by Calculated Risk on 5/26/2025 10:29:00 AM

Monday, May 26, 2025

Memorial Day: Remembering James Hoey

Memorial Day is about remembering those that in the words of Abraham Lincoln, “gave the last full measure of devotion” in defending our nation so “that this government of the people, by the people, for the people, shall not perish from the earth”.

Today I’m thinking of my distant relative, James Hoey (Jan 14, 1842 – Aug 13, 1864) who fought for the Union during the Civil War and gave the ultimate sacrifice at the age of 22. Thank you, James!

My family has fought in every major American war. For example, my 4th Great Grandfather, William Marks (1749 – 1824) fought in the revolutionary war. His son, my 3rd Great Grandfather, William Marks, Jr. was a Brigadier General during the war of 1812 – and went on the serve as a U.S. Senator from the State of Pennsylvania.

We must also remember what they all fought for: America’s core value is the rule of law rooted in the U.S. Constitution. We are a Nation of Laws, not of men.

Housing May 26th Weekly Update: Inventory up 2.6% Week-over-week, Up 32.4% Year-over-year

by Calculated Risk on 5/26/2025 08:11:00 AM

Click on graph for larger image.

Click on graph for larger image. This second inventory graph is courtesy of Altos Research.

This second inventory graph is courtesy of Altos Research.Sunday, May 25, 2025

The Normal Seasonal Pattern for Median House Prices

by Calculated Risk on 5/25/2025 08:12:00 AM

This week, in the CalculatedRisk Real Estate Newsletter on March existing home sales, NAR: Existing-Home Sales Decreased to 4.00 million SAAR in April; Down 2.0% YoY, I noted:

On a month-over-month basis, median prices increased 2.7% from March and are now down 3.0% from the June 2024 peak. This is less than the normal seasonal increase in the median price for April.Seasonally, median prices typically peak in June (closed sales are mostly for contracts signed in April and May).

And seasonally, prices usually bottom the following January (contracts signed in November and December).

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|---|---|---|

| Jan to Apr | 7.1% | 7.1% | 7.7% | 12.2% | 11.6% | 6.9% | 7.4% | 5.2% |

| Apr to Jun | 6.2% | 6.9% | 2.6% | 7.7% | 4.6% | 6.3% | 5.0% | NA |

| Jan to Jun | 13.7% | 14.4% | 10.6% | 20.8% | 16.8% | 13.7% | 12.8% | NA |

| Jun to Jan | -8.9% | -6.7% | 3.1% | -3.4% | -12.8% | -7.7% | -7.8% | NA |

The 2025 increase in median prices from January to April was less than the normal seasonal increase.

Saturday, May 24, 2025

Real Estate Newsletter Articles this Week: Existing-Home Sales Decreased to 4.00 million SAAR in April

by Calculated Risk on 5/24/2025 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• NAR: Existing-Home Sales Decreased to 4.00 million SAAR in April; Down 2.0% YoY

• New Home Sales Increase to 743,000 Annual Rate in April

• "How do you grade the Spring housing market?"

• In Q1 2025, 19% of Units Started Built-for-Rent were Single Family

• California Home Sales "Retreat" in April; New Listings "Surge"

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

Schedule for Week of May 25, 2025

by Calculated Risk on 5/24/2025 08:11:00 AM

The key reports this week are the second estimate of Q1 GDP, March Case-Shiller house prices, and Personal Income and Outlays for April.

For manufacturing, the May Richmond and Dallas Fed manufacturing surveys will be released.

All US markets will be closed in observance of Memorial Day.

8:30 AM: Durable Goods Orders for April from the Census Bureau. The consensus is for a 7.8% decrease in durable goods orders.

9:00 AM: S&P/Case-Shiller House Price Index for March. The consensus is for the Case-Shiller 20-City Composite Index to increase 4.5% YoY, unchanged from 4.5% YoY in February.

9:00 AM: S&P/Case-Shiller House Price Index for March. The consensus is for the Case-Shiller 20-City Composite Index to increase 4.5% YoY, unchanged from 4.5% YoY in February.This graph shows the year-over-year change in the seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

9:00 AM: FHFA House Price Index for March. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM: Dallas Fed Survey of Manufacturing Activity for May.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for May.

2:00 PM: FOMC Minutes, Minutes Meeting of May 6-7, 2025

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for initial claims of 225 thousand, down from 227 thousand last week.

8:30 AM: Gross Domestic Product, 1st quarter 2025 (Second estimate). The consensus is that real GDP decreased 0.3% annualized in Q1, unchanged from the advance estimate of -0.3%.

10:00 AM: Pending Home Sales Index for April. The consensus is for a 0.4% decrease in the index.

8:30 AM ET: Personal Income and Outlays, April 2025. The consensus is for a 0.3% increase in personal income, and for a 0.2% increase in personal spending. And for the Core PCE price index to increase 0.1%. PCE prices are expected to be up 2.2% YoY, and core PCE prices up 2.5% YoY.

9:45 AM: Chicago Purchasing Managers Index for May.

10:00 AM: University of Michigan's Consumer sentiment index (Final for May). The consensus is for a reading of 50.8.

Friday, May 23, 2025

May 23rd COVID Update: Weekly COVID Deaths at New Pandemic Low

by Calculated Risk on 5/23/2025 07:05:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Deaths per Week | 306✅ | 368 | ≤3501 | |

| 1my goals to stop weekly posts. 🚩 Increasing number weekly for Deaths. ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported since Jan 2023.

This appears to be a leading indicator for COVID hospitalizations and deaths. This is moving towards the lows last May.

This appears to be a leading indicator for COVID hospitalizations and deaths. This is moving towards the lows last May.Q2 GDP Tracking: Low 2%

by Calculated Risk on 5/23/2025 02:00:00 PM

From BofA:

Since our last weekly publication, our 2Q and 1Q GDP tracking are down two-tenths each to +2.0% q/q saar and -0.5% q/q saar, respectively. [May 23rd estimate]From Goldman:

emphasis added

We left our Q2 GDP tracking estimate unchanged at +2.1% (quarter-over-quarter annualized) and our Q2 domestic final sales forecast unchanged at 0%. We left our past-quarter tracking estimate unchanged at -0.5%. [May 23rd estimate]And from the Atlanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2025 is 2.4 percent on May 16, down from 2.5 percent on May 15. After this morning’s housing starts report from the US Census Bureau and the release of import and export price indexes from the US Bureau of Labor Statistics, the nowcast of second-quarter real residential fixed investment growth decreased from 0.4 percent to -3.0 percent. [May 16th estimate] (Next update on May 27th)

Newsletter: New Home Sales Increase to 743,000 Annual Rate in April

by Calculated Risk on 5/23/2025 10:59:00 AM

Today, in the Calculated Risk Real Estate Newsletter: New Home Sales Increase to 743,000 Annual Rate in April

Brief excerpt:

The Census Bureau reported New Home Sales in April were at a seasonally adjusted annual rate (SAAR) of 743 thousand. The previous three months were revised down significantly, combined.There is much more in the article.

...

The next graph shows new home sales for 2024 and 2025 by month (Seasonally Adjusted Annual Rate). Sales in April 2025 were up 3.3% from April 2024.

New home sales, seasonally adjusted, have increased year-over-year in 19 of the last 25 months. This is essentially the opposite of what happened with existing home sales that had been down year-over-year for 40 of the last 44 months.

New Home Sales Increase to 743,000 Annual Rate in April

by Calculated Risk on 5/23/2025 10:00:00 AM

The Census Bureau reports New Home Sales in April were at a seasonally adjusted annual rate (SAAR) of 743 thousand.

The previous three months were revised down significantly, combined.

Sales of new single-family houses in April 2025 were at a seasonally-adjusted annual rate of 743,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 10.9 percent above the March 2025 rate of 670,000, and is 3.3 percent above the April 2024 rate of 719,000.

emphasis added

Click on graph for larger image.

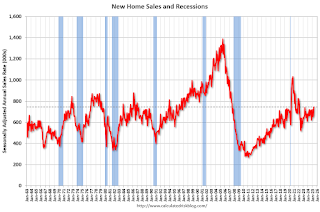

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

New home sales were above pre-pandemic levels.

The second graph shows New Home Months of Supply.

The months of supply decreased in April to 8.1 months from 9.1 months in March.

The months of supply decreased in April to 8.1 months from 9.1 months in March. The all-time record high was 12.2 months of supply in January 2009. The all-time record low was 3.3 months in August 2020.

This is well above the top of the normal range (about 4 to 6 months of supply is normal).

"The seasonally-adjusted estimate of new houses for sale at the end of April 2025 was 504,000. This is 0.6 percent below the March 2025 estimate of 507,000, and is 8.6 percent above the April 2024 estimate of 464,000.Sales were above expectations of 700 thousand SAAR, however sales for the three previous months were revised down significantly, combined. I'll have more later today.

This represents a supply of 8.1 months at the current sales rate. The months' supply is 11.0 percent below the March 2025 estimate of 9.1 months, and is 5.2 percent above the April 2024 estimate of 7.7 months."

ICE First Look at April Mortgage Performance: "Foreclosure Activity Edges Higher Following Recent Record Lows"

by Calculated Risk on 5/23/2025 08:09:00 AM

From Intercontinental Exchange: ICE First Look at Mortgage Performance: Foreclosure Activity Edges Higher Following Recent Record Lows

Intercontinental Exchange, Inc. (NYSE:ICE) ... today released its April 2025 First Look, which shows U.S. Department of Veterans Affairs (VA) mortgages progressing through the foreclosure pipeline following the recent moratorium expiration.

The ICE First Look reports on month-end delinquency, foreclosure and prepayment statistics sourced from its loan-level database, which covers a majority of the U.S. mortgage market. Key takeaways from this month’s findings include:

• The national delinquency rate ticked up 1 basis point (bp) to 3.22% in April and is up a modest 13 bps (4.1%) from the same time last year. Still, delinquencies remain below pre-pandemic levels.

• Serious delinquencies – loans 90+ days past due but not in foreclosure – improved seasonally but rose 14% from April 2024 marking the sixth consecutive month of 10%+ annual increases.

• While foreclosure activity remains muted, foreclosure starts (+13%), sales (+9%), and active inventory (+4%) all rose on an annual basis for the second consecutive month.

• April’s 6,500 foreclosure sales marked the largest single-month volume in 15 months, with VA sales, which account for the bulk of the recent rise, hitting their highest level since 2019.

• Prepayment activity, measured in single month mortality, jumped to 0.71%, the highest level since October. This rise was driven by stronger home sale and refinance-related prepayments, which grew +19.0% over the previous month and +34.9% over the previous year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a table from ICE.