by Calculated Risk on 6/04/2025 12:58:00 PM

Wednesday, June 04, 2025

Q1 Update: Delinquencies, Foreclosures and REO

Today, in the Calculated Risk Real Estate Newsletter: Q1 Update: Delinquencies, Foreclosures and REO

A brief excerpt:

This entire housing cycle I’ve argued that we would NOT see a surge in foreclosures that would significantly impact house prices (as happened following the housing bubble) for two key reasons: 1) mortgage lending has been solid, and 2) most homeowners have substantial equity in their homes.There is much more in the article.

...

This graph shows the nominal dollar value of Residential REO for FDIC insured institutions based on the Q1 FDIC Quarterly Banking Profile released last week. Note: The FDIC reports the dollar value and not the total number of REOs.

The dollar value of 1-4 family residential Real Estate Owned (REOs, foreclosure houses) was up 5% YOY from $742 million in Q1 2024 to $784 million in Q1 2025. This is historically extremely low.

Heavy Truck Sales Down 8% YoY in May

by Calculated Risk on 6/04/2025 10:51:00 AM

This graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is the May 2025 seasonally adjusted annual sales rate (SAAR) of 446 thousand.

Heavy truck sales really collapsed during the great recession, falling to a low of 180 thousand SAAR in May 2009. Then heavy truck sales increased to a new record high of 570 thousand SAAR in April 2019.

Note: "Heavy trucks - trucks more than 14,000 pounds gross vehicle weight."

Heavy truck sales declined sharply at the beginning of the pandemic, falling to a low of 288 thousand SAAR in May 2020.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

The second graph shows light vehicle sales since the BEA started keeping data in 1967. ISM® Services Index decreased to 49.9% in May

by Calculated Risk on 6/04/2025 10:00:00 AM

(Posted with permission). The ISM® Services index was at 49.9%, down from 51.6% last month. The employment index increased to 50.7%, from 49.0%. Note: Above 50 indicates expansion, below 50 in contraction.

From the Institute for Supply Management: Services PMI® at 49.9% May 2025 Services ISM® Report On Business®

Economic activity in the services sector contracted in May, the first time since June 2024, say the nation's purchasing and supply executives in the latest Services ISM® Report On Business®. The Services PMI® indicated slight contraction at 49.9 percent, below the 50-percent breakeven point for only the fourth time in 60 months since recovery from the coronavirus pandemic-induced recession began in June 2020.This was below consensus expectations for a reading of 52.0.

The report was issued today by Steve Miller, CPSM, CSCP, Chair of the Institute for Supply Management® (ISM®) Services Business Survey Committee: “In May, the Services PMI® registered 49.9 percent, 1.7 percentage points lower than the April figure of 51.6 percent. The Business Activity Index was ‘unchanged’ in May, registering 50 percent, 3.7 percentage points lower than the 53.7 percent recorded in April. This is the index’s first month out of expansion territory since May 2020. The New Orders Index dropped into contraction territory in May, recording a reading of 46.4 percent, a decrease of 5.9 percentage points from the April figure of 52.3 percent. The Employment Index returned to expansion after two months in contraction; the reading of 50.7 percent is 1.7 percentage points higher than the 49 percent recorded in April and is the second straight month-over-month gain.

“The Supplier Deliveries Index registered 52.5 percent, 1.2 percentage points higher than the 51.3 percent recorded in April. This is the sixth consecutive month that the index has been in expansion territory, indicating slower supplier delivery performance. (Supplier Deliveries is the only ISM® Report On Business® index that is inversed; a reading of above 50 percent indicates slower deliveries, which is typical as the economy improves and customer demand increases.)

“The Prices Index registered 68.7 percent in May, a 3.6-percentage point increase from April’s reading of 65.1 percent; the index has elevated 7.8 percentage points in the last two months to reach its highest level since November 2022 (69.4 percent). This is the first time the index has recorded this high of a two-month increase since a 9.2-percentage point gain in February and March 2021. The May reading is also its sixth in a row above 60 percent.

The Inventories Index returned to contraction territory in May, registering 49.7 percent, a decrease of 3.7 percentage points from April’s figure of 53.4 percent. This is the second time the index has contracted in 2025. The Inventory Sentiment Index expanded for the 25th consecutive month, registering 62.9 percent, up 6.8 percentage points from April’s figure of 56.1 percent and its highest reading since July 2024 (63.2 percent). The Backlog of Orders Index registered 43.4 percent in May, a 4.6-percentage point decrease from the April figure of 48 percent, indicating contraction for the ninth time in the last 10 months and its lowest reading since August 2023 (41.8 percent).

“Ten industries reported growth in May, down one from the 11 industries reported in April. The Services PMI® has contracted in only four of the last 60 months dating back to June 2020. The May reading of 49.9 percent is 2.4 percentage points below the 12-month average reading of 52.3 percent.”

Miller continues, “May’s PMI® level is not indicative of a severe contraction, but rather uncertainty that is being expressed broadly among ISM Services Business Survey panelists. The average reading of 50.8 percent over the last three months still indicates expansion in that time period, but it is a notable shift of 2 percentage points below its average of 52.8 percent over the previous nine months. The New Orders Index moved into contraction territory for the first time in nearly a year. Tariff impacts are likely elevating prices paid by services sector companies, with the Prices Index hitting its highest level since November 2022, when the Bureau of Labor Statistics’ CPI indicated that prices had increased 7.1 percent as compared to November 2021. Respondents continued to report difficulty in forecasting and planning due to longer-term tariff uncertainty and frequently cited efforts to delay or minimize ordering until impacts become clearer.”

emphasis added

ADP: Private Employment Increased 37,000 in May

by Calculated Risk on 6/04/2025 08:15:00 AM

“After a strong start to the year, hiring is losing momentum,” said Dr. Nela Richardson, chief economist, ADP. “Pay growth, however, was little changed in May, holding at robust levels for both job-stayers and job-changers.”This was well below the consensus forecast of 120,000. The BLS report will be released Friday, and the consensus is for 130,000 non-farm payroll jobs added in May.

emphasis added

MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

by Calculated Risk on 6/04/2025 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 3.9 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending May 30, 2025. This week’s results included an adjustment for the Memorial Day holiday.

The Market Composite Index, a measure of mortgage loan application volume, decreased 3.9 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 15 percent compared with the previous week. The Refinance Index decreased 4 percent from the previous week and was 42 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 4 percent from one week earlier. The unadjusted Purchase Index decreased 15 percent compared with the previous week and was 18 percent higher than the same week one year ago.

“Most mortgage rates moved lower last week, with the 30-year fixed rate declining to 6.92 percent and staying in the 6.8 to 7 percent range since April,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Mortgage applications decreased over the week, but continue to exhibit annual gains, with purchase applications running 18 percent ahead of last year’s place. Government purchase applications were little changed over the week driven by a slight increase in FHA purchase applications. Refinance activity fell across both conventional and government segment and the overall average refinance loan size was the smallest since July 2024, as potential borrowers hold out for larger rate drops.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($806,500 or less) decreased to 6.92 percent from 6.98 percent, with points decreasing to 0.66 from 0.67 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is up 18% year-over-year unadjusted.

Tuesday, June 03, 2025

Wednesday: ADP Employment, ISM Services

by Calculated Risk on 6/03/2025 08:29:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for May. This report is for private payrolls only (no government). The consensus is for 120,000 payroll jobs added in May, up from 62,000 in April.

• At 10:00 AM: the ISM Services Index for May. The consensus is for a reading of 52.0, up from 51.6.

Light Vehicles Sales Decrease to 15.65 million SAAR in May

by Calculated Risk on 6/03/2025 04:50:00 PM

Wards Auto released their estimate of light vehicle sales for May: U.S. Light-Vehicle Sales Growth Slows in May After March-April “Tariff” Surge (pay site).

Although sales in May dropped to a level more in line with – in fact, slightly below - pre-tariff expectations after spiking above trend in the prior two months due to consumers trying to get ahead of potential tariff-related price increases, part of the cooling off was caused by the drain on inventory from the March-April surge. The drop in inventory, which at the end of last month was down year-over-year for the first time in nearly three years, helped explain a 10% decline in incentive spending in May from April, as there was less pressure to move stock off dealer lots despite the sharp slowdown in demand. That dynamic likely continues not just in June, but into Q3, as most automakers do not currently appear anxious to raise production levels enough to fully replace declining stock levels.

Click on graph for larger image.

Click on graph for larger image.This graph shows light vehicle sales since 2006 from the BEA (blue) and Wards' estimate for April (red).

Sales in May were well below the consensus forecast.

Asking Rents Mostly Unchanged Year-over-year

by Calculated Risk on 6/03/2025 12:50:00 PM

Today, in the Real Estate Newsletter: Asking Rents Mostly Unchanged Year-over-year

Brief excerpt:

Another monthly update on rents.This is much more in the article.

Tracking rents is important for understanding the dynamics of the housing market. Slower household formation and increased supply (more multi-family completions) has kept asking rents under pressure.

More recently, immigration policy has become a negative for rentals.

Apartment List: Asking Rent Growth -0.5% Year-over-year ...

On the supply side of the rental market, our national vacancy index currently sits at 7 percent, marking a new record high in the history of that monthly data series, which goes back to the start of 2017. After a historic tightening in 2021, multifamily occupancy has been slowly but consistently easing for over three years amid an influx of new inventory. 2024 saw the most new apartment completions since the mid-1980s, and although we’re past the peak of new multifamily construction, this year is still bringing a robust level of new supply.Realtor.com: 21st Consecutive Month with Year-over-year Decline in RentsIn April 2025, U.S. median rent posted its 21st consecutive year-over-year decline, dropping 1.7% for 0–2 bedroom properties across the 50 largest metropolitan areas.

BLS: Job Openings Increased to 7.4 million in April

by Calculated Risk on 6/03/2025 10:00:00 AM

From the BLS: Job Openings and Labor Turnover Summary

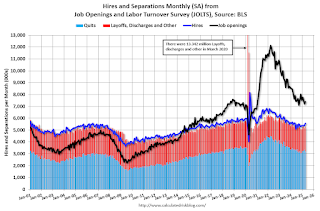

The number of job openings was little changed at 7.4 million in April, the U.S. Bureau of Labor Statistics reported today. Over the month, both hires and total separations were little changed at 5.6 million and 5.3 million, respectively. Within separations, quits (3.2 million) and layoffs and discharges (1.8 million) changed little.The following graph shows job openings (black line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for April; the employment report this Friday will be for May.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are usually pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

The spike in layoffs and discharges in March 2020 is labeled, but off the chart to better show the usual data.

Jobs openings increased in April to 7.39 million from 7.20 million in March.

The number of job openings (black) were down 3% year-over-year.

Quits were down 6% year-over-year. These are voluntary separations. (See light blue columns at bottom of graph for trend for "quits").

Monday, June 02, 2025

Tuesday: Job Openings, Vehicle Sales

by Calculated Risk on 6/02/2025 08:09:00 PM

Mortgage rates have been in an exceptionally narrow range since last Tuesday with the 30yr fixed index hovering just under 7%. The average lender is just a hair higher today versus last Friday, but still just under 7%.Tuesday:

...

As the week continues, several other important reports will be released. Friday's jobs report is traditionally the most closely watched when it comes to the rate market. [30 year fixed 6.96%]

emphasis added

• At 10:00 AM ET, Job Openings and Labor Turnover Survey for April from the BLS.

• Late, Light vehicle sales for May. The consensus is for light vehicle sales to be 16.4 million SAAR in May, down from 17.3 million in April (Seasonally Adjusted Annual Rate).