by Calculated Risk on 6/21/2008 10:08:00 AM

Saturday, June 21, 2008

Non-Residential Investment: Multimerchandise shopping

The previous post discussed the incentives being offered by mall owners to marginal retailers. Move in incentives are common in retail (and frequently in commercial too), but according to the WSJ in the case of Steve & Barry's the incentives were essential:

Without these payments, the stores are barely profitable, if at all ...That shows the desperation of mall owners with vacancy rates rising rapidly.

Just like for residential, there was substantial overbuilding in multimerchandise shopping space in recent years.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows investment in multimerchandise shopping space starting in 1997 in current dollars (inflation adjusted Q1 2008). The circle shows the probable period of overinvestment.

It appears that $20 billion per year or so would be a normal level of investment. However, with the recent over investment, non-residential investment in multimerchandise shopping structures will probably fall below $20 billion per year for a few years.

Unfortunately the investment data for multimerchandise shopping is only available starting in 1997.

Steve & Barry's: The Mall Vacancy Answer? Probably Not.

by Calculated Risk on 6/21/2008 12:35:00 AM

The WSJ has an article about fast growing retailer Steve & Barry's facing possible bankruptcy. This story has an interesting twist: Steve & Barry's Faces Cash Crunch

[S]ome of the forces pushing Steve & Barry's growth were not tied to end-consumer demand, but the needs of mall owners in a softening commercial-real-estate market. Much of the company's earnings came in the form of one-time, up-front payments from mall owners. Those payments were designed to lure the retailer to take over vacated sites, say several people familiar with the company.So the mall owner pays the tenant to take retail space that the the tenant can barely afford unless other mall owners pay the tenant to take additional space. And on and on.

Without these payments, the stores are barely profitable, if at all ...

This shows just how tough the mall leasing environment currently is.

Friday, June 20, 2008

MBIA: $2.9 Billion Required for Contract Terminations

by Calculated Risk on 6/20/2008 05:30:00 PM

UPDATE: from Yves Smith at Naked Capitalism: MBIA Downgrade Increases Collateral Requirements; Clarification on CDS Acceleration in Insolvency/Custodianship

MBIA Comments on the Impact of the Moody's Downgrade

As a result of the downgrade to A2, MBIA expects that it will require $2.9 billion to satisfy potential termination payments under Guaranteed Investment Contracts (GICs). In addition, MBIA expects to be required to post approximately $4.5 billion in eligible collateral to satisfy potential collateral posting requirements under GIC's as a result of the downgrade. MBIA Inc. has total assets of $25 billion related to its ALM business, of which $15.2 billion is available to satisfy these requirements including approximately $4.0 billion in cash and liquid short-term investments; $1.0 billion of unpledged eligible collateral on hand; and approximately $10.2 billion of other unpledged diversified securities with an average rating of Double-A. In addition, MBIA Inc. also has available another $1.4 billion in cash, including the proceeds of its recent equity offering.

S&P Research Downgrades BofA

by Calculated Risk on 6/20/2008 02:17:00 PM

From MarketWatch: S&P cuts Bank of America to sell from hold

"We take unfavorable note of the large Countrywide option-adjustable rate mortgage portfolio that Bank of America will inherit, since we believe this portfolio has yet to be stress tested," S&P said in its action.Not stress tested ... yet. The losses are coming for these Option ARM (and HELOC) portfolios.

More on Bear Stearns Indictment

by Calculated Risk on 6/20/2008 01:16:00 PM

Bloomberg has an overview: Bear Stearns Fund Prosecutors Reveal `Lot of Evidence' of Fraud

As I noted yesterday, the indictment contains several allegations that the managers knew specific material information about the condition of the funds, and then provided false information to investors. Bloomberg noted the same example I gave yesterday:

``It's very hard to say you weren't shading the truth in an important way when you say you had a couple of million dollars of redemptions when in fact you had $47 million,'' [Christopher Clark, a former federal prosecutor in New York] said.If the prosecutors can prove the managers knew certain material facts on a certain date, and then prove the managers told investors materially different facts on a subsequent date - IMO that is powerful evidence of securities fraud.

The WSJ has the indictment here. I think the actual indictment is much stronger than the flimsy evidence provided in the advance news stories.

Ford Warns on Sales

by Calculated Risk on 6/20/2008 11:04:00 AM

From MarketWatch: Ford delays new F-150 pickup, cuts truck production

[Ford] pared its 2008 U.S. industry sales forecast to a range of 14.7 million to 15.2 million cars and trucks, down from its previous projection of 15 million to 15.4 million vehicles. Ford cut its third-quarter production plans to 475,000 vehicles, 50,000 units lower than prior targets ...Apparently June auto sales are looking really weak according to this article in the Detriot Free Press:

[I]n November ... executives were assuming Americans would buy ... only about 15.5 million [vehicles in 2008]. ... [S]o far in June ... J.D. Power and Associates and Citigroup are seeing a sales pace that is almost 20% lower -- only 12.5 million vehicles per year.

Chris Thornberg: Possible 50% House Price Declines in SoCal

by Calculated Risk on 6/20/2008 10:24:00 AM

From Jon Lansner at the O.C. Register: SoCal home woes could mean 50% price drop

[Economist Chris] Thornberg, founding partner at Beacon Economics and former UCLA economics professor, said home prices would have to fall about 40% from peak to trough to return to the historical norm. But add in the impact of rising gasoline prices, the subprime mortgage meltdown and rising foreclosures, and it’s likely prices will fall 50% peak to trough.I think Dr. Thornberg is optimistic on the timing (he sees the price bottom in mid-to-late 2009). This might be true for low end areas, but I expect prices in the mid-to-higher end areas to be a little more sticky - so the price declines might take a few more years.

The S&P/Case-Shiller index shows that prices for the L.A./O.C. area are down 24% from the peak, so the region is about halfway to the bottom, Thornberg said.

In Orange County, price declines will be more severe at the bottom of the price spectrum than the top end, but “the top end is going to get hit, (too),” he said.

That will be a rude awakening for many homeowners suffering from what he called “homallucinations,” or the ability to convince oneself that while the price of everyone else’s home will fall, your neighborhood is clearly different.

BofA and Countrywide: July 1st Target Date

by Calculated Risk on 6/20/2008 09:16:00 AM

From the LA Times: The final days: BofA may swallow Countrywide by July 1

A Bank of America Corp. spokesman in Charlotte confirmed today that the company could complete its takeover of the loss-ridden mortgage giant by July 1.This is one of those deals that seemed destined to be renegotiated - and that never happened.

Countrywide shareholders are to meet on Wednesday at the firm’s Calabasas headquarters to vote on the deal. (Not that they have any real choice.)

Once it gets that approval, BofA could complete its stock swap by July 1.

...

Under terms of the deal, announced in January, BofA will exchange 0.1822 of its shares for each Countrywide share. When the takeover was announced on Jan. 11, BofA shares were at $38.50. That put a value of $7.01 a share on Countrywide.

Today, BofA’s stock fell 23 cents to $28.14, its lowest since 2001. That values Country- wide at $5.13 a share ...

Thursday, June 19, 2008

Night Music: Wall Street Meltdown

by Calculated Risk on 6/19/2008 10:35:00 PM

Wall Street Meltdown:

Inspired by the Richter Scales classic ("Here Comes Another Bubble):

Monthly GDP

by Calculated Risk on 6/19/2008 08:10:00 PM

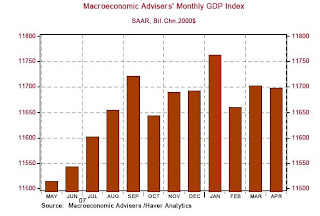

Here is a chart of monthly GDP from Northern Trust: Click on graph for larger image in new window.

Click on graph for larger image in new window.

Even though the average GDP in Q1 2008 was slightly higher than Q4 2007, on a monthly basis it appears GDP peaked in January - and for six of the last seven months (except January), GDP was lower than Sept '07.

Other measures of an economic recession, such as employment and industrial production, suggest the recession started in December '07 or January '08.

The question now is how long and deep the economic slump will be.

Moody's Downgrades MBIA and Ambac

by Calculated Risk on 6/19/2008 06:11:00 PM

Headlines and short story only now from MarketWatch:

Moody's downgrades MBIA to 'A2' from 'Aaa'Here come some more write downs for the banks associated with counterparties being downgraded.

Moody's downgrades Ambac to 'Aa3' from 'Aaa'

Recession: A "Wild Card" for Housing

by Calculated Risk on 6/19/2008 03:24:00 PM

From John Spence at MarketWatch: Builder execs nervous about jobs and the economy

Home-builder executives said at an industry conference Thursday that they're making progress clearing out excess inventory, but warned that a recession and spiking unemployment could stop that advance in its tracks.Yes, the homebuilders are finally building fewer homes than they are selling - so new home inventory is declining. But the huge overhang of existing homes on the market - especially distressed inventory - will keep housing under pressure for some time.

"No one who's unemployed ever bought a house," said Lawrence Angelilli, senior vice president of finance at Centex Corp. "That's the wild card that everybody is waiting to see is if we get a true economic recession."

Also, I think a few unemployed people did buy homes during the boom. NINJA loans were one of the big jokes: No Income, No Job, No Assets.

DOT: Americans Drove Fewer Highway Miles in April

by Calculated Risk on 6/19/2008 12:50:00 PM

From the Department of Transportation: Americans Drove 1.4 Billion Fewer Highway Miles in April of 2008 than in April 2007 While Fuel Prices and Transit Ridership Are Both on the Rise

[U.S. Transportation Secretary Mary E. Peters] said that Americans drove 1.4 billion fewer highway miles in April 2008 than at the same time a year earlier and 400 million miles less than in March of this year. She added that vehicle miles traveled (VMT) on all public roads for April 2008 fell 1.8 percent as compared with April 2007 travel. This marks a decline of nearly 20 billion miles traveled this year, and nearly 30 billion miles traveled since November.This is the fewest miles driven in April since 2003.

Bear Stearns Indictment

by Calculated Risk on 6/19/2008 12:25:00 PM

The WSJ has the indictment here.

According to the indictment, the managers knew material information about the condition of the funds, and then provided false information to other investors. As an example, the indictment alleges the managers knew of a major investor withdrawing their entire investment, but in answering direct questions about redemptions, falsely stated that fund redemptions would be minor.

Citigroup Expects Substantial Additional CDO Write Downs

by Calculated Risk on 6/19/2008 11:57:00 AM

Here are few headlines from the Citi conference call.

Impact of CDOs in quarter will be "substantial"

CDO Marks will not be as big as last quarter.

Consumer Credit remains a challenge.

Story to follow ...

Philly Fed: Manufacturing "Continued weakening", "Cost pressures widespread"

by Calculated Risk on 6/19/2008 11:35:00 AM

Here is the Philadelphia Fed Index for June activity released today: Business Outlook Survey.

Note the special question at the bottom on prices. The average expected price change this year is 5.4%!  Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the Philly index vs. recessions for the last 40 years. There are a number of times the index was below zero without a recession - so the reading today doesn't mean the economy is in recession. However it is very likely that the economy is already in recession.

From the release, weaker conditions and higher prices :

Indicators Reflect Continued Weakening

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, decreased slightly, from -15.6 in May to -17.1 this month. The index has now been negative for seven consecutive months.

More Manufacturers Report Higher Input Prices

A larger share of firms — 72 percent, up from 61 percent in May— reported higher input prices this month. The prices paid index jumped 16 points, to 69.3, its highest reading since November 1980. (see chart)

Outlook Is Less Optimistic

Following significant improvement in expectations over the last two months, the future general activity index retreated in June, falling from a May reading of 28.2 to 21.3. Forty percent of the firms expect growth in activity over the next six months; 18 percent expect a decline.

1. What impact are these recent cost increases having, or expected to have, on the prices of your finished products over the next three months? | |||

| We expect price decreases | 14.6% | ||

| We expect steady prices | 20.2% | ||

| We expect price increases | 65.2% | ||

| Less than 2.5% | 4.5% | ||

| Between 2.5-5% | 28.1% | ||

| Between 5-7.5% | 13.5% | ||

| Between 7.5-10% | 11.2% | ||

| Between 10-15% | 3.3% | ||

| Greater than 15% | 2.3% | ||

| No response | 2.3% | ||

| Total | 100.0% | ||

| Average expected price change | 5.4% | ||

| Average reported price increase* since the beginning of the year: | 3.8% | ||

*Firms were asked what increases in prices have already occurred since January.

| |||

China to raise gasoline, diesel prices

by Calculated Risk on 6/19/2008 10:18:00 AM

From Reuters: China to raise gasoline, diesel prices

China, the world's second largest oil consumer, will increase retail gasoline and diesel prices by 1,000 yuan ($145.50) per tonne from Friday, according to industry sources.See the analyst comments in the story.

Meanwhile, the Shanghai cliff diving continues with the SSE Composite Index off 6.5% last night.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This is a spectacular sell off.

I suspect this stock sell off could be in anticipation of a slowing Chinese economy, and a combination of a Chinese slowdown and lower oil and gasoline subsidies could lead to lower world oil prices later this year.

It's Not A Real RE Bust . . .

by Anonymous on 6/19/2008 09:40:00 AM

. . . until a mortgage insurer goes down.

It's official:

WINSTON-SALEM, N.C., June 19, 2008 /PRNewswire-FirstCall via COMTEX/ -- Triad Guaranty Inc. announced today that it has ended its negotiations with Lightyear Capital LLC to form a new mortgage insurance company. Triad also reported today that Freddie Mac informed Triad that the appeal of its subsidiary's suspension as an approved mortgage insurer has been denied. As a result of these developments, Triad's subsidiary, Triad Guaranty Insurance Corporation, will cease issuing commitments for mortgage insurance effective July 15, 2008 and will work with its customers, the Illinois Division of Insurance and each of the GSEs to assure an orderly transition of its business to run-off.

Bear Stearns Managers Arrested

by Calculated Risk on 6/19/2008 09:21:00 AM

From NPR: Bear Stearns Hedge Fund Managers Arrested

And on the indictment from the WSJ: Prosecutors in Bear Case Focus In on Email

Fund manager Matthew Tannin emailed his more senior colleague Ralph Cioffi that he feared the market for complex bond securities in which they had invested was "toast." He suggested they discuss the possibility of shutting down the funds, according to the email, which was sent from Mr. Tannin's private account.This seems a little flimsy for a criminal charge - people do change their minds - and hopefully the indictment will be publicly released today with more details.

...

Four days after the Sunday-morning email, Mr. Tannin told fund investors on a conference call that he was "quite comfortable" with their holdings. Mr. Cioffi used similar language.

Weekly Unemployment Claims

by Calculated Risk on 6/19/2008 09:02:00 AM

Here is another look at unemployment claims. According to the Department of Labor for the week ending June 14, initial unemployment claims were at 381,000, and the 4-week moving average was 375,250. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the continued claims since 1989.

Continued claims declined this week, but have been trending higher and are still above the 3 million level.

Notice that following the previous two recessions, continued claims stayed elevated for a couple of years after the official recession ended - suggesting the weakness in the labor market lingered. The same will probably be true for the current recession (probable). The second graph shows the weekly claims and the four week moving average of weekly unemployment claims since 1989. The four week moving average has been trending upwards for the last few months, and the level is now solidly above the possible recession level (approximately 350K).

The second graph shows the weekly claims and the four week moving average of weekly unemployment claims since 1989. The four week moving average has been trending upwards for the last few months, and the level is now solidly above the possible recession level (approximately 350K).