by Calculated Risk on 7/09/2025 07:00:00 AM

Wednesday, July 09, 2025

MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

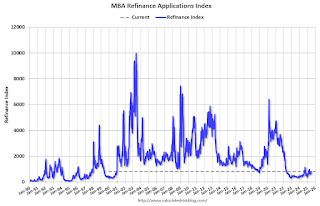

Mortgage applications increased 9.4 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending July 4, 2025. Last week’s results included an adjustment for the July 4th holiday.

The Market Composite Index, a measure of mortgage loan application volume, increased 9.4 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 13 percent compared with the previous week. The Refinance Index increased 9 percent from the previous week and was 56 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 9 percent from one week earlier. The unadjusted Purchase Index decreased 13 percent compared with the previous week and was 25 percent higher than the same week one year ago.

“Mortgage rates moved lower last week, with the 30-year fixed rate decreasing to 6.77 percent, its lowest level in three months. After adjusting for the July 4th holiday, purchase applications increased to the highest level of activity since February 2023 and remained above year-ago levels,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Homebuyer demand is being fueled by increasing housing inventory and moderating home-price growth. The average loan size on a purchase application, at $432,600, was at its lowest since January 2025. The refinance index also increased over the week, with VA refinances in particular up 32 percent.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($806,500 or less) decreased to 6.77 percent from 6.79 percent, with points holding steady at 0.62 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is up 25% year-over-year unadjusted.

Tuesday, July 08, 2025

Wednesday: FOMC Minutes

by Calculated Risk on 7/08/2025 06:43:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 2:00 PM, FOMC Minutes, Meeting of June 17-18

1st Look at Local Housing Markets in June

by Calculated Risk on 7/08/2025 11:05:00 AM

Today, in the Calculated Risk Real Estate Newsletter: 1st Look at Local Housing Markets in June

A brief excerpt:

Tracking local data gives an early look at what happened the previous month and also reveals regional differences in both sales and inventory.There is much more in the article.

Closed sales in June were mostly for contracts signed in April and May, and mortgage rates, according to the Freddie Mac PMMS, averaged 6.73% in April and 6.82% in May (slightly higher than for closed sales in May).

...

In June, sales in these early reporting markets were up 0.9% YoY. Last month, in May, these same markets were down 5.7% year-over-year Not Seasonally Adjusted (NSA).

Important: There were more working days in June 2025 (20) as in June 2024 (19). So, the year-over-year change in the headline SA data will be lower than for the NSA data.

...

This was just several early reporting markets. Many more local markets to come!

Wholesale Used Car Prices Increased in June; Up 6% Year-over-year

by Calculated Risk on 7/08/2025 09:22:00 AM

From Manheim Consulting today: Wholesale Used-Vehicle Prices Increase in June

Wholesale used-vehicle prices (on a mix, mileage, and seasonally adjusted basis) were higher in June compared to May. The Manheim Used Vehicle Value Index (MUVVI) increased to 208.5, representing a 6.3% year-over-year increase and a 1.6% rise above May levels. The seasonal adjustment forced the index higher in the month, as non-seasonally adjusted values fell more than usual following the volatility induced by the tariff announcement. The non-adjusted price in June decreased 1.1% compared to May, which now makes the unadjusted average price higher by 5.1% year over year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This index from Manheim Consulting is based on all completed sales transactions at Manheim’s U.S. auctions.

Small Business Optimism Index decreased slightly in June

by Calculated Risk on 7/08/2025 08:31:00 AM

Note: Usually small business owners complain about taxes and regulations (currently 1st and 6th on the "Single Most Important Problem" list). During a recession, "poor sales" is usually the top problem and recently "inflation" was number 1.

From the National Federation of Independent Business (NFIB): June 2025 Report: Small Business Optimism Index

The NFIB Small Business Optimism Index remained steady in June, edging down 0.2 of a point to 98.6, slightly above the 51-year average of 98. A substantial increase in respondents reporting excess inventories contributed the most to the decline in the index. The Uncertainty Index decreased by five points from May to 89. Nineteen percent of small business owners reported taxes as their single most important problem, up one point from May and ranking as the top problem again. The last time taxes reached 19 percent was in July 2021.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

Right now for most important problem, after taxes (19%), "Quality of Labor" (16%) is #2, inflation (11%) is #3, and "Poor Sales" (10%) and "Cost of Labor" are tied for #4.

Monday, July 07, 2025

Tuesday: Small Business Index

by Calculated Risk on 7/07/2025 07:48:00 PM

For the entire 2nd half of June, it was easy to be spoiled by the absence of volatility in mortgage rates. During that time, rates were either lower or unchanged every single day. The past few business days have been a different story. [30 year fixed 6.79%]Tuesday:

emphasis added

• At 6:00 AM ET, NFIB Small Business Optimism Index for June.

Update: Lumber Prices Up 26% YoY

by Calculated Risk on 7/07/2025 02:38:00 PM

This is something to watch again. Here is another monthly update on lumber prices.

SPECIAL NOTE: The CME group discontinued the Random Length Lumber Futures contract on May 16, 2023. I switched to a physically-delivered Lumber Futures contract that was started in August 2022. Unfortunately, this impacts long term price comparisons since the new contract was priced about 24% higher than the old random length contract for the period when both contracts were available.

This graph shows CME random length framing futures through August 2022 (blue), and the new physically-delivered Lumber Futures (LBR) contract starting in August 2022 (Red).

Click on graph for larger image.

Click on graph for larger image.July ICE Mortgage Monitor: Home Prices Continue to Cool, Early Signs of Homeowner Risk Emerge

by Calculated Risk on 7/07/2025 10:57:00 AM

Today, in the Real Estate Newsletter: July ICE Mortgage Monitor: Home Prices Continue to Cool, Early Signs of Homeowner Risk Emerge

Brief excerpt:

House Price Growth Continues to Slow

Here is the year-over-year in house prices according to the ICE Home Price Index (HPI). The ICE HPI is a repeat sales index. ICE reports the median price change of the repeat sales. The index was up 1.6% year-over-year in May, down from 2.0% YoY in April. The early look at the June HPI shows a 1.3% YoY increase.

• Mortgage rates in the high 6% range and growing inventory across the country continue to cool home price growthThere is much more in the newsletter.

• Annual price growth eased to 1.6% in May with ICE’s enhanced Home Price Index showing growth slowing further to 1.3% in early June marking the slowest growth rate since mid-2023

• Early June data also shows home prices rose by a modest 0.02% on a seasonally adjusted basis, which is equivalent to a seasonally adjusted annualized rate (SAAR) of +0.3%, suggesting more slowing on the horizon

• Single family prices were up +1.6% from the same time last year, while condo prices were down -1.3%, marking the softest condo market since 2012

• More than half of the top 100 housing markets in the U.S. are seeing condo prices below last year’s levels, with the largest declines in Florida, led by Cape Coral (-12.7%) and North Port (-10.4%)

Housing July 7th Weekly Update: Inventory up 2.7% Week-over-week, Only Down 10% from 2019 Levels

by Calculated Risk on 7/07/2025 08:11:00 AM

Click on graph for larger image.

Click on graph for larger image. This second inventory graph is courtesy of Altos Research.

This second inventory graph is courtesy of Altos Research.Sunday, July 06, 2025

Sunday Night Futures

by Calculated Risk on 7/06/2025 06:17:00 PM

Weekend:

• Schedule for Week of July 6, 2025

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are down 22 and DOW futures are down 112 (fair value).

Oil prices were up over the last week with WTI futures at $66.50 per barrel and Brent at $68.30 per barrel. A year ago, WTI was at $84, and Brent was at $89 - so WTI oil prices are down about 21% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.09 per gallon. A year ago, prices were at $3.46 per gallon, so gasoline prices are down $0.37 year-over-year.