by Calculated Risk on 9/24/2007 02:44:00 PM

Monday, September 24, 2007

Housing: Soft "repairs, maintenance and improvement markets"

From The Times: Wolseley's fresh alert on US housing market

Wolseley, the plumbing and heating engineer, which makes half its income in America, gave warning today that revenues of its US building materials business have collapsed by almost 75 per cent.Real spending on home improvement has held up pretty well so far. If this housing bust is similar to the early '80s or '90s, real home improvement investment will slump 15% to 20%.

It has eliminated 3,500 staff and shut 46 branches.

...

Chip Hornsby, the chief executive, said that there were no signs of a turnaround in the residential housing market and that "the repairs, maintenance and improvement market is now beginning to soften".

Click on graph for larger image.

Click on graph for larger image.This graph shows real home improvement investment (2000 dollars) since 1959. Recessions are in gray (source: BEA)

Although real spending declined slightly in Q2 2007, home improvement spending has held up pretty well compared to the other components of Residential Investment. With declining MEW, it is very possible that home improvement spending will slump like in the early '80s and '90s.

MMBS: Bikes on the Balcony!

by Anonymous on 9/24/2007 02:34:00 PM

Ye Gods. That's almost as bad as laundry in the backyard.

The Wall Street Journal treats us to "The Invasion of Renters." I for one am unable to determine how far my leg is being pulled here, or how seriously this reporter is taking his own story. We begin with the familiar narrative build-up:

Mark Spector was happy with his new neighborhood. Then the renters started moving in.I have no idea how Mr. Spector can keep tabs on the occupancy status of 750 homes; I'm just glad he isn't my neighbor. Anyway, you're wondering what happened next, right?

In 2004, Mr. Spector and his wife, Deanna, paid $350,000 for a six-bedroom house in Bridgewater, a new development in Wesley Chapel, Fla., about 25 miles north of Tampa. They moved into their home and looked forward to meeting their neighbors.

Then Florida's once-feverish housing market started to cool. Investors who'd bought a large percentage of the properties in Bridgewater found they couldn't flip them for a quick profit, and brought in tenants, instead. By last year, Mr. Spector estimates, close to half of the residents in the subdivision of 750-plus homes were renters.

The result, Mr. Spector says: overgrown lawns, drug deals in the park and loud parties in the "frat houses" down the street. "You'll see some driveways with a dozen cars parked in the driveway and on the grass," he says.So, basically, we don't like abandoned homes, we don't like unsold homes, and we don't like renters. We also don't want to drop our sales prices so that those homes can be sold to owner-occupants. I am torn between wondering how bad those parties really are--as if owner-occupants never have parties that involve more than 12 parked cars--and wondering what people expected in the no-doc mortgage frenzy. Anecdotal evidence suggests that at least some of those no-doc loans involved drug money laundering to start with. How renters could be worse news than the owners is hard to fathom.

The extent of the problem is also hard to get a grasp on:

In another manifestation of the housing slump, thousands of property owners across the country are now renting out homes they cannot sell. As a result, developments and condos that once were largely owner-occupied are filling up with renters who some neighbors say are less engaged in their communities and less concerned about maintenance."Thousands"? Across the whole country? How many thousands?

I don't know, but I do know that mixing horror stories of drug deals and criminal complaints with stuff like this is not winning sufficient sympathy from me:

Denver, Colo., resident Neval Gupta says that when his 63-unit condo complex began running into problems as the number of renters grew, the board stepped up enforcement of its rules, including bans on storing bicycles on balconies and doing auto repairs in the parking garage. "We really crack down on the owners now to be accountable for their renters," says Mr. Gupta, the president of the condo board. "We do have a problem with some owners who put any renter they can find in there."Just exactly when did "auto repairs" become a problematic thing to do in a garage? Are we really talking about someone blocking access with a major engine rebuild, or just some poor sap topping off the washer fluid? Do you trust anyone who has convulsions over a bike on a balcony to tell the difference?

Mr. Gupta and other residents say such vigilance has helped cut down on some problems. But it has also created new ones. Craig White, who bought his unit as an investment and rents it out, says his last tenants left when they got tired of being "harassed" by over-zealous owner-occupants. "If you put your bike out [on the balcony] for a day or two, you're going to get a phone call," Mr. White says.

Of course, plenty of renters cut their grass, take in the garbage cans and turn down the music at 9 p.m. And not all homeowners are model neighbors. Denise Bower, of Community Management, Inc., which manages 122 developments around Portland, Ore., says renters are often more responsive to complaints because they know they run the risk of losing their leases if they don't. "I have more problems with owners, by far," Ms. Bower says. "They get stubborn."No, really? Might that stubborness be why some of these owners "have to" rent the place? Can't get more than what you paid in 2005?

Housing: Watch Inventory

by Calculated Risk on 9/24/2007 11:41:00 AM

The August existing home sales report is scheduled to be released tomorrow.

Preliminary evidence suggests sales declined sharply in August. As an example, for California, DataQuick reported that August sales of new and existing homes declined 5% from July. The usual seasonal pattern is for sales to increase from July to August (by 5% to 10%), so on a seasonally adjusted basis, the decline in August is even more significant.

Also the NAR Pending Home Sales Index, based on contracts signed in July, was off 12%. The usual period from signing to closing is about 45 to 60 days for existing homes. This index is for contracts signed in July, so there will probably be some impact on the reported existing home sales for August, and even more of an impact on sales in the report for September.

But what about inventory?

The usual seasonal pattern is for inventory to peak in late summer. If 2007 follows the usual pattern, inventory levels in August will be about the same as the all time record set in July (4.592 million units). However 2007 isn't a "typical year" for housing, and it will be interesting to see if inventory levels follow the usual pattern - or continue to increase.

The other measure of inventory, "Months of Supply", will be through the roof!

The following graph shows existing home sales, inventory and months of supply since 1969 (inventory since 1982). Note: All data is end of the year, except 2007 is for July.

Click on graph for larger image.

For July, months of supply was 9.6 months. Depending on how far sales fell in August, months of supply could be well over 10 months in August, just shy of the year end record set in 1982 (with 11.5 months at year end).

Sales will be the headline number in the report tomorrow, but inventory will also be interesting.

"Captain Tanta" Has a Nice Ring to It . . .

by Anonymous on 9/24/2007 10:15:00 AM

Via Clyde, a fascinating (well, if you're mortgage- and rating agency-obsessed) discussion from Institutional Risk Analytics. I thought former regulator Thomas Day's remarks on the surreal nature of his own mortgage experience were quite interesting; imagine how surreal it was for those who never worked for the Federal Reserve.

But this is certainly Quote of the Day material:

The next speaker was Sylvain Raynes of RR Consulting, who also teaches at Baruch College in New York. Raynes began by reminding the audience that while it may seem easy to criticize the actions of the major ratings agencies, "most people are trying to find ways to look beyond the rating agencies. Most regulators have stopped believing in them a long time ago, at least five years ago, as far as I can see. But what you cannot do is throw the captain overboard in the middle of a storm because then you become the captain. This is the Caine mutiny strategy.

A New Bear Stearns Deal

by Anonymous on 9/24/2007 09:22:00 AM

It used to be basically impossible to keep up with the terms of newly-issued mortgage deals, but you could at least stay up to date with downgrades. Now that the situation is completely reversed, I thought it might be interesting to look at the terms of one of the very few new issues out there.

This Bear Stearns deal (Asset Backed Securities I Trust, Series 2007-AC6) just got rated. With 7.90% credit enhancement to the AAA tranches for an Alt-A deal--that's more than you used to get in some subprime--I thought it might be interesting to look at the prospectus.

Remember the uproar earlier in the year about Bear buying delinquent loans out of securities in an attempt, it was alleged, to "manipulate" the market? This prospectus has a new bit I've never seen before that clarifies that:

[A]s described in this prospectus supplement, the sponsor has the option to repurchase mortgage loans that are 90 days or more delinquent or mortgage loans for which the initial scheduled payment becomes thirty days delinquent. The sponsor may exercise such option on its own behalf or may assign this right to a third party, including a holder of a class of certificates, that may benefit from the repurchase of such mortgage loans. These repurchases will have the same effect on the holders of the certificates as a prepayment of the mortgage loans. You should also note that the removal of any such delinquent mortgage loan from the issuing entity may affect the loss and delinquency tests that determine the distributions of principal prepayments to the certificates, which may adversely affect the market value of the certificates. A third party is not required to take your interests into account when deciding whether or not to direct the exercise of this option and may direct the exercise of this option when the sponsor would not otherwise exercise it. As a result, the performance of this transaction may differ from transactions in which this option was not granted to a third party.You have been warned, I guess. There is also this:

The sponsor may from time to time implement programs designed to encourage refinancing. These programs may include, without limitation, modifications of existing loans, general or targeted solicitations, the offering of pre-approved applications, reduced origination fees or closing costs, or other financial incentives. Targeted solicitations may be based on a variety of factors, including the credit of the borrower or the location of the related mortgaged property. In addition, The sponsor may encourage assumptions of mortgage loans, including defaulted mortgage loans, under which creditworthy borrowers assume the outstanding indebtedness of the mortgage loans which may be removed from the mortgage pool. As a result of these programs, with respect to the mortgage pool underlying any issuing entity, the rate of principal prepayments of the mortgage loans in the mortgage pool may be higher than would otherwise be the case, and in some cases, the average credit or collateral quality of the mortgage loans remaining in the mortgage pool may decline. . . .You have been even more warned. Furthermore,

Modifications of mortgage loans implemented by the related servicer or the master servicer in order to maximize ultimate proceeds of such mortgage loans may have the effect of, among other things, reducing or otherwise changing the loan rate, forgiving payments of principal, interest or other amounts owed under the mortgage loan, such as taxes or insurance premiums, extending the final maturity date of the mortgage loan, capitalizing or deferring delinquent interest and other amounts owed under the mortgage loan, or any combination of these or other modifications. Any modified loan may remain in the issuing entity, and the reduction in collections resulting from a modification may result in reduced distributions of interest or principal on, may extend the final maturity of, or result in an allocation of a realized loss to, one or more classes of the certificates.

The underwriter intends to make a secondary market in the offered certificates, but the underwriter has no obligation to do so. We cannot assure you that a secondary market will develop or, if it develops, that it will continue. Consequently, you may not be able to sell your certificates readily or at prices that will enable you to realize your desired yield. The market values of the certificates are likely to fluctuate, and such fluctuations may be significant and could result in significant losses to you.In case you hadn't noticed, you're getting warned again.

The secondary markets for asset backed securities have experienced periods of illiquidity and can be expected to do so in the future. Illiquidity can have a severely adverse effect on the prices of certificates that are especially sensitive to prepayment, credit or interest rate risk, or that have been structured to meet the investment requirements of limited categories of investors.

As far as the mortgage pool? It's fixed-rate Bridge Mix: 18% full doc; WA FICO of 701 with range from less than 600 to more than 800; average balance just under $306,000 with a range from $33,000 to $2MM; 14% non-owner-occupied; 29% CA and 10% FL; 35% interest only. The sort of thing that would have skated by a year ago, in other words. The big difference here: only 28% of loans are purchase-money, and only 19% have subordinate financing.

The loans are also rather older than new production issues have been in the last few years--averaging 7-10 months--which suggests that it took a while to put this deal together. I'd say this is less an indicator of what kind of loans are being made today than it is what kind of loans have been parked in Bear Stearns' inventory since the first quarter, waiting for the RMBS market to revive. And with subordination levels of nearly 8.00% on fixed rate "Alt-A," it's quite clear that rates to consumers for "non-conforming" loans have nowhere to go but up.

Sunday, September 23, 2007

House Prices: "Get real"

by Calculated Risk on 9/23/2007 11:32:00 PM

Quote of the day:

"Economists tend to think people are crazy because they won’t sell their houses for less than they paid for them — and people think economists are crazy for thinking things exactly like that."From the NY Times: A Reality Check for Home Sellers

Professor Christopher Mayer, director of the Paul Milstein Center for Real Estate at Columbia Business School

This article discusses homeowners not want to sell for a loss. But even homeowners with some profit reluctantly reduce their prices, unrealistically hoping for a price close to recent sales in their neighborhood. As the article notes:

... the [housing] market went into a deep freeze as many people held out for market prices that no one would reasonably pay.We will see how much of a "deep freeze" later this week when the new and existing home sales reports are released.

Want To Buy A Second Home?

by Anonymous on 9/23/2007 10:50:00 AM

The Washington Post has some excellent advice for you, if you do. My favorite part was making sure you found a job thirty years ago that paid a lifetime pension with health coverage, and you stuck to it like glue. Otherwise, you'll want to look into the strategy of borrowing as much as possible (up to the conforming limit) at 6.50% because after taxes (retiree taxes, no less) you can surely end up ahead by investing your savings elsewhere. And if you're trying to maximize your mortgage interest deduction, why wait for RE prices to come down a bit more?

So a couple of folks with $600,000 in savings and a $20,000 balance on their HELOC (on the "paid off" home) allowed their names to appear in the newspaper. I'd guess by noon they'll have 47 mortgage brokers lined up in the driveway . . .

Saturday, September 22, 2007

Deposit Insurance: U.K. May Increase Coverage

by Calculated Risk on 9/22/2007 06:01:00 PM

From Bloomberg: U.K. May Insure 100,000 Pounds of Depositor Funds (hat tip FFDIC)

The U.K. government may guarantee as much as 100,000 pounds ($202,000) of people's bank deposits as it seeks to avoid a repeat of the run on Northern Rock Plc, Chancellor of the Exchequer Alistair Darling said.Currently the official deposit insurance program covers 100% of the first £2,000, and 90% up to £35,000. This is a flawed insurance program, and didn't prevent the bank run at Northern Rock. To stop the bank run, the British government ended up guaranteeing all deposits - talk about encouraging moral hazard!

Although most people think deposit insurance is intended to protect depositors, perhaps a more important reason for insurance is to prevent bank runs and maintain the stability of the financial system.

The problem with the current British system isn't the size of the insured deposit £35,000 (about $70,000) but the coinsurance feature above £2,000. The coinsurance idea is flawed, both in concept and in practice (see Northern Rock). The idea of having relatively small depositors assess the risk of a bank is absurd. In practice, small depositors will just move their deposits to another bank at the slightest hint of trouble.

Many other coinsurance programs work very well. As an example, a co-pay for a doctor's visit lowers the overall cost of medical care. Without a co-pay, some patients overuse the services of doctors (this isn't a discussion of health care, rather an example of a positive aspect of coinsurance). But the purpose of coinsurance for deposit insurance is to encourage the depositor to assess the risk of the institution - something perhaps beyond the capability of most depositors. And even if the depositor has the skill to assess the institution, and the access to adequate information, it is still easier to just move their funds.

There are Moral Hazard and Principal/Agent issues with deposit insurance. For those interested in this topic, I suggest this paper, written in 1999 by George Hanc at the FDIC: Deposit Insurance Reform: State of the Debate. Here is an excerpt on Moral Hazard:

When applied to deposit insurance, the term moral hazard refers to the incentive for insured banks to engage in riskier behavior than would be feasible in the absence of insurance. Because insured depositors are fully protected, they have little incentive to monitor the risk behavior of banks or to demand interest rates that are in line with that behavior. Accordingly, banks are able to finance various projects at interest costs that are not commensurate with the risk of the projects, a situation that under certain circumstances may lead to excessive risk taking by banks, misallocation of economic resources, bank failures, and increased costs to the insurance fund, to solvent banks, and to taxpayers.In the U.S., the insurance premium is based on the FDIC's evaluation of the riskiness of the institution. The FDIC is in a much better position to judge the riskiness of institutions than depositors.

Moral hazard is present because (1) a stockholder's loss, in the event a bank fails, is limited to the amount of his or her investment; and (2) deposit insurance premiums have been unrelated to, or have not fully compensated the FDIC for, increases in the risk posed by a particular bank. Moral hazard is particularly acute for institutions that are insolvent or close to insolvency. Owners of insolvent or barely solvent banks have strong incentives to favor risky behavior because losses are passed on to the insurer, whereas profits accrue to the owners. Owners of nonbank companies with little capital also have reason to favor risky activities, but attempts to shift losses to creditors are restrained by demands for higher interest rates, refusal to roll over short-term debt, or, in the case of outstanding longterm bond indebtedness, restrictive covenants required when the bonds were issued.

Probably the most effective counterforce to moral hazard is a strong capital position. Because losses will be absorbed first by bank capital, the likelihood (other things being equal) that they will be shifted to the FDIC diminishes as the capital of the bank increases. In addition, increased capital serves to protect creditors and helps reduce distortions in bank funding costs caused by deposit insurance. Capital regulation, therefore, tends to curb moral hazard, as do other forms of supervisory intervention--specifically the examination, supervision, and enforcement process. Moreover, risk-based capital standards and risk-based insurance premiums attempt to impose costs on banks according to the institutions' risk characteristics.

Placing the burden on the depositor defeats the purpose of deposit insurance:

Proposals for exposing depositors to greater risk seek to induce depositors to increase their monitoring of bank risk and, by means of their deposit and withdrawal activity, discipline and restrain risky banks. However, increasing depositors' risk could defeat the very purpose of deposit insurance.If the U.K. is going to offer deposit insurance, my suggestion would be to set the limit to cover the total deposits of say 98% of all depositors (£35,000 might be sufficient), and eliminate the coinsurance feature (insure 100% to £35,000).

...one should bear in mind the following considerations: (1) the relative cost of acquiring the information and analytical skills needed to monitor bank risk as compared with the cost and/or inconvenience of shifting funds to alternative investments entailing little risk; (2) the ability of depositors (and other market participants) to monitor bank risk effectively on the basis of publicly available data, given the 'opaque' quality of bank loan portfolios; and (3) the threat to the stability of the banking system resulting when potentially ill-informed depositors have greater risk exposure.

Fannie, Freddie Portfolio Caps Could be Lifted Next Year

by Calculated Risk on 9/22/2007 02:41:00 PM

The WSJ reports: Limits on Fannie, Freddie Could Be Lifted

The top regulator for Fannie Mae and Freddie Mac said limits on both companies' investment portfolios could be entirely lifted in February if they begin filing timely and audited financial statements.This is a discussion of removing the portfolio cap limit, not the conforming limit for the size of a loan.

...

The Office of Federal Housing Enterprise Oversight imposed strict limits on the portfolio size at Fannie Mae and Freddie Mac last year after accounting scandals at both companies. ... Neither company has filed timely audited financial statements in several years, though both plan to do so by early 2008.

Ofheo Director James Lockhart said in an interview that much could change between now and February, but he indicated for the first time that the caps could be eased. "There's a reasonable chance that the caps will be lifted or changed significantly" by that time, Mr. Lockhart said.

CRE: Bought at the top?

by Calculated Risk on 9/22/2007 12:50:00 AM

From the WSJ: Macklowes On a Wire

Mr. Macklowe and his son Billy paid $6.8 billion to buy seven New York buildings from Equity Office Properties Trust. ... the sale was one the most expensive real-estate deals in U.S. history, symbolizing the skyrocketing prices paid for buildings at a time of cheap debt and demand for office buildings.Talk about a leveraged transaction: borrowing $7.6 Billion for a $6.8 Billion purchase on properties that have probably declined in value. Approximately $5.0 Billion of the debt must be paid off in February.

The transaction was emblematic of the lax underwriting standards of the real-estate boom. Macklowe Properties put in only $50 million of equity and borrowed $7.6 billion, according to the documents. (Mr. Macklowe borrowed more than the purchase price to cover closing costs and other fees.) The deal also had "negative debt service," meaning that the rents from the buildings weren't expected to cover the debt payments for five years ...

Friday, September 21, 2007

Eurozone Slows

by Calculated Risk on 9/21/2007 07:35:00 PM

Wile E. Coyote UPDATE: Video of Paul Krugman interviewed by Georges de Menil on financial markets and global imbalances. (if this doesn't work, go to this page.)

From the Financial Times: Eurozone suffers ‘worst’ jolt since 9/11

The eurozone economy has this month suffered its biggest jolt ... with global financial turmoil hitting the services sector particularly hard, according to a closely watched survey.With the Euro at $1.41, and an ongoing credit crunch, it is no surprise that the Eurozone economy is slowing. Yesterday I argued that if the trade deficit has peaked - as seems likely - the dollar is probably much closer to the bottom than the top.

The unexpectedly steep fall on Friday in the eurozone purchasing managers’ index – the third consecutive monthly drop ...

... financial markets have started speculating that the next ECB interest rate move will be downwards.

This would be the other side of the coin: with the weak dollar, trade from the Eurozone to the U.S. will slow, impacting the Eurozone economy (although the service sector took the biggest hit in this report). This will probably lead to rate cuts in Europe - and that would also support the dollar at the current level.

Harman Says Buyout Scuttled

by Calculated Risk on 9/21/2007 04:25:00 PM

WSJ: Harman Says Buyout Scuttled

Harman International Industries Inc. learned this afternoon that Kohlberg Kravis Roberts & Co. and Goldman Sachs Group's GS Capital Partners VI Fund LP don't intend to complete their $8 billion buyout of Harman.The breakup fee is $225 Million. Perhaps that is why KKR is arguing Harman breached the merger agreement - to avoid, or at least negotiate, the fee.

...

Harman said the private-equity companies informed [Harman] that they believe there was a "material adverse change" in Harman's business and that Harman breached the merger agreement.

Harman disagrees ...

Q2 Mortgage Equity Withdrawal: $140.3 Billion

by Calculated Risk on 9/21/2007 03:41:00 PM

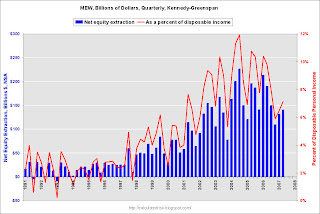

Here are the Kennedy-Greenspan estimates of home equity extraction for Q2 2007, provided by Jim Kennedy based on the mortgage system presented in "Estimates of Home Mortgage Originations, Repayments, and Debt On One-to-Four-Family Residences," Alan Greenspan and James Kennedy, Federal Reserve Board FEDS working paper no. 2005-41. Click on graph for larger image.

Click on graph for larger image.

For Q2 2007, Dr. Kennedy has calculated Net Equity Extraction as $140.3 Billion, or 7.1% of Disposable Personal Income (DPI). Note that equity extraction for Q1 2007 has been revised upwards to $131.3 Billion.

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, both in billions of dollars quarterly (not annual rate), and as a percent of personal disposable income.

It is very likely that MEW will collapse in Q3 2007, based on the tighter lending standards and falling home prices, leading, most likely, to less consumer spending.

HSBC to Close U.S. Mortgage Unit

by Calculated Risk on 9/21/2007 12:57:00 PM

From the WSJ: HSBC to Close U.S. Mortgage Unit

HSBC PLC will close its standalone U.S. subprime-mortgage business and take $945 million in related charges ...The beat goes on.

The London banking giant will close Decision One Mortgage, which originates nonprime mortgages through brokers. Instead, the company will focus on loan origination and servicing through its HFC and Beneficial bank branches.

...

Approximately 750 people will lose their jobs ...

Fed's Kohn on Causes of Housing Bubble

by Calculated Risk on 9/21/2007 11:48:00 AM

From Fed Vice Chairman Donald L. Kohn: Success and Failure of Monetary Policy since the 1950s. An excerpt on the causes of the housing bubble:

"... it is far too soon to pass judgment on what went wrong in the U.S. housing market and why. I suspect that, when studies are done with cooler reflection, the causes of the swing in house prices will be seen as less a consequence of monetary policy and more a result of the emotions of excessive optimism followed by fear experienced every so often in the marketplace through the ages. To some extent, too, the amplitude of the housing cycle was heightened by the newness of the subprime market, the fragmentation of regulatory oversight responsibility for that market, and the complexity and opacity of the newer instruments for transforming and distributing risk. Low policy interest rates early in this decade helped feed the initial rise in house prices. However, the worst excesses in the market probably occurred when short-term rates were already well on their way to more normal levels, but longer-term rates were held down by a variety of forces. And similar, sometimes even sharper, trajectories of house prices have been witnessed in some economies in which the central banks said they were paying more attention to asset prices."Many very lengthy papers will be written on the causes of the bubble. Agree or disagree, Kohn touches on a few key points: monetary policy definitely contributed to the initial surge in prices, lax oversight - Kohn says because of "fragmentation of regulatory oversight responsibility" - allowed the bubble to expand, and speculation played a key role. I'll post on what I consider the key causes this weekend.

Report: Harman LBO Deal in Trouble

by Calculated Risk on 9/21/2007 02:19:00 AM

Another private equity LBO is in trouble.

From the WSJ: Harman's Suitors Sour on Buyout

The private-equity buyers of Harman International Industries Inc. are balking at completing the $8 billion purchase of the audio-equipment maker, people familiar with the matter said, as yet another leveraged buyout falls into a hostile tête-à-tête between buyer and seller.Based on previous reports, the average loss on recent LBOs has been about 4% of the

...

Should KKR and Goldman choose to break the deal, they would have to pay a $225 million termination fee, according to corporate filings. That fee is about 2.86% of the deal's value, which is somewhat lower than other transactions of a similar size, according to an analysis by MergerMetrics.com.

As an aside, the Harman business has recently underperformed expectations, probably as a direct result of the housing bust.

Thursday, September 20, 2007

Emily Litella as a Central Banker: "Never mind"

by Calculated Risk on 9/20/2007 09:55:00 PM

Floyd Norris writes at the NY Times: Inside the Mind of the Fed

Six weeks ago, the Federal Reserve thought the American economy would easily weather problems in the credit market. One week ago, the Bank of England warned against the risks of bailing out those who had made risky loans.Norris notes that the Fed and the BoE changed course, but ...

This was a week to say “never mind.”

By yesterday ... the markets were moving in ways that cannot have made the Fed happy. The dollar fell — an expected result from cutting short-term interest rates — but long-term rates rose, and so did mortgage rates.This was my concern when I outlined a possible vicious cycle that could occur as the Fed cut rates: Watch Long Rates.

“Alan Greenspan’s conundrum is becoming Ben Bernanke’s calamity,” said Robert Barbera, the chief economist of ITG, recalling that when the Fed raised short-term rates under Mr. Greenspan, long-term rates did not follow. Now the opposite is happening, a fact that will make it that much harder to stimulate the economy.

Norris goes on to highlight two recent Fed papers that we've discussed before:

Those wanting to understand the Fed’s reversal can profit from reading two papers by Fed officials, released this summer as the credit squeeze was worsening.emphasis added

In total, they constitute an admission that the Fed was surprised by the housing and borrowing boom on the upside, and now fears it will be surprised on the downside.

The Dollar and the Trade Deficit

by Calculated Risk on 9/20/2007 03:07:00 PM

The following graph shows the U.S. trade deficit as a percent of GDP compared to the Fed Nominal Major Currencies Dollar Index.

NOTE: The trade deficit as a percent of GDP is presented as a positive number (for easier comparison to the dollar index). The 2007 trade deficit is estimated at 5.1% of GDP. The 2007 currency index is set to the Sept value. Click on graph for larger image.

Click on graph for larger image.

The common pattern is a currency strengthens and the trade deficit increases. Some time after the currency peaks, the trade deficit peaks. And that is followed by a bottom in the currency. There are other factors, but that is the common pattern.

The recent increase, and extraordinary size of the U.S. trade deficit, was probably related to the housing bubble and mortgage equity withdrawal (MEW). Now that MEW is generally declining, and the U.S. economy weakening, the U.S. trade deficit will probably continue to decline.

If the trade deficit has peaked, the dollar is probably much closer to the bottom than the top. I know this may seem like heresy, especially given recent events.

The biggest short term concern is that MEW will collapse, and the trade imbalance will unwind faster than expected. A "Wile E. Coyote moment"! (see Krugman: Will There be a Dollar Crisis? )

Also, from the WSJ: World Economy in Flux As America Downshifts

"We're definitely poised to have some significant rebalancing" of trade, says Harvard University economist Kenneth Rogoff, a former chief economist for the International Monetary Fund. He had been expecting the account deficit to shrink "by maybe half a percentage point of GDP over the next twelve months. Now it seems likely it will go down by 1.5 percentage points." And, he adds, "We could see something more rapid."

Something "more rapid" could be painful. Since Americans have financed their prosperity with borrowed money, reversing that habit means a period of living less opulently.

If foreign money turns scarce and the trade deficit narrows suddenly, Americans could face a tumbling dollar, soaring interest rates and an economic downturn. That could send shock waves back through Europe and Asia if their own consumers don't make up for lost demand from the U.S., the world's largest national economy.

If it happens more gradually, the recent run of American prosperity may continue, in a more subdued way.

Bernanke: Subprime mortgage lending and mitigating foreclosures

by Calculated Risk on 9/20/2007 11:19:00 AM

Fed Chairman Ben Bernanke testified before the House Committee on Financial Services this morning: Subprime mortgage lending and mitigating foreclosures. A few excerpts:

During the past two years, serious delinquencies among subprime adjustable-rate mortgages (ARMs) have increased dramatically. (Subprime mortgages with fixed rates, on the other hand, have had a more stable performance.) The fraction of subprime ARMs past due ninety days or more or in foreclosure reached nearly 15 percent in July, roughly triple the low seen in mid-2005.1 For so-called near-prime loans in alt-A securitized pools (those made to borrowers who typically have higher credit scores than subprime borrowers but still pose more risk than prime borrowers), the serious delinquency rate has also risen, to 3 percent from 1 percent only a year ago. These patterns contrast sharply with those in the prime-mortgage sector, in which less than 1 percent of loans are seriously delinquent.In July Bernanke argued that what started in subprime would stay in subprime. He was wrong. Now he is arguing that the problems will be contained to subprime and "near prime" loans. More likely delinquency rates will increase in all categories as house prices fall.

The Federal Reserve takes responsible lending and consumer protection very seriously. Along with other federal and state agencies, we are responding to the subprime problems on a number of fronts. We are committed to preventing problems from recurring, while still preserving responsible subprime lending.The Fed's job was to prevent these problems from "occurring". Preventing them from "recurring" is a tacit acknowledgment of the Fed's earlier failures.

On raising the GSE conforming limit:

Some have suggested that the GSEs could help restore functioning in the secondary markets for non-conforming mortgages (specifically jumbo mortgages, those with principal value greater than $417,000) if the conforming-loan limits were raised. However, in my view, the reason that GSE securitizations are well-accepted in the secondary market is because they come with GSE-provided guarantees of financial performance, which market participants appear to treat as backed by the full faith and credit of the U.S. government, even though this federal guarantee does not exist. Evidently, market participants believe that, in the event of the failure of a GSE, the government would have no alternative but to come to the rescue. The perception, however inaccurate, that the GSEs are fully government-backed implies that investors have few incentives in their role as counterparties or creditors to act to constrain GSE risk-taking. Raising the conforming-loan limit would expand this implied guarantee to another portion of the mortgage market, reducing market discipline further.In general I agree with Bernanke's comments on the GSEs and conforming limits. It might be reasonable to have different limits for different areas, based on the median income for each area.

There is much more in the speech.