by Calculated Risk on 5/23/2025 10:00:00 AM

Friday, May 23, 2025

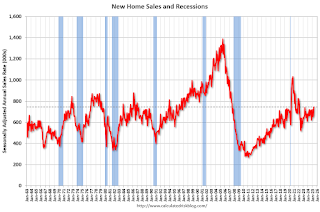

New Home Sales Increase to 743,000 Annual Rate in April

The Census Bureau reports New Home Sales in April were at a seasonally adjusted annual rate (SAAR) of 743 thousand.

The previous three months were revised down significantly, combined.

Sales of new single-family houses in April 2025 were at a seasonally-adjusted annual rate of 743,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 10.9 percent above the March 2025 rate of 670,000, and is 3.3 percent above the April 2024 rate of 719,000.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

New home sales were above pre-pandemic levels.

The second graph shows New Home Months of Supply.

The months of supply decreased in April to 8.1 months from 9.1 months in March.

The months of supply decreased in April to 8.1 months from 9.1 months in March. The all-time record high was 12.2 months of supply in January 2009. The all-time record low was 3.3 months in August 2020.

This is well above the top of the normal range (about 4 to 6 months of supply is normal).

"The seasonally-adjusted estimate of new houses for sale at the end of April 2025 was 504,000. This is 0.6 percent below the March 2025 estimate of 507,000, and is 8.6 percent above the April 2024 estimate of 464,000.Sales were above expectations of 700 thousand SAAR, however sales for the three previous months were revised down significantly, combined. I'll have more later today.

This represents a supply of 8.1 months at the current sales rate. The months' supply is 11.0 percent below the March 2025 estimate of 9.1 months, and is 5.2 percent above the April 2024 estimate of 7.7 months."

ICE First Look at April Mortgage Performance: "Foreclosure Activity Edges Higher Following Recent Record Lows"

by Calculated Risk on 5/23/2025 08:09:00 AM

From Intercontinental Exchange: ICE First Look at Mortgage Performance: Foreclosure Activity Edges Higher Following Recent Record Lows

Intercontinental Exchange, Inc. (NYSE:ICE) ... today released its April 2025 First Look, which shows U.S. Department of Veterans Affairs (VA) mortgages progressing through the foreclosure pipeline following the recent moratorium expiration.

The ICE First Look reports on month-end delinquency, foreclosure and prepayment statistics sourced from its loan-level database, which covers a majority of the U.S. mortgage market. Key takeaways from this month’s findings include:

• The national delinquency rate ticked up 1 basis point (bp) to 3.22% in April and is up a modest 13 bps (4.1%) from the same time last year. Still, delinquencies remain below pre-pandemic levels.

• Serious delinquencies – loans 90+ days past due but not in foreclosure – improved seasonally but rose 14% from April 2024 marking the sixth consecutive month of 10%+ annual increases.

• While foreclosure activity remains muted, foreclosure starts (+13%), sales (+9%), and active inventory (+4%) all rose on an annual basis for the second consecutive month.

• April’s 6,500 foreclosure sales marked the largest single-month volume in 15 months, with VA sales, which account for the bulk of the recent rise, hitting their highest level since 2019.

• Prepayment activity, measured in single month mortality, jumped to 0.71%, the highest level since October. This rise was driven by stronger home sale and refinance-related prepayments, which grew +19.0% over the previous month and +34.9% over the previous year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a table from ICE.

Thursday, May 22, 2025

Friday: New Home Sales

by Calculated Risk on 5/22/2025 08:17:00 PM

Friday:

• At 10:00 AM ET, New Home Sales for April from the Census Bureau. The consensus is for 700 thousand SAAR, down from 724 thousand SAAR in March.

Realtor.com Reports Most Actively "For Sale" Inventory since 2019

by Calculated Risk on 5/22/2025 04:59:00 PM

What this means: On a weekly basis, Realtor.com reports the year-over-year change in active inventory and new listings. On a monthly basis, they report total inventory. For May, Realtor.com reported inventory was up 30.6% YoY, but still down 16.3% compared to the 2017 to 2019 same month levels.

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report: Weekly Housing Trends View—Data for Week Ending May 17, 2025

• Active inventory climbed 29.7% year-over-year

The number of homes actively for sale remains on a strong upward trajectory, now 29.7% higher than this time last year. This represents the 80th consecutive week of annual gains in inventory. There were more than 1 million homes for sale last week, the highest inventory level since December 2019.

• New listings—a measure of sellers putting homes up for sale—rising 8.2% year-over-year

New listings rose again last week, up 8.2% compared to the same period last year.

• The median list price falls more than 1%

After nine consecutive weeks of flat or rising prices, the national median listing price fell year-over-year last week. Ongoing affordability challenges, along with growing concerns about personal finances and job security, continue to pose significant hurdles for many buyers. Nearly four in five home shoppers believe it’s a bad time to buy, which is dampening demand.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory was up year-over-year for the 80th consecutive week.

Hotels: Occupancy Rate Decreased 0.4% Year-over-year

by Calculated Risk on 5/22/2025 02:01:00 PM

The U.S. hotel industry reported mixed year-over-year comparisons, according to CoStar’s latest data through 17 May. ...The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

11-17 May 2025 (percentage change from comparable week in 2024):

• Occupancy: 67.2% (-0.4%)

• Average daily rate (ADR): US$166.31 (+1.3%)

• Revenue per available room (RevPAR): US$111.80 (+0.9%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2025, blue is the median, and dashed light blue is for 2024. Dashed purple is for 2018, the record year for hotel occupancy.

Newsletter: NAR: Existing-Home Sales Decreased to 4.00 million SAAR in April; Down 2.0% YoY

by Calculated Risk on 5/22/2025 10:52:00 AM

Today, in the CalculatedRisk Real Estate Newsletter: NAR: Existing-Home Sales Decreased to 4.00 million SAAR in April; Down 2.0% YoY

Excerpt:

Sales in April (4.00 million SAAR) were down 0.5% from the previous month and were 2.0% below the April 2024 sales rate. This was the 3rd consecutive month with a year-over-year decline in sales.There is much more in the article.

...

Sales Year-over-Year and Not Seasonally Adjusted (NSA)

The fourth graph shows existing home sales by month for 2024 and 2025.

Sales decreased 2.0% year-over-year compared to April 2024.

...

On an NSA basis for the month of April, this was at the low for housing bust for the month of April that happened in April 2009. Year-to-date, sales are down 2.4% NSA.

NAR: Existing-Home Sales Decreased to 4.00 million SAAR in April; Down 2.0% YoY

by Calculated Risk on 5/22/2025 10:00:00 AM

From the NAR: Existing-Home Sales Edged Lower by 0.5% in April

Existing-home sales slowed in April, according to the National Association of REALTORS®. Sales dipped in the Northeast and West, grew in the Midwest and were unchanged in the South. Year-over-year, sales declined in three regions and remained steady in the Northeast.

Total existing-home sales – completed transactions that include single-family homes, townhomes, condominiums and co-ops – slipped 0.5% from March to a seasonally adjusted annual rate of 4.00 million in April. Year-over-year, sales descended 2.0% (down from 4.08 million in April 2024)..

...

Total housing inventory registered at the end of April was 1.45 million units, up 9.0% from March and 20.8% from one year ago (1.2 million). Unsold inventory sits at a 4.4-month supply at the current sales pace, up from 4.0 months in March and 3.5 months in April 2024.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1994.

Sales in April (4.00 million SAAR) were down 0.5% from the previous month and were 2.0% below the April 2024 sales rate. This was the 3rd consecutive month with a year--over-year decline in sales.

According to the NAR, inventory increased to 1.45 million in April from 1.33 million the previous month.

According to the NAR, inventory increased to 1.45 million in April from 1.33 million the previous month.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was up 20.8% year-over-year (blue) in April compared to April 2024.

Inventory was up 20.8% year-over-year (blue) in April compared to April 2024. Months of supply (red) increased to 4.4 months in April from 4.0 months the previous month.

As expected, the sales rate was below the consensus forecast. I'll have more later.

Weekly Initial Unemployment Claims Decrease to 227,000

by Calculated Risk on 5/22/2025 08:30:00 AM

The DOL reported:

In the week ending May 17, the advance figure for seasonally adjusted initial claims was 227,000, a decrease of 2,000 from the previous week's unrevised level of 229,000. The 4-week moving average was 231,500, an increase of 1,000 from the previous week's unrevised average of 230,500.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 231,500.

The previous week was unrevised.

Weekly claims were lower than the consensus forecast.

Wednesday, May 21, 2025

Thursday: Existing Home Sales, Unemployment Claims

by Calculated Risk on 5/21/2025 07:01:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for initial claims of 232 thousand, up from 229 thousand last week.

• Also at 8:30 AM, Chicago Fed National Activity Index for April. This is a composite index of other data.

• At 10:00 AM, Existing Home Sales for April from the National Association of Realtors (NAR). The consensus is for 4.15 million SAAR, up from 4.02 million. Housing economist Tom Lawler expects the NAR to report sales of 3.98 million SAAR.

ICE: "Annual home price growth nationally slowed to 1.6% in May"

by Calculated Risk on 5/21/2025 03:12:00 PM

The ICE Home Price Index (HPI) is a repeat sales index. ICE reports the median price change of the repeat sales.

From ICE (Intercontinental Exchange):

Annual home price growth nationally slowed to 1.6% in May from 2% in April, as inventory surpluses that began in the Sunbelt spread to the West.As ICE mentioned, cities in the South have been leading the way in inventory increases and price declines (especially Florida and Texas). Now the West Coast markets are following, although inventory levels are mostly still below the pre-pandemic levels.• 40% of the nation’s largest housing markets experienced seasonally adjusted month-over-month price declines from April to May, including 23 of the 24 top markets in the WestPrice declines appear to be inventory driven:

• The number of markets with year-over-year price declines increased from 9 to 23 by mid-May, with a majority (9) of the newcomers located in the West

• Those markets include: Denver (-1.6%), San Francisco and Stockton, Calif. (-1.5%), Phoenix (-1.2%), with more modest declines in Honolulu, Colorado Springs, Tucson, Sacramento, and San Diego

• That’s the largest number of markets with annual price declines since interest rates surged above 7.5% in late 2023• Western markets (led by California) have seen sharp rises in inventory, with every major California market now having at least +40% more homes available for sale than at the same time last year, led by Stockton (+87% ) and Oxnard and San Diego (+70% each)If current trends persist, we could see prices fall year over year in even more West Coast markets.

• Inventories in San Francisco, San Jose, and Stockton have already surpassed pre-pandemic levels, with other California markets on pace to ‘normalize’ later this year