by Calculated Risk on 7/02/2025 08:46:00 AM

Wednesday, July 02, 2025

ADP: Private Employment Decreased 33,000 in June

“Though layoffs continue to be rare, a hesitancy to hire and a reluctance to replace departing workers led to job losses last month,” said Dr. Nela Richardson, chief economist, ADP. “Still, the slowdown in hiring has yet to disrupt pay growth.”This was well below the consensus forecast of 110,000 jobs added. The BLS report will be released Thursday, and the consensus is for 129,000 non-farm payroll jobs added in June.

emphasis added

MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

by Calculated Risk on 7/02/2025 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 2.7 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending June 27, 2025. Last week’s results included an adjustment for the Juneteenth holiday.

The Market Composite Index, a measure of mortgage loan application volume, increased 2.7 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index increased 13 percent compared with the previous week. The Refinance Index increased 7 percent from the previous week and was 40 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 0.1 percent from one week earlier. The unadjusted Purchase Index increased 10 percent compared with the previous week and was 16 percent higher than the same week one year ago.

“Mortgage rates were lower across all loan types last week, with the 30-year fixed rate declining to its lowest level since April at 6.79 percent. This decline prompted an increase in refinance applications, driven by a 10 percent increase in conventional applications and a 22 percent increase in VA refinance applications,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “As borrowers with larger loans tend to be more sensitive to rate changes, the average loan size for a refinance application increased to $313,700 after averaging less than $300,000 for the past six weeks. Purchase activity was essentially flat over the week, as overall uncertainty continues to hold homebuyers out of the market. However, purchase activity still remains 16 percent higher than last year’s pace.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($806,500 or less) decreased to 6.79 percent from 6.88 percent, with points decreasing to 0.62 from 0.63 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is up 16% year-over-year unadjusted.

Tuesday, July 01, 2025

Wednesday: ADP Employment

by Calculated Risk on 7/01/2025 08:43:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for June. This report is for private payrolls only (no government). The consensus is for 110,000 payroll jobs added in June, up from 37,000 in May.

Cotality: House Prices Increased 1.8% YoY in May

by Calculated Risk on 7/01/2025 04:39:00 PM

From Cotality (formerly CoreLogic): US home price insights — July 2025

Spring homebuying season continues to be defined by slower price growth and tepid home buying activity.House prices are under pressure with more inventory and sluggish sales.

• Year-over-year price growth dipped to 1.8% in May 2025, down from 5% price growth last May and slowest since the winter of 2012.

• Seasonal increase in home prices continues to be weak, up 0.3% compared to the month before, and less than half of 0.8% increase typically seen between April and May

• In more affordable Midwestern markets, such as Indianapolis, Kansas City, and Knoxville, as well as markets surrounding New York metro, seasonal gains in May continued to outperform pre-pandemic trends

• Illinois, up 6.4% year-over-year entered the top 5 states with the highest home price growth, following Rhode Island, New Jersey, Wyoming and Connecticut which all continue to record more than triple the national rate of price growth

• Florida, Texas, Hawaii, and Washington D.C. reported negative home price growth.

emphasis added

Construction Spending Decreased 0.3% in May

by Calculated Risk on 7/01/2025 02:46:00 PM

From the Census Bureau reported that overall construction spending decreased:

Construction spending during May 2025 was estimated at a seasonally adjusted annual rate of $2,138.2 billion, 0.3 percent below the revised April estimate of $2,145.5 billion. The May figure is 3.5 percent below the May 2024 estimate of $2,215.4 billion.Private spending decreased and public spending increased slightly:

emphasis added

Spending on private construction was at a seasonally adjusted annual rate of $1,626.6 billion, 0.5 percent below the revised April estimate of $1,634.2 billion. ...

In May, the estimated seasonally adjusted annual rate of public construction spending was $511.6 billion, 0.1 percent above the revised April estimate of $511.3 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential (red) spending is 9.2% below the peak in 2022.

Private non-residential (blue) spending is 6.8% below the peak in December 2023.

Public construction spending (orange) is slightly below the peak of October 2024.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is down 6.7%. Private non-residential spending is down 3.9% year-over-year. Public spending is up 3.3% year-over-year.

Fannie and Freddie: Single Family Serious Delinquency Rates Decreased in May; Fannie Multi-Family Delinquency Rate Near Highest Since Jan 2011 (ex-Pandemic)

by Calculated Risk on 7/01/2025 11:45:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Fannie and Freddie: Single Family Serious Delinquency Rates Decreased in May

Excerpt:

Freddie Mac reported that the Single-Family serious delinquency rate in May was 0.55%, down from 0.57% April. Freddie's rate is up year-over-year from 0.49% in May 2024, however, this is below the pre-pandemic level of 0.60%.

Freddie's serious delinquency rate peaked in February 2010 at 4.20% following the housing bubble and peaked at 3.17% in August 2020 during the pandemic.

Fannie Mae reported that the Single-Family serious delinquency rate in May was 0.53%, down from 0.55% in April. The serious delinquency rate is up year-over-year from 0.48% in May 2024, however, this is below the pre-pandemic lows of 0.65%.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59% following the housing bubble and peaked at 3.32% in August 2020 during the pandemic.

BLS: Job Openings Increased to 7.8 million in May

by Calculated Risk on 7/01/2025 10:10:00 AM

From the BLS: Job Openings and Labor Turnover Summary

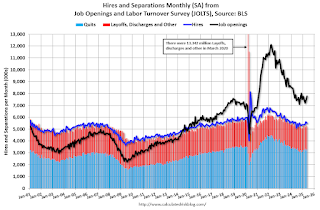

The number of job openings was little changed at 7.8 million in May, the U.S. Bureau of Labor Statistics reported today. Over the month, both hires and total separations were little changed at 5.5 million and 5.2 million, respectively. Within separations, quits (3.3 million) and layoffs and discharges (1.6 million) changed little.The following graph shows job openings (black line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for May; the employment report this Friday will be for June.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are usually pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

The spike in layoffs and discharges in March 2020 is labeled, but off the chart to better show the usual data.

Jobs openings increased in May to 7.77 million from 7.40 million in April.

The number of job openings (black) were down 2% year-over-year.

Quits were down 2% year-over-year. These are voluntary separations. (See light blue columns at bottom of graph for trend for "quits").

ISM® Manufacturing index Increased to 49.0% in June

by Calculated Risk on 7/01/2025 10:00:00 AM

(Posted with permission). The ISM manufacturing index indicated expansion. The PMI® was at 49.0% in June, up from 48.5% in May. The employment index was at 45.0%, down from 46.8% the previous month, and the new orders index was at 46.2%, down from 47.6%.

From ISM: Manufacturing PMI® at 49% June 2025 Manufacturing ISM® Report On Business®

The report was issued today by Susan Spence, MBA, Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee:This suggests manufacturing contracted in June. This was slightly above the consensus forecast. New export orders were still weak; employment was weak and prices very strong.

“The Manufacturing PMI® registered 49 percent in June, a 0.5-percentage point increase compared to the 48.5 percent recorded in May. The overall economy continued in expansion for the 62nd month after one month of contraction in April 2020. (A Manufacturing PMI® above 42.3 percent, over a period of time, generally indicates an expansion of the overall economy.) The New Orders Index contracted for the fifth month in a row following a three-month period of expansion; the figure of 46.4 percent is 1.2 percentage points lower than the 47.6 percent recorded in May. The June reading of the Production Index (50.3 percent) is 4.9 percentage points higher than May’s figure of 45.4, returning the index to expansion territory. The Prices Index remained in expansion (or ‘increasing’) territory, registering 69.7 percent, up 0.3 percentage point compared to the reading of 69.4 percent reported in May. The Backlog of Orders Index registered 44.3 percent, down 2.8 percentage points compared to the 47.1 percent recorded in May. The Employment Index registered 45 percent, down 1.8 percentage points from May’s figure of 46.8 percent.

“The Supplier Deliveries Index indicated slower delivery performance, though the pace picked up somewhat: The reading of 54.2 percent is down 1.9 percentage points from the 56.1 percent recorded in May. (Supplier Deliveries is the only ISM® Report On Business® index that is inversed; a reading of above 50 percent indicates slower deliveries, which is typical as the economy improves and customer demand increases.) The Inventories Index registered 49.2 percent, up 2.5 percentage points compared to May’s reading of 46.7 percent.

“The New Export Orders Index reading of 46.3 percent is 6.2 percentage points higher than the reading of 40.1 percent registered in May. The Imports Index gained back its loss from the previous month, registering 47.4 percent, 7.5 percentage points higher than May’s reading of 39.9 percent.”

emphasis added

Monday, June 30, 2025

Tuesday: Fed Chair Powell, ISM Mfg, Construction Spending, Job Openings, Vehicle Sales

by Calculated Risk on 6/30/2025 08:16:00 PM

April 3rd and 4th saw the average top tier 30yr fixed mortgage rates well into the "mid 6's." Many lenders were able to quote 6.5% at the time. Just a few days ago, we noted there was still a ways to go before breaking below those early April levels, but the past few days have taken us within striking distance. [30 year fixed 6.67%]Tuesday:

emphasis added

• At 9:30 AM ET, Discussion, Fed Chair Jerome Powell, Policy Panel Discussion, At the European Central Bank Forum on Central Banking 2025, Sintra, Portugal

• At 10:00 AM, ISM Manufacturing Index for June. The consensus is for the ISM to be at 48.8, up from 48.5 in May.

• At 10:00 AM, Construction Spending for May. The consensus is for a 0.1% decrease in construction spending.

• At 10:00 AM, Job Openings and Labor Turnover Survey for May from the BLS.

• Late in the day, Light vehicle sales for June. The consensus is for light vehicle sales to be 15.5 million SAAR in June, down from 15.6 million in May (Seasonally Adjusted Annual Rate).

Trump and Fed Policy

by Calculated Risk on 6/30/2025 04:20:00 PM

Today President Trump put out a note urging Fed Chair Powell to lower rates.

The following image, courtesy of Conor Sen, shows the central bank rates around the world. Mr. Trump wrote:

Jerome, You are, as usual, "Too Late". You have cost the USA a fortune - and continue to do so - you should lower the rate - by a lot! Hundreds of billions of dollars being lost! No Inflation.

Click on graph for larger image.

Click on graph for larger image.Goldman Sachs economists noted today:

"We are pulling forward our forecast for the next cut to September. We had previously expected a cut in December because we thought that the peak summer tariff effects on monthly inflation would make it awkward to cut sooner. But the very early evidence suggests that the tariff effects look a bit smaller than we expected, other disinflationary forces have been stronger, and we suspect that the Fed leadership shares our view that tariffs will only have a one-time price level effect. And while the labor market still looks healthy, it has become hard to find a job, and both residual seasonality and immigration policy changes pose near-term downside risk to payrolls."Maybe the impact on inflation from the tariffs will be less than expected. And it seems likely the impact will be mostly transitory.

It is also possible the economic weakness from policy (immigration, fiscal) will more than offset any boost to inflation from the tariffs. Although immigration policy might push up inflation for food, etc. It is very uncertain right now.