by Anonymous on 5/30/2008 07:18:00 AM

Friday, May 30, 2008

Bloomberg's Weird Numbers

Forgive me for once again falling into despair over the media's inability to report sensibly and critically on foreclosure and delinquency numbers. I should be immune by now. If you are wiser than I, just skip to the next post. If you still cradle to your wounded heart the battered but indomitable belief that even media outlets like Bloomberg can learn to spot the flaws in a reported statistic, and that there is a point to doing this, click the link below.

***********

The headline: "New Overdue Home Loans Swamp Effort to Fix Mortgages in Default." We will take this as a promise that the article is going to demonstrate something about the relationship between newly delinquent loans and workout efforts.

The lede: May 30 (Bloomberg) -- Newly delinquent mortgage borrowers outnumbered people who caught up on their overdue payments by two to one last month, a sign that nationwide efforts to help homeowners avoid default may be failing.

The last of eighteen paragraphs:

In April, 73,880 homeowners with privately insured mortgages fell more than 60 days late on payments, compared with 39,584 who got back on track, a report today from the Washington-based Mortgage Insurance Companies of America said.Last month's 54 percent "cure ratio" among defaulted mortgages compares with 80 percent a year earlier and 87 percent in March. The comparison may not be valid because one lender changed the way it calculated defaults and cures reported to the insurers.

So we start with an eye-popping number, and then only at the very end do we note that this number may mean much less than meets the eye. This is, in fact, what MICA said in its data release:WASHINGTON, D.C. May 30, 2008 – Mortgage Insurance Companies of America (MICA) today released its monthly statistical report for April which includes a one-time adjustment to the number of defaults and cures and also notes an 11.7% increase in new insurance written year-over-year.

I assumed when I read this that somebody--a large somebody, since it significantly impacts the data--switched over from the OTS method to the MBA method of delinquency reporting. I do not know if this is the case or not. Before I published this article, however, I might have called MICA for a comment. In any case I might have been more cautious with headlining a number that is described as a "one-time adjustment" to the data collection. Burying that in the last paragraph is . . . disingenuous.

As a result of a major lender’s change to its methodology for recording delinquencies, and to how it reports them to MICA’s members, there was a sharp increase, to 73,880, in reported defaults in April. The increase includes both newly reported defaults for the month, as well as previously unreported defaults by this lender.

MICA’s members reported 39,584 cures in April. This statistic also reflects the above noted change in reporting defaults.

I'm also a touch troubled by the statement that "Last month's 54 percent 'cure ratio' among defaulted mortgages compares with 80 percent a year earlier and 87 percent in March." That is literally true. However, the cure rate in December of 2007 was 54.1% and in January of 2008 was 51.4%. Could there be some seasonality in these numbers? Another confounding factor besides new delinquencies?

So what about the second half of the claim?"Modifications are not occurring nearly at the numbers necessary to stem the foreclosure crisis," Allen Fishbein, housing director for the Consumer Federation of America in Washington, said in a May 19 interview. "People are still going into foreclosure when, with a writedown on existing principal, they could still stay in their homes."

Did you assume, when you read that second paragraph, that the 114,000 modifications were exclusive of (not the same loans as) the 346,000 foreclosure starts? It seems you were supposed to assume that. But is is true? "Foreclosure start" simply means that a legally-required preliminary filing (a Notice of Default, Notice of Intent, or Lis Pendens, depending on the state and the type (judicial or non-judicial) of foreclosure) has been made. That is a "start" because in most jurisdictions it will be another 90 to 180 days, or even more in some states, until the auction can be scheduled, the home sold, and the foreclosure "completed." My own view is that the "best practice" is to work hard to negotiate a modification, if possible, in the early days of delinquency before starting the foreclosure process. However, that is not always possible, and it is also "best practice" to continue to attempt reasonable workouts during the foreclosure process all the way up the day before sale, if necessary. There are certainly cases in which a borrower simply cannot be brought to talk to the servicer until the initial FC filing galvanizes him into it. All of this means that it is impossible to look simply at modifications completed in a period compared to foreclosures started in a period and conclude that the starts will never get a mod or that the mods were not effected after the FC start.

In the first two months of 2008, lenders modified loans for 114,000 borrowers while starting 346,000 foreclosures, according to a study by the Durham, North Carolina-based Center for Responsible Lending. In April, 22 percent of the homes in the foreclosure process had been taken over by lending banks; a year earlier, that figure was 15 percent, according to Irvine, California-based data provider RealtyTrac.

Besides that, where is the data to back up the idea that a 30% ratio of modifications to foreclosure starts is poor performance? I am personally not sure that much more than 30% of recent vintage loans can be saved. Back out fraud, flippers and speculators, and borrowers whose loan balances would have to be reduced by half in order to get a workable payment--which would most likely exceed the cost to the investor of a foreclosure--and 30% doesn't sound so shabby.

As far as the second claim--the increase from 15% to 22% of homes in foreclosure "taken over by lending banks," I'm prepared to read that literally. There is no jurisdiction in which a foreclosed home must be purchased by the lender at the foreclosure sale; all jurisdictions require public auctions in which third parties can bid. An increase in REO (lenders "winning" the auction) does not necessarily mean an increase in completed foreclosures; it can mean that fewer third parties care to bid on foreclosed homes. All the data I have seen recently suggests that this is the case: buyers are still wary of further price declines, and lenders are still bidding higher than potential RE investors. One therefore expects the FC-to-REO numbers to increase. But they can do that even in the absence of an increase in total foreclosures. In order for this statistic to mean much, we have to know how much of the increase is due to more foreclosures, and how much due to fewer third-party bidders.

So put these dubious statistics together--the rest of the Bloomberg article is basically filler--and you get anomalous data on new delinquencies, ambiguous data on modification-to-foreclosure-starts, and a claim about REO rates substituting for a claim about foreclosure completion rates. How about taking back that headline, Bloomberg?

You know, last year I might have had some more sympathy for these reporters. We were just newly into the whole problem and a lot of concepts--delinquency reporting methodology, foreclosure processes, various ways of reporting "cures" and "starts"--were all new to everybody except industry insiders and a handful of totally Nerdly blog readers. But surely by now we can have moved the ball forward a couple of yards? I am here to affirm that if you have been reporting on "the foreclosure crisis" for a year or more and you still can't ask basic questions about the press releases you read, you aren't doing your job.

Thursday, May 29, 2008

Reader Survey

by Calculated Risk on 5/29/2008 06:30:00 PM

In an effort to attract better advertising, we've been asked to survey our readers. If you'd like to participate - thank you - it's short, anonymous, and hopefully painless.

Reader Survey

Thanks to all,

CR and Tanta

All: I'll probably bump this a couple of times - in the morning and on the weekend. Also, I'll post a link to the results this weekend.

Fed Letter: Crude Awakening: Behind the Surge in Oil Prices

by Calculated Risk on 5/29/2008 05:24:00 PM

Here is an economic letter from Stephen P. A. Brown, Raghav Virmani and Richard Alm at the Dallas Fed: Crude Awakening: Behind the Surge in Oil Prices

A good starting point is strong demand, which has pushed world oil markets close to capacity. New supplies haven’t kept up with this demand, fueling expectations that oil markets will remain tight for the foreseeable future. A weakening dollar has put upward pressure on the price of a commodity that trades in the U.S. currency. And because a large share of oil production takes place in politically unstable regions, fears of supply disruptions loom over markets.See the charts in the economic letter on each of these points. And their conclusion:

These factors have fed the steady, sometimes swift rise of oil prices in recent years. Their persistence suggests the days of relatively cheap oil are over and the global economy faces a future of high energy prices.

At first blush, crude oil demand doesn’t offer much hope for lower prices. It is likely to grow with an expanding world economy. Higher oil prices will prompt some conservation and take some of the edge off prices—but not much.After reading the letter, their conclusion was a bit of a surprise!

...

Geopolitics and exchange rates aside, long-term oil prices will largely be set by supply and demand, which will affect prices directly and influence the expectations that shape futures markets. The key lies in how much new oil reaches markets. Four scenarios for conventional oil resources show a range of outcomes and impacts for the trajectory of prices:... International Strategy and Investment, an energy consulting business, has documented a substantial number of projects under way that would boost world oil supplies. The development of these resources could undermine the expectations underlying the higher oil price scenarios—even those of oil nationalism.Oil production reaches a plateau or peak—prices likely to rise further. Oil nationalism continues to slow the development of new resources—prices likely to remain relatively high. In a shift of strategy, OPEC increases its output sharply—prices likely to fall. Aggressive exploration activities pay off with the quick development of significant new resources—prices likely to fall.

Supplies could be bolstered by nonconventional oil sources—tar sands, oil shale, coal-to-liquids. ... The substantial development of these nonconventional oil resources could mean downward pressure on crude oil prices in future years....

What’s the bottom line? Absent supply disruptions, it will be difficult to sustain oil prices above $100 (in 2008 dollars) over the next 10 years.

The Economist: Chart on Historical Changes in House Prices

by Calculated Risk on 5/29/2008 04:07:00 PM

From the Economist.com: House Prices: Through the Floor (hat tip Ryan)

Earlier this week, the S&P Case-Shiller National Home Price index was released showing a 14.1% decline over the last four quarters. The Economist has a chart (from Professor Shiller) putting this decline into historical perspective by showing the YoY change in U.S. house prices since 1920. The Economist notes:

Now Robert Shiller, an economist at Yale University and co-inventor of the index, has compiled a version that stretches back over a century. This shows that the latest fall in nominal prices is already much bigger than the 10.5% drop in 1932, the worst point of the Depression.During the Depression, the rapid decline in house prices was primarily due to the extremely weak economy and high unemployment. This time prices are falling rapidly because of the excesses of the housing bubble - especially excessive speculation and loose lending standards.

This doesn't mean the economy will fall into a depression (very unlikely in my view); instead the current rapid price decline shows how ridiculous house prices and lending standards were during the bubble.

CIBC: $2.48 Billion in Write Downs

by Calculated Risk on 5/29/2008 01:45:00 PM

From The Canadian Press: CIBC loses $1.11 billion in quarter on massive credit-market hit

Canadian Imperial Bank of Commerce (TSX:CM) posted a net loss of $1.11 billion in the second quarter as it booked a massive hit tied to the credit market.Just a couple billion (and change) more ...

...

The results in the second quarter of the bank's financial year included a loss of $2.48 billion, or $1.67 billion after tax, on writedowns of structured credit, added to $3.46 billion in first-quarter writedowns.

...

The CIBC World Markets investment banking division ... warned that "market and economic conditions relating to the financial guarantors may change in the future, which could result in significant future losses."

...

The bank said it expects Canadian economic growth "to remain very sluggish in the coming quarter, held back by weak exports as the U.S. appears to be entering a mild recession."

FDIC: Banks hit by Troubled Real Estate Loans

by Calculated Risk on 5/29/2008 11:20:00 AM

"This is a worrisome trend. It's the kind of thing that gives regulators heartburn."From the FDIC: Insured Banks and Thrifts Earned $19.3 Billion in the First Quarter

FDIC Chairman Sheila C. Bair, May 29, 2008 on the eroding coverage ratio.

Commercial banks and savings institutions insured by the Federal Deposit Insurance Corporation (FDIC) reported net income of $19.3 billion in the first quarter of 2008, a decline of $16.3 billion (45.7 percent) from the $35.6 billion that the industry earned in the first quarter of 2007.

...

Noncurrent loans are still rising sharply. Loans that were noncurrent (90 days or more past due or in nonaccrual status) increased by $26 billion (or 24 percent) to $136 billion during the first quarter. That followed a $27 billion increase in the fourth quarter of 2007. Almost 90 percent of the increase in noncurrent loans in the first quarter consisted of real estate loans, but noncurrent levels increased in all major loan categories. At the end of the first quarter, 1.7 percent of the industry's loans and leases were noncurrent.

Earnings remain burdened by high provisions for loan losses. Rising levels of troubled loans, particularly in real estate portfolios, led many institutions to increase their provisions for loan losses in the quarter. Loss provisions totaled $37.1 billion, more than four times the $9.2 billion the industry set aside in the first quarter of 2007. Almost a quarter of the industry's net operating revenue (net interest income plus total noninterest income) went to building up loan-loss reserves.

Click on graph for larger image.

Click on graph for larger image.The industry's "coverage" ratio -- its loss reserves as a percentage of nonperforming loans -- continued to erode. Loan-loss reserves increased by $18.5 billion (18.1 percent), the largest quarterly increase in more than 20 years, but the larger increase in noncurrent loans meant that the coverage ratio fell from 93 cents in reserves for every $1.00 of noncurrent loans to 89 cents, the lowest level since 1993. "This is a worrisome trend," [FDIC Chairman Sheila C. Bair] said. "It's the kind of thing that gives regulators heartburn."Here is the quarterly report.

She added, "The banks and thrifts we're keeping an eye on most are those with high levels of exposure to subprime and nontraditional mortgages, with concentrations of construction loans in overbuilt markets, and institutions that get a large share of their revenues from market-related activities, such as from securities trading."

Continued Unemployment Claims Continue to Rise

by Calculated Risk on 5/29/2008 10:08:00 AM

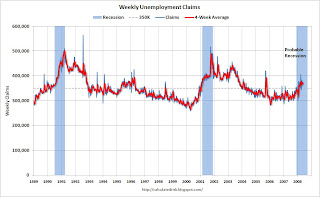

Earlier this month, continued unemployment claims exceeded 3 million for the first time in four years. Now the continued claims have passed 3.1 million (see first graph).

Here is the data from the Department of Labor for the week ending May 24th. Click on graph for larger image.

Click on graph for larger image.

The first graph shows the continued claims since 1989.

Clearly people losing their jobs are having difficulty finding new jobs.

Notice that following the previous two recessions, continued claims stayed elevated for a couple of years after the official recession ended - suggesting the weakness in the labor market lingered. The same will probably be true for the current recession (probable). The second graph shows the weekly claims and the four week moving average of weekly unemployment claims since 1989. The four week moving average has been trending upwards for the last few months, and the level is now solidly above the possible recession level (approximately 350K).

The second graph shows the weekly claims and the four week moving average of weekly unemployment claims since 1989. The four week moving average has been trending upwards for the last few months, and the level is now solidly above the possible recession level (approximately 350K).

Labor related gauges are at best coincident indicators, and this indicator suggests the economy is in recession.

BK Judge Rules Stated Income HELOC Debt Dischargeable

by Anonymous on 5/29/2008 07:10:00 AM

This is a big deal, and will no doubt strike real fear in the hearts of stated-income lenders everywhere. Our own Uncle Festus sent me this decision, in which Judge Leslie Tchaikovsky ruled that a National City HELOC that had been "foreclosed out" would be discharged in the debtors' Chapter 7 bankruptcy. Nat City had argued that the debt should be non-dischargeable because the debtors made material false representations (namely, lying about their income) on which Nat City relied when it made the loan. The court agreed that the debtors had in fact lied to the bank, but it held that the bank did not "reasonably rely" on the misrepresentations.

I argued some time ago that the whole point of stated income lending was to make the borrower the fall guy: the lender can make a dumb loan--knowing perfectly well that it is doing so--while shifting responsibility onto the borrower, who is the one "stating" the income and--in theory, at least--therefore liable for the misrepresentation. This is precisely where Judge Tchaikovsky has stepped in and said "no dice." This is not one of those cases where the broker or lender seems to have done the lying without the borrower's knowledge; these are not sympathetic victims of predatory lending. In fact, the very egregiousness of the borrowers' misrepresentations and chronic debt-binging behavior is what seems to have sent the Judge over the edge here, leading her to ask the profoundly important question of how a bank like National City could have "reasonably relied" on these borrowers' unverified statements of income to make this loan.

And as I argued the other day on the subject of due diligence, it isn't so much that individual loans are fraudulent than that the published guidelines by which the loans were made and evaluated encouraged fraudulent behavior, or at least made it "fast and easy" for fraud to occur. Judge Tchaikovsky directly addresses the issue of the bank's reliance on "guidelines" that should, in essence, never have been relied upon in the first place.

*************

Here follow some lengthy quotes from the decision, which was docketed yesterday and is not, as far as I know, yet published. From In re Hill (City National Bank v. Hill), United States Bankruptcy Court, Northern District of California, Case No. A.P. 07-4106 (May 28, 2008):This adversary proceeding is a poster child for some of the practices that have led to the current crisis in our housing market.

Indeed. The debtors, the Hills, bought their home in El Sobrante, California, twenty years ago for $220,000. After at least five refinances, their total debt on the home at the time they filed for Chapter 7 in April of 2007 was $683,000. Mr. Hill worked for an automobile parts wholesaler; Mrs. Hill had a business distributing free periodicals. According to the court, their combined annual income never exceeded $65,000.

In April 2006, the Hills refinanced their existing $100,000 second lien through a mortgage broker with National City. Their new loan was an equity line of $200,000; after paying off the old lien and other consumer debt, the Hills received $60,000 in cash. On this application the Hills stated their annual income as $145,716. The property appraised for $785,000.

By October 2006 the Hills were short of money again, and applied directly to National City to have their HELOC limit increased to $250,000 to obtain an additional $50,000 in cash. On this application, six months later, the Hills' annual income was stated as $190,800, and the appraised value was $856,000.

At the foreclosure sale in April 2007, the first lien lender bought the house at auction for $450,000, apparently the amount of its first lien.

The Hills claimed that they did not misrepresent their income on the April loan, and that they had signed the application without reading it. The broker testified rather convincingly that the Hills had indeed read the documents before signing them--Mrs. Hill noticed an error on one document and initialed a correction to it. No doubt because the October loan, the request for increase of an existing HELOC, did not go through a broker, the Hills admitted to having misrepresented their income on that application. The Court found that:Moreover, the Hills, while not highly educated, were not unsophisticated. They had obtained numerous home and car loans and were familiar with the loan application process. They knew they were responsible for supplying accurate information to a lender concerning their financial condition when obtaining a loan. Even if the Court were persuaded that they had signed and submitted the October Loan Application without verifying its accuracy, their reckless disregard would have been sufficient to satisfy the third and fourth elements of the Bank’s claim.

This is not an excessively soft-hearted judge who fell for some self-serving sob story from the debtors. "Reckless disregard" is rather strong language.

Unfortunately for National City, Her Honor was just as unsympathetic to its claims:However, the Bank’s suit fails due to its failure to prove the sixth element of its claim: i.e., the reasonableness of its reliance.6 As stated above, the reasonableness of a creditor’s reliance is judged by an objective standard. In general, a lender’s reliance is reasonable if it followed its normal business practices. However, this may not be enough if those practices deviate from industry standards or if the creditor ignored a “red flag.” See Cohn, 54 F.3d at 1117. Here, it is highly questionable whether the industry standards–-as those standards are reflected by the Guidelines–-were objectively reasonable. However, even if they were, the Bank clearly deviated to some extent from those standards. In addition, the Bank ignored a “red flag” that should have called for more investigation concerning the accuracy of the income figures. . . .

In short, while the Court found that the Hills knowingly made false representations to the lender, the lender's claim that it "reasonably relied" on these representations doesn't hold water, because "stated income guidelines" are not reasonable things to rely on. In essence, the Court found, such lending guidelines boil down to what the regulators call "collateral dependent" loans, where the lender is relying on nothing, at the end of the day, except the value of the collateral, not the borrower's ability or willingness to repay. If you make a "liar loan," the Judge is saying here, then you cannot claim you were harmed by relying on lies. And if you rely on an inflated appraisal, that's your lookout, not the borrower's.

Based on the foregoing, the Court concludes that either the Bank did not rely on the Debtors representations concerning their income or that its reliance was not reasonable based on an objective standard. In fact, the minimal verification required by an “income stated” loan, as established by the Guidelines, suggests that this type of loan is essentially an “asset based” loan. In other words, the Court surmises that the Bank made the loan principally in reliance on the value of the collateral: i.e., the House. If so, the Bank obtained the appraisal upon which it principally relied in making the loan. Subsequent events strongly suggest that the appraisal was inflated. However, under these circumstances, the Debtors cannot be blamed for the Bank’s loss, and the Bank’s claim should be discharged.

This is going to give a lot of stated income lenders--and investors in "stated income" securities--a really bad rotten no good day. As it should. They have managed to give the rest of us a really bad rotten no good couple of years, with no end in sight.

Wednesday, May 28, 2008

Housing Wire: S&P Confidence in Alt-A overcollateralization waning

by Calculated Risk on 5/28/2008 11:50:00 PM

Housing Wire has more on the S&P Alt-A downgrades: S&P Lowers the Boom on 1,326 Alt-A RMBS Classes

The downgrades affect an $33.95 billion in issuance value and affect Alt-A loan pools securitized in the first half of 2007 — roughly 14 percent of S&P’s entire Alt-A universe in that timeframe.

Perhaps more telling were an additional 567 other Alt-A classes put on negative credit watch by the ratings agency.

A review of affected securities by Housing Wire found that all of the classes put on watch for a pending downgrade are currently rated AAA, suggesting that S&P’s confidence in thin overcollateralization typical of most Alt-A deals is quickly waning. The total dollar of potential downgrades to the AAA classes in question would dwarf Wednesday’s downgrades, which affected only mezzanine and equity tranches.

Spam: The Ultimate Inferior Good?

by Calculated Risk on 5/28/2008 07:52:00 PM

From AP: Sales of Spam rise as consumers trim food costs

And from Monty Python: Spam

S&P Downgrades $34 Billion Alt-A Bonds

by Calculated Risk on 5/28/2008 04:54:00 PM

From Bloomberg: S&P Downgrades $34 Billion of Bonds Backed by Alt-A Mortgages (hat tip ken and SC)

Standard & Poor's lowered its ratings on $34 billion of securities backed by Alternative-A mortgages, the firm's largest downgrade for the type of debt ...

Ratings on 1,326 classes of the bonds created in the first half of 2007 were downgraded, or 14 percent of the total ...

CRE: Orange County Non-Residential Permits Value off 40%

by Calculated Risk on 5/28/2008 04:35:00 PM

From Jon Lansner at the O.C. Register: O.C.’s commercial construction down in ‘08

The Construction Industry Research Board reports ... that the estimated value of permits for non-residential construction fell nearly 40% this year so far from the same period in 2007. Permit values fell to just under $527 million so far this year. Last year, developers received permits for projects valued at $873 million from January through April.Just more evidence of the CRE bust.

Regional Bank Problems: KeyCorp

by Calculated Risk on 5/28/2008 01:04:00 PM

From Bloomberg: KeyCorp Slide Foretells Losses at `Delusional' Banks

KeyCorp ... doubl[ed] its forecast for loans that won't be repaid, prompting concern that regional banks have underestimated the cost of bad mortgages.And they are also having problem with home improvement loans. Here is the KeyCorp release from the 8-K SEC filing:

KeyCorp [said] debts may be as much as 1.3 percent of average total loans this year. The figure may rise even more, KeyCorp said, as the Cleveland-based company cuts holdings tied to homebuilders.

The revision by the Ohio bank, which last month quadrupled its provision for loan losses to $187 million, may foretell similar increases at U.S. commercial banks as home prices keep sliding, analysts said.

KeyCorp (the "Corporation") is updating its previous outlook for net loan charge-offs for 2008. The previous estimated range for net loan charge-offs was .65% to .90% of average loans. The Corporation now anticipates that net loan charge-offs will be in the range of 1.00% to 1.30% for 2008, with second quarter and potentially third quarter net charge-offs running above this range as the Corporation deals aggressively with reducing exposures in the residential homebuilder portfolio and anticipates elevated net loan charge-offs in its education and home improvement loan portfolios. The Corporation announced in the fourth quarter of 2007 that it had: (i) decided to cease conducting business with “out of footprint” nonrelationship homebuilders, (ii) recorded additional reserves to address continued weakness in the housing market, and (iii) decided to exit dealer-originated home improvement lending activities, which involve prime loans but are largely out-of-footprint.

More banks freeze home equity lines

by Calculated Risk on 5/28/2008 11:22:00 AM

From the Cleveland Plain Dealer: Banks freeze home equity lines as home values fall

While the practice started a few months ago in other parts of the country, it's just now hitting Northeast Ohio as banks from Fifth Third to Chase to AmTrust reduce their exposure to over-leveraged consumers. Most banks that haven't yet frozen home equity lines are looking at doing so.We are about to see mounting losses for lenders from HELOCs, and less consumer spending - especially for autos and home improvement - as lenders restrict HELOC borrowing.

...

AmTrust spokeswoman Donna Winfield said the bank's move to freeze equity lines here "was across the board" in areas where property values have declined and among customers who had less equity left.

Broker's Commissions: Riding the Double Bubble

by Calculated Risk on 5/28/2008 10:47:00 AM

First, the NY Times reports on the Realtors antitrust settlement: Realtors Agree to Stop Blocking Web Listings

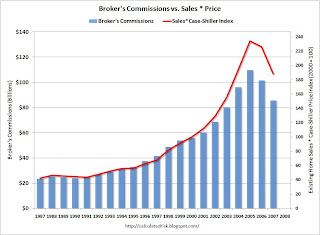

The Justice Department and the National Association of Realtors reached a major antitrust settlement Tuesday that government officials said should spur competition among brokers and ultimately bring down hefty sales commissions.Innovation will probably put pressure on commissions. This gives us an excuse to look at a long term graph of Broker's Commissions:

The deal frees Internet brokers and other real-estate agents offering heavily discounted commissions to operate on a level playing field with traditional brokers by using the multiple listing services that are the lifeblood of the industry, government officials said.

...

Norman Hawker, a business professor at Western Michigan University who ... predicted that the settlement would ultimately mean a drop in sales commissions of 25 percent to 50 percent as a result of increased competition.

Click on graph for larger image.

Click on graph for larger image. This graph shows broker's commissions as a percent of GDP.

Not surprisingly - giving the housing bubble - broker's commissions soared in recent years, rising from $56 billion in 2000, to $109 billion in 2005 (see 2nd graph for commissions in dollars). Commissions have declined to an annual rate of $72 billion in Q1 2008. (All data from the BEA).

Here is a simple formula: Commissions = transactions X price X commission percent.

Broker's commissions increased because of both soaring prices and soaring activity. A double bubble.

Only the percent commission held down total commissions a little. This might surprise some readers, but at the peak of the bubble, many agents were discounting commissions below 6%. Listings were like printing money, and it was common for agents in California (and probably elsewhere) to offer to list a property for 4 1/2% or 5%, with the selling agents receiving 3%, and the listing agent taking less.

The following graph compares broker's commissions with an index created by multiplying sales transactions times the Case-Shiller National Home Price Index:

UPDATE: Reader 'get sum' notes in the comments that per his discussions with the BEA, their estimate of commissions assumes a 6% rate.

Note that broker's commissions didn't completely keep up with the double bubble. Sales times prices actually rose faster than commissions, suggesting: 1) that the percent commission declined somewhat, or 2) that Case-Shiller overstated the price increase in recent years. Or some combination of both (likely).

Note that broker's commissions didn't completely keep up with the double bubble. Sales times prices actually rose faster than commissions, suggesting: 1) that the percent commission declined somewhat, or 2) that Case-Shiller overstated the price increase in recent years. Or some combination of both (likely).Now, with prices falling, transactions falling, and more competition, it is likely that total commissions will fall further over the next few years. Tough times for many real estate agents.

Appraisal Tightening: No More Mailbox Money For You!

by Anonymous on 5/28/2008 08:18:00 AM

As a general rule I do not recommend reading "Realty Times" at 6:00 a.m., but I'm blaming twist.

It's not that people don't want homes, it's that they can't buy them under the stricter lending standards. . . .In 1975, it was not unknown--it was in fact only made illegal that year by the Equal Credit Opportunity Act--to inquire about a married woman's future childbearing plans, her use of contraception, and her religion before deciding whether to "count" any income she might produce for purposes of qualifying for a loan. (If she said "Catholic," forget it.) If you think we are experiencing 1975 mortgage loan underwriting, you were born yesterday.

Lenders are turning the clock back to 1975, requiring larger downpayments and higher credit scores to qualify for low interest rates. That's only prudent, but what they're also doing is tightening appraisals on properties that are being sold or refinanced.

So why is it "prudent" to require larger downpayments and higher credit scores, but another thing entirely to tighten up on appraisals? And how is this nefarious appraisal tightening preventing people from buying homes?

*****************

There must be an anecdote, and we actually get a twofer:

Dallas Realtor Mary O'Keefe was hit with the new lending realities in a double whammy just this week.So the purchase transaction actually did close, although it was--gasp!--"delayed," but this poor lady who wanted to cash out the "equity" in a townhome she was not going to occupy was stymied by some evil bank who--get this--wouldn't use a year-old appraisal. Turn on the disco ball and haul out your lava lamps! It's the seventies!

"I had a closing that was delayed because the lender wanted a second appraisal," says Mary O'Keefe, a Dallas broker. "I told my clients absolutely no way would they pay for a second appraisal."

That deal finally closed, but O'Keefe lost another. A client wanted to take out some equity on her townhome, buy another property to live in, and save the townhome for mailbox money. The client had an 800-plus credit score, was approved by a lender, but went to her personal banker for the HELOC. She had an appraisal from the year before for $467,000 giving her about $155,000 in equity.

Because banks want to use appraisals no less than six months old, the personal banker called for a drive-by appraisal, which came in at $400,000, more than $20,000 below the lowest priced home in the community, and $75,000 below a home that sold a year ago three doors down.

I confess to being somewhat alarmed, by the way, about a Realtor who tells a buyer that "no way" are they going to pay for a second appraisal. You would not, in the current environment, even consider paying another $350-$400 to assure yourself that you are not overpaying for your property by thousands of dollars?

The real problem here is that Realty Times wants to continue to perpetrate the view that establishing reliable appraised values is not in a homebuyer's best interest as well as a lender's. For some reason this reminded me of a story we posted just a year ago, in which the Wall Street Journal waxed outraged about some poor rich doctor who was having trouble getting his loan approved to buy a property for $1.05 million when the lender had gotten a broker price opinion stating that it was only worth $750,000. I did a bit of looking in the county real estate records, and it appears that our man did indeed buy the home on April 17, 2007 for $1.05 million. On April 27, 2007, the county assessed the property for tax purposes at $793,400. Per the WSJ he borrowed $885,000. I wonder if he still feels ripped off by the lender who told him he was overpaying for that home.

Tuesday, May 27, 2008

Rent vs. Buy: NY Times Leonhardt Buys

by Calculated Risk on 5/27/2008 10:44:00 PM

From David Leonhardt at the NY Times: As Home Prices Drop Low Enough, a Committed Renter Decides to Buy

The case for renting has been simple enough. House prices rose so high in the first half of this decade that you could often get more for your money by renting. You could also avoid having a large part of your net worth tied up in a speculative bubble.Leonhardt isn't buying for appreciation, and he realizes the price will probably still decline further. He is buying because prices have fallen enough that the intangibles of homeownership (as he and his wife value them) outweigh the extra costs of owning a home compared to renting.

All this time, I have been a renter myself, ... [but] the housing market has, obviously, changed quite a bit since our last move, in 2005.

...

This month, we found a house that we really liked, and we made an offer. It was accepted.

I’m still not sure how good our timing was. Based on the backlog of houses on the market, I fully expect that our new house will be worth less in six months than it is today. ...

In fact, if you’re now renting — almost anywhere — and do not need to move, I’d probably recommend that you wait to buy. The market is still coming your way.

But it’s O.K. with me if our timing wasn’t perfect.

The article also has an interactive rent vs. buy tool with a number of options.

The Bagholder Battles: Investors vs. Banks

by Calculated Risk on 5/27/2008 08:25:00 PM

From Ruth Simon at the WSJ: Investors Press Lenders on Bad Loans

Unhappy buyers of subprime mortgages, home-equity loans and other real-estate loans are trying to force banks and mortgage companies to repurchase a growing pile of troubled loans. The pressure is the result of provisions in many loan sales that require lenders to take back loans that default unusually fast or contained mistakes or fraud.Tanta and I were discussing who the eventual bagholders would be way back in 2005 - while the bubble was still inflating - and although the picture is much clearer today, some bagholders still don't want to be, uh, bagholders! And who could blame them?

...

The potential liability from the growing number of disputed loans could reach billions of dollars ...

NPR on Mortgage Quality Control

by Anonymous on 5/27/2008 04:49:00 PM

This is a sobering, if rather overstated, segment on mortgage loan sale due diligence and the pressures to accept even the most dubious of loans.

Tracy Warren is not surprised by the foreclosure crisis. She saw the roots of it firsthand every day. She worked for a quality control contractor that reviewed subprime loans for investment banks before they were sold off on Wall Street. . . .I have no particular reason to question Ms. Warren's abilities or her take on the situation; I have no doubt that for any number of reasons marginal loans were pushed back into pools over the objections of perfectly competent auditors. I have also had experience with staff whose supervisors stopped telling them when they had been overruled, because . . . life is too short. I suspect I am not the only one who has had this experience. Whatever the merits of this story may be, this I think is an overstatement:

Warren thinks her supervisors didn't want her to do her job. She says that when she would reject, or kick out, a loan, they usually would overrule her and approve it.

"The QC reviewer who reviewed our kicks would say, 'Well, I thought it had merit.' And it was like 'What?' Their credit score was below 580. And if it was an income verification, a lot of times they weren't making the income. And it was like, 'What kind of merit could you have determined?' And they were like, 'Oh, it's fine. Don't worry about it.' "

After a while, Warren says, her supervisors stopped telling her when she had been overruled.

"This is a smoking gun," says Christopher Peterson, a law professor at the University of Utah who has been studying the subprime mess and meeting with regulators. "It suggests that auditors working for Wall Street investment bankers knew how preposterous these loans were, and that could mean Wall Street liability for aiding and abetting fraud."Forgive me for being a shill for Wall Street, but this strikes me as silly. The investment banks, including Bear Stearns, published loan underwriting guidelines detailing what they would accept in mortgage pools, and everybody in the industry had a copy at the time. The things came right out and said that things like stated income for a wage earner were acceptable. Was Mr. Peterson calling that "preposterous" at the time? I was. And I never had to look at a single loan file.

What I suspect Ms. Warren is overlooking is, precisely, that the due diligence on those Bear Stearns pools--like every other pool for every other investor--was based on evaluating the individual loans' compliance with the specific guidelines agreed to for the pool. If the guidelines allowed utter stupidity, it isn't likely that the project supervisors would kick out a loan for displaying that particular kind of stupid. If there's something preposterous here, it was in plain sight in the prospectuses to every one of these loan deals. I am having a hard time with the idea that "the smoking gun" didn't show up until this week.

And then there is this part, which has made it all over the web today:

A bankruptcy examiner in the case of the collapsed subprime lender New Century recently released a 500-page report, and buried inside it is a pretty interesting detail. According to the report, some investment banks agreed to reject only 2.5 percent of the loans that New Century sent them to package up and sell to investors.Now, I actually plowed my way through that New Century report, and I have to say that there's a reason this claim was, um, "buried" therein. From page 135 of the report (Warning! Big Honkin' pdf that will take forever to download!):

If that's true, it would be like saying no matter how many bad apples are in the barrel, only a tiny fraction of them will be rejected.

"It's amazing if any investment bank agreed to a maximum number of loans they would kick back for defects. That means that they were willing to accept junk. There's no other way to put it," says Kurt Eggert, a law professor at Chapman University.

[K]ickout data may not be a true indication of loan quality trends because New Century was able, particularly when the subprime market was strong and housing prices were rising, to negotiate understandings with certain loan purchasers to limit kickouts to a maximum rate, such as 2.5%. Flanagan [NEW's former head of loan sales] was explicit in stating to the Examiner that such understandings were reached. The Examiner was unable to establish corroboration for this statement. Nevertheless, such understandings may have limited kickouts, masking loan quality problems that existed but were not reported.The report goes on to document that NEW's typical kickout rate was north of 5.00% and in many months much higher than that; except in securitization (not whole loan) deals where NEW retained residual credit risk, the kickout rate of 2.5% was, to quote the report, "probably more aspirational than real." The fact that no one could produce a contract or set of deal stips or e-mail or sticky note "corroborating" this claim suggests to me that it may have existed only in Mr. Flanagan's mind.

There are, of course, situations in the whole loan sale world in which people have perfectly respectable reasons to agree to limit "kickouts" up front. Occasionally pools are offered for bid with the stipulation of no kickouts: these are "as is" pools and it is expected that the price offered will reflect that. I have myself both offered and bid on no-exclusion loan pools. This is mostly an issue in the "scratch and dent" loan market, where one might have a mixed pool of pretty good and pretty botched up loans to sell. Allowing a buyer to "cherry pick" the deal just leaves you with all the botched up loans to sell separately, which is never anyone's preferred approach. Of course any buyer of loans can decline to bid on a no- or limited-kickout basis. Those who do bid on these deals tend to lower the bid price accordingly. The NEW report also documents the steady deterioration in NEW's profit margin on its whole-loan sales, and trying to get investors to take packages of loans with limited or no kickouts might explain some of that. My guess, from reading the report, is that while NEW might have thought it wanted a 2.5% kickout rate, it ended up accepting a much higher one because the price discount was more than it could face.

I am not trying to suggest that anyone is particularly innocent here. This all just has a sort of Captain Renault quality to it: we are shocked, shocked! that gambling went on in these casinos. The published underwriting guidelines that were available to everyone involved made explicit what was going on with these loans, and those guidelines were published with the deal prospectuses. Now we have a bunch of investors--including institutional ones with absolutely no excuse--wanting to grab hold of stories like Ms. Warren's about cruddy individual loans, as if the pool guidelines weren't themselves a big flaming hint that the loans were absurd.

New Home Sales: No Spring in 2008

by Calculated Risk on 5/27/2008 03:59:00 PM

There was no spring this year. Click on graph for larger image.

Click on graph for larger image.

This graph shows the Not Seasonally Adjusted (NSA) new home sales for the last 45 years.

Usually sales increase in the spring - but not this year. The pervious worst spring on record was 1982 - in the midst of a severe recession, with 30 year fixed mortgage rates at 17%, and close to double digit unemployment.

In 1982, sales picked up late in the year as interest rates declined sharply (30 year fixed rates fell from 17% to about 13% at the end of the year). The second graph shows monthly new home sales NSA for the last few years (repeated from this morning).

The second graph shows monthly new home sales NSA for the last few years (repeated from this morning).

The Red columns are for 2008. This is the lowest sales for April since the recession of '91.

Once again, the 2008 spring selling season has never really started.