by Calculated Risk on 6/23/2008 11:21:00 AM

Monday, June 23, 2008

When Bankers Decorate ...

"When the bankers are selecting color schemes, you know a project isn't going well"

reader Brian, June 23, 2008

This article from Bloomberg is a good summary of the banks exposure to commercial real estate (CRE): Deutsche Bank Lost in Vegas as Defaults Make Lenders Decorators

Workers building the $3.5 billion Cosmopolitan Resort & Casino on the Las Vegas strip are getting used to their financiers from Deutsche Bank AG. Lately, the weekly visitors from 60 Wall Street have been critiquing plans that called for a black-and-white decor.

``They are considering changing the color palettes and finishes,'' said Travis Burton, a vice president for lead contractor Perini Corp., who outfits the bankers with safety vests and hard hats before touring the site.

...

Deutsche Bank ... is one of a dozen investment banks that rode a five-year boom in commercial real estate by financing developers and landlords while profiting by packaging loans into securities. Then credit markets seized up in 2007, sticking banks and brokerage firms with commercial mortgages and bonds. The amount for large U.S. banks alone: $169 billion ... The resolution may take more than providing advice on drapes as the economy falters and mall vacancies increase.

Harvard: Bleak Outlook for Housing

by Calculated Risk on 6/23/2008 09:02:00 AM

Note: Dean Baker comments on the Joint Center for Housing Studies at Harvard University. As I noted below, the JCHS outlook sections always seem too optimistic, but the report does provide some excellent data.

Hat tip Ben Zipperer in Baker's comments:

When America's housing boom finally ends, don't expect a loud pop.

"It's not going to be a big dramatic event," says William Apgar, senior scholar at Harvard University's Joint Center for Housing Studies.

From the WSJ in August 2005: How Will Home Boom End?

"But comparing the [sudden price declines in the] stock market and the housing market is misleading at best. Because people live as well as invest in their homes, many owners stay put when prices first show signs of softening. This reduces the number of houses on the market and helps bring supply and demand back into balance, forestalling faster and sharper price declines."From the San Diego Union: Harvard report: Housing outlook remains bleak

-- from a 2005 Joint Center report

"With the slowdown in the entire residential construction sector, the home improvement market has downshifted to a more sustainable rate of growth... The dip in spending should, however, be both mild and short-lived. The fundamentals of remodeling demand remain positive, and the backlog of under-improved homes ensures a ready market for upgrades in the near term. And with home equity still at record levels, owners have the means as well as the motivation to continue to invest in their properties over the coming years."

-- from a 2007 Joint Center report

In a grim report on the weakened state of the housing industry, Harvard University says the United States is caught in a real estate market downturn “that is shaping up to be the worst in a generation.”Hopefully the report will be available online soon (check here). The annual Harvard report is a great source of data, however for the last few years I've noted that the report seemed too optimistic.

The decline in housing construction and home sales “already rivals the worst downturns in the post World War II era,” said the report out today from Harvard's Joint Center for Housing Studies. Price drops and mortgage failures “are the worst on records that date back to the 1960s and 1970s.”

Despite the “State of the Nation's Housing” report's somber tone, some analysts said it might be understating the problem.

“We have never had anything like this happen,” said Christopher Thornberg, an economist with the Beacon Economics research firm in Los Angeles. “It's a bloodbath. Prices are falling because they are too high. You would have to have prices in California fall 40 percent in order to get back to an historical level of affordability relative to incomes.”

...

“I think it is going to take another year nationwide for us to work through all of our problems in the housing market, at least to make a significant dent,” [Mark Zandi, chief economist for Moody's Economy.com] said. “In some parts of the country, the market will remain depressed well into the next decade. It is going to be a slog.”

Krugman: Home Not-So-Sweet Home

by Calculated Risk on 6/23/2008 01:23:00 AM

From the NY Times: Home Not-So-Sweet Home

Listening to politicians, you’d think that every family should own its home — in fact, that you’re not a real American unless you’re a homeowner. ... Even Democrats seem to share the sense that Americans who don’t own houses are second-class citizens.Krugman lists three disadvantages to owning that we've discussed:

...

And the belief that you’re nothing if you don’t own a home is reflected in U.S. policy. Because the I.R.S. lets you deduct mortgage interest from your taxable income but doesn’t let you deduct rent, the federal tax system provides an enormous subsidy to owner-occupied housing.

...

In effect, U.S. policy is based on the premise that everyone should be a homeowner. But here’s the thing: There are some real disadvantages to homeownership.

Krugman concludes:

All I’m suggesting is that we drop the obsession with ownership, and try to level the playing field that, at the moment, is hugely tilted against renting.Hear, hear!

And while we’re at it, let’s try to open our minds to the possibility that those who choose to rent rather than buy can still share in the American dream — and still have a stake in the nation’s future.

Sunday, June 22, 2008

Report: Citi to Cut 10% of Investment Banking Jobs

by Calculated Risk on 6/22/2008 07:14:00 PM

The WSJ is reporting: Citi to Slash Investment Banking Jobs World-Wide

Citigroup ... will dismiss thousands of investment-banking employees world-wide as part of a plan to cut the roughly 65,000-employee group by 10% ...According to the WSJ the cuts will probably happen tomorrow, with entire trading desks eliminated in New York and other cities.

Update: from the Financial Times: Job fears mount as Goldman sheds staff (hat tip crispy&cole)

... it emerged that Goldman Sachs ... cut staff at its investment banking division last week.The FT article ends with:

The Wall Street bank is now expected to cut up to 10 per cent of staff in the division that handles mergers and acquisition advice and corporate fundraisings over the course of 2008 ...

“Any bank that says it’s not cutting is lying,” said one industry insider on Sunday. “It’s getting to halfway through the year and everyone can see that business hasn’t picked up.”It is becoming more clear that the '2nd half recovery' was a mirage - not only for the financial industry, but for the economy in general.

Property Taxes Falling

by Calculated Risk on 6/22/2008 05:13:00 PM

From the LA Times: Tax cushion for falling property values

Assessors in the five-county Los Angeles area are now in the process of cutting property taxes on more than half a million homes because of plunging home values. ...In California, the assessed value is set to the sales price (in most cases), and then the assessed value is limited to a maximum increase of 2% per year. Property taxes are 1% of the assessed value.

Although savings will vary widely, the average annual property tax reduction in Los Angeles County is expected to be about $750. In Riverside County, it'll be around $1,200.

Homeowners who bought years ago will still see their property taxes increase 2% per year (since the assessed value is still below the market value). However for recent home buyers, with falling prices, the market value will likely be below the purchase price. These homeowners can appeal the assessment value - or as in this case, the assessors office may reduce the assessed value automatically.

A decline of $1,200 per year in Riverside suggests assessed values have fallen $120,000 on average.

Those tax breaks will go only to selected homeowners who bought their homes around the market's peak in 2005 and 2006. The Los Angeles County Assessor's office, for example, reviewed only properties purchased since July 1, 2004, and will be lowering taxes on 128,000 out of the 318,000 examined.This is both good news and bad news for homeowners. Imagine opening a letter from the assessors office saying your property taxes have decreased $1,200 per year - but that the value of your home has declined $120,000. Ouch!

Assessors in Orange, Riverside, San Bernardino and Ventura counties reviewed sales since Jan. 1, 2004, and say they expect to reduce taxes on about two-thirds of those homes.

My guess is the assessors office will have to review sales back to 2003 or even 2002 next year.

Saudi Arabia Plans to Increase Oil Production

by Calculated Risk on 6/22/2008 10:53:00 AM

Here is a story from Bloomberg on the "Oil Summit" in Saudi Arabia: Saudi Arabia Boosts Oil Supply, May Pump More Later

``Saudi Arabia is prepared and willing to produce additional barrels of crude above and beyond the 9.7 million barrels per day, which we plan to produce during the month of July, if demand for such quantities materializes and our customers tell us they are needed,'' [Saudi Oil Minister Ali al- Naimi] said.

Saudi Arabia's capacity will be 12.5 million barrels a day by the end of 2009 and may rise to 15 million after that if necessary, he said.

UK Housing: Starts Off 56%

by Calculated Risk on 6/22/2008 01:13:00 AM

From The Guardian: Number of new houses being built plummets nearly 60%

The National House Building Council, which has 20,000 registered house builders on its books, said there were 6,890 new starts in the private sector in May, compared with 15,713 this time last year. This represents a drop of 56%.And on house prices in the UK: HBOS predicts 9% fall in house prices and sales to halve

..

This news came on the same day as Halifax, the UK's biggest mortgage lender, announced that it would be raising its fixed rates on loans by half a percentage-point from today ... Homeowners who have more than 25% equity in their houses now face an increase on a two-year fixed-rate mortgage from 6.49 to 6.99%.

House prices will fall 9% this year, HBOS warned yesterday in its gloomiest prediction for the housing market since 1989.Just a reminder that the housing bust is

Saturday, June 21, 2008

Foreclosure Rage

by Calculated Risk on 6/21/2008 08:08:00 PM

I wonder if he has a demolition permit? (30 secs) Be careful what you buy!

BofA and the Dodd Bailout Bill

by Calculated Risk on 6/21/2008 08:07:00 PM

Peter Viles at the LA Times (L.A. Land blog) has the story: Did Bank of America write the Dodd bailout bill?

Update: I don't like the system, but I don't see a scandal here. Bank of America employees have given to almost all candidates, and almost legislation is written by lobbyists.

Non-Residential Investment: Multimerchandise shopping

by Calculated Risk on 6/21/2008 10:08:00 AM

The previous post discussed the incentives being offered by mall owners to marginal retailers. Move in incentives are common in retail (and frequently in commercial too), but according to the WSJ in the case of Steve & Barry's the incentives were essential:

Without these payments, the stores are barely profitable, if at all ...That shows the desperation of mall owners with vacancy rates rising rapidly.

Just like for residential, there was substantial overbuilding in multimerchandise shopping space in recent years.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows investment in multimerchandise shopping space starting in 1997 in current dollars (inflation adjusted Q1 2008). The circle shows the probable period of overinvestment.

It appears that $20 billion per year or so would be a normal level of investment. However, with the recent over investment, non-residential investment in multimerchandise shopping structures will probably fall below $20 billion per year for a few years.

Unfortunately the investment data for multimerchandise shopping is only available starting in 1997.

Steve & Barry's: The Mall Vacancy Answer? Probably Not.

by Calculated Risk on 6/21/2008 12:35:00 AM

The WSJ has an article about fast growing retailer Steve & Barry's facing possible bankruptcy. This story has an interesting twist: Steve & Barry's Faces Cash Crunch

[S]ome of the forces pushing Steve & Barry's growth were not tied to end-consumer demand, but the needs of mall owners in a softening commercial-real-estate market. Much of the company's earnings came in the form of one-time, up-front payments from mall owners. Those payments were designed to lure the retailer to take over vacated sites, say several people familiar with the company.So the mall owner pays the tenant to take retail space that the the tenant can barely afford unless other mall owners pay the tenant to take additional space. And on and on.

Without these payments, the stores are barely profitable, if at all ...

This shows just how tough the mall leasing environment currently is.

Friday, June 20, 2008

MBIA: $2.9 Billion Required for Contract Terminations

by Calculated Risk on 6/20/2008 05:30:00 PM

UPDATE: from Yves Smith at Naked Capitalism: MBIA Downgrade Increases Collateral Requirements; Clarification on CDS Acceleration in Insolvency/Custodianship

MBIA Comments on the Impact of the Moody's Downgrade

As a result of the downgrade to A2, MBIA expects that it will require $2.9 billion to satisfy potential termination payments under Guaranteed Investment Contracts (GICs). In addition, MBIA expects to be required to post approximately $4.5 billion in eligible collateral to satisfy potential collateral posting requirements under GIC's as a result of the downgrade. MBIA Inc. has total assets of $25 billion related to its ALM business, of which $15.2 billion is available to satisfy these requirements including approximately $4.0 billion in cash and liquid short-term investments; $1.0 billion of unpledged eligible collateral on hand; and approximately $10.2 billion of other unpledged diversified securities with an average rating of Double-A. In addition, MBIA Inc. also has available another $1.4 billion in cash, including the proceeds of its recent equity offering.

S&P Research Downgrades BofA

by Calculated Risk on 6/20/2008 02:17:00 PM

From MarketWatch: S&P cuts Bank of America to sell from hold

"We take unfavorable note of the large Countrywide option-adjustable rate mortgage portfolio that Bank of America will inherit, since we believe this portfolio has yet to be stress tested," S&P said in its action.Not stress tested ... yet. The losses are coming for these Option ARM (and HELOC) portfolios.

More on Bear Stearns Indictment

by Calculated Risk on 6/20/2008 01:16:00 PM

Bloomberg has an overview: Bear Stearns Fund Prosecutors Reveal `Lot of Evidence' of Fraud

As I noted yesterday, the indictment contains several allegations that the managers knew specific material information about the condition of the funds, and then provided false information to investors. Bloomberg noted the same example I gave yesterday:

``It's very hard to say you weren't shading the truth in an important way when you say you had a couple of million dollars of redemptions when in fact you had $47 million,'' [Christopher Clark, a former federal prosecutor in New York] said.If the prosecutors can prove the managers knew certain material facts on a certain date, and then prove the managers told investors materially different facts on a subsequent date - IMO that is powerful evidence of securities fraud.

The WSJ has the indictment here. I think the actual indictment is much stronger than the flimsy evidence provided in the advance news stories.

Ford Warns on Sales

by Calculated Risk on 6/20/2008 11:04:00 AM

From MarketWatch: Ford delays new F-150 pickup, cuts truck production

[Ford] pared its 2008 U.S. industry sales forecast to a range of 14.7 million to 15.2 million cars and trucks, down from its previous projection of 15 million to 15.4 million vehicles. Ford cut its third-quarter production plans to 475,000 vehicles, 50,000 units lower than prior targets ...Apparently June auto sales are looking really weak according to this article in the Detriot Free Press:

[I]n November ... executives were assuming Americans would buy ... only about 15.5 million [vehicles in 2008]. ... [S]o far in June ... J.D. Power and Associates and Citigroup are seeing a sales pace that is almost 20% lower -- only 12.5 million vehicles per year.

Chris Thornberg: Possible 50% House Price Declines in SoCal

by Calculated Risk on 6/20/2008 10:24:00 AM

From Jon Lansner at the O.C. Register: SoCal home woes could mean 50% price drop

[Economist Chris] Thornberg, founding partner at Beacon Economics and former UCLA economics professor, said home prices would have to fall about 40% from peak to trough to return to the historical norm. But add in the impact of rising gasoline prices, the subprime mortgage meltdown and rising foreclosures, and it’s likely prices will fall 50% peak to trough.I think Dr. Thornberg is optimistic on the timing (he sees the price bottom in mid-to-late 2009). This might be true for low end areas, but I expect prices in the mid-to-higher end areas to be a little more sticky - so the price declines might take a few more years.

The S&P/Case-Shiller index shows that prices for the L.A./O.C. area are down 24% from the peak, so the region is about halfway to the bottom, Thornberg said.

In Orange County, price declines will be more severe at the bottom of the price spectrum than the top end, but “the top end is going to get hit, (too),” he said.

That will be a rude awakening for many homeowners suffering from what he called “homallucinations,” or the ability to convince oneself that while the price of everyone else’s home will fall, your neighborhood is clearly different.

BofA and Countrywide: July 1st Target Date

by Calculated Risk on 6/20/2008 09:16:00 AM

From the LA Times: The final days: BofA may swallow Countrywide by July 1

A Bank of America Corp. spokesman in Charlotte confirmed today that the company could complete its takeover of the loss-ridden mortgage giant by July 1.This is one of those deals that seemed destined to be renegotiated - and that never happened.

Countrywide shareholders are to meet on Wednesday at the firm’s Calabasas headquarters to vote on the deal. (Not that they have any real choice.)

Once it gets that approval, BofA could complete its stock swap by July 1.

...

Under terms of the deal, announced in January, BofA will exchange 0.1822 of its shares for each Countrywide share. When the takeover was announced on Jan. 11, BofA shares were at $38.50. That put a value of $7.01 a share on Countrywide.

Today, BofA’s stock fell 23 cents to $28.14, its lowest since 2001. That values Country- wide at $5.13 a share ...

Thursday, June 19, 2008

Night Music: Wall Street Meltdown

by Calculated Risk on 6/19/2008 10:35:00 PM

Wall Street Meltdown:

Inspired by the Richter Scales classic ("Here Comes Another Bubble):

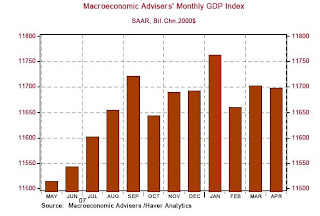

Monthly GDP

by Calculated Risk on 6/19/2008 08:10:00 PM

Here is a chart of monthly GDP from Northern Trust: Click on graph for larger image in new window.

Click on graph for larger image in new window.

Even though the average GDP in Q1 2008 was slightly higher than Q4 2007, on a monthly basis it appears GDP peaked in January - and for six of the last seven months (except January), GDP was lower than Sept '07.

Other measures of an economic recession, such as employment and industrial production, suggest the recession started in December '07 or January '08.

The question now is how long and deep the economic slump will be.

Moody's Downgrades MBIA and Ambac

by Calculated Risk on 6/19/2008 06:11:00 PM

Headlines and short story only now from MarketWatch:

Moody's downgrades MBIA to 'A2' from 'Aaa'Here come some more write downs for the banks associated with counterparties being downgraded.

Moody's downgrades Ambac to 'Aa3' from 'Aaa'