by Calculated Risk on 8/05/2021 04:06:00 PM

Thursday, August 05, 2021

Northwest Real Estate in July: Sales up 11% YoY, Inventory down 23% YoY

The Northwest Multiple Listing Service reported Home buyers are finding some relief, but Northwest MLS brokers say it is temporary

Competition for homes eased slightly in July across much of Washington state, but brokers from Northwest Multiple Listing Service expect the respite to be short-lived, with inventory still tight and prices still climbing.The press release is for the Northwest MLS area. There were 10,919 closed sales in July 2021, up 11.0% from 9,840 sales in July 2020. Active inventory for the Northwest is down 22.5%.

"Although the local market is intense, buyers can find some relief because there aren't as many offers to compete with compared to earlier this year," observed J. Lennox Scott, chairman and CEO of John L. Scott Real Estate. He noted the number of listings brokers added last month outgained the number of homes going under contract by a small margin in most areas in the report.

...

At month end, there were 7,948 total listings offered for sale, down 22.5% from the year-ago total of 10,259. That was the highest level since October when inventory totaled 8,623 properties, including single family homes and condominiums.

emphasis added

In King County, sales were up 18.4% year-over-year, and active inventory was down 30.9% year-over-year.

In Seattle, sales were up 27.8% year-over-year, and inventory was down 22.7% year-over-year. This puts the months-of-supply in Seattle at just 0.93 months.

August 5th COVID-19

by Calculated Risk on 8/05/2021 03:46:00 PM

Congratulations to the residents of Maine and New Jersey on joining the 80% club! Well done. Go for 90%!!!

The 7-day average deaths is the highest since June 8th.

According to the CDC, on Vaccinations.

Total doses administered: 348,966,419, as of a week ago 344,071,595. Average doses last week: 0.70 million per day.

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Yesterday | Week Ago | Goal | |

| Percent over 18, One Dose✅ | 70.4% | 70.1% | 69.4% | ≥70.0%1,2 |

| Fully Vaccinated✅ (millions) | 165.6 | 165.3 | 163.9 | ≥1601 |

| New Cases per Day3🚩 | 89,976 | 89,663 | 67,273 | ≤5,0002 |

| Hospitalized3🚩 | 44,865 | 43,037 | 31,331 | ≤3,0002 |

| Deaths per Day3🚩 | 377 | 355 | 279 | ≤502 |

| 1 America's Short Term Goals, 2my goals to stop daily posts, 37 day average for Cases, Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Short term goal met (even if late). | ||||

KUDOS to the residents of the 20 states and D.C. that have achieved the 70% goal (percent over 18 with at least one dose): Vermont, Hawaii, Massachusetts, Connecticut, Maine and New Jersey are at 80%+, and New Mexico, Rhode Island, Pennsylvania, California, Maryland, Washington, New Hampshire, New York, Illinois, Virginia, Delaware, Minnesota, Oregon, Colorado and D.C. are all over 70%.

Next up are Florida at 69.9%, Utah at 68.5%, Nebraska at 68.1%, Wisconsin at 67.7%, Kansas at 67.0%, South Dakota at 66.8%, Nevada at 66.4%, and Iowa at 66.2%.

Click on graph for larger image.

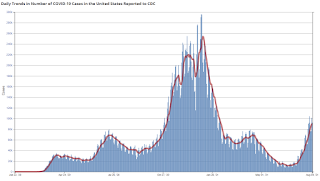

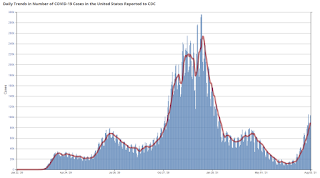

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

July Employment Preview

by Calculated Risk on 8/05/2021 11:45:00 AM

On Friday at 8:30 AM ET, the BLS will release the employment report for July. The consensus is for 900 thousand jobs added, and for the unemployment rate to decrease to 5.7%.

Click on graph for larger image.

Click on graph for larger image.• First, currently there are still about 6.8 million fewer jobs than in February 2020 (before the pandemic).

This graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession was by far the worst recession since WWII in percentage terms, but is now better than the worst of the "Great Recession".

• ADP Report: The ADP employment report showed a gain of 330,000 private sector jobs, well below the consensus estimate of 675,000 jobs added. The ADP report hasn't been very useful in predicting the BLS report, but this suggests the BLS report could be below expectations.

• ISM Surveys: Note that the ISM services are diffusion indexes based on the number of firms hiring (not the number of hires). The ISM® manufacturing employment index increased in July to 52.9%, up from 49.9% last month. This would suggest little change in manufacturing employment in July. ADP showed 8,000 manufacturing jobs added.

The ISM® Services employment index increased in July to 53.8%, from 49.3% last month. This would suggest about 175,000 service jobs added in April. ADP showed 318,000 service jobs added.

In general, the ISM indexes suggest employment growth below expectations.

• Unemployment Claims: The weekly claims report showed a small increase in the number of initial unemployment claims during the reference week (include the 12th of the month) from 418,000 in June to 424,000 in July. This would usually suggest about the same turnover in July as in June, although this might not be very useful right now. In general, weekly claims have been close to expectations in July.

• Permanent Job Losers: Something to watch in the employment report will be "Permanent job losers". While there has been a strong bounce back in total employment, from the shutdown in March and April 2020, permanent job losers had been flat over the last several months.

• Permanent Job Losers: Something to watch in the employment report will be "Permanent job losers". While there has been a strong bounce back in total employment, from the shutdown in March and April 2020, permanent job losers had been flat over the last several months.This graph shows permanent job losers as a percent of the pre-recession peak in employment through the June report.

This data is only available back to 1994, so there is only data for three recessions. In June, the number of permanent job losers decreased to 3.187 million from 3.234 million in May. These jobs will likely be the hardest to recover.

• IMPORTANT: The employment report will probably show a large increase in state and local government education hiring. This is because of a quirk in the seasonal adjustment due to fewer educators hired this year due to the pandemic, so fewer educators will be let go in July.

• Conclusion: The data suggests a weaker than expected report in July. There are some seasonal factors that will boost the BLS report (especially related to education).

Hotels: Occupancy Rate Down 6% Compared to Same Week in 2019

by Calculated Risk on 8/05/2021 10:28:00 AM

Note: The year-over-year occupancy comparisons are easy, since occupancy declined sharply at the onset of the pandemic. So STR is comparing to the same week in 2019.

The occupancy rate is down 6.2% compared to the same week in 2019.

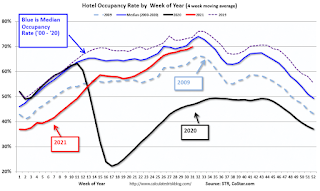

U.S. weekly hotel occupancy dipped from the previous week, while room rates were up slightly, according to STR‘s latest data through July 31.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

July 25-31, 2021 (percentage change from comparable week in 2019*):

• Occupancy: 70.1% (-6.2%)

• Average daily rate (ADR): $142.76 (+6.8%)

• Revenue per available room (RevPAR): $100.07 (+0.1%)

ADR remained at an all-time high on a nominal basis but not when adjusted for inflation ($135).

...

*Due to the steep, pandemic-driven performance declines of 2020, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2021, black is 2020, blue is the median, dashed purple is 2019, and dashed light blue is for 2009 (the worst year on record for hotels prior to 2020).

Note: Y-axis doesn't start at zero to better show the seasonal change.

Trade Deficit Increased to $75.7 Billion in June

by Calculated Risk on 8/05/2021 08:47:00 AM

From the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $75.7 billion in June, up $4.8 billion from $71.0 billion in May, revised.

June exports were $207.7 billion, $1.2 billion more than May exports. June imports were $283.4 billion, $6.0 billion more than May imports.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Exports and imports increased in June.

Exports are up 31% compared to June 2020; imports are up 35% compared to June 2020.

Both imports and exports decreased sharply due to COVID-19, and have now bounced back (imports more than exports),

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Note that net, imports and exports of petroleum products are close to zero.

The trade deficit with China decreased to $27.8 billion in June, from $28.3 billion in June 2020.

Weekly Initial Unemployment Claims decrease to 385,000

by Calculated Risk on 8/05/2021 08:36:00 AM

The DOL reported:

In the week ending July 31, the advance figure for seasonally adjusted initial claims was 385,000, a decrease of 14,000 from the previous week's revised level. The previous week's level was revised down by 1,000 from 400,000 to 399,000. The 4-week moving average was 394,000, a decrease of 250 from the previous week's revised average. The previous week's average was revised down by 250 from 394,500 to 394,250.This does not include the 94,476 initial claims for Pandemic Unemployment Assistance (PUA) that was up from 93,060 the previous week.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 394,000.

The previous week was revised down.

Regular state continued claims decreased to 2,930,000 (SA) from 3,296,000 (SA) the previous week.

Note: There are an additional 5,156,982 receiving Pandemic Unemployment Assistance (PUA) that decreased from 5,246,162 the previous week (there are questions about these numbers). This is a special program for business owners, self-employed, independent contractors or gig workers not receiving other unemployment insurance. And an additional 4,246,207 receiving Pandemic Emergency Unemployment Compensation (PEUC) up from 4,233,883.

Weekly claims were close to the consensus forecast.

Wednesday, August 04, 2021

Thursday: Trade Deficit, Unemployment Claims

by Calculated Risk on 8/04/2021 09:00:00 PM

Thursday:

• At 8:30 AM ET, Trade Balance report for June from the Census Bureau. The consensus is the trade deficit to be $73.9 billion. The U.S. trade deficit was at $71.2 Billion the previous month.

• Also at 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for a decrease to 390 thousand from 400 thousand last week.

August 4th COVID-19: Second Worst Wave for Cases and Hospitalizations

by Calculated Risk on 8/04/2021 04:21:00 PM

According to the CDC, on Vaccinations.

Total doses administered: 348,102,478, as of a week ago 343,361,524. Average doses last week: 0.68 million per day.

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Yesterday | Week Ago | Goal | |

| Percent over 18, One Dose✅ | 70.1% | 70.1% | 69.3% | ≥70.0%1,2 |

| Fully Vaccinated✅ (millions) | 165.3 | 165.1 | 163.6 | ≥1601 |

| New Cases per Day3🚩 | 89,463 | 85,825 | 62,432 | ≤5,0002 |

| Hospitalized3🚩 | 42,938 | 40,935 | 29,601 | ≤3,0002 |

| Deaths per Day3🚩 | 354 | 333 | 261 | ≤502 |

| 1 America's Short Term Goals, 2my goals to stop daily posts, 37 day average for Cases, Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Short term goal met (even if late). | ||||

KUDOS to the residents of the 20 states and D.C. that have achieved the 70% goal (percent over 18 with at least one dose): Vermont, Hawaii, Massachusetts and Connecticut are at 80%+, and Maine, New Mexico, New Jersey, Rhode Island, Pennsylvania, California, Maryland, Washington, New Hampshire, New York, Illinois, Virginia, Delaware, Minnesota, Oregon, Colorado and D.C. are all over 70%.

Next up are Florida at 69.6%, Utah at 68.5%, Nebraska at 67.8%, Wisconsin at 67.6%, Kansas at 66.9%, South Dakota at 66.7%, Nevada at 66.2%, and Iowa at 66.0%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

Denver Real Estate in July: Sales Down 21% YoY, Active Inventory Down 37% YoY

by Calculated Risk on 8/04/2021 01:22:00 PM

While still in a robust seller's market, the July 2021 report indicates that as we head into fall, buyers will start to have more time to review properties and less competition on the number of offers overall. The July residential real estate market reported an increased inventory of 29.92 percent, while it also represented a decrease in closings of 12.30 percent compared to the previous month, indicating a supply increase and demand decrease.Active inventory in Denver is up 111% from the record low in March 2021.

“The real estate market continuously changes,” said Andrew Abrams, Chair of the DMAR Market Trends Committee and Metro Denver REALTOR®. “It appears that, for now, we are back to drawing within the lines. For buyers, this can be beneficial by having more normal expectations of what it takes to buy. For sellers with grandiose dreams of what their house could be worth, now is the time to come back to reality and use the data to help make an educated decision.”

emphasis added

ISM® Services Index Increased to 64.1% in July

by Calculated Risk on 8/04/2021 10:04:00 AM

(Posted with permission). The July ISM® Services index was at 64.1%, up from 60.1% last month. The employment index increased to 53.8%, from 49.3%. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: July 2021 Services ISM® Report On Business®

Economic activity in the services sector grew in July for the 14th month in a row, say the nation’s purchasing and supply executives in the latest Services ISM® Report On Business®.This was above the consensus forecast, and the employment index increased to 53.8%, from 49.3% the previous month.

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Services Business Survey Committee: “The Services PMI® registered another all-time high of 64.1 percent, which is 4 percentage points higher than the June reading of 60.1 and eclipses the previous record of 64 percent in May 2021. The July reading indicates the 14th straight month of growth for the services sector, which has expanded for all but two of the last 138 months.

“The Supplier Deliveries Index registered 72 percent, up 3.5 percentage points from June’s reading of 68.5 percent. (Supplier Deliveries is the only ISM® Report On Business® index that is inversed; a reading of above 50 percent indicates slower deliveries, which is typical as the economy improves and customer demand increases.) The Prices Index registered 82.3 percent, up 2.8 percentage points from the June figure of 79.5 percent and its second-highest reading ever, behind September 2005 (83.5 percent).

“According to the Services PMI®, 17 services industries reported growth. The composite index indicated growth for the 14th consecutive month after a two-month contraction in April and May 2020. The rate of expansion in the services sector recorded another all-time high. The Employment Index reflected growth, even though the constrained labor pool continues to be an issue. Materials shortages, inflation and logistics continue to negatively impact the continuity of supply,” says Nieves.

emphasis added