by Calculated Risk on 6/04/2025 07:00:00 AM

Wednesday, June 04, 2025

MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 3.9 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending May 30, 2025. This week’s results included an adjustment for the Memorial Day holiday.

The Market Composite Index, a measure of mortgage loan application volume, decreased 3.9 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 15 percent compared with the previous week. The Refinance Index decreased 4 percent from the previous week and was 42 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 4 percent from one week earlier. The unadjusted Purchase Index decreased 15 percent compared with the previous week and was 18 percent higher than the same week one year ago.

“Most mortgage rates moved lower last week, with the 30-year fixed rate declining to 6.92 percent and staying in the 6.8 to 7 percent range since April,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Mortgage applications decreased over the week, but continue to exhibit annual gains, with purchase applications running 18 percent ahead of last year’s place. Government purchase applications were little changed over the week driven by a slight increase in FHA purchase applications. Refinance activity fell across both conventional and government segment and the overall average refinance loan size was the smallest since July 2024, as potential borrowers hold out for larger rate drops.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($806,500 or less) decreased to 6.92 percent from 6.98 percent, with points decreasing to 0.66 from 0.67 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is up 18% year-over-year unadjusted.

Tuesday, June 03, 2025

Wednesday: ADP Employment, ISM Services

by Calculated Risk on 6/03/2025 08:29:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for May. This report is for private payrolls only (no government). The consensus is for 120,000 payroll jobs added in May, up from 62,000 in April.

• At 10:00 AM: the ISM Services Index for May. The consensus is for a reading of 52.0, up from 51.6.

Light Vehicles Sales Decrease to 15.65 million SAAR in May

by Calculated Risk on 6/03/2025 04:50:00 PM

Wards Auto released their estimate of light vehicle sales for May: U.S. Light-Vehicle Sales Growth Slows in May After March-April “Tariff” Surge (pay site).

Although sales in May dropped to a level more in line with – in fact, slightly below - pre-tariff expectations after spiking above trend in the prior two months due to consumers trying to get ahead of potential tariff-related price increases, part of the cooling off was caused by the drain on inventory from the March-April surge. The drop in inventory, which at the end of last month was down year-over-year for the first time in nearly three years, helped explain a 10% decline in incentive spending in May from April, as there was less pressure to move stock off dealer lots despite the sharp slowdown in demand. That dynamic likely continues not just in June, but into Q3, as most automakers do not currently appear anxious to raise production levels enough to fully replace declining stock levels.

Click on graph for larger image.

Click on graph for larger image.This graph shows light vehicle sales since 2006 from the BEA (blue) and Wards' estimate for April (red).

Sales in May were well below the consensus forecast.

Asking Rents Mostly Unchanged Year-over-year

by Calculated Risk on 6/03/2025 12:50:00 PM

Today, in the Real Estate Newsletter: Asking Rents Mostly Unchanged Year-over-year

Brief excerpt:

Another monthly update on rents.This is much more in the article.

Tracking rents is important for understanding the dynamics of the housing market. Slower household formation and increased supply (more multi-family completions) has kept asking rents under pressure.

More recently, immigration policy has become a negative for rentals.

Apartment List: Asking Rent Growth -0.5% Year-over-year ...

On the supply side of the rental market, our national vacancy index currently sits at 7 percent, marking a new record high in the history of that monthly data series, which goes back to the start of 2017. After a historic tightening in 2021, multifamily occupancy has been slowly but consistently easing for over three years amid an influx of new inventory. 2024 saw the most new apartment completions since the mid-1980s, and although we’re past the peak of new multifamily construction, this year is still bringing a robust level of new supply.Realtor.com: 21st Consecutive Month with Year-over-year Decline in RentsIn April 2025, U.S. median rent posted its 21st consecutive year-over-year decline, dropping 1.7% for 0–2 bedroom properties across the 50 largest metropolitan areas.

BLS: Job Openings Increased to 7.4 million in April

by Calculated Risk on 6/03/2025 10:00:00 AM

From the BLS: Job Openings and Labor Turnover Summary

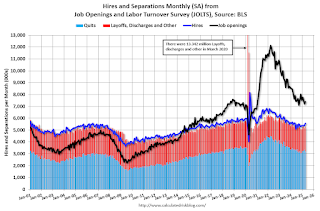

The number of job openings was little changed at 7.4 million in April, the U.S. Bureau of Labor Statistics reported today. Over the month, both hires and total separations were little changed at 5.6 million and 5.3 million, respectively. Within separations, quits (3.2 million) and layoffs and discharges (1.8 million) changed little.The following graph shows job openings (black line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for April; the employment report this Friday will be for May.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are usually pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

The spike in layoffs and discharges in March 2020 is labeled, but off the chart to better show the usual data.

Jobs openings increased in April to 7.39 million from 7.20 million in March.

The number of job openings (black) were down 3% year-over-year.

Quits were down 6% year-over-year. These are voluntary separations. (See light blue columns at bottom of graph for trend for "quits").

Monday, June 02, 2025

Tuesday: Job Openings, Vehicle Sales

by Calculated Risk on 6/02/2025 08:09:00 PM

Mortgage rates have been in an exceptionally narrow range since last Tuesday with the 30yr fixed index hovering just under 7%. The average lender is just a hair higher today versus last Friday, but still just under 7%.Tuesday:

...

As the week continues, several other important reports will be released. Friday's jobs report is traditionally the most closely watched when it comes to the rate market. [30 year fixed 6.96%]

emphasis added

• At 10:00 AM ET, Job Openings and Labor Turnover Survey for April from the BLS.

• Late, Light vehicle sales for May. The consensus is for light vehicle sales to be 16.4 million SAAR in May, down from 17.3 million in April (Seasonally Adjusted Annual Rate).

June ICE Mortgage Monitor: Home Prices Continue to Cool

by Calculated Risk on 6/02/2025 02:01:00 PM

Today, in the Real Estate Newsletter: June ICE Mortgage Monitor: Home Prices Continue to Cool

Brief excerpt:

House Price Growth Continues to Slow

Here is the year-over-year in house prices according to the ICE Home Price Index (HPI). The ICE HPI is a repeat sales index. ICE reports the median price change of the repeat sales. The index was up 2.0% year-over-year in April, down from 2.4% YoY in March. The early look at the May HPI shows a 1.6% YoY increase.

• Improved inventory levels are providing more options and a softer price dynamic for homeowners shopping this springThere is much more in the newsletter.

• Annual home price growth cooled to a revised +2.0% in April from +3.6% at the start of the year, with ICE’s Home Price Index suggesting price growth cooled further to +1.6% in May, the slowest growth rate in nearly two years

• May data also shows home prices rose by a modest 0.1% in the month on a seasonally adjusted basis, which would mark the softest single-month growth since late 2023, when mortgage rates climbed above 7.5%

• If recent seasonally adjusted gains persist, the annual home price growth rate is poised to cool further

• Single family prices were up by +1.9% in May from the same time last year, with condos down -0.7% as signals of a softer condo market grow louder

• Condo prices are now down from last year in half of all major U.S. markets, with the largest declines along Florida’s Gulf Coast, plus Stockton CA, Austin, Memphis and Denver

Fannie and Freddie: Single Family Serious Delinquency Rates Decreased in April; Fannie Multi-Family Delinquency Rate Highest Since Jan 2011 (ex-Pandemic)

by Calculated Risk on 6/02/2025 11:10:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Fannie and Freddie: Single Family Serious Delinquency Rates Decreased in April

Excerpt:

Freddie Mac reported that the Single-Family serious delinquency rate in April was 0.57%, down from 0.59% March. Freddie's rate is up year-over-year from 0.51% in April 2024, however, this is close to the pre-pandemic level of 0.60%.

Freddie's serious delinquency rate peaked in February 2010 at 4.20% following the housing bubble and peaked at 3.17% in August 2020 during the pandemic.

Fannie Mae reported that the Single-Family serious delinquency rate in March was 0.55%, down from 0.56% in March. The serious delinquency rate is up year-over-year from 0.49% in April 2024, however, this is below the pre-pandemic lows of 0.65%.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59% following the housing bubble and peaked at 3.32% in August 2020 during the pandemic.

Construction Spending Decreased 0.4% in April

by Calculated Risk on 6/02/2025 10:18:00 AM

From the Census Bureau reported that overall construction spending decreased:

Construction spending during April 2025 was estimated at a seasonally adjusted annual rate of $2,152.4 billion, 0.4 percent below the revised March estimate of $2,162.0 billion. The April figure is 0.5 percent below the April 2024 estimate of $2,163.2 billion. During the first four months of this year, construction spending amounted to $660.2 billion, 1.4 percent above the $651.3 billion for the same period in 2024.Private spending decreased and public spending increased:

emphasis added

Spending on private construction was at a seasonally adjusted annual rate of $1,638.9 billion, 0.7 percent below the revised March estimate of $1,650.8 billion. ...

In April, the estimated seasonally adjusted annual rate of public construction spending was $513.5 billion, 0.4 percent above the revised March estimate of $511.3 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential (red) spending is 8.9% below the peak in 2022.

Private non-residential (blue) spending is 1.4% below the peak in February 2025.

Public construction spending (orange) is at a new peak.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is down 4.8%. Private non-residential spending is up 1.0% year-over-year. Public spending is up 5.5% year-over-year.

ISM® Manufacturing index Decreased to 48.5% in May

by Calculated Risk on 6/02/2025 10:00:00 AM

(Posted with permission). The ISM manufacturing index indicated expansion. The PMI® was at 48.5% in May, down from 48.7% in April. The employment index was at 46.8%, up from 46.5% the previous month, and the new orders index was at 47.6%, up from 47.2%.

From ISM: Manufacturing PMI® at 48.5% May 2025 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector contracted in May for the third consecutive month, following a two-month expansion preceded by 26 straight months of contraction, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®.This suggests manufacturing contracted in May. This was below the consensus forecast and new export orders were weak and prices very strong.

The report was issued today by Susan Spence, MBA, Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee:

“The Manufacturing PMI® registered 48.5 percent in May, 0.2 percentage point lower compared to the 48.7 percent recorded in April. The overall economy continued in expansion for the 61st month after one month of contraction in April 2020. (A Manufacturing PMI® above 42.3 percent, over a period of time, generally indicates an expansion of the overall economy.) The New Orders Index contracted for the fourth month in a row following a three-month period of expansion; the figure of 47.6 percent is 0.4 percentage point higher than the 47.2 percent recorded in April. The May reading of the Production Index (45.4 percent) is 1.4 percentage points higher than April’s figure of 44 percent. The index continued in contraction in March for the third straight month after two months of expansion preceded by eight months of contraction. The Prices Index remained in expansion (or ‘increasing’) territory, registering 69.4 percent, down 0.4 percentage point compared to the reading of 69.8 percent in April. The Backlog of Orders Index registered 47.1 percent, up 3.4 percentage points compared to the 43.7 percent recorded in April. The Employment Index registered 46.8 percent, up 0.3 percentage point from April’s figure of 46.5 percent.

“The Supplier Deliveries Index indicated a continued slowing of deliveries, registering 56.1 percent, 0.9 percentage point higher than the 55.2 percent recorded in April. (Supplier Deliveries is the only ISM® Report On Business® index that is inversed; a reading of above 50 percent indicates slower deliveries, which is typical as the economy improves and customer demand increases.) The Inventories Index registered 46.7 percent, down 4.1 percentage points compared to April’s reading of 50.8 percent.

“The New Export Orders Index reading of 40.1 percent is 3 percentage points lower than the reading of 43.1 percent registered in April. The Imports Index plunged into extreme contraction in May, registering 39.9 percent, 7.2 percentage points lower than April’s reading of 47.1 percent.”

emphasis added