by Calculated Risk on 8/02/2021 12:12:00 PM

Monday, August 02, 2021

Black Knight Mortgage Monitor for June; Large Number of Forbearance Plans Expire in Sept and Oct

Black Knight released their Mortgage Monitor report for June today. According to Black Knight, 4.37% of mortgage were delinquent in June, down from 4.73% of mortgages in May, and down from 7.59% in June 2020. Black Knight also reported that 0.27% of mortgages were in the foreclosure process, down from 0.36% a year ago.

This gives a total of 5.01% delinquent or in foreclosure.

Press Release: Black Knight: Servicers Face Operational Challenge of Processing Up To 18,000 Forbearance Plans Per Day as Newly Detailed Forbearance Timelines Frontload Expirations to the Fall

Today, the Data & Analytics division of Black Knight, Inc. released its latest Mortgage Monitor Report, based upon the company’s industry-leading mortgage, real estate and public records datasets. Considering recently updated forbearance expiration timelines announced by FHFA, FHA, VA, and USDA, this month’s report looks at the impact of the many varying allowable forbearance periods. According to Black Knight Data & Analytics President Ben Graboske, due to the complexity of the expiration matrices across different agencies, the operational challenge mortgage servicers were already facing this fall has been compounded even more.

“Prior to the agencies issuing clarifying guidance on allowable forbearance periods, some 950,000 plans were set to expire over the final six months of the year – representing about half of all loans in forbearance,” said Graboske. “That estimate assumed a blanket 18-month maximum allowable forbearance period. However, now we have detailed matrices of differing forbearance periods across the various agencies. Depending upon the specific agency and when forbearance was initially requested by the homeowner, a plan can have a 6-, 12-, 15- or 18-month limit. Assuming borrowers stay in for the maximum allowable term, this means plans that started as much as seven months apart are now scheduled to expire simultaneously, frontloading expirations of forbearance plans sooner than estimated.

“As a result, 65% of active plans – representing approximately 1.2 million homeowners – are now set to expire over the rest of 2021, including nearly 80% of all FHA and VA loans in forbearance. Nearly three quarters of a million plans would expire in September and October alone. Over the course of just two months this fall, the nation’s mortgage servicers would have to process up to approximately 18,000 expiring plans per business day, guiding borrowers through complex loss mitigation waterfalls directed by changing regulatory requirements. The operational challenge this represents is staggering, even before noting the oversized share of FHA and VA loans. Given the heightened challenges those borrowers may face in returning to making mortgage payments as compared to those in GSE loans, effective loss mitigation efforts and automated processes become even more critically important.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph on delinquencies from Black Knight:

• After a calendar-related setback in May, mortgage delinquencies returned to their trend of improvement in June, falling to 4.37% from 4.73% the month prior

• The national delinquency rate is now back below its 2000-2005 pre-Great Recession average for this time of year and currently stands 1.17 percentage points above the record low reached just before the onset of the pandemic

• While the overall delinquency rate remains on pace to return to pre-pandemic levels by early 2022, serious delinquencies continue to improve at a much slower rate

And on estimated expiration of forbearance plans from Black Knight:

And on estimated expiration of forbearance plans from Black Knight: • Prior to the clarifying guidance on allowable forbearance periods, Black Knight had estimated some 950K plans were set to expire over the final six months of the year – representing about half of all loans in forbearanceThere is much more in the mortgage monitor.

• However, under the current matrices 65% of active plans – representing approximately 1.2 million homeowners – are now set to expire over the rest of 2021, including nearly 80% of all FHA and VA loans in forbearance

• While some borrowers will elect to leave forbearance early between now and their final expiration, servicers are still facing significant operational challenges, especially with FHA loans which may take additional processing time due to the complexities of post-forbearance workouts

• Under the current matrices, the nation’s mortgage servicers would have to process up to 18K expiring plans per business day in September and October alone, guiding borrowers through complex loss mitigation waterfalls directed by changing regulatory requirements

Housing Inventory August 2nd Update: Inventory Increased Slightly Week-over-week, Up 33% from Low in early April

by Calculated Risk on 8/02/2021 10:55:00 AM

Tracking existing home inventory will be very important this year.

This inventory graph is courtesy of Altos Research.

Mike Simonsen discusses this data regularly on Youtube.

Construction Spending increased 0.1% in June

by Calculated Risk on 8/02/2021 10:30:00 AM

From the Census Bureau reported that overall construction spending decreased:

Construction spending during June 2021 was estimated at a seasonally adjusted annual rate of $1,552.2 billion, 0.1 percent above the revised May estimate of $1,551.2 billion. The June figure is 8.2 percent above the June 2020 estimate of $1,435.0 billion.Private spending increased and public spending decreased:

emphasis added

Spending on private construction was at a seasonally adjusted annual rate of $1,215.2 billion, 0.4 percentabove the revised May estimate of $1,210.3 billion. ...

In June, the estimated seasonally adjusted annual rate of public construction spending was $337.0 billion, 1.2 percent below the revised May estimate of $340.9 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Residential spending is 13% above the bubble peak (in nominal terms - not adjusted for inflation).

Non-residential spending is 9% above the bubble era peak in January 2008 (nominal dollars), but has been weak recently.

Public construction spending is 4% above the previous peak in March 2009, and 29% above the austerity low in February 2014, but weak recently.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 29.3%. Non-residential spending is down 6.0% year-over-year. Public spending is down 7.5% year-over-year.

Construction was considered an essential service in most areas and did not decline sharply like many other sectors, but some sectors of non-residential have been under pressure. For example, lodging is down 26.5% YoY, multi-retail down 5.2% YoY, and office down 9.1% YoY.

ISM® Manufacturing index Decreased to 59.5% in July

by Calculated Risk on 8/02/2021 10:03:00 AM

(Posted with permission). The ISM manufacturing index indicated expansion in July. The PMI® was at 59.5% in July, down from 60.6% in June. The employment index was at 52.9%, up from 49.9% last month, and the new orders index was at 64.9%, down from 66.0%.

From ISM: July 2021 Manufacturing ISM® Report On Business®

conomic activity in the manufacturing sector grew in July, with the overall economy notching a 14th consecutive month of growth, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®.This was below expectations.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee:

“The July Manufacturing PMI® registered 59.5 percent, a decrease of 1.1 percentage points from the June reading of 60.6 percent. This figure indicates expansion in the overall economy for the 14th month in a row after contraction in April 2020. The New Orders Index registered 64.9 percent, decreasing 1.1 percentage points from the June reading of 66 percent. The Production Index registered 58.4 percent, a decrease of 2.4 percentage points compared to the June reading of 60.8 percent. The Prices Index registered 85.7 percent, down 6.4 percentage points compared to the June figure of 92.1 percent, which was the index’s highest reading since July 1979 (93.1 percent). The Backlog of Orders Index registered 65 percent, 0.5 percentage point higher than the June reading of 64.5 percent. The Employment Index registered 52.9 percent, 3 percentage points higher compared to the June reading of 49.9 percent. The Supplier Deliveries Index registered 72.5 percent, down 2.6 percentage points from the June figure of 75.1 percent. The Inventories Index registered 48.9 percent, 2.2 percentage points lower than the June reading of 51.1 percent. The New Export Orders Index registered 55.7 percent, a decrease of 0.5 percentage point compared to the June reading of 56.2 percent. The Imports Index registered 53.7 percent, a 7.3-percentage point decrease from the June reading of 61 percent.”

emphasis added

This suggests manufacturing expanded at a slower pace in July than in June.

Seven High Frequency Indicators for the Economy

by Calculated Risk on 8/02/2021 08:30:00 AM

These indicators are mostly for travel and entertainment. It will interesting to watch these sectors recover as the pandemic subsides.

The TSA is providing daily travel numbers.

This data is as of August 1st.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Blue) and 2021 (Red).

The dashed line is the percent of 2019 for the seven day average.

The 7-day average is down 20.1% from the same day in 2019 (79.9% of 2019). (Dashed line)

There was a slow increase from the bottom starting in May 2020 - and then TSA data picked up in 2021 - but has mostly sideways over the last few of weeks.

The second graph shows the 7-day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through July 31st, 2021.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Note that this data is for "only the restaurants that have chosen to reopen in a given market". Since some restaurants have not reopened, the actual year-over-year decline is worse than shown.

Dining picked up during the holidays, then slumped with the huge winter surge in cases. Dining is generally picking up, but was down 6% in the US (7-day average compared to 2019). Florida and Texas are above 2019 levels.

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $92 million last week, down about 63% from the median for the week.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The red line is for 2021, black is 2020, blue is the median, dashed purple is 2019, and dashed light blue is for 2009 (the worst year on record for hotels prior to 2020).

Occupancy is well above the horrible 2009 levels and weekend occupancy (leisure) has been solid.

This data is through July 24th. The occupancy rate is down 7.8% compared to the same week in 2019. Note: Occupancy was up year-over-year, since occupancy declined sharply at the onset of the pandemic. However, the 4-week average occupancy is still down from normal levels.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.Blue is for 2020. Red is for 2021.

As of July 23rd, gasoline supplied was down 2.4% compared to the same week in 2019.

There have been 3 weeks so far this year when gasoline supplied was up compared to the same week in 2019.

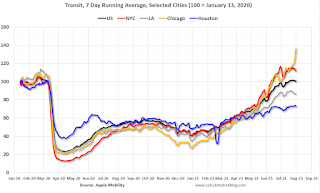

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

There is also some great data on mobility from the Dallas Fed Mobility and Engagement Index. However the index is set "relative to its weekday-specific average over January–February", and is not seasonally adjusted, so we can't tell if an increase in mobility is due to recovery or just the normal increase in the Spring and Summer.

This data is through July 31st for the United States and several selected cities.

This data is through July 31st for the United States and several selected cities.The graph is the running 7-day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7 day average for the US is at 10% of the January 2020 level.

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider. This is weekly data since 2015.

This graph is from Todd W Schneider. This is weekly data since 2015. This data is through Friday, July 30th.

Schneider has graphs for each borough, and links to all the data sources.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Sunday, August 01, 2021

Monday: ISM Mfg, Construction Spending

by Calculated Risk on 8/01/2021 07:29:00 PM

Weekend:

• Schedule for Week of August 1, 2021

• A Few Comments on Inflation

Monday:

• At 10:00 AM ET, ISM Manufacturing Index for July. The consensus is for the ISM to be at 60.9, up from 60.6 in June. The employment index was at 49.9% in June, and the new orders index was at 66.0%.

• Also at 10:00 AM, Construction Spending for June. The consensus is for a 0.4% increase in construction spending.

• At 2:00 PM, Senior Loan Officer Opinion Survey on Bank Lending Practices for July.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 19 and DOW futures are up 135 (fair value).

Oil prices were up over the last week with WTI futures at $73.85 per barrel and Brent at $75.26 per barrel. A year ago, WTI was at $40, and Brent was at $43 - so WTI oil prices are UP about 80% year-over-year (oil prices collapsed at the beginning of the pandemic).

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.16 per gallon. A year ago prices were at $2.18 per gallon, so gasoline prices are up $0.98 per gallon year-over-year.

A Few Comments on Inflation

by Calculated Risk on 8/01/2021 04:22:00 PM

I haven't commented much on inflation because I do not consider inflation a serious economic problem.

“Inflation is not going to be transitory,” the chief economic adviser at Allianz SE said in an interview on Bloomberg TV’s The Open show ... “I have a whole list of companies that have announced price increases, that have told us they expect further price increases, and that they expect them to stick,” El-Erian said.First, transitory doesn't mean that price increases won't "stick". It means that year-over-year (YoY) inflation will decline back to the Fed's target of 2%.

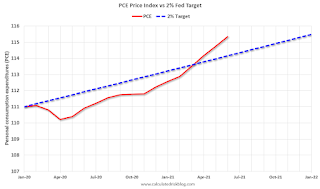

The first graph shows the PCE price index since January 2020 (before the pandemic), and the dashed blue line is the Fed's target of 2%.

Click on graph for larger image.

Click on graph for larger image.As I've mentioned before, there was some deflation at the beginning of the pandemic, and this has increased the YoY change (base effect). There is some transitory inflation from supply chain issues, and surging rents will probably push up Owners Equivalent Rent (OER) over the next year.

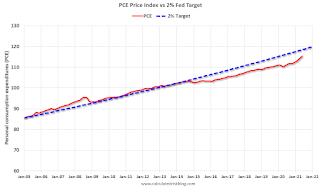

The second graph is from January 2005 (just an arbitrary date).

The second graph is from January 2005 (just an arbitrary date).This shows that inflation has been below target for years. If we were doing price targeting (we aren't) we would be looking for more price increases.

The graphs for core PCE inflation show the same pattern.

The question is not will some prices "stick", but rather will YoY inflation ease back towards the Fed's target? Or will inflation stay at the current 4.0% (PCE YoY in June)?

My sense is inflation will ease back towards the Fed's target.

August 1st COVID-19, New Cases, Hospitalizations, Vaccinations

by Calculated Risk on 8/01/2021 04:16:00 PM

Note: Cases and Deaths not updated on Sundays.

According to the CDC, on Vaccinations.

Total doses administered: 346,456,669, as of a week ago 341,818,968. Average doses last week: 0.66 million per day.

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Yesterday | Week Ago | Goal | |

| Percent over 18, One Dose | 69.9% | 69.7% | 69.0% | ≥70.0%1,2 |

| Fully Vaccinated✅ (millions) | 164.8 | 164.4 | 163.0 | ≥1601 |

| New Cases per Day3🚩 | 72,493 | 67,556 | 50,333 | ≤5,0002 |

| Hospitalized3🚩 | 35,457 | 34,810 | 25,141 | ≤3,0002 |

| Deaths per Day3🚩 | 308 | 277 | 245 | ≤502 |

| 1 America's Short Term Goals, 2my goals to stop daily posts, 37 day average for Cases, Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met (even if late). | ||||

KUDOS to the residents of the 20 states and D.C. that have achieved the 70% goal (percent over 18 with at least one dose): Vermont, Hawaii, Massachusetts and Connecticut are at 80%+, and Maine, New Mexico, New Jersey, Rhode Island, Pennsylvania, California, Maryland, Washington, New Hampshire, New York, Illinois, Virginia, Delaware, Minnesota, Oregon, Colorado and D.C. are all over 70%.

Next up are Florida at 69.0%, Utah at 68.0%, Nebraska at 67.5%, Wisconsin at 67.4%, Kansas at 66.5%, South Dakota at 66.4%, Iowa at 65.7%, and Nevada at 65.7%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of hospitalizations reported.

Saturday, July 31, 2021

July 31st COVID-19, New Cases, Hospitalizations, Vaccinations; Already 2nd Worst Wave for Cases

by Calculated Risk on 7/31/2021 05:42:00 PM

According to the CDC, on Vaccinations.

Total doses administered: 345,640,466, as of a week ago 341,039,972. Average doses last week: 0.66 million per day.

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Yesterday | Week Ago | Goal | |

| Percent over 18, One Dose | 69.7% | 69.4% | 68.8% | ≥70.0%1,2 |

| Fully Vaccinated✅ (millions) | 164.4 | 163.9 | 162.7 | ≥1601 |

| New Cases per Day3🚩 | 72,493 | 67,556 | 50,333 | ≤5,0002 |

| Hospitalized3🚩 | 34,769 | 33,084 | 23,822 | ≤3,0002 |

| Deaths per Day3🚩 | 308 | 277 | 245 | ≤502 |

| 1 America's Short Term Goals, 2my goals to stop daily posts, 37 day average for Cases, Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met (even if late). | ||||

KUDOS to the residents of the 20 states and D.C. that have achieved the 70% goal (percent over 18 with at least one dose): Vermont, Hawaii, Massachusetts and Connecticut are at 80%+, and Maine, New Mexico, New Jersey, Rhode Island, Pennsylvania, California, Maryland, Washington, New Hampshire, New York, Illinois, Virginia, Delaware, Minnesota, Oregon, Colorado and D.C. are all over 70%.

Next up are Florida at 68.7%, Utah at 68.0%, Wisconsin at 67.3%, Nebraska at 67.3%, South Dakota at 66.3%, Kansas at 66.3%, Iowa at 65.7%, and Nevada at 65.5%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

Schedule for Week of August 1, 2021

by Calculated Risk on 7/31/2021 08:11:00 AM

The key report this week is the July employment report.

Other key reports include ISM manufacturing and services indexes, July vehicle sales, and the Trade deficit for June.

10:00 AM: ISM Manufacturing Index for July. The consensus is for the ISM to be at 60.9, up from 60.6 in June. The employment index was at 49.9% in June, and the new orders index was at 66.0%.

10:00 AM: Construction Spending for June. The consensus is for a 0.4% increase in construction spending.

2:00 PM: Senior Loan Officer Opinion Survey on Bank Lending Practices for July.

8:00 AM ET: Corelogic House Price index for June

All Day: Light vehicle sales for July from the BEA. The consensus is for light vehicle sales to be 15.7 million SAAR in July, up from 15.4 million in June (Seasonally Adjusted Annual Rate).

All Day: Light vehicle sales for July from the BEA. The consensus is for light vehicle sales to be 15.7 million SAAR in July, up from 15.4 million in June (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the sales rate for last month.

11:00 AM: NY Fed: Q2 Quarterly Report on Household Debt and Credit

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for July. This report is for private payrolls only (no government). The consensus is for 675 thousand payroll jobs added in July, down from 692 thousand added in June.

10:00 AM: the ISM Services Index for July. The consensus is for a reading of 60.4, up from 60.1.

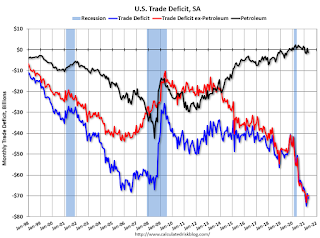

8:30 AM: Trade Balance report for June from the Census Bureau.

8:30 AM: Trade Balance report for June from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is the trade deficit to be $73.9 billion. The U.S. trade deficit was at $71.2 Billion the previous month.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a decrease to 390 thousand from 400 thousand last week.

8:30 AM: Employment Report for July. The consensus is for 900,000 jobs added, and for the unemployment rate to decrease to 5.7%.

8:30 AM: Employment Report for July. The consensus is for 900,000 jobs added, and for the unemployment rate to decrease to 5.7%.There were 850,000 jobs added in June, and the unemployment rate was at 5.9%.

This graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession was by far the worst recession since WWII in percentage terms, but currently is not as severe as the worst of the "Great Recession".