by Anonymous on 8/23/2007 09:31:00 AM

Thursday, August 23, 2007

MMI: Calling All Tools

Sorry I'm up so late this morning. This, however, is probably the best Bloomberg headline I have ever seen.

Bernanke Using `All Tools' to Calm Markets, Dodd Says

Wednesday, August 22, 2007

BofA Invests $2 Billion in Countrywide

by Calculated Risk on 8/22/2007 07:46:00 PM

From the WSJ: Bank of America Invests $2 Billion in Countrywide

Bank of America Corp. acquired a $2 billion equity stake in Countrywide Financial Corp., a move aimed at dispelling a crisis of confidence among creditors and investors in the nation's largest home-mortgage lender.

The move illustrates how amid the current shakeout among mortgage lenders, some financial heavyweights -- including Bank of America and Wells Fargo & Co. -- are gaining a firmer grip on the home-mortgage business even as smaller rivals with less-secure financing and capital bases fall by the wayside or are forced to retrench.

...

Bank of America's investment involved Countrywide nonvoting convertible preferred stock yielding 7.25% annually. The preferred can be converted into common stock, subject to restrictions on trading for 18 months. A full conversion would give Bank of America a 16% to 17% stake in Countrywide's common shares...

Lehman Brothers Shuts Down Subprime Unit

by Calculated Risk on 8/22/2007 02:52:00 PM

From Bloomberg: Lehman Brothers Shuts Down Subprime Unit, Fires 1,200 Employees (hat tip Viv)

Lehman Brothers Holdings Inc., the biggest underwriter of U.S. bonds backed by mortgages, became the first firm on Wall Street to close its subprime-lending unit and said 1,200 employees will lose their jobs.The beat goes on.

... Lehman acquired Irvine, California-based BNC [Mortgage] in 2004 and used it to expand in lending to homeowners with poor credit or heavy debt loads. ...

Accredited Home Lenders Holding Co., a subprime specialist, announced 1,600 job cuts earlier today in an effort to outlast the credit crunch that has forced dozens of rivals out of business. HSBC Holdings Plc is eliminating 600 positions in its U.S. operations and closing a mortgage office in Indiana, and Capital One Financial Corp. is closing GreenPoint Mortgage because it can't make money anymore lending to homeowners and then selling those mortgages to investors.

Banks borrow $2 bln from Fed Discount Window

by Calculated Risk on 8/22/2007 12:42:00 PM

From MarketWatch: U.S. banking giants borrow $2 bln from Fed

... Citigroup Inc., J.P. Morgan Chase, Bank of America and Wachovia Corp. said on Wednesday that they borrowed $2 billion from the Federal Reserve ...

Citibank said it took out a $500 million, 30-day loan from the New York Fed's discount window program for its clients. ... "Citibank stands ready to continue to access the discount window as client needs and market conditions warrant," the bank said in a statement.

Toll Brothers: Look Out Below

by Calculated Risk on 8/22/2007 11:49:00 AM

"In single-family communities, we typically do not start a home until we have a contract in place and a significant non-refundable down-payment. ...So even with significant non-refundable down-payments, Toll Brothers is experiencing record cancellation rates for Toll (this is 24% for Toll, below many other builders because of the larger non-refundable deposits). And this was for the period ending July 31st - so this is the "pre-turmoil" cancellation rate.

Even with these policies, during this downturn, we have experienced a much higher rate of cancellations than at any time in our twenty-one-year history as a public company."

Bob Toll, CEO Toll Brothers, Aug 22, 2007 (emphasis added)

"Through our third-quarter-end [July 31st, pre-turmoil], our buyers generally were able to obtain both conforming and jumbo loans (loans over $417,000).Translation: "Look out below!"

Nevertheless, tightening credit standards will likely shrink the pool of potential home buyers: Mortgage market liquidity issues and higher borrowing rates may impede some customers from closing, while others may find it more difficult to sell their existing homes."

"We believe that reducing new home production until the current oversupply is absorbed is a key step in bringing housing markets back into equilibrium."Translation: "If everyone else would stop building, maybe we would be OK."

Watch for housing sales and starts to decline precipitously in the coming quarters. Yesterday, BofA analysts forecast new home sales to fall to 700K per year (SAAR). My forecast is for starts to fall to around a 1.1 million SAAR.

Update: Herb Greenberg had almost the same reaction: For Whom the Market Tolls (As in Homebuilder)

Just Say No To Stated Income

by Anonymous on 8/22/2007 11:05:00 AM

I'm going to get all detailed and nerdy about this, but it's a huge matter of current policy debate. And, frankly, the cheerleaders for stated-income lending get by with the quickie soundbites that might sound plausible to those who are not well-versed in traditional methods of mortgage underwriting. Those arguments don't hold up to scrutiny, but not enough people are doing that scrutinizing.

My text today is "Should Stated-Income Loans Be Barred?" by Jack Guttentag, who calls himself "The Mortgage Professor." No way that kind of hubris is going unpunished today.

The "Professor" believes that stated income loans, or what he refers to as "SILs," should remain widely available. He offers some examples of "legitimate" SILs:

Full documentation generally requires that applicants show that the income they claim was actually earned in each of the two prior years. This is usually done by presenting W-2s or tax returns for two years. Self-employed borrowers usually have the most trouble meeting this requirement; stated-income loans were originally designed to deal with them, but other legitimate cases quickly emerged.This, of course, is confusing a lender's rules on calculation of qualifying income with a lender's practice of verifying it. If a lender's guideline is that applicants are qualified at the average of the last two years' income--and sometimes this is a rule--you are using "SIL" to lie your way around the guidelines if, when asked to state your average income for the last two years, you state your income from last month.

Many applicants with incomes from salaries can't meet full-doc requirements. They may not have held their position long enough, or their latest increase in salary may not be reflected in documents covering past income.

Every lender can make an exception to the two-year average rule-of-thumb for determining "qualifying income." If you just stopped being Nurse Sue and became Assistant Professor of Nursing Sue, and you spent the last two years renting while you were building up your credentials for that career move, waiting to buy until it made more financial sense for you, and you can give me the W-2s, rental history, and employment agreement with Nursing U to prove it, I won't just make you a loan, I'll cut your cake and give you a big warm hug because you're my kind of borrower.

If you've been behind the counter at Taco Bell for the last two years, but just recently got put on the payroll at your brother-in-law's new vitamin supplement marketing startup company, and now you'd like to do a cash-out refi to make a little investment with? You will be "qualified" on your average Taco Bell income for the last two years. I'm the underwriter. I make the rules. You do not get to "underwrite yourself" by deciding that my rule on qualifying income is "unfair" to you and therefore you can get around them by "going stated."

If a married couple pool their incomes and one has a much lower credit score than the other, the full-doc rule is that the lower score is the one used. Stated income allows the partner with the higher score to claim all the income, which appears reasonable in most situations, especially in community-property states, where husband and wife share legal right to each other's incomes.It appears reasonable to use stated income to lie your way around the lender's rules on credit history? Really?

Since the dawn of time, Prudence has married Spendy. The idea is usually that Prudence is going to "reform" Spendy. The love of a good spouse and all that. Fine. I'm an underwriter, not your mother. You can marry whoever you want to.

The problem is that, since the day after the dawn of time, divorce lawyers have been admitted to the bar, because it does tend to turn out that Prudence and Spendy argue a lot. Sometimes it's over whether they should make the mortgage payment or take the cruise to Aruba. The mortgage payment does not always win.

If you want me to consider you an "economic unit" for the purposes of granting you a loan, then I will do so. But that means that I can consider your creditworthiness in terms of the total unit. If I count Spendy's income, I count Spendy's FICO. Claiming that all the income is Prudence's in order to get around this is fraudulent misrepresentation designed to induce a lender to make a loan that it would not otherwise grant.

Got one of those situations where one spouse has excellent credit and one is just recovering from a past bout of misfortune? Fine. Give me the documents showing the layoff, the illness, the resumption of payments, the well-managed current debt situation, and we'll talk. Tell me it was all a misunderstanding, while refusing to give me paystubs? I don't think so.

Full documentation rules are backward-looking; forecasts of future changes in income are not accepted, no matter how well grounded they may be. This means, for example, that the low-paid medical resident who, barring a catastrophe, will triple her salary in three months can declare only her current salary with full documentation. Using an SIL, however, the resident can declare her future income.Look, I love medical residents. My own life has literally been saved by a medical resident. I have never met a finer group of people than medical residents.

A medical school graduate without a job is an unemployed person with decent prospects. I don't lend on prospects. A resident with a residency agreement that will start in September may or may not have any business buying a house right now, but that's OK. I will look at your credit and your debt and your property just like I would anyone else's, and you can get the same deal Nurse Sue got if you qualify.

I have run into very few medical resident loans in which the medical resident wouldn't cough up that residency agreement. I have met one or two 22-year-old Business Administration Majors with the ink still wet on their BS degrees who want me to qualify them for a loan assuming they'll be a Senior Vice President in five years, because that's The Plan.

It doesn't seem to have occurred to The Professor that, at some level, we qualify everybody based on reasonable assumptions about the future. Unless I see something in your file that indicates otherwise, I'll assume you won't get fired tomorrow. I will set my DTI guidelines in such a way that can allow first-time homebuyers, who may be at the beginning, not the peak, of their earning years, to "grow into the loan" a little bit. But I still have to make sure you can carry the loan from payment one. We have just experienced an "Early Payment Default" crisis of unprecedented magnitude, and somebody is telling me I should stop worrying about whether a borrower can make the payment in the here and now. It's like dropping acid without the amusement value.

Does The Professor consider this problem? Why, yes:

The valid rap on SILs is that some borrowers, without any realistic basis for expecting a rise in income, lie about their current income and take loans they cannot afford. This irrational behavior of some borrowers may be encouraged by rational behavior on the part of rapacious loan officers or brokers, who get paid only if a loan closes and have no interest in what happens afterwards.This is from the guy who just suggested that borrowers use stated income to get around my FICO rules.

Because borrowers with high credit scores are much less likely to be irrational in their financial affairs, lenders place a lot more weight on credit scores of SIL borrowers than of full-doc borrowers. SILs will not be available to borrowers with very low credit scores, and if they are available, the price difference between good credit and poor credit is much larger on SILs than on full-doc loans.

This is after we just had S&P admit that high-FICO SILs are going down just like low-FICO SILs. This is after we just discovered that apparently "the price difference" wasn't nearly enough to cover the losses on this stuff. This is after we discovered that FICOs can be manipulated. This is after we discovered that the RE market doesn't care what your FICO is.

Look. Coming up with all this documentation I'm asking for in these odd situations is time-consuming. This is a mortgage loan. It is the largest debt most people ever contemplate. It has, as we have seen lately, not just profound personal repercussions, but social and political and macro-economic ones, as well. It should be time-consuming, and it should be more expensive, in terms of transaction costs, than getting a $200 Barnes and Noble Master Card at the counter so you can get 10% off your copy of Elvis, Jesus, and Coca-Cola. It does not have to be draconian, just sensible.

Stated income is never sensible. Guidelines that take into account differences in qualifying income or ratios for young people, first-time homebuyers, people with sporadic income, people with lots of cash assets, etc., have always existed and will (if we get through the crunch that stated caused, that is) continue to exist. But those guidelines put the onus on the lender to make an occasionally difficult decision and justify it to the investors, the insurers, the regulators, and the public.

This "stated" thing just pushes the "responsibility" for foolishness back onto the borrower, who cannot pay the cost of his foolishness. That is the situation we are now in. You all can get as morally-disapproving of these borrowers as you like. These borrowers cannot pay the cost of their mistakes. That was the whole problem. It is still the whole problem.

Now we're all paying for it one way or another. And someone calling himself an expert on the mortgage business wants to continue to allow borrowers to underwite their own loans, and lenders to continue to pretend we don't know what this is all about.

The only sane policy is to require verification of any income used in qualifying. That does not mean that Congress writes the rules that define "qualifying" in all cases. Let lenders be "lenders." But let's quit letting borrowers be "lenders except for the fact that it isn't their money."

OTS "Kept Up At Night"

by Anonymous on 8/22/2007 08:27:00 AM

Happy Wednesday, everyone.

WASHINGTON -(Dow Jones)- The number of troubled assets among federally regulated thrifts rose rose 49% in the second quarter from 12 months before to the highest level since the savings and loan crisis, the Office of Thrift Supervision reported Tuesday.

The agency also reported that the number of "problem thrifts," or companies rated poorly by regulatory standards, had risen to 10, up from just 4 in the second quarter of 2006.

Still, the regulator said that although the 836 thrifts it regulates are continuing to feel stress from housing and liquidity markets, the overall health of the companies remains strong, based on earnings and capital.

Thrifts are federally regulated banks that originate one out of every four mortgages. The companies largely originate prime or jumbo loans, so their stressed loan portfolios suggest that more loan types - not just subprime mortgages - are under pressure.

The thrift industry had $14.2 billion in troubled loans, which are either noncurrent loans or repossessed assets, the OTS said. That's up from $9.5 billion in the second quarter of 2006. This is the highest level of troubled assets since 1993, though as a percentage of total assets its only the highest level since 1997. Noncurrent loans include mortgage delinquencies, which have grown precipitously as the adjustable-rate mortgages that were very popular during the recent housing boom reset into much higher monthly commitments.

"This is what is keeping us as regulators up at night," James Caton, director of financial monitoring and analysis, said at a press briefing to discuss the data.

Tuesday, August 21, 2007

San Diego Foreclosure Activity

by Calculated Risk on 8/21/2007 08:45:00 PM

UPDATE: Rich Toscano at pigginton.com provides a long term graph of NODs and NOTs in San Diego normalized by the San Diego labor force. (hat tip SDMisfit).

According to Ramsey Su, an investor and former real-estate broker in San Diego, there were 349 REOs (bank Real Estate Owned) in San Diego for the week ending August 17th. There were 602 NODs (Notice of Defaults) and 278 NOTs (Notice of Trustee's sale) for the same week.

"I have been involved in real estate since the mid-1970s. I have never seen anything like this."

Ramsey Su, an investor and former real-estate broker, Aug 21, 2007.

Click on graph for larger image.

Click on graph for larger image.This graph shows a 3 week centered average (to smooth data) for NODs, NOTs, and REOs in San Diego.

NOTs are shifted 90 days (since it takes 90 days from NOD to NOT), and REOs are shifted another 21 days (the time required between NOTs and the actual sale).

REOs last week were 349 (3 week centered average was 247). To put this number into perspective, the San Diego MLS reported 1072 closings (regular sales) from Aug 1 to Aug 20, so pretty soon foreclosures are going to completely swamp the real estate market in San Diego.

First Magnus Files for Bankruptcy

by Calculated Risk on 8/21/2007 08:41:00 PM

From AP: First Magnus Files for Bankruptcy (hat tip Gary)

First Magnus Financial Corp. filed for bankruptcy Tuesday ...

The lender's total assets were estimated at more than $942 million and its total liabilities at nearly $813 million in the company's bankruptcy petition ...

...

First Magnus, which originated home loans and then sold bundled loans into the secondary loan market, stopped taking mortgage loan applications and fired 99 percent of its 6,000 employees Thursday.

...

''The company went out of business overnight,'' [company spokesman Gary] Baraff said . ''Three weeks ago we were at the apex of the company's history. Everything was falling into place for us, and we had remarkable momentum across the country. It was shocking to everyone that essentially the secondary market collapsed.''

First Magnus was caught in the credit liquidity crunch now causing a meltdown in the mortgage industry, even though it was not engaged in selling ''sub-prime'' mortgages that sparked the crisis in recent months.

Fitch to Review $92.1 Billion of Subprime Securities

by Calculated Risk on 8/21/2007 06:07:00 PM

From Bloomberg: Fitch to Review $92.1 Billion of Subprime Securities (hat tip energyecon)

Fitch Ratings placed $92.1 billion of securities backed by subprime residential mortgages ``under analysis,'' the first step toward a possible credit rating downgrade.More potential downgrades - what a surprise!

The review affects 235 classes of securities, including 131 from before 2006 representing $19.4 billion of debt and 104 from last year with $72.7 billion of debt outstanding, New York-based Fitch analysts led by Jack Lohrs said in a statement today.

Fitch said $4.2 billion of the bonds, which are rated BBB or below, are the most likely to face ratings actions.

BofA: New Home Sales could fall to 700K

by Calculated Risk on 8/21/2007 02:54:00 PM

From MarketWatch: Mortgage crisis will strain home builders: B. of A.

The broadening mortgage crisis, which is making home loans more difficult to obtain, will hit home builders hard as home sales slump, Bank of America analysts said on Tuesday.There are several key points here: 1) some builders, maybe even some large public builders, will likely go BK, 2) with a surge in cancellations, new home sales will be overstated, and inventory levels understated by the Census Bureau, 3) New Home sales (and existing home sales) will continue to decline, and 4) remodeling expenditures will probably decline significantly.

...

As mortgage lenders tighten underwriting standards and home prices fall, Bank of America analysts estimated that 40% of home buyers who got a mortgage in 2006 probably wouldn't qualify for a home loan now.

That dwindling mortgage availability means that more home purchases will be cancelled as buyers fail to get the loan they need to pay for their new house. Such disruptions could strain home builder's access to liquidity and borrowing, the analysts warned.

...

"Our market checks point to a recent spike in cancellations as lenders pull loan commitments and buyers fail to qualify," Bank of America analyst Daniel Oppenheim and his colleagues wrote in a note to clients on Tuesday. "Lower cash flow will strain liquidity, particularly for high leverage builders."

...

Lack of mortgage availability will mean demand for new homes could fall 35% in 2007, the analysts said. That's bigger than the 20% drop they were predicting earlier this year when subprime problems emerged.

New-home sales could fall as low as 700,000 a year, down from 1.283 million in 2005, they said, noting that traffic at real estate agents is down sharply in August.

...

The dwindling supply of home loans will also crimp remodeling activity, Oppenheim and colleagues said. Remodeling could drop by 20% ...

To understand the impact of cancellations on sales and inventory, see this explanation from the Census Bureau: Cancelled Sales Contracts.

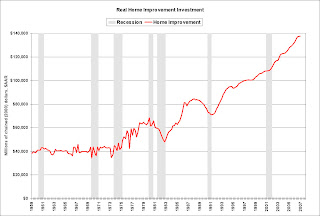

The point on remodeling is interesting. In response to a comment from Home Depot CEO, I wrote the following back in May: What Home Improvement Investment Slump? (the following is a repeat - obviously I think Oppenheim is correct):

"We believe the home-improvement market will remain soft throughout 2007."Soft? Actually real spending on home improvement is holding up pretty well. If this housing bust is similar to the early '80s or '90s, real home improvement investment will slump 15% to 20%.

Frank Blake, Home Depot Chairman and CEO, May 15, 2007

Click on graph for larger image.

Click on graph for larger image.This graph shows real home improvement investment (2000 dollars) since 1959. Recessions are in gray.

Although real spending was flat in Q1 2007, home improvement spending has held up pretty well compared to the other components of Residential Investment. With declining MEW, it is very possible that home improvement spending will slump like in the early '80s and '90s.

Fed's Lacker: Economic Outlook

by Calculated Risk on 8/21/2007 12:44:00 PM

From Jeffrey Lacker, President, Richmond Fed: The Economic Outlook. These excerpts are Lacker's view of the impact of the recent financial turmoil on the 'real economy'.

The Committee’s action last week underscores an important point. Financial market volatility, in and of itself, does not require a change in the target federal funds rate, in my view. Interest rate policy needs to be guided by the outlook for real spending and inflation. Financial turbulence has the potential to change the assessment of the appropriate rate if it induces a sufficient revision in growth or inflation prospects.Yes, Lacker has consistently been wrong on housing, but he is finally realizing there is a serious problem.

Even before the recent stint of financial market turbulence, the predominant concern on the real side of the economy was the outlook for housing activity. Residential investment fell rapidly over the last three quarters of 2006, but then the rate of decline slowed in the first half of this year. The question in my mind a couple of months ago concerned whether home-building would bottom out soon or continue declining. Recent data on actual housing market activity have dampened my optimism, however. Housing starts and residential building permits, which earlier this year looked as if they might be stabilizing, have both softened in the last couple of months. Broader measures of sales activity are also showing a pronounced downward trend.emphasis added.

While the housing market implications of the recent financial market turmoil are quite unclear at this stage, there is a possibility that it will result in further increases in retail mortgage rates for some borrower classes and thus further dampen residential investment. ...Allow me to translate, Lacker is really saying: "Look out below!"

Business investment spending has been an impressive source of strength over much of this expansion. ... Business investment faltered late last year, with weaker sales of autos and construction materials apparently playing important roles. Most of the fundamentals for business investment are still quite positive, however; profitability is high and the cost of capital is still fairly low, despite recent financial market developments. Thus investment could well maintain momentum this year, I believe, and we have been seeing some favorable signs. For example, manufacturing production increased by 2.2 percent from March through July.I agree that non-residential investment, especially in structures, is a key going forward, but I'm not as sanguine as Lacker.

It is worth noting here that there is one area in which financial market events could affect business investment spending. One of the market segments in which activity has slowed dramatically in recent weeks is in the financing of leveraged buy-outs used to take companies private. ... Given the other strong fundamentals for business spending, it is not clear that the rising cost of buy-out financing should have significant effects on real investment.And on consumer spending:

Financial market turmoil has the potential to make households apprehensive and thereby cause a precautionary pullback in consumer spending. We have numerous experiences in the past several decades, however, of declines in household financial net worth, and experience suggests that the effect on household spending tends to be small. Evidently, consumer expectations regarding their future income prospects is a stabilizing influence on their spending plans.There will be an impact of falling house prices (reverse wealth effect) and less MEW (Mortgage equity withdrawal) on consumer spending. The question is how big the impact will be. Once again I'm more pessimistic than Lacker, and I think the impact on (PCE) personal consumption expenditures could be significant.

...

On balance, then, I still expect consumer spending to be reasonably healthy, and for business investment to continue to expand. But I expect overall growth to come in somewhat below its long-term trend for the remainder of this year, based on my expectation that the drag from housing will continue for some time. The most plausible downside risk is that financial market developments will lead to higher mortgage rate spreads and will further depress housing activity. Other finance-related risks to economic growth appear to be relatively minor.

Foreclosure Activity Increases in July

by Calculated Risk on 8/21/2007 10:11:00 AM

From Bloomberg: Home Foreclosures Almost Double in July as Rates Rise

U.S. homes facing foreclosure almost doubled in July as property owners with adjustable-rate mortgages saw their payments rise, RealtyTrac Inc. said.

Lenders sent 179,599 notices of default, scheduled auctions or bank repossessions last month, a 93 percent increase from a year earlier ... California, Florida, Michigan, Ohio and Georgia accounted for more than half of the country's total filings.

...

California foreclosure filings totaled 39,013 in July, about triple the previous year. ... Florida ranked second with a 78 percent increase to 19,179 foreclosure filings. Michigan replaced Ohio as the state with the third highest number foreclosures: 13,979.

Nevada ranked the worst with one foreclosure filing for every 199 homes, about three times the national average.

MMI: It's Getting Ugly Out There

by Anonymous on 8/21/2007 07:32:00 AM

CNN, "Housing Woes Hit High End":

For years jumbo rates were only 0.25 of a percentage point above those of "conforming" loans -- those below the cutoff (now $417,000). In recent weeks that spread has exploded to 0.75 of a percentage point or more. BankRate.com reports that the average tariff on jumbo loans soared to 7.35% nationally in August, and many mortgage brokers are reporting figures that exceed 8%.Tariff? It's like we have . . . two Americas or something . . .

FT, "Money Market Funds Abused, Claims Founder":

Most investors, Mr Bent says, are unaware that some of the largest money market funds are putting their cash into one of the riskiest debt investments in the world - collateralised debt obligations backed by subprime mortgage loans.Actually, I think they wouldn't recognize credit risk if it inappropriately jazzed their returns for several lucky years. Now that it's got its teeth firmly embedded in their gluteus maximus, they seem to be catching on.

"That is clearly inappropriate," Mr Bent says. "It really reflects poorly on what we are here to do. The sanctity of the dollar is key."

He adds that cash management must be viewed as a separate business and requires a certain skill. "In the current market environment, lots of money fund portfolio managers are acting as credit analysts when they are not. In fact, they wouldn't know if the underlying credit risk bit them on the behind."

WaPo, "For Wall Street's Math Brains, Miscalculations":

Short for "quantitative equity," a quant fund is a hedge fund that relies on complex and sophisticated mathematical algorithms to search for anomalies and non-obvious patterns in the markets. These glitches, often too small for the human eye, can present opportunities for short- and long-term trades that yield high-profit returns.Sigh.

The models replace instinct. They try to turn historical trends into predictive science, using elegant mathematics seemingly above the comprehension of your average 401(k) participant or Wall Street fund manager.

Instead of veteran, market-savvy traders waving fistfuls of sell slips, the elite quant funds employ Nobel nerds with math PhDs, often divorced from the real world. It's not for nothing that they are called "black-box" funds -- opaque to outsiders, the boxes contain investment magic understood by only the wizards who conjured it up.

In any period of market correction--let alone a full-blown crisis--you can always, always count on the mainstream press to trot out anti-intellectual drivel like this. I don't want to do a reductio in the other direction, but you know, a lot of our current problems were caused by lenders who didn't read the numbers off a paystub, or couldn't measure the riskiness of 50% of pretax income being devoted to debt service. For some reason, when we have an elephant in the room, we want to go after those "too small for the naked eye" quant nerds first. Why is that?

Monday, August 20, 2007

Fed Fund Probabilities

by Calculated Risk on 8/20/2007 07:49:00 PM

Click on graph for larger image.

Click on graph for larger image.

Source: Cleveland Fed, Fed Funds Rate Predictions

The market expects a rate cut by the September meeting. It may even happen sooner, now that the Fed has shifted their bias, from being more concerned about inflation, to being more concerned about growth. The shift in bias was the big news in the Friday announcement, as the Fed prepared the market for a possible rate cut.

Check out the probabilities for the October and December meetings too. The "R" word is back.

Capital One Shuts Down GreenPoint Mortgage Unit

by Calculated Risk on 8/20/2007 05:03:00 PM

From the WSJ: Capital One Shuts Down GreenPoint Mortgage Unit

Capital One Financial Corp. plans to shut down its struggling GreenPoint mortgage unit ...Update: Tanta on GreenPoint (from the comments to previous thread):

Capital One bought GreenPoint in last year's $13.2 billion purchase of North Fork Bancorp, of Melville, N.Y. North Fork had earlier paid $6.3 billion for GreenPoint Financial Corp., then a large N.Y. savings-and-loan specializing in mortgages.

The unit specialized in so-called nonconforming loans, which do not meet the standards set by Fannie Mae and Freddie Mac, the government-sponsored providers of mortgage funds. GreenPoint specialized in "jumbo" loans above the $417,000 limit and Alt-A loans to home buyers who do not fully document their income or assets.

Let me say that GreenPoint basically invented Subprime-in-Alt-A-Drag.

If memory serves me correctly, they were about the first to do every stupid $%# thing that every other Alt-A lender proceeded to do in the great race to the bottom.

Stated IO 100% cashout at 620 FICO on a 6-month ARM with a prepayment penalty? Hell, GreenPoint would do it if you threw in a lender-funded buydown and an old appraisal!

Sorry I'm being bitter. I spent several years listening to people say, but GP does that! Why are you being such a hand-wringer!

SEC files fraud charges against Sentinel Management

by Calculated Risk on 8/20/2007 04:02:00 PM

From the WSJ: Sentinel Faces SEC Fraud Charges

Chicago money manager Sentinel Management Group Inc., which sought bankruptcy protection Friday after halting redemptions from its $1.5 billion fund, is facing fraud charges from the Securities and Exchange Commission.

The agency is seeking to freeze proceeds that Sentinel gained from selling investment assets to Citadel Investment Group. Further detail on the SEC's action wasn't immediately available.

Sentinel, meanwhile, is seeking approval to distribute to clients the $312 million it garnered from the sales.

In papers filed Monday with the U.S. Bankruptcy Court in Chicago, Sentinel said Bank of New York -- the firm's clearing agent -- was reluctant to distribute the proceeds in light of court rulings Friday barring Sentinel from selling assets owned by three brokerage firm clients.

Sentinel Management filed for Chapter 11 protection Friday after clients began suing the company for selling their assets too cheaply. According to a Wall Street Journal report, Citadel bought the assets for about 80 cents to 90 cents on the dollar.

Deutsche Bank uses “discount window”

by Calculated Risk on 8/20/2007 12:03:00 PM

From the Financial Times: Deutsche Bank taps Fed credit window

Deutsche Bank has ... according to people close to the situation ... borrowed funds from the “discount window”.UPDATE: Here is the link to the discount window data (hat tip self). The aggregate data (not by bank) is released weekly on Thursday. The key line is "Loans to depository institutions".

The move came on Friday ... Deutsche Bank declined to comment, but people close to the situation said its decision to tap the window was taken to show support for the Fed’s move to combat the credit squeeze.

It is unclear how much Deutsche has borrowed from the discount window.

After Foreclosure, a Big Tax Bill

by Calculated Risk on 8/20/2007 11:07:00 AM

From the NY Times: After Foreclosure, a Big Tax Bill

Two years ago, William Stout lost his home in Allentown, Pa., to foreclosure when he could no longer make the payments on his $106,000 mortgage. Wells Fargo offered the two-bedroom house for sale on the courthouse steps. No bidders came forward. So Wells Fargo bought it for $1, county records show.

... Mr. Stout was relieved that his debt was wiped clean ...

But on July 9, they received a bill from the Internal Revenue Service for $34,603 in back taxes. The letter explained that the debt canceled by Wells Fargo upon foreclosure was subject to income taxes, as well as penalties and late fees. ...

...

Notices of unpaid taxes, unanticipated and little understood, will probably multiply as more people fall behind on their mortgages, said Ellen Harnick, senior policy counsel at the Center for Responsible Lending, a nonpartisan research and policy center in Durham, N.C.

Foreclosure is one way that beleaguered homeowners can fall into this tax trap. The other is when homeowners are forced to sell their homes for less than the value of the mortgage. If the lender forgives that difference, they are liable for income taxes on that amount.

The 1099 shortfall, as it is called, stems from an Internal Revenue Service policy that treats forgiven debt of all types as income even if the taxpayer has nothing tangible to show for it, unless the debt is canceled through bankruptcy.