by Calculated Risk on 9/14/2007 01:52:00 PM

Friday, September 14, 2007

Commercial Paper

From BusinessWeek: A New Risk to the Credit Markets

The shaky U.S. credit markets will face a critical test over the next few weeks, as companies try to find buyers for hundreds of billions of dollars in short-term debt that is set to expire. Corporate borrowers are expected to struggle in refinancing their debts, and the repercussions may go far beyond the companies in question. ...For reference, here is the Fed page tracking commercial paper and a couple of charts from the Fed.

The tightest squeeze may come in what's known as the asset-backed commercial paper market. ... About $417 billion worth of asset-backed commercial paper is scheduled to come due during the weeks of Sept. 10 and Sept. 17, or about half of the $959 billion market, according to Sherif Hamid, an investment-grade credit strategist at Lehman Brothers.

August Retail Sales

by Calculated Risk on 9/14/2007 11:42:00 AM

From MarketWatch: Autos boost August's retail sales

Retail sales rose 0.3% in August, led by a 2.8% increase in auto sales, the Commerce Department said Friday. Excluding motor vehicles, sales fell 0.4%, the biggest decline since last September.The ex-auto number is concerning, but overall this report shows sluggish - but not recessionary - consumer spending. If there is an impact from declining mortgage equity withdrawal (MEW), it is still not significant. Hopefully the Q2 MEW numbers will be available next week. I expect MEW to have increased slightly in Q2.

Sales were slightly weaker than expected, but an upward revision to July's figures -- to a 0.5% increase -- put the level of sales closer to expectations.

Northern Rock Bank Run

by Calculated Risk on 9/14/2007 09:01:00 AM

| UPDATE: From Paul in London. Northern Rock branch in Hounsditch, City of London 3.12pm today. |  |

From Bloomberg: Northern Rock Customers Crowd London Branches, Withdraw Money

Hundreds of Northern Rock Plc customers crowded into branches in London today to pull out their savings after the mortgage-loan provider sought emergency funding from the Bank of England ...

The Bank of England said it will provide emergency cash to Northern Rock, Britain's third-largest mortgage provider, in the nation's biggest bailout of a financial institution in 30 years. The rising cost of credit left the lender unable to make new loans and stoked concern among customers about their money.It looks like the older customers stand in the queue; there is probably an online bank run too.

Thursday, September 13, 2007

Video of the Day

by Calculated Risk on 9/13/2007 09:02:00 PM

NOTE: The video of the day (or so) won't be a post - it will just be at the bottom of the page. It's just for fun when I feel like updating it. People frequently send me funny videos, but I don't want to make them posts, so this gives me an outlet to put them on the blog. CR

At the bottom of the posts, I've started posting a video of the day. I'll try to change it every day or so. I'm trying to pick videos that are funny or related to housing and /or the economy. Please don't read too much into the videos I pick - and please feel free to suggest other videos.

Here were the first few couple I picked.

| Professor Shiller speaks on housing at the Jackson Hole 2007 Symposium. | |

| Students at the Columbia Business School Spring 2006 Follies make fun of their Dean and Fed Chairman Ben Bernanke to the Police's "Every Breath You Take". | |

Professor Krugman on housing from Sept 2006. Here is a quote from Dr. Krugman, in a "Paul Krugman responds to reader's comments" on the impact of mortgage equity extraction: "Actually, a lot has been written on that, although mainly on blogs like calculatedrisk.blogspot.com, my go-to site on housing matters. So far the effect of the housing slump on consumer spending has been much less than I expected, although there are hints in the data that it's finally beginning to bite." |

Best to all.

BofE Bails out Northern Rock

by Calculated Risk on 9/13/2007 08:26:00 PM

From AFP: Bank of England to bail out British lender: reports (hat tip Brian jb Carlomagno sk)

According to the BBC and the Financial Times newspaper, Britain's fifth-biggest mortgage lender has struggled with lending since a credit market squeeze over the summer after concern sparked by uncertainty in the US subprime mortgage sector.The article notes the letter BoE Governor Mervyn King sent yesterday:

They said that the Bank of England (BoE), Britain's central bank, had agreed to provide short-term lending to Northern Rock to help it see out the crisis in what the FT described as the most dramatic development in the UK banking market since the crisis began.

...

John McFall, chairman of the parliamentary committee that oversees financial issues, urged the lender's customers to stay calm.

He said Northern Rock's request for funding should be seen as "reassuring, because it means they think the problems are temporary."

In a letter to McFall's committee on Wednesday, BoE Governor Mervyn King warned that providing short-term liquidity to the financial markets while they were experiencing trouble served to encourage "excessive risk-taking and sows the seeds of a future financial crisis".So much for tough talk.

"The provision of large liquidity facilities penalises those financial institutions that sat out the dance, encourages herd behaviour and increases the intensity of future crises."

Housing Starts and Demographics

by Calculated Risk on 9/13/2007 06:48:00 PM

Both the UCLA Anderson Forecast and Goldman Sachs have recently revised down their estimates for housing starts for the next couple of years. UCLA is now forecasting starts falling to 1 million units annually. Goldman Sachs' forecast is for starts to fall to 1.1 million units in Q4 '07 and Q1 '08 (see bottom of this post for Goldman's housing forecast by quarter).

My forecast is for starts to fall to about 1.1 million units.

Two Key Points:

1. If these forecasts are accurate, starts have fallen less than 60% from the recent peak annual rate in 2005 (2.07 million units) to the eventual bottom. We are barely more than half way, in terms of starts, from the peak to the trough!

2. Demographics are NOT currently favorable for housing as compared to the late '60 through early '80s.

Here is a graph of housing starts since 1959 at a Seasonally Adjusted Annual Rate (SAAR) (Source: Census Bureau). Note: Remember starts include homes built for sales, owner built homes, apartments and condominiums. These number can't be compared directly to New Home sales. Click on graph for larger image.

Click on graph for larger image.

This graph shows that starts have fallen from just over 2 million units per year to an average of 1.45 million (SAAR) over the first 7 months of 2007. Based on the above forecasts there is a second significant decline in starts coming.

Look at those peaks in starts in the '70s and early '80s. This has led some analysts to argue that the recent peak in activity wasn't extraordinary, especially since the U.S. population is growing. This is an inaccurate view. The second graph shows the trend of people per household (and people per total housing units) in the United States since 1950. Before the period shown on this graph there was a long steady down trend in the number of people per household.

The second graph shows the trend of people per household (and people per total housing units) in the United States since 1950. Before the period shown on this graph there was a long steady down trend in the number of people per household.

Note: the dashed lines indicates estimates based on the decennial Census for 1950 and 1960.

Starting in the late '60s there was a rapid decrease in the number of persons per household until about the late '80. This was primarily due to the "baby boom" generation forming new households en masse.

It was during this period - of rapid decline in persons per household - that the peaks in housing starts occurred. Many of those starts, especially in the '70s, were for apartments. Even if there had been no increase in the U.S. population, the U.S. would have needed approximately 27% more housing units at the end of this period just to accommodate the change in demographics (persons per household).

Now look at the period since 1988, the persons per household has remained flat. The increase in 2002 was due to revisions, and isn't an actual shift in demographics. If the population had remained steady since 1988, the U.S. wouldn't have needed any additional housing units!

Here is a simple formula for housing starts (assuming no excess inventory):

Housing Starts = f(population growth) + f(change in household size) + demolitions.

f(change in household size) was an important component of housing demand in the '70s and early '80s. In recent years, f(change in household size) = zero.

Now for a little good news for housing:

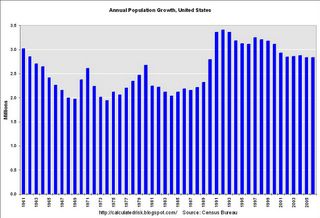

This chart show the annual U.S. population growth according to the Census Bureau. The surge in the early '90s was probably a combination of the Baby Boom echo and perhaps immigration. But the key is that population growth is currently running about 2.85 million people per year.

Back to the formula, this means f(population growth) is larger now than in the '70 and '80s. Unfortunately the improvement in this term is dwarfed by the decline in f(change in household size).

Another piece of good news for housing is that the housing inventory is aging, meaning that the need for demolitions is steadily increasing.

As I noted above, this analysis excludes excess inventory, and unfortunately the current excess is significant (I'll return to this point).

The two key points: there is a second significant decline in starts ahead of us, and demographics are not currently favorable for housing (compared to the '70 and early '80s).

Bay Area home sales slowest since 1992

by Calculated Risk on 9/13/2007 03:01:00 PM

From DataQuick: Bay Area home sales slowest since early 1990s, flat prices

Bay Area homes sold at the slowest pace in 15 years last month as market uncertainty intensified, forcing more buyers, sellers and lenders to the sidelines. Prices remained flat at the regional level but there were local variations, a real estate information service reported.And on prices:

A total of 7,299 new and resale houses and condos were sold in the nine-county Bay Area in August. That was down 1.7 percent from 7,423 in July, and down 24.9 percent from 9,713 for August a year ago, according to DataQuick Information Systems.

Sales have decreased on a year-over-year basis the last 31 months. Sales last month were the lowest for any August since 1992 when 6,688 homes were sold. The strongest August in DataQuick's statistics, which go back to 1988, was in 2004 when 13,940 homes were sold. The August average is 10,170.

"Homes in the Bay Area are more expensive than elsewhere and most of them are financed with 'jumbo' mortgages. The turbulence in the mortgage markets has made it more difficult to get this type of financing. The question is: does this pull the plug on some market activity, or does it just slow things down? We won't know the answer for a few months," said Marshall Prentice, DataQuick president.On foreclosures:

The median price paid for a Bay Area home was $655,000 last month. That was down 1.5 percent from the June and July peak of $665,000, and up 4.0 percent from $630,000 for August a year ago.

Foreclosure resales accounted for 4.8 percent of August's sales activity, up from 4.5 percent in July, and up from 1.2 percent in August of last year. Foreclosure resales do not yet have a regional effect on prices.These numbers are for both new and existing homes. For existing homes, sales that closed in August were actually signed in June or July - before the credit market turmoil. That is why we have to wait a couple of months to know the answer to DataQuick's question: "The question is: does this pull the plug on some market activity, or does it just slow things down?"

Greenspan: "I really didn't get it"

by Calculated Risk on 9/13/2007 12:51:00 PM

From the WSJ: ‘60 Minutes’: Greenspan Praises Bernanke

Greenspan says he knew about the questionable subprime lending tactics that gave loans to homebuyers and investors with low adjustable interest rates that could rise precipitously, but not the severe economic consequences they posed. “While I was aware a lot of these practices were going on, I had no notion of how significant they had become until very late,” he tells Stahl. “I really didn’t get it until very late in 2005 and 2006.”And from October 2006:

Former Federal Reserve Chairman Alan Greenspan said the "worst may well be over" for the U.S. housing industry that's suffering its worst downturn in more than a decade.I hate to pick on Greenspan (too easy of a target), but it was his job to know about the loose lending practices. And no matter how he tries to rewrite history, Greenspan didn't "get it" even in October of 2006.

See CFC See FC, by BD

by Anonymous on 9/13/2007 12:45:00 PM

This will either fix those of you who complain that my posts are too text-heavy, or it will not.

CFC's August Operational Report

by Anonymous on 9/13/2007 09:17:00 AM

A lot of this we've already seen in various news reports, but since it always comes up for discussion, I thought it might be helpful to look at the various moving parts of CFC's operational changes:

Addressing liquidity and funding needs by accelerating our plans to migrate the funding of our mortgage originations to Countrywide Bank, and our borrowing of $11.5 billion under our lines of credit. Additionally, the Company recently arranged for $12 billion in additional secured borrowing capacity through new or existing credit facilitiesI did an UberNerd post the other day on "origination channels," one purpose of which was to explain the difference between a mortgage banker and a bank. What CFC is doing is (attempting to) transform itself from primarily a mortgage banker (with a small bank) to a big bank. Instead of borrowing money to make mortages with in the capital markets, and selling them immediately, as a mortgage banker does, CFC is "migrating" to depository banking, using deposits and the kind of borrowing that is available to banks (interbank loans, for instance) to fund mortgages.

Materially tightening product and underwriting guidelines such that all loans the Company now originates are eligible for Fannie Mae, Freddie Mac or Ginnie Mae securitization programs, or otherwise meet Countrywide Bank's investment criteria.This is more of the implications of moving from mortgage banking to banking: CFC will still sell loans, but only to the GSEs/Government-insured market. The "nonagency" loans will have to be "portfolio" quality (even if they do not always remain in the investment portfolio). What this excludes is, precisely, the kind of loans that you would be willing to sell but not to hold, or a big chunk of what got made in the last 5 years or so under the private-issue Alt-A/subprime rubric. That's one of the costs of being a bank. Of course, since the bottom fell out of the Alt-A/subprime market, it's not much of a "cost" today. Except that:

Taking advantage of reduced primary market competition to adjust pricing, which is expected to have a favorable impact on mortgage banking gain-on-sale margins and result in greater returns on the high-quality loans originated for our Bank's investment portfolio.Profit margins for good old-fashioned GSE swap/portfolio hold depositories have never been quite as rich as the profit margins for high-rollin' Alt/Subprime mortgage bankers. What you are being told here is that CFC plans on being "the last man standing," and therefore to use the "pricing power" this provides to be a bank that makes money like a mortgage banker. However, that still requires something like a bank's expense load:

Announcing plans to reduce expenses in response to lower expectations for mortgage origination market volume. These plans include workforce reductions of up to 20 percent.So. Welcome to Main Street, Countrywide. Lay off the high-flying sales force, hire tellers to take deposits, make Your Dad's Mortgage Loans, and start calculating your gain on sale and net interest margin in nickels and dimes. Just like the old fogie bankers on Elm and Maple you've been stomping all over for years. Hope it works for you. Can I get a free calendar?

Prepayment Penalties and Bologna Sandwiches

by Anonymous on 9/13/2007 08:20:00 AM

The NYT has an article on prepayment penalties this morning, that almost but not quite arrives at the core issue:

The lenders say the trade-off is the only way to offer low monthly payments initially because otherwise borrowers would flee when rates adjust upward and make the loan a losing deal. The fees usually equal several months’ interest, and they decline over a few years before disappearing altogether.The "traditional" prepayment penalty is, indeed, a way of putting an "exercise price" on the "imbedded call" in a mortgage loan. A mortgage borrower always has the right to prepay the loan (in options lingo, that's a "call"). Without a prepayment penalty, the price of that call is always par: you may refinance at any time by paying the lender just the principal due (and any accrued interest to the payoff date).

A prepayment penalty, in essence, forces you to "buy" your loan from the original lender at an above-par price. Looking at it in terms of yield, which is more a more everyday way of going at it, the prepayment penalty collects the interest that the lender gave up by making the loan at an originally discounted interest rate. If you "survive" the prepayment penalty period, the discount is in your pocket; if you don't, the lender is "reimbursed" for the discount out of the penalty interest. You give up mobility in return for lower interest costs. Is the theory.

In an environment of "traditional" underwriting in which people actually qualify for the loans they get, prepayment penalties can certainly be construed as "fair" (assuming they're fully disclosed and the penalty is no more than the value of the initial discount). The problem we have here is that the "discount" is a teaser: it crosses the line from "initial rate break" to "hook," as qualifying on the teaser rate is the only way the borrower can get the loan. Then it becomes just "back-loaded" interest payments, because these loans are structured to either force the borrower to refinance (and pay the penalty) to avoid the way above market reset, or to pay the way above market reset, which quickly "erases" the initial discount. That's some "call option."

The Nontraditional Mortgage Guidance, insofar as it put paid to qualifying borrowers at anything other than the fully-indexed, fully-amortizing loan payment, has already indirectly cut out most toxic prepayment penalties, since it takes away the incentive to artificially discount the start rate of the loan. Indeed, the 2/28 expired as a product not all that long after widespread adoption of the Guidance. From a certain perspective, this does, exactly, mean what all the industry lobbyists so plaintively warned us it would mean: the cost of mortgage credit went up in response to regulatory action.

But it is always worthwhile to look at it from another perspective, which is that the cost of mortgage credit just got smoothed out, not increased: borrowers are now paying their interest load from the beginning, at a tolerable level, rather than paying it "at the back of the loan" in a way that breaks the borrower's back. Insofar as it is still "unaffordable" to get a mortgage loan, we can return to the subject of insane home prices and lagging incomes.

We close, as does the Times article, with words of wisdom from a mortgage broker:

That is what happened to Dorinda Weisman, a social worker in Elk Grove, Calif. In 2005 she borrowed $353,000 from Pacific American Mortgage to buy a home in Sacramento with a small down payment. The prepayment penalty, of $9,000, expired in just a year.

“One of the things I always wanted was to own a house,” Ms. Weisman said in a telephone interview. “I was a single parent, and my son is a hemophiliac. I had been living in a middle-class African-American neighborhood that went downhill after the drugs came in.”

By the time the penalty expired, her house had declined in value. Refinancing was no longer possible.

Her interest rate had shot up to 9.8 percent from 4.75 percent. She says about 85 percent of what she brings home — her salary is $60,000 as a social service consultant with the state government — now goes to the mortgage.

She is trying to negotiate a new loan with the help of the Neighborhood Assistance Corporation of America, a nonprofit home ownership organization based in Jamaica Plain, Mass.

“Like a lot of people, the adjustable ate up her equity,“ said her mortgage broker, Antonio Cook of Toneco Financial. “She’s got to ride it out and sacrifice. I tell people, ‘I don’t care if you eat bologna sandwiches, just pay your bills on time.’ If she can ride it out, things start coming up good.”

First Data Loans Delayed

by Calculated Risk on 9/13/2007 03:04:00 AM

From Bloomberg: First Data Loans Delayed as KKR, Banks Keep Talking, People Say

Kohlberg Kravis Roberts & Co. may delay the sale of loans to fund its $26 billion buyout of First Data Corp. until at least next week after failing to agree on terms with its bankers ...

KKR ... and banks led by Credit Suisse Group couldn't agree today on pricing or how much of the debt lenders will try to sell ...

Demand for LBO debt has evaporated. After buying a record $754 billion of leveraged loans this year, investors are balking at debt without covenants, or restrictions, that give them greater power over a company's finances.

Wednesday, September 12, 2007

Tough Talk from BofE's Mervyn King

by Calculated Risk on 9/12/2007 09:37:00 PM

Here is a letter today from Mervyn King, Governor of the Bank of England including, a paper titled: Turmoil in Financial Markets: What can Central Banks do?.

Here is the conclusion:

The path ahead is uncertain. There are strong private incentives to market players to recognise early and transparently their exposures to off-balance sheet entities and to accelerate the re-pricing of asset-backed securities. Policy actions must be supportive of this process. Injections of liquidity in normal money market operations against high quality collateral are unlikely by themselves to bring down the LIBOR spreads that reflect a need for banks collectively to finance the expansion of their balance sheets. To do that, general injections of liquidity against a wider range of collateral would be necessary. But unless they were made available at an appropriate penalty rate, they would encourage in future the very risk-taking that has led us to where we are. All central banks are aware that there are circumstances in which action might be necessary to prevent a major shock to the system as a whole. Balancing these considerations will pose considerable challenges, and in present circumstances judging that balance is something we do almost daily.

The key objectives remain, first, the continuous pursuit of the inflation target to maintain economic stability and, second, ensuring that the financial system continues to function effectively, including the proper pricing of risk. If risk continues to be under-priced, the next period of turmoil will be on an even bigger scale. The current turmoil, which has at its heart the earlier under-pricing of risk, has disturbed the unusual serenity of recent years, but, managed properly, it should not threaten our long-run economic stability.

emphasis added

Lawyers: CRE Slowdown "Like an Earthquake"

by Calculated Risk on 9/12/2007 05:40:00 PM

From Law.com: Real Estate Deals Are Feeling the Credit Pinch (hat tip Vader)

The sudden queasiness of lenders has cast a pall over the once-robust real estate market in the last six weeks, [Stephen Cowan, a DLA Piper real estate partner] and other lawyers report. Deals have been interrupted mid-stride. Some have been re-jiggered and others have just died.The landscape has shifted. The CRE slump is here.

...

The up-and-down nature of the real estate practice is nothing new. What is new, lawyers say, is the quickness with which this dip descended.

"I've been through cycles in the '70s, '80s and '90s -- this was a very sudden change," said DLA's Cowan. "It caught everyone off guard -- even though everyone was saying, 'It's coming, it's coming.' It was like an earthquake."

In a Hole? Keep Digging!

by Anonymous on 9/12/2007 03:33:00 PM

Normally I see very little point in reading press releases, but this one caught my eye. Worried about lenders using those AVMs to value real estate in mortgage lending transactions? Worry no more! You can now buy a cheap piece of software to "test" the results of your cheap piece of software! It will either still be cheaper than sending an appraiser out to look for foundation cracks, which will mean no one will ever look for foundation cracks, or it will be even more expensive what with running both kinds of software, in which case, we'll pass that "savings" on to you, the consumer, and still not use professional appraisers! You have to love simple solutions to regulatory policy changes.

Is it happy hour yet?

AUSTIN, Texas, Sep 12, 2007 (BUSINESS WIRE) -- FirstClose, a service of First Lenders Data, Inc. (FLDI), an Austin, Texas-based provider of bundled mortgage settlement services, announced today that it has developed a comprehensive approach to back-testing Automated Valuation Models (AVMs), entitled ValueTest(TM).Oh, the vendor of this wildly exciting product also sells "settlement services," meaning it has a vested interest in seeing to it that closings don't get cancelled because of those pesky "valuation" problems. Surprise! Could that be why this is so "inexpensive," or is it just some PlaySkool My First Laptop-quality version of everyone's favorite game, Regulatory Evasion? Or both?

The ValueTest(TM) program is designed to help lenders satisfy recent regulations and guidelines from Fannie Mae, Freddie Mac, the OCC, the NCUA, and other regulatory bodies that have imposed requirements or guidelines on lenders to "back test" AVMs regarding their accuracy. Utilizing a vast array of the mortgage industries top AVM companies and collateral risk assessment tools, ValueTest(TM) provides lenders with a simple, easy, and inexpensive way to satisfy regulatory requirements.

"We are excited about offering an inexpensive, yet comprehensive solution to our mortgage lending customers to help them satisfy regulatory requirements," said Tedd R. Smith, Chief Executive Officer of First Lenders Data, Inc. "Back Testing AVMs has been an ongoing concern of our customers since regulatory inception and no one seems to be able to provide a safe and inexpensive solution until now."

According to Fannie Mae's Perspective on Automated Valuation Models (AVMs), "It is critical that users of AVMs design an appropriate use and implementation strategy that considers the overall credit risk of the loan and reflects the specific strengths and weaknesses of the particular AVMs they use, particularly the property data supporting those products." The ValueTest(TM) program works well for any mortgage lender offering both first and second mortgage loans. As part of quality control checks and balances, the ValueTest(TM) program can be custom designed to fit any lenders needs and requirements.

As soon as I finish development of HorseHockeyTest™, I'm going to quit blogging and get rich. You have been warned.

DataQuick: SoCal home sales at 15-year low

by Calculated Risk on 9/12/2007 02:12:00 PM

From DataQuick: SoCal home sales at 15-year low, prices edge down

Home sales in Southern California dropped to their lowest level since 1992 as buyers, sellers and lenders held back in an environment of market uncertainty. Prices are off their peak, markedly so in lower cost neighborhoods, a real estate information service reported.For existing homes August typically has more sales than July, so on a seasonally adjusted basis, this report is worse than it appears.

A total of 17,755 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month. That was down 0.6 percent from 17,867 for the previous month, and down 36.3 percent from 27,857 for August last year, according to DataQuick Information Systems.

Last month's sales were the slowest for any August since 1992, when 16,379 homes sold, the lowest for any August in DataQuick's statistics, which go back to 1988. The strongest August was in 2003, when 39,562 homes sold. The August sales average is 28,160.

On prices:

The median price paid for a Southland home was $500,000 last month, down 1.0 percent from $505,000 in July, and up 2.7 percent from $487,000 for August last year.On foreclosures:

When adjusted for shifts in market mix (i.e. fewer lower-cost homes selling now), year-over-year price changes went negative in January and are now 3.5 percent below year-ago levels.

Foreclosure resales accounted for 8.8 percent of August's sales activity, up from 8.3 percent in July, and up from 2.2 percent in August of last year. Foreclosure resales do not yet have a marketwide effect on prices, although foreclosure discounts appear to be emerging in some local Inland Empire and High Desert markets.

CRE: The Big Chill in Orange County

by Calculated Risk on 9/12/2007 01:05:00 PM

From the WSJ on Orange County, CA: Troubled Lenders May Chill Once-Hot Market

The subprime-mortgage industry crisis and Orange County's economic tailspin are likely to have a chilling effect on nearly all types of commercial real estate in this formerly go-go market, some analysts say.The CRE story: falling demand, rising supply.

A number of shrinking mortgage companies are already dumping office space on the market. The area's weakening job and housing market will also pinch consumer spending ...

...many office landlords are trying hard to win tenants with deals of free rents and other concessions that have masked the downward pressure ... Asking rents on premium space that now average about $35 a square foot are likely to fall as much as 15% over the next 18 months as building owners face the double whammy of a drop in demand and a surge of new speculative construction coming on line, Mr. Ingham says.

In the previous story on shopping centers, Orange County was consider one of the strong areas:

In metropolitan areas with strong population growth, like Phoenix and Orange County, Calif., new shopping centers are easily attracting tenants, according to a report by the CoStar Group, a research company in Bethesda, Md. But new centers in several other metropolitan areas — Memphis, Cleveland, Indianapolis, Tucson, Southwest Florida and Nashville — are having trouble leasing space, CoStar said.Phoenix and Orange County are the strong areas? Oh my ...

Shopping Centers Feeling Housing Woes

by Calculated Risk on 9/12/2007 12:03:00 PM

More on CRE.

From the NY Times: Shopping Centers Begin to Feel Ripples of Housing’s Ills (hat tip vader)

... shopping centers have been caught in the credit squeeze that has transformed the capital markets. Private buyers, who were once able to finance 95 percent or more of the cost of a transaction, are being driven out of the market because such high leverage is no longer available.Rising vacancy rates, falling prices, increasing supply and tighter credit: a prescription for a CRE slump.

According to investors, brokers and analysts, deals are taking longer to complete, and prices — at least for the second- and third-tier properties — are declining by as much as 10 percent.

...

While demand for space remains strong at the high-end regional malls, the average vacancy rate at strip malls, which are generally anchored by supermarkets, has been creeping up for more than two years, even though relatively little new space has been developed, according to Sam Chandan, the chief economist for Reis, a New York research company.

Mr. Chandan said the vacancy rate stood at 7.3 percent at the end of June and was expected to rise to 7.6 percent by the end of the year, its highest level since 1995.

In the second half of the year, he said, about 26.2 million square feet in strip malls will be completed, which would contribute to an oversupply. “That’s the highest level of completions we’ve seen in many years, and it coincides with the slowdown in the underlying drive for space,” he said.

WSJ on AHM Servicing

by Anonymous on 9/12/2007 11:25:00 AM

This is an absolute horror. It's the kind of thing I have had in mind when, in the last few months, I have expressed generalized terror over the idea of large servicer failures.

Thousands of homeowners face an "imminent risk" of losing their homes because of clashes between American Home Mortgage Investment Corp. and its former financial backers, according to Freddie Mac, a government-chartered housing financier.HousingWire has more on the story here.

In documents filed with the U.S. Bankruptcy Court in Wilmington, Del., Freddie Mac said it seized $7 million that homeowners sent to American Home to cover principal and interest payments, property taxes and insurance just before the company's Aug. 6 collapse. American Home quit making payments to tax authorities and insurance companies Aug. 24.

Freddie Mac said 4,547 loans valued at nearly $797 million are at stake. It said it doesn't have the loan files necessary to pay insurance premiums and property taxes on them, however. "Therefore, there is the imminent risk that borrowers' insurance policies may lapse for nonpayment, subjecting the borrowers to a risk of loss of their mortgaged properties," Freddie Mac said.

Property-tax bills will go unpaid, Freddie Mac said, "resulting in increased tax liabilities and possible tax-foreclosure sales." It added it needs a court order allowing it to seize American Home's loan files "to avoid these serious consequences stemming from AHM's inability to service the Freddie Mac mortgage loans." . . .

American Home has resisted demands that it give up loan-servicing files, hoping to auction its loan-servicing business intact in an effort to raise money for creditors. Loan-servicing businesses have proven to be among the few valuable assets left in the wreckage of the failed lenders. Some of Wall Street's biggest investment banks are fighting for control of them.

For ordinary homeowners, however, the results could be dire, consumer lawyers say. "Companies receive the loan files that they are supposed to be servicing, but the payments don't catch up," said Jill Bowman, an attorney with James Hoyer Newcomer & Smiljanich, a Tampa, Fla., law firm that represents consumers in class-action suits against mortgage companies. "Payments are being deemed late, even when they're not, because they can't catch up with the paper." The result is additional insurance costs and accumulating late fees. . . .

Just days before American Home's bankruptcy filing, Freddie Mac and Ginnie Mae terminated the company's loan-servicing rights. They also sent representatives to collect loan files from American Home's servicing facility in Irving, Texas.

In court documents, American Home said Ginnie Mae representatives "stood in a line in front of the doors and sat on the stairs, preventing AHM Servicing employees from entering the office." Freddie Mac said American Home "had its security personnel escort the Freddie Mac representatives out."

In addition to Freddie Mac and Ginnie Mae, several Wall Street banks are fighting to extract their loans from American Home's servicing operation. The list includes Morgan Stanley, Deutsche Bank AG, Credit Suisse Group and EMC Mortgage.

In an interview last week, Ginnie Mae's senior vice president, Theodore B. Foster, said Ginnie Mae had seized from American Home some of the insurance and tax payments collected from homeowners. "What's occurred is that we have the money, but AHM hasn't been able to or willing to pay the taxes and insurance, and they have the loan records," Mr. Foster said. "Therefore, we don't know who to pay, and we don't know how much."

Bottom line: attempts to "preserve values" in bankruptcy proceedings pit the servicer's creditors against the interests of the borrowers. Investors like Freddie Mac have to seize custodial accounts to make sure they don't disappear, but without cooperation of the servicer they can't apply that money to customer accounts. The servicer presumably knows how to apply it, but the investors aren't willing to let them.

Oh yeah, and all that dope we've been smoking for years about how it's all electronic and online now and we don't have to actually have physical brawls in the corridors over actual physical loan files? That was, well, dope. It isn't clear to me why Freddie and Ginnie folks had to show up on the doorstep if all they needed were computer files. Of course, the problem is that Freddie and Ginnie don't use AHM's servicing software, so a computer file of loan data (including tax and insurance payment information) wouldn't help them any.

This makes people like me want to throw up, when you think about the number of times mortgage servicers screw up escrow payments when there is no BK and they use their normal systems. You have to imagine investors like Freddie getting ahold of a paper file, and then doing all this manual processing to cover the tax and insurance disbursements. Freddie Mac and Ginne Mae (and Fannie Mae) are not mortgage servicers; their capacity to handle this sort of thing is limited. But even if they could find a substitute emergency servicer, it looks like the substitute servicer would have been thrown out by AHM as well.

OTOH, the idea of Ginnie Mae reps forming a human chain across AHM's door and singing "We Shall Overcome" until someone handed over the damned files does warm the cockles of my pinko little heart. Ginnie Vive!

Housing Costs as Percent of Paychecks

by Calculated Risk on 9/12/2007 10:55:00 AM

From the NY Times: Housing Costs Consumed More of Paychecks in 2006

Housing costs ate up more of the monthly paycheck for millions of Americans in 2006 than the year before, despite signs of a slowdown in the housing market, according to figures made public today by the Census Bureau.

Nationally, half of renters and more than one third of mortgage holders — 37 percent, up from 35 percent in 2005, or a rise of more than 1.5 million households — spent at least 30 percent of their gross income on housing costs, the level many government agencies consider the limit of affordability.