may well be "worth" less than the underlying collateral, if you can imagine that, foul is cried:

Of course, the purpose of FAS 157 was to make the market more transparent and efficient, which Mr. Schwarzman doesn’t take issue with.In other words, mark-to-market is great on the way up, but it's not fair to have to mark on the way down.

“The concept of fair value accounting is correct and useful, but the application during periods of crisis is problematic,” he said. “It’s another one of those unintended consequences of making a rule that’s supposed to be good that turns out the other way.”

Construction Spending in May

by Calculated Risk on 7/01/2008 10:00:00 AM

Construction spending declined in May for residential, but increased slightly for non-residential private construction.

From the Census Bureau: May 2008 Construction at $1,085.2 Billion Annual Rate

Spending on private construction was at a seasonally adjusted annual rate of $784.2 billion, 0.7 percent below the revised April estimate of $789.4 billion.

Residential construction was at a seasonally adjusted annual rate of $378.9 billion in May, 1.6 percent below the revised April estimate of $385.1 billion.

Nonresidential construction was at a seasonally adjusted annual rate of $405.3 billion in May, 0.2 percent above the revised April estimate of $404.3 billion.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The graph shows private residential and nonresidential construction spending since 1993. With revisions, private non-residential construction spending has now passed residential construction spending for the first time (since the Census Bureau started tracking spending).

Nonresidential spending has been strong as builders complete projects, but there is substantial evidence of a looming slowdown - less lending for new projects, less work for architects - and the expected slowdown in non-residential spending will happen in the 2nd half of 2008.

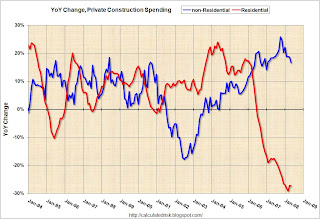

The second graph shows the year-over-year change for private residential and non-residential construction spending.

The YoY change in non-residential spending is starting to slow down and will probably turn negative later this year.

Eli Broad: Economy "Worst Period" in his Life

by Calculated Risk on 7/01/2008 09:04:00 AM

From Bloomberg: Broad Says Economy in Worst Slump Since World War II

Billionaire investor Eli Broad [the founder of homebuilder KB Home] said the U.S. economy is in the ``worst period'' of his adult life as a housing market recovery remains ``several years'' away.For anyone associated with home building, the current period has to feel like an economic depression.

UK: Mortgage Approvals Collapse

by Calculated Risk on 7/01/2008 01:23:00 AM

From the Telegraph: UK house prices in grip of slump that experts expect to deepen

Britain is in the grip of a housing slump as bad as at any stage since the 1970s, property experts warned, as data suggested that first time buyers had all but disappeared from the market.We've sure seen a lot of records recently. Record foreclosures. Record inventory. Record house price declines. Record low mortgage approvals in the UK.

...

Just 42,000 loans were handed out in May – down from 58,000 in April and a massive slump of 64pc compared to this time a year ago, when 116,000 mortgages were given to home buyers. This is the lowest level recorded in any month since the Bank of England started collecting data in 1993.

Another day, another record ...

Monday, June 30, 2008

CRL Report on Indymac

by Calculated Risk on 6/30/2008 08:00:00 PM

Here is a new report from the Center for Responsible Lending IndyMac: What Went Wrong? Here is the PDF file

Ben Butler, an 80-year-old retiree in Savannah, Georgia got an IndyMac loan in 2005 to build a modular house. IndyMac okayed the mortgage based on an application that said Mr. Butler made $3,825 a month in Social Security income.That is just one example. The CRL claims to have "substantial evidence that IndyMac routinely made loans with little regard for their customers' ability to repay the loans."

One problem: The maximum Social Security benefit at the time was barely half that.

Mr. Butler had no idea his income had been inflated by IndyMac or the mortgage broker who arranged the deal, his attorney maintains. Even if IndyMac wasn’t the one that puffed up the dollar figure, the attorney says, it should have easily caught such an obvious lie.

Move aside Countrywide, it looks like Indymac will take a turn at the whipping post.

Indymac: Schumer Caused Minor Bank Run

by Calculated Risk on 6/30/2008 05:36:00 PM

Indymac Responds to Letters Sent by Senator Charles Schumer (hat tip Nemo)

[A]s a result of Sen. Schumer making his letters public and the resulting press coverage, we did experience elevated customer inquiries and withdrawals in our branch network last Friday and on Saturday of roughly $100 million, about ½ of 1% of total deposits. And while branch traffic is somewhat elevated this morning, it is substantially lower than on Saturday, and we are hopeful that this issue appropriately abates soon ...

Update on Oceanside REO

by Calculated Risk on 6/30/2008 04:34:00 PM

Realtor Jim has informed me that they have two firm offers at full price for the REO featured in Oceanside REO: Back to 2002 / 2003 Prices.

These are owner occupied offers. That is what I suspected since the property doesn't make sense for cash flow investors at the current asking price.

The important point here is the difference in market dynamics between the low end (with significant investor activity) and the mid-range markets (most homes will be bought by owner occupants). Investors will probably set the price floor for low end single family homes and condos, but owner occupants will probably be more prevalent in the mid-range - buying at prices above what most investors are willing to pay. Just something to keep in mind ...

Wachovia Waives Refi Fees for Pick-A-Pay, Discontinues NegAm Products

by Calculated Risk on 6/30/2008 02:24:00 PM

Note: Pick-A-Pay is Wachovia's Option ARM (adjustable rate mortgage) product with a NegAm (negative amortization) option.

Press Release: Wachovia Corporation Announces Assistance for Pick-A-Pay Customers

Effectively immediately, Wachovia is waiving all prepayment fees associated with its Pick-A-Pay mortgage to allow customers complete flexibility in their home financing decisions.Obviously Wachovia wants people to refinance out of their current Option ARMs. The NegAm products are really hurting Wachovia.

...

Additionally, for all new loan originations, Wachovia is discontinuing offering products that include payment options resulting in negative amortization.

Unemployment Benefits Extended

by Calculated Risk on 6/30/2008 12:05:00 PM

An extension of unemployment benefits for 13 weeks was included in the war funding bill signed by President Bush today.

This extension covers workers who used all their unemployment benefits between November 2006 and March 2009. As I noted last week, some of these people will reapply for benefits, probably pushing weekly claims over 400K per week once the benefits become available. (Typically an extension of benefits adds about 50K per week for about four weeks).

Extended benefits are not included in continued claims (there is a separate category), however continued claims will probably also get a small boost as some job seekers wait for better opportunities.

Although unemployed workers receive the direct benefit of this extension, this program (like all safety nets) is really aimed at employed workers worried about their jobs. Far more people are worried about losing their jobs than will actually be laid off in this downturn - and if all these people pull back sharply on their spending, then the layoffs might become a self fulfilling prophesy. This program helps reduce the financial fear for these workers.

Oceanside REO: Back to 2002 / 2003 Prices

by Calculated Risk on 6/30/2008 10:43:00 AM

Here is another Countrywide REO in Oceanside offered at $359,900 (from Jim the Realtor). This house sold for $469,000 in early 2004, and is now being offered at late 2002, early 2003 prices. (see graph at bottom of this post)

Unlike the low end home discussed last month, these mid-range homes are not as attractive to cash flow oriented investors. Jim says the rent would be $2000 per month (maybe as high as $2500 per month all fixed up). The cap rate would probably be around 4.5%; too low for most investors.

Hey, where is the shower?

The following graph is the Case-Shiller home price index for San Diego, using the previous sales price of this Oceanside property to scale the price ($469,000 in Feb 2004). NOTE: These prices are not for San Diego and are used just to put this property on the Case-Shiller graph. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Although this REO is priced below the current Case-Shiller price - and is being offered at late 2002 / early 2003 prices, this is probably still too high for most investors.

This type of property will probably sell to owner occupied buyers, as opposed to investors, unless the price falls another 20+% (my guess is investors would be interested around $275,000). Although there are many more low end REOs on the market, lenders are starting to price those properties aggressively, and will probably sell many of those properties to investors. These mid-range REOs will probably linger on the market waiting for owner occupied buyers (or even lower prices). Jim did tell me there might be an offer coming in, but he noted: "I'll believe when I see it".

BIS: Economy Near "Tipping Point"

by Calculated Risk on 6/30/2008 08:56:00 AM

From the WSJ: Bank for International Settlements Sees Economy Near 'Tipping Point'

In its annual report, the central bank for central banks said the impact of rising food and energy prices on consumers' incomes, combined with heavy household debts and a pullback in bank lending, may lead to a slowdown in global growth that "could prove to be much greater and longer-lasting than would be required to keep inflation under control."Here is the report.

Meanwhile, from Bloomberg: European Prices Rise More Than Forecast as Oil Surges

The inflation rate in the euro area rose to 4 percent this month, the highest in more than 16 years ...

European retail sales plunged in June with the Bloomberg purchasing managers index falling to 44 from 53.1 in May.

...

``The surge in inflation is the reason why we've seen the economy lurching downwards,'' said Ken Wattret, senior economist at BNP Paribas in London. ``The pipeline pressures are increasing and the news on the wage front has been very alarming.''

Shanghai Cliff Diving

by Calculated Risk on 6/30/2008 02:23:00 AM

The Shanghai SSE composite index is off another 1.9% tonight (most recent quote), and is now below 2700 for the first time since early 2007. The index is off 54% from the peak. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This is some serious cliff diving.

And other markets are also selling off, probably because of some combination of a slowing global economy and higher inflation.

As the NY Times notes: Falling Prices Grip Major Stock Markets Around the World

In ... Germany, the benchmark DAX index is off slightly more than 20 percent this year, and the CAC-40 in France is down almost 22 percent. The Euro Stoxx 50, a gauge for the 15-nation euro zone, has declined by about 24 percent. The nearly 15 percent decline in the FTSE 100 in Britain looks tame by comparison.

Emerging market indexes have fared even worse. The Hang Seng in Hong Kong has plunged nearly 21 percent, the Shanghai Composite has lost nearly half its value this year. The Bombay 500 in India lost about 38 percent.

Sunday, June 29, 2008

Lawrence Summers "Most dangerous moment"

by Calculated Risk on 6/29/2008 06:49:00 PM

Lawrence Summers writes in the Financial Times: What we can do in this dangerous moment

It is quite possible that we are now at the most dangerous moment since the American financial crisis began last August.Summers has four recommendations:

First, the much debated housing bill should be passed immediately by Congress and signed into law.I haven't commented very much about this housing bill. Many of the critics have labeled it a $300 billion bailout - it's not. The cost will only be a small fraction of that amount, and the bill will probably be inconsequential. For more on the bill, see the CBO's analysis Federal Housing Finance Regulatory Reform Act of 2008 and Vikas Bajaj's article today in the NY Times: As Housing Bill Evolves, Crisis Grows Deeper.

Second, Congress should move promptly to pass further fiscal measures to respond to our economic difficulties. ... There is now also a case for carefully designed support for infrastructure investment ... There are legitimate questions about how rapidly the impact of infrastructure spending will be felt. ...Yes, it appears the 2nd half recovery has been cancelled and there will be calls for more stimulus packages. Some infrastructure investment - that provides jobs for unemployed construction workers - seems to make sense. Atrios made a similar point this morning.

And from Summers on inflation:

Third, policymakers need to make a clear commitment to addressing the non-monetary factors causing inflation concerns. ... the primary source of inflation concern is increases in the price of oil, food and other commodities. ... Appropriate steps include reform of misguided ethanol subsidies that distort grain markets to minimal environmental benefit, allowing farm land now being conserved to be planted; measures to promote the use of natural gas; and reform of Strategic Petroleum Reserve Policy to encourage swaps at times when the market is indicating short supply. Major importance should be attached to encouraging the reduction or elimination of energy subsidies in the developing world.There seems to be an overwhelming consensus that corn ethanol is misguided - and yet the program persists.

Fourth, it needs to be recognised that in the months ahead there is the real possibility that significant financial institutions will encounter not just liquidity but solvency problems as the economy deteriorates and further writedowns prove necessary.Solvency is the real issue, and I'm not sure about the solution.

Shiller: More Stimulus Needed

by Calculated Risk on 6/29/2008 09:49:00 AM

Robert Shiller writes in the NY Times: One Rebate Isn’t Enough

In January, just before Congress passed the stimulus bill authorizing the rebate checks, Peter R. Orszag, director of the Congressional Budget Office, wrote that, in the current economic situation, there was a risk of “a self-reinforcing spiral (of less lending, lower house prices, more foreclosures, even less lending, and so on) that could further impair economic activity and potentially turn a mild recession into a long and deep recession.”And Shiller goes on to argue that more stimulus is needed:

In his view, there was only a moderate probability that this “self-reinforcing spiral” would take hold. The goal of the rebate checks, he said, would be to lower this probability “to an acceptable value.” He thought that an economic stimulus bill might well make the difference.

...

Has the tax rebate substantially reduced the probability of a downward spiral?

It is too soon to tell, because the Treasury only started to send out rebate checks in late April. Retail sales did rise in May. But the dreaded serious recession still seems very much a possibility.

[W]e should be putting in place another stimulus package like the current one, and stand ready for another after that, and another.With the "2nd half recovery" apparently cancelled, and the immediate effects of the stimulus mostly behind us, it is not surprising that more stimulus is being discussed. But if the stimulus checks go to Saudi Arabia or China, it isn't really helping (there is no multiplier effect).

And it's not clear how a little more consumer spending is supposed to slow the downward spiral of "of less lending, lower house prices, more foreclosures, even less lending, and so on" other than to buy a little time.

Saturday, June 28, 2008

You know Gas is Expensive when Teenagers Stop Cruising!

by Calculated Risk on 6/28/2008 09:14:00 PM

From the NY Times: Cruise Night, Without the Car

For car-loving American teenagers, this is turning out to be the summer the cruising died.

...

From coast to coast, American teenagers appear to be driving less this summer. Police officers who keep watch on weekend cruising zones say fewer youths are spending their time driving around in circles, with more of them hanging out in parking lots, malls or movie theaters.

Apartment Landlords Offering Significant Incentives in Manhattan

by Calculated Risk on 6/28/2008 09:00:00 AM

From the NY Times: Luring Affluent Renters in Manhattan

ONE month’s free rent. Two months’ free rent. No security deposit.Note that this is for some high-end buildings only. It looks like the layoffs in the financial industry are starting to bite ... and it's about to get worse:

How about a year’s worth of storage at Manhattan Mini Storage or an appointment at a doggie day spa for Rover on moving day?

As the rental market in Manhattan has softened in recent months, these are some of the incentives that owners of high-end buildings are offering to lure tenants.

... many of the people laid off by Wall Street firms will not officially become unemployed until their severance pay runs out. For the entire metropolitan area, she said, Moody’s economy.com is projecting a loss of 60,000 jobs by the beginning of 2009, with about 45,000 of those jobs in financial services.

Friday, June 27, 2008

UK: "House prices won't recover until 2015"

by Calculated Risk on 6/27/2008 08:23:00 PM

From Edmund Conway at the Telegraph: House prices won't recover until 2015, ex-MPC expert warns

Families must wait until 2015 for the property market to start booming again, according to Stephen Nickell, who heads up the unit which advises the Prime Minister on housing planning.It's probably too early to be talking about when house prices will return to pre-credit crunch levels, but at least Gordon Brown is hearing that it will take years.

...

"The housing market - in terms of the price of houses - will not look much the same as it did before the credit crunch until after six or seven years."

Also from the Telegraph: British household debt is highest in history

Families in the UK now owe a record 173pc of their incomes in debts, official figures have shown. The ratio of debt to income is higher than any other country in the Group of Seven leading industrialised economies, and is sharply higher than the 129pc of incomes it was five years ago.

...

Michael Saunders of Citigroup warned that - at 173pc of household incomes - the debt burden is higher even than Japan's when it peaked in 1990, before more than a decade of deflation.

"Not only are we the highest in the G7, we are the highest a G7 country has ever seen," he said.

J.D. Power: June Auto Sales at 12.5 million rate

by Calculated Risk on 6/27/2008 03:40:00 PM

From the WSJ: Deep June Car-Sales Slump Seen in J.D. Power Estimate

J.D. Power & Associates sees the market for U.S. light vehicles contracting 15.4% in the month of June compared to a year ago, according to a report released Friday ... The firm expects the closely-watched seasonally adjusted annual rate of sales to fall to 12.5 million vehicle rate, well below the 16.3 million rate set in the same period last year.This is more grim news for the U.S. auto industry.

Bear Markets

by Calculated Risk on 6/27/2008 01:45:00 PM

For those with a round number fetish, the Dow is now off more than 20% from the peak last October. If it closes at or below this level, then this will be considered an official bear market.

Dow closing high on Oct 9, 2007: 14,164.53

20% off would be: 11,331.62 (right now 11,326 so it's close).

The closing high for the S&P 500 was 1565.15 last October 9th and 20% off would be 1252.12 - so we still have a little ways to go for the S&P.

Professor Duy: "This Is Not Good"

by Calculated Risk on 6/27/2008 10:54:00 AM

Tim Duy has another great post on the Fed being caught between inflation and recession: This Is Not Good. Here is his conclusion:

This is a no win situation...which way will the Fed turn? The Fed will hold the current policy in place until policymakers becomes sufficiently distressed by the impact of energy price inflation ... Note that market participants are increasingly aware that the Fed’s default policy for the time being is higher inflation, as evidenced by the rise in 10 year TIPS breakeven levels to 254bp today.

In theory, the best outcome is to find is a sweet spot that allows global growth outside of the US to decelerate while avoiding a free fall in the Dollar. In the absence of such equilibrium, the US economy can hobble along only as long as the following three conditions hold:

1. The Federal Reserve can maintain easy monetary policy.

2. The US government can sustain repeated fiscal stimulus measures.

3. China and the rest of the dollar bloc continue to be willing to accumulate US assets, primarily the Treasury debt needed for fiscal stimulus.

When these conditions no longer hold – such as the Fed needs to tighten to counter energy inflation, or the demand for US debt drops sharply – then I suspect the US economic environment will shift decisively toward higher inflation or significant recession.