by Anonymous on 10/24/2007 06:37:00 PM

Wednesday, October 24, 2007

Subprime: Winners are Losers, Too

We haven't seen that many defenses of subprime lending recently. Long-time readers of the blog will remember a certain vogue earlier this year for the "but subprime helps the poor" schtick, which predictably got less fashionable as the losses racked up.

So it was interesting to see this Barron's column heaving out the old argument in order to scare us all about Barney Frank's proposed subprime mortgage regulation:

Some two million borrowers have taken subprime mortgages in the past few years, of which one-quarter astonishingly may go into foreclosure. That means 1.5 million Americans own homes that they wouldn't likely get to buy under Barney Frank's rules. They are lucky, indeed.What a ringing defense of the subprime industry: we have to make 500,000 disasters in order to get 1,500,000 successes, and apparently which group you're in is a matter of luck, since tighter standards would have eliminated all 2 million, not just the 500,000. I am curious: do other industries get away with results like that?

Then there's the "strivers" canard:

Immigrant and other minority borrowers would be most likely to be shut out. These strivers often have cash businesses and avail themselves of "no-doc" loans, even though they may have good incomes and assets. Frank's measure would end that.If there's an interpretation of that claim that isn't "Look, we know that brown people frequently cheat on their taxes, and tax cheats have great cash flow to make loan payments with!", would someone share it with me in the comments?

But this part is my favorite, and I think the key to Forsyth's real discomfort with Frank's proposed legislation:

Legislation introduced by Barney Frank, the Massachusetts Democrat who heads the House Financial Services Committee, would, among other things, permit subprime borrower to sue Wall Street firms that underwrote securities backed by those loans. No matter that Lehman, Merrill Lynch or any their cohorts weren't in the neighborhood when some slick mortgage broker [was?] selling an unsophisticated borrower on a lousy loan, the big Street firms can be deemed an accessory after the fact.Here's my modest proposal: you should not be allowed to opine on the subject of assignee liability if you do not understand that the definition of a broker (as opposed to a lender) is that a broker has no money to lend. Someone else must supply the money. Assignee liability is a matter of getting clear on who the "lender" really is in the first place. And you should also not use Lehman or Merrill as your example of innocent Wall Street bystanders when two minutes on Google would tell you they both own mortgage originators.

So there's your argument: people with capital to lend cannot be responsible for what kinds of loans get made, because they delegate the process of taking applications to brokers, and nothing that happens after the application is taken matters. This is true because apparently loan success or failure is unpredictable, a sheer matter of luck. That implies that you just have to produce 100 loans, and let God pick out the 75 that are blessed with homeownership. Drag and all about the 25, but as long as you change the disclosures to let everyone know that this is just a casino, the ones who lose can't complain. New motto: Subprime: The odds are better than blackjack!

For what it’s worth, a recent research report from Lehman* just caught my eye. The analysts looked at a pool of subprime ARM loans from older vintages that are current, and have always been current, but have never refinanced out of those old pools. This is a curious phenomenon, since these borrowers are paying very high interest rates (they’re in ARMs that have already adjusted), they didn’t necessarily start with a high CLTV, and in many cases their properties have probably not depreciated that much, or even appreciated at least some, since origination. Why wouldn’t they refi into a cheaper prime loan with a 24-48 month perfect mortgage payment history and a sliver of equity?

The analysis compared the borrowers’ FICO at origination of the loan with the borrower’s current FICO (presumably ordered for account monitoring purposes). Some 40% of subprime loans with a perfect 24-48 month mortgage history have FICOs that are unchanged or have dropped by as much as 75 points since the loan closed. The implication is that a significant number of current borrowers subsidized their mortgage payment shocks with credit cards: the high balance-to-limit or mounting delinquencies on consumer debt is offsetting the positive FICO effect of on-time mortgage payments. This is a recipe for a permanent subprime borrower: someone who “performs” on the mortgage by supplementing income shortfalls with credit card debt, keeping the FICO at a level that precludes ever becoming a prime mortgage borrower.

That should knock the last leg out from under the argument of subprime lenders that they are giving borrowers a chance to “cure” their credit problems. You have to wonder whether these folks would have been given a mortgage in the first place if they had been qualified on the fully-indexed, fully-amortizing payment and documented income; my guess is they probably wouldn’t. In that sense, they'd "lose out" under tighter mortgage regulation.

But they’re trapped: they’ve got some equity they don’t want to walk away from, yet they can maintain the mortgage payment only by racking up unsustainable consumer debt. Eventually they’ll have to sell the property: there’s only so long you can keep making your mortgage payment with a credit card. But in what sense will they then have been "successful" homeowners? They may never have had a mortgage delinquency, and they may have avoided foreclosure, but they still spent years paying too much for too little purpose.

Until we get straight on the idea that there's something wrong with holding a high-risk lottery to see who among first-time homebuyers gets to become middle-class, and that there's something wrong with a situation in which "success" is defined as quitting before you get fired, we're never going to get straight on what has to be done to reform the mortgage industry.

*Akhil Mago, Lehman, "Overview of the Subprime Sector," October 2007 (not available online)

Homebuilder Reports: Pulte and MDC

by Calculated Risk on 10/24/2007 06:21:00 PM

M.D.C. Holdings Announces Third Quarter 2007 Results

MDC received orders, net of cancellations, for 1,228 homes with an estimated sales value of $365.0 million during the 2007 third quarter, compared with net orders for 2,120 homes with an estimated sales value of $678.0 million during the same period in 2006. For the nine months ended September 30, 2007, the Company received net orders for 5,756 homes with a sales value of $1.92 billion, compared with orders for 8,658 homes with a sales value of $2.95 billion for the nine months ended September 30, 2006.Pulte Homes Reports Third Quarter 2007 Financial Results

During the third quarter and first nine months of 2007, the Company's approximate order cancellation rates were 57% and 44%, respectively, compared with rates of 49% and 40% experienced during the same periods in 2006.

Net new home orders for the third quarter were 4,582 homes, valued at $1.3 billion, which represent declines of 37% and 47%, respectively, from prior year third quarter results.Just plain ugly.

Added: Ryland Reports Results for the Third Quarter of 2007

New orders of 1,876 units for the quarter ended September 30, 2007, represented a decrease of 20.9 percent, compared to new orders of 2,372 units for the same period in 2006. For the third quarter of 2007, new order dollars declined 27.0 percent to $491.4 million from $673.2 million for the third quarter of 2006. Backlog at the end of the third quarter of 2007 decreased 36.6 percent to 4,334 units from 6,835 units at the end of the third quarter of 2006. At September 30, 2007, the dollar value of the Company’s backlog was $1.2 billion, reflecting a decline of 41.6 percent from September 30, 2006.

Tim Duy's Fed Watch

by Calculated Risk on 10/24/2007 01:11:00 PM

Mark Thoma says Tim Duy is losing sleep.

Fed Watch: Runaway Rate Cut Train?. Excerpts

... housing is bad. This morning we get existing home sales, which, considering the local reports I have seen, are almost certain to be simply dismal. I did a road trip to Bend last week, and can confidently report that close to half of central Oregon is for sale. Housing of course was the big topic; when will the downturn end, will prices fall, etc. My story of how bubble markets generally end badly, and don’t bounce back for years (look at the NASDAQ, I say), does not make me many friends.Although Dr. Duy sees spillover from housing into the general economy, it is not enough to concern him. He is more worried about the Fed cutting too much:

But when I pressed the business community (not realtors – they only tell you to wait two months, prices will be on the rise again) on the environment outside of sectors directly tied to housing, I continuously received the same story – no problem.

My expectation remains that the US economy will weather the housing rout better than expected, especially given the global pull, particularly from emerging markets. That leads me to believe that we are not on a runaway rate cut train in the US. Indeed, from an inflation standpoint, the last thing the global economy needs is a runaway rate cut train placing further downward pressure on the dollar.I'm not as sanguine as Tim, but his piece is an excellent overview.

More on September Existing Home Sales

by Calculated Risk on 10/24/2007 12:37:00 PM

For more existing home sales graphs, please see the previous post: September Existing Home Sales Plummet

To put the NAR numbers into perspective, here are the year-end sales, inventory and months of supply numbers, since 1969. This graph shows the actual annual sales, year end inventory and months of supply, since 1982 (sales since 1969). For 2007, the September inventory and Seasonally Adjusted Annual Rate (SAAR) for sales were used.

This graph shows the actual annual sales, year end inventory and months of supply, since 1982 (sales since 1969). For 2007, the September inventory and Seasonally Adjusted Annual Rate (SAAR) for sales were used.

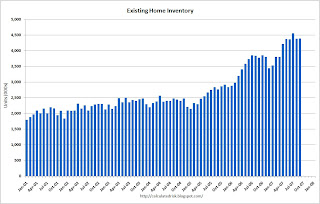

The current inventory of 4.399 million is just below the all time record set in July and well above the record year end inventory for any other year. The "months of supply" metric is 10.5 months. The "months of supply" is now above the level of the previous housing slump in the early '90s, but still below the worst levels of the housing bust in the early '80s.

Both the numerator and the denominator are moving in the wrong direction. Not only is inventory at record levels, but sales - though falling - are still somewhat above the normal range as a percent of owner occupied units.

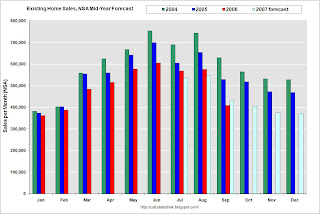

The second graph is an update to my mid-year forecast adding the actual results for July, August and September in 2007. My forecast was for sales to be between 5.6 and 5.8 million units.

My forecast was for sales to be between 5.6 and 5.8 million units.

At mid-year I updated my forecast to the lower end of the previous range (5.6 million units). Through September there have been 4.5 million units sold, and it looks like the total will be right around 5.6 million.

September Existing Home Sales Plummet

by Calculated Risk on 10/24/2007 10:00:00 AM

The NAR reports that Existing Home sales plummeted to 5.04 million in September, the lowest level since September 2001.

Total existing-home sales – including single-family, townhomes, condominiums and co-ops – fell 8.0 percent to a seasonally adjusted annual rate1 of 5.04 million units in September from a downwardly revised pace of 5.48 million in August, and are 19.1 percent below the 6.23 million-unit level in September 2006.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the NSA sales per month for the last 3 years.

The impact of the credit crunch is obvious as sales in September declined sharply.

For existing homes, sales are reported at the close of escrow. So September sales were for contracts signed in July and August.

The second graph shows nationwide inventory for existing homes. According to NAR, inventory was flat at 4.4 million homes for sale in September.

The second graph shows nationwide inventory for existing homes. According to NAR, inventory was flat at 4.4 million homes for sale in September. Total housing inventory inched up 0.4 percent at the end of September to 4.40 million existing homes available for sale, which represents a 10.5-month supply at the current sales pace, up from a downwardly revised 9.6-month supply in August.This is basically the same inventory level as August, although the months of supply increased to 10.5 months because of the sharp drop in sales.

This is the normal historical pattern for inventory - inventory peaks at the end of summer and then stay fairly flat until the holidays (it then usually declines somewhat). This says nothing about the increasing anxiety of sellers and the rising foreclosure sales.

This wasn't true in 2005 - as inventory continued to increase throughout the year - and that was one of the indicators that the housing boom had ended.

For 2007, I expect that inventory levels are close to the peak level.

The third graph shows the monthly 'months of supply' metric for the last six years.

The third graph shows the monthly 'months of supply' metric for the last six years.Even if inventory levels stabilize, the months of supply could continue to rise - and possibly rise significantly - if sales continue to decline.

The fourth graph shows monthly sales (SAAR) since 1993.

This shows sales have now fallen to the level of September 2001 (when sales were impacted by 9/11).

This shows sales have now fallen to the level of September 2001 (when sales were impacted by 9/11). I wouldn't be surprised to see a small rebound in SAAR sales next month, but the trend is clearly down.

More later today on existing home sales.

Merrill Reports $8 Billion Write Down

by Calculated Risk on 10/24/2007 08:47:00 AM

From the WSJ: Merrill Lynch Posts Wide Loss, Discloses Bigger Write-Downs

Merrill Lynch & Co. swung to a wider-than-projected third-quarter net loss because of $7.9 billion in write-downs on collateralized debt obligations and subprime mortgages.Talk about a shocking visit to the confessional!

Merrill had warned earlier this month that it would post a net loss of up to 50 cents a share because of writing down $4.5 billion in collateralized debt obligations and subprime mortgages and recording a net $463 million on leveraged finance commitments.

But the CDO and subprime write-downs were much higher than that and even above that of some analysts who were projecting Merrill to record write-downs at or above $7 billion.

Tuesday, October 23, 2007

Prime Loans Gone Bad

by Calculated Risk on 10/23/2007 10:52:00 PM

From the WSJ: 'Option ARM' Delinquencies Bleed Into Profitable Prime Mortgages

Subprime mortgages aren't the only challenge facing Countrywide Financial Corp. ... Some loans classified as prime when they were originated are now going bad at a rapid pace.

These ... option ARMs ... typically have low introductory rates and allow minimal payments in the early years of the mortgage. Multiple payment choices include a minimum payment that covers none of the principal and only part of the interest normally due. If borrowers choose that minimum payment, their loan balances grow -- a phenomenon known as "negative amortization."

| Click on graph for larger image. This chart from Credit Suisse via the IMF shows the heavy subprime resets in 2008, plus it shows the reset problems with Alt-A and Option ARM loans in later years. |

... An analysis prepared for The Wall Street Journal by UBS AG shows that 3.55% of option ARMs originated by Countrywide in 2006 and packaged into securities sold to investors are at least 60 days past due. That compares with an average option-ARM delinquency rate of 2.56% for the industry as a whole and is the highest of six companies analyzed by UBS.These Option ARMs, especially the low doc, minimal downpayment Option ARMs, are ticking time bombs.

...

The deteriorating performance of option ARMs is evidence that lax underwriting that led to problems in subprime loans is showing up in the prime market, where defaults typically are minimal. Challenges could grow, as from 2009 to 2011, monthly payments on some $229 billion of option ARMs will be adjusted to include market-rate interest and principal, according to Moody's Economy.com.

...

It now appears that many borrowers who moved into option ARMs were attracted by the low payments and may have been staving off other financial problems. More than 80% of borrowers who are current on these loans make only the minimum payment, according to UBS. emphasis added

Axon SIV NAV Plummets, Ratings Cut

by Calculated Risk on 10/23/2007 07:34:00 PM

From Reuters: Moody's slashes Axon SIV as capital NAV plummets

Moody's Investors Service on Tuesday slashed its credit ratings on Axon Financial Funding, a structured investment vehicle (SIV), after its capital net asset value plummeted.OUCH.

Moody's said in a statement it has cut Axon's commercial paper to Not Prime from Prime-1. It has cut its medium term notes to Ba3, three notches below investment-grade status, from triple-A. And it has cut its mezzanine capital notes to Ca, 10 notches below investment-grade, from A1.

...

Moody's said Axon's capital net asset value had fallen to 39 percent on Oct. 18 from 96 percent on July 27.

More from Bloomberg: SIV Defaults May Prompt Others to Close Their Doors

Axon Financial Funding Ltd. LLC, a SIV with $9.8 billion of debt, had its credit ratings cut by Moody's today after its net asset value fell by more than half. The SIV, set up by New York- based hedge fund TPG-Axon Capital Management LP, had the rankings of its medium-term notes lowered by 12 steps to Ba3, three levels below investment grade, from Aaa, the highest-possible rating.

Centex Posts Large Loss

by Calculated Risk on 10/23/2007 05:33:00 PM

From the WSJ: Centex Posts $644 Million Loss Amid Continued Housing Woes

Centex Corp. reported a fiscal second-quarter loss, as the company recorded $983 million in impairments and other land charges, continuing a bloody season for U.S. home builders.The positive news is that Centex reduced their inventory "of unsold homes by 28% to 4,708" and their "cancellation rate decreased to 35.4%".

...

Revenue fell 21% to $2.22 billion.

...

"Market conditions were extremely challenging during the quarter, reflecting the serious disruptions in the credit and mortgage markets that occurred during that period," said Chairman and Chief Executive Tim Eller in a prepared statement late Tuesday. "In response, we meaningfully reduced prices in order to improve affordability for our home buyers."

Countrywide to Modify $16B in Loans

by Calculated Risk on 10/23/2007 02:04:00 PM

From AP: Countrywide to Modify $16B in Loans

Countrywide Financial Corp ... said Tuesday it will begin calling borrowers to offer refinancing or modifications on $16 billion in loans whose interest rate is set to adjust by the end of 2008. ...

...

The Calabasas, Calif.-based company said it would reach out to borrowers who are current on their loans but are facing an imminent rate reset to discuss options. Countrywide said it would refinance about $10 billion in loans and modify another $4 billion.

It also plans to contact borrowers of some $2.2 billion who are late on their loans and having trouble paying because of a recent rate reset.

In total Countrywide's plan would reach out to about 82,000 borrowers for some kind of relief.

Transportation Weakness: UPS and Burlington Northern

by Calculated Risk on 10/23/2007 12:54:00 PM

From the WSJ: UPS Posts 3.7% Rise in Profit Amid International Growth

The world's largest package delivery company expects domestic package volume in the fourth quarter will grow at its slowest rate for the period in four years, amid weakened consumer spending in the U.S. ...Also from the WSJ: Burlington Northern Earnings Rise 8.4% Despite High Fuel Costs

"Retail sales growth is expected to remain weak and is a wild card going into the holiday shipping season," Chief Financial Officer Scott Davis said during a conference call with analysts. "It remains to be seen how quickly the U.S. economy will return to long-term growth trends," he added, noting that UPS sees economic growth of about 2% this year.

"Although we have concerns near-term about the economy, housing markets, high fuel prices and general consumer softness, we continue to be optimistic about the long-term future of BNSF," [Chairman and Chief Executive Matthew K. Rose] said.The UPS numbers are weak, but not too bad - the Burlington Northern volumes look recessionary.

...

In July, the railroad said it expected about a 3% decline in volume in the third quarter, mainly due to weak intermodal volume, which involves transferring freight from one method of transport to another. Tuesday, the company said volume fell 4.7%. A recession in freight volumes has been affecting the rail industry for nearly a year, partly because of weakness in the housing and automotive markets.

Neumann Homes prepares bankruptcy filing

by Calculated Risk on 10/23/2007 12:42:00 PM

From the Chicago Tribune: Chicago builder, Neumann Homes, closes branches, prepares bankruptcy filing (hat tip Lyle)

Neumann Homes, one of Chicago's largest homebuilders, announced on Monday that it intends to file for bankruptcy.Homebuilders bankruptcies will probably become common (someone will have to start a home builder implode-o-meter), but also note the comment "... significant help we have received from our lenders". Eventually lenders will start giving up on homebuilders, and this means more builder bankruptcies, and more write downs for the lenders.

...

The company, ranked among the top 10 in Chicago, also builds in Wisconsin and Colorado. Company CEO Kenneth P. Neumann said in the statement that "significant downturn in the Detroit, Chicago and Denver housing markets resulted in this situation. ... Even after the significant help we have received from our lenders this year, the company can no longer weather this storm."

It's 10:00 a.m. Do You Know Where Your Loan File Is?

by Anonymous on 10/23/2007 10:01:00 AM

I guess we can only hope that the credit crunch cramps the style of identity thieves. From the Wall Street Journal:

Last month, Waldell Thomas, a maintenance worker at Montego Apartments in Atlanta, made a discovery inside the complex's Dumpster: a cache of 40 boxes of loan files containing Social Security numbers, credit reports and other data on customers of Ameriquest Mortgage Co.Next time you talk to a mortgage broker, you might want to ask about their file retention/destruction policies. As a general rule, "I keep them in cardboard boxes in my basement until I take them to the dumpster of some condo project" is not the right answer.

The worst part of this is that there do not seem to be criminal penalties for file dumping in Georgia. I guess it's not a crime until the dumpster-divers find your credit report.

BKUNA Neg Am Portfolio

by Anonymous on 10/23/2007 09:19:00 AM

Thanks to Anonymous, our attention is directed to BankUnited's visit to the confessional. Somehow loan loss reserves went from $8-10MM in pre-release to $19.1MM in the official release. It's the sort of thing that can happen to anyone, you know.

Because we were talking about Option ARMs yesterday, I thought I'd share this bit:

As of Sept. 30, 2007, BankUnited’s option-ARM balances totaled $7.6 billion, which represented 70% of the residential loan portfolio and 60% of the total loan portfolio. For the quarter ended Sept. 30, 2007, the growth in negative amortization was $48 million, compared to $46.4 million for the quarter ended June 30, 2007. Of the $7.6 billion in option-ARM balances, $6.5 billion had negative amortization of $270 million, or 3.55%, of the option-ARM portfolio.If I'm reading that correctly, it means that 87% of the OA portfolio, by balance, is negatively amortizing, and the total amount of negative amortization is 4.1%. Without the weighted average age of the loans, there is no way to calculate an annual rate of negative amortization. I would be surprised if the average age is more than 24 months, which would produce a rate of around 2.00% annual average balance growth.

Monday, October 22, 2007

More Homeowners Filing Bankruptcy to Halt Foreclosure

by Calculated Risk on 10/22/2007 09:20:00 PM

From the WSJ: To Keep Homes, More People Bet On Bankruptcy

As the nation's housing slump continued, consumer bankruptcy filings last month were up nearly 23% from a year earlier -- representing nearly 69,000 people, according to the American Bankruptcy Institute ... Overall, consumer bankruptcy filings were up 44.76% during the first nine months of this year.

In some areas where the real-estate boom was especially heated, the increase in filings has been even sharper -- especially for a type of bankruptcy that allows homeowners to halt foreclosures on their homes.

...

In recent months ... more homeowners are filing for bankruptcy under Chapter 13, which staves off foreclosure proceedings while the homeowner works out a plan to pay ...

In California, one of the nation's hottest markets during the recent real-estate boom, the number of nonbusiness Chapter 13 petitions in the second quarter more than doubled from a year earlier ... Over the same period, such filings increased nearly 40% in the northern district of Illinois, which includes Chicago, and 70% in Massachusetts.

"It's a mess," says William McLeod, a Boston bankruptcy attorney who says he is receiving twice as many calls from debtors as he did a year ago. "This is fed right now by real estate, and what's been this mortgage frenzy in the last several years."

Fires in SoCal

by Calculated Risk on 10/22/2007 03:38:00 PM

I just spoke with a friend in San Diego - they were evacuated at 2AM this morning. Apparently at least four homes on their block have burned, including the house right next door to them (they saw it on the news).

MarketWatch has an audio from Herb Greenberg describing his evacuation. Here is his blog:

This is remarkable. They’ve just evacuated a major part of San Diego: Everywhere East of the I-5, North of the 56 and South of Lake Hodges. If you know San Diego, this is, well, half the area. My area, Carmel Valley, is included. This is JUST east of Del Mar. Total track home city, but also includes Rancho Santa Fe.It is really smoky at my house in Orange County, but it is safe.

IMF: Mortgage Reset Chart

by Calculated Risk on 10/22/2007 11:05:00 AM

From the IMF: Assessing Risks to Global Financial Stability

LBO: KKR, Goldman cancel Harman deal

by Calculated Risk on 10/22/2007 10:44:00 AM

From MarketWatch: KKR, Goldman cancel Harman deal, to invest $400 mln

[KKR] and Goldman Sachs will cancel their $8 billion takeover for Harman International but invest $400 million in convertible notes ... KKR and Goldman won't be sued and won't have to pay a termination fee under the agreement struck.A pretty clean exit for KKR and Goldman. No pier loans here.

Zelman: House Price Declines could range from 16% to 22%

by Calculated Risk on 10/22/2007 10:15:00 AM

From Bloomberg: U.S. Housing Decline Threatens to Last Into 2009: John F. Wasik. A few excerpts:

[Ivy] Zelman ... says it's unlikely the U.S. housing market will recover before 2009, adding there's a ``50 to 60 percent chance of a recession,'' as the housing slump curbs consumer spending.It's nice to have Zelman back in the news. Her views are close to mine.

...

When you consider the huge home inventories and tight-as-a- drum mortgage restrictions, it's easy to conclude that the housing slump could extend well past 2008. ...

``I've never seen the market as bad as this,'' Zelman said. ``And it could get worse. The home-price decline could range from 16 percent to 22 percent.''

...

``These are the worst inventories we've seen as a nation,'' she says.

...

``Some 74 percent of consumer expenditures are correlated to housing. I don't think the consumer will hold up. They will cut back on things like buying cars and vacations.''

While Zelman forecasts that sales will drop for the next two years, she isn't as optimistic on home prices, which she says may continue falling until 2010 or 2011.

``We'd be better off if prices corrected all at once. It will get worse before it gets better.''

...

Keep in mind that job growth and consumer spending bear close scrutiny. If Zelman is right about a recession coming, then prices may fall more, plunging the housing market into an even sorrier state.

Lessons From the Foreclosure Crisis

by Anonymous on 10/22/2007 09:45:00 AM

Via the New York Times:

“The market’s really low right now, so you can get a good price,” said Lori Crook, a food server at Keys Cafe who said she was looking for a place she could fix up and sell. “Even if you can’t sell it right away, if you just sit on it and sit on it, it will go up.”Some day this war's going to start.

The auction involved a tiny fraction of foreclosures in the state. Julie Gugin, executive director of the nonprofit Minnesota Homeownership Center, projected statewide foreclosures at 20,000 this year, up from 11,000 last year, based on data from sheriffs’ sales. . . .

“This is such a stark and dramatic illustration of how serious the problem is,” said Ron Elwood, a lawyer at the Legal Services Advocacy Project, which lobbies in the interest of low-income residents. “The reality is, half the reason 300 homes are being auctioned off is that speculators tried to make a killing and failed to do so.” In Minneapolis, 55 percent of foreclosures this year involved houses not occupied by their owners, according to county records.

But instead of alarming buyers about the risks, the auction of so many foreclosures at once was an invitation to speculators, small and large. Some, including Bryan Kihle and Jim Casha, who bought a four-bedroom house for $145,000, bid without seeing the properties. “I just looked at the picture and thought if we got it cheap enough, we could rent it for a year, then sell it when the market goes back up,” said Mr. Kihle, a building contractor.