by Calculated Risk on 5/21/2025 07:00:00 AM

Wednesday, May 21, 2025

MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 5.1 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending May 16, 2025.

The Market Composite Index, a measure of mortgage loan application volume, decreased 5.1 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 5 percent compared with the previous week. The Refinance Index decreased 5 percent from the previous week and was 27 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 5 percent from one week earlier. The unadjusted Purchase Index decreased 6 percent compared with the previous week and was 13 percent higher than the same week one year ago.

“Mortgage rates jumped to their highest level since February last week, with investors concerned about rising inflation and the impact of increasing deficits and debt,” said Mike Fratantoni, MBA’s SVP and Chief Economist. “Higher rates, including the 30-year fixed rate increasing to 6.92 percent, led to a slowdown across the board. However, purchase applications are up 13 percent from one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($806,500 or less) increased to 6.92 percent from 6.86 percent, with points increasing to 0.69 from 0.68 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is up 13% year-over-year unadjusted.

Tuesday, May 20, 2025

Wednesday: Architecture Billings Index

by Calculated Risk on 5/20/2025 07:41:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, State Employment and Unemployment (Monthly) for April 2025

• During the day, The AIA's Architecture Billings Index for April (a leading indicator for commercial real estate).

May Vehicle Forecast: Sales "Cooling Off" to 15.9 million SAAR

by Calculated Risk on 5/20/2025 03:52:00 PM

From WardsAuto: U.S. Light-Vehicle Sales Cooling Off in May; Inventory Still Falling (pay content). Brief excerpt:

With inventory set to continue declining month-to-month, and the cost to automakers of the tariffs more strongly kicking in by July, sales are likely to continue sequential weakness into the summer – unless automakers decide to eat most of the increased cost. Based on the North America production outlook for the next several months, most are not planning to eat a lot of the cost.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows actual sales from the BEA (Blue), and Wards forecast for May (Red).

On a seasonally adjusted annual rate basis, the Wards forecast of 15.9 million SAAR, would be down 7.9% from last month, and up 0.5% from a year ago.

Energy expenditures as a percentage of PCE

by Calculated Risk on 5/20/2025 02:13:00 PM

During the early stages of the pandemic, energy expenditures as a percentage of PCE hit an all-time low of 3.3% of PCE. Energy expenditures as a percentage of PCE increased to 2018 levels by the end of 2021 and increased further in 2022 due to the Russian invasion of Ukraine.

This graph shows expenditures on energy goods and services as a percent of total personal consumption expenditures. This is one of the measures that Professor Hamilton at Econbrowser looks at to evaluate any drag on GDP from energy prices.

Click on graph for larger image.

Data source: BEA.

In general, energy expenditures as a percent of PCE has been trending down for decades. The huge spikes in energy prices during the oil crisis of 1973 and 1979 are obvious. As is the increase in energy prices during the 2001 through 2008 period.

Update: Lumber Prices Up 13% YoY

by Calculated Risk on 5/20/2025 11:32:00 AM

This is something to watch again. Here is another monthly update on lumber prices.

SPECIAL NOTE: The CME group discontinued the Random Length Lumber Futures contract on May 16, 2023. I switched to a physically-delivered Lumber Futures contract that was started in August 2022. Unfortunately, this impacts long term price comparisons since the new contract was priced about 24% higher than the old random length contract for the period when both contracts were available.

This graph shows CME random length framing futures through August 2022 (blue), and the new physically-delivered Lumber Futures (LBR) contract starting in August 2022 (Red).

California Home Sales "Retreat" in April; New Listings "Surge"

by Calculated Risk on 5/20/2025 08:21:00 AM

Today, in the Calculated Risk Real Estate Newsletter: California Home Sales "Retreat" in April; New Listings "Surge"

A brief excerpt:

From the California Association of Realtors® (C.A.R.): California home sales retreat for second straight month in April as median home price hits new all-time high, C.A.R. reportsThere is much more in the article.April’s sales pace fell 3.4 percent from the 277,030 homes sold in March and was down 0.2 percent from a year ago, when 268,170 homes were sold on an annualized basis. April’s sales level was the lowest in three months.

...

Total active listings in April rose on a year-over-year basis at the fastest pace since January 2023. The level of active listings last month reached a 66-month high (since October 2019) and recorded its 15th consecutive month of annual gain in housing supply.

Monday, May 19, 2025

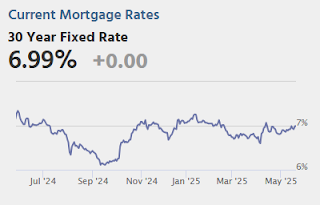

"Mortgage Rates Briefly Over 7%"

by Calculated Risk on 5/19/2025 07:03:00 PM

Mortgage rates jumped sharply over the weekend as financial markets reacted to Moody's credit rating downgrade of the U.S. News of the downgrade broke with only minutes left in Friday's market/business day, so most of the response played out when global markets opened again late last night.Tuesday:

...

Most mortgage lenders are deciding on rates for the day in the 9am-10am ET time frame. Because this was one of the weakest moments for the bond market, mortgage rates were sharply higher at first. The average lender was back over 7% for the 1st time since April 11th, and only the 2nd time in 3 months.

No sooner were these rates being published than the underlying market began moving back in the other direction. Mortgage lenders prefer to only set rates once per day, but will make mid-day updates when things change enough. Today's reversal was more than sufficient to prompt a re-price. After that, the average top tier 30yr fixed rate moved just barely back below 7.0%--still higher than Friday, but much more in line with last week's range. [30 year fixed 6.99%]

emphasis added

• No major economic releases scheduled.

LA Ports: April Inbound Traffic Up YoY, Outbound Down

by Calculated Risk on 5/19/2025 01:55:00 PM

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12-month average.

Click on graph for larger image.

Click on graph for larger image.On a rolling 12-month basis, inbound traffic increased 0.7% in April compared to the rolling 12 months ending the previous month. Outbound traffic decreased 0.3% compared to the rolling 12 months ending the previous month.

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday and then decline sharply and bottom in the Winter depending on the timing of the Chinese New Year.

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday and then decline sharply and bottom in the Winter depending on the timing of the Chinese New Year. "How do you grade the Spring housing market?"

by Calculated Risk on 5/19/2025 10:51:00 AM

Today, in the Calculated Risk Real Estate Newsletter: "How do you grade the Spring housing market?"

A brief excerpt:

Last week, Housing Wire Editor in Chief Sarah Wheeler asked Lead Analyst Logan Mohtashami the above question: "How do you grade the Spring housing market?"There is much more in the article.

My friend Logan replied: “Generally, just for how I look at housing, this kind of gets an A ...”

I almost fell out of my chair!

Housing May 19th Weekly Update: Inventory up 1.5% Week-over-week, Up 32.7% Year-over-year

by Calculated Risk on 5/19/2025 08:11:00 AM

Click on graph for larger image.

Click on graph for larger image. This second inventory graph is courtesy of Altos Research.

This second inventory graph is courtesy of Altos Research.