by Calculated Risk on 7/02/2021 01:34:00 PM

Friday, July 02, 2021

Q2 GDP Forecasts: Revised Down, under 10%

From BofA:

The construction spending data sliced another 0.5pp from 2Q GDP tracking, leaving us at a still impressive 9.5% qoq saar. [July 2 estimate]From Goldman Sachs:

emphasis added

We left our Q2 GDP tracking estimate unchanged at +8.5% (qoq ar). [July 2 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 3.2% for 2021:Q2 and 3.9% for 2021:Q3. [July 2 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2021 is 7.8 percent on July 2, down from 8.6 percent on July 1. [July 2 estimate]

June Vehicles Sales Decreased Sharply to 15.36 Million SAAR

by Calculated Risk on 7/02/2021 11:14:00 AM

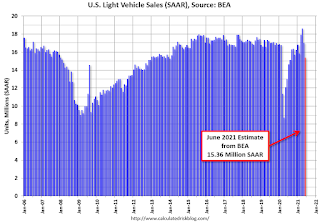

The BEA released their estimate of light vehicle sales for June this morning. The BEA estimates sales of 15.36 million SAAR in June 2021 (Seasonally Adjusted Annual Rate), down 9.8% from the May sales rate, and up 18% from June 2020.

Click on graph for larger image.

Click on graph for larger image.This graph shows light vehicle sales since 2006 from the BEA (blue) and the BEA's estimate for June (red).

The impact of COVID-19 was significant, and April 2020 was the worst month.

Since April 2020, sales have increased, and were close to sales in 2019 (the year before the pandemic).

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate of 15.36 million SAAR.

Note: dashed line is current estimated sales rate of 15.36 million SAAR.Comments on June Employment Report

by Calculated Risk on 7/02/2021 09:51:00 AM

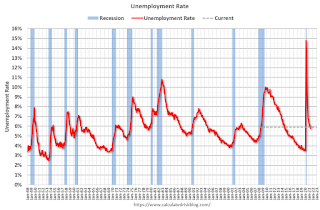

The headline jobs number in the June employment report was above expectations, and employment for the previous two months was revised up. However, the participation rate was unchanged and the unemployment rate increased slightly to 5.9%.

Earlier: June Employment Report: 850 Thousand Jobs, 5.9% Unemployment Rate

In June, the year-over-year employment change was 7.919 million jobs. This turned positive in April due to the sharp jobs losses in April 2020.

Permanent Job Losers

Click on graph for larger image.

Click on graph for larger image.This graph shows permanent job losers as a percent of the pre-recession peak in employment through the report today. (ht Joe Weisenthal at Bloomberg).

In June, the number of permanent job losers decreased to 3.187 million from 3.234 million in May.

Prime (25 to 54 Years Old) Participation

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.The prime working age will be key as the economy recovers.

The 25 to 54 participation rate increased in June to 81.7% from 81.3% in May, and the 25 to 54 employment population ratio increased to 77.2% from 77.1% in May.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of persons employed part time for economic reasons decreased by 644,000 to 4.6 million in June. This decline reflected a drop in the number of persons whose hours were cut due to slack work or business conditions. The number of persons employed part time for economic reasons is up by 229,000 since February 2020. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs."The number of persons working part time for economic reasons decreased in June to 4.627 million from 5.271 million in May.

These workers are included in the alternate measure of labor underutilization (U-6) that decreased to 9.8% from 10.2% in May. This is down from the record high in April 22.9% for this measure since 1994 and close to pre-recession lows.

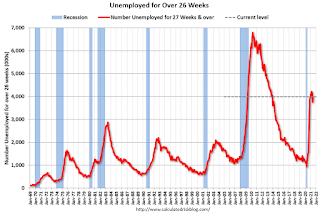

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 3.985 million workers who have been unemployed for more than 26 weeks and still want a job, up from 3.752 million in May.

This does not include all the people that left the labor force. This will be a key measure to follow during the recovery.

Summary:

The headline monthly jobs number was above expectations, and the previous two months were revised up by 15,000 combined. However, the headline unemployment rate increased slightly to 5.9%.

June Employment Report: 850 Thousand Jobs, 5.9% Unemployment Rate

by Calculated Risk on 7/02/2021 08:42:00 AM

From the BLS:

Total nonfarm payroll employment rose by 850,000 in June, and the unemployment rate was little changed at 5.9 percent, the U.S. Bureau of Labor Statistics reported today. Notable job gains occurred in leisure and hospitality, public and private education, professional and business services, retail trade, and other services.

...

The change in total nonfarm payroll employment for April was revised down by 9,000, from +278,000 to +269,000, and the change for May was revised up by 24,000, from +559,000 to +583,000. With these revisions, employment in April and May combined is 15,000 higher than previously reported.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the year-over-year change in total non-farm employment since 1968.

In June, the year-over-year change was 7.919 million jobs. This was up significantly - since employment collapsed in April 2020.

Total payrolls increased by 850 thousand in June. Private payrolls increased by 662 thousand.

Payrolls for April and May were revised up 15 thousand, combined.

The second graph shows the job losses from the start of the employment recession, in percentage terms.

The second graph shows the job losses from the start of the employment recession, in percentage terms.The current employment recession was by far the worst recession since WWII in percentage terms, but currently is not as severe as the worst of the "Great Recession".

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate was unchanged at 61.6% in June, from 61.6% in May. This is the percentage of the working age population in the labor force.

The Labor Force Participation Rate was unchanged at 61.6% in June, from 61.6% in May. This is the percentage of the working age population in the labor force. The Employment-Population ratio was unchanged at 58.0% from 58.0% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate increased in June to 5.9% from 5.8% in May.

This was above consensus expectations, and April and May were revised up by 15,000 combined.

Black Knight: Number of Homeowners in COVID-19-Related Forbearance Plans Decreased

by Calculated Risk on 7/02/2021 08:12:00 AM

Note: Both Black Knight and the MBA (Mortgage Bankers Association) are putting out weekly estimates of mortgages in forbearance.

This data is as of June 29th.

From Andy Walden at Black Knight: Mild Forbearance Improvement as Quarterly Reviews Continue

As we mentioned last week, there were still more than 300,000 homeowners in forbearance whose plans were scheduled for review by the end of June. Well, of the roughly 146,000 plans reviewed for extension or removal over the past week, 44,000 homeowners left forbearance, while the plans of the other 102,000 were extended.

All in all, we wound up with a net decline of 6,000 plans. Not overly impactful, but it does set us up nicely for what could be a larger improvement next week as some 218,000 plans were still scheduled for review by Wednesday, June 30.

Our weekly snapshots run through Tuesday, though. As of June 29, our McDash Flash daily loan-level performance dataset showed 2.05 million homeowners – representing 3.9% of mortgaged properties – remaining in COVID-19 related forbearance plans.

Click on graph for larger image.

This puts the overall number of active plans down 145,000, a 6.6% decline from the same time last month with the rate of improvement picking up from 6% last week and 5.4% the week before.

A 5,000 reduction in the number of active GSE forbearance plans and a 2,000 drop in FHA/VA plans were partially offset by a rise of 1,000 among portfolio and privately held mortgages.

Plan starts continued to fall over the last seven days. In fact, last week saw the lowest total starts in five weeks (since the shortened business week of Memorial Day). There have been about 9% fewer starts over the last four weeks than there were in the preceding four-week period..

emphasis added

Thursday, July 01, 2021

Friday: Employment Report, Trade Deficit

by Calculated Risk on 7/01/2021 08:55:00 PM

My June Employment Preview

Goldman June Payrolls Preview

Friday:

• At 8:30 AM ET, Employment Report for June. The consensus is for 675,000 jobs added, and for the unemployment rate to decrease to 5.6%.

• Also at 8:30 AM, Trade Balance report for May from the Census Bureau. The consensus is the trade deficit to be $70.8 billion. The U.S. trade deficit was at $68.9 billion the previous month.

June Employment Preview

by Calculated Risk on 7/01/2021 04:58:00 PM

On Friday at 8:30 AM ET, the BLS will release the employment report for June. The consensus is for 675 thousand jobs added, and for the unemployment rate to decrease to 5.6%.

This graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession was by far the worst recession since WWII in percentage terms, but is now better than the worst of the "Great Recession".

• ADP Report: The ADP employment report showed a gain of 692,000 private sector jobs, above the consensus estimate of 600,000 jobs added. The ADP report hasn't been very useful in predicting the BLS report, but this suggests the BLS report could be above expectations.

• ISM Surveys: Note that the ISM services are diffusion indexes based on the number of firms hiring (not the number of hires). The ISM® manufacturing employment index decreased in June to 49.9%, down from last month. This would suggest approximately 20,000 manufacturing jobs lost in June. ADP showed 19,000 manufacturing jobs added.

The ISM Services employment index for June has not been released yet.

• Unemployment Claims: The weekly claims report showed a small decline in the number of initial unemployment claims during the reference week (include the 12th of the month) from 444,000 in May to 418,000 in June. This would usually suggest some pickup in hiring, although this might not be very useful right now. In general, weekly claims have been close to expectations in June.

• Permanent Job Losers: Something to watch in the employment report will be "Permanent job losers". While there has been a strong bounce back in total employment, from the shutdown in March and April 2020, permanent job losers had been flat over the last several months.

• Permanent Job Losers: Something to watch in the employment report will be "Permanent job losers". While there has been a strong bounce back in total employment, from the shutdown in March and April 2020, permanent job losers had been flat over the last several months.This graph shows permanent job losers as a percent of the pre-recession peak in employment through the May report.

This data is only available back to 1994, so there is only data for three recessions. In May, the number of permanent job losers decreased to 3.234 million from 3.529 million in April.

• Conclusion: The data is a little mixed this month.

Goldman June Payrolls Preview

by Calculated Risk on 7/01/2021 04:39:00 PM

A few brief excerpts from a note by Goldman Sachs economist Spencer Hill:

We estimate nonfarm payrolls rose 750k in June (mom sa) ... Coupled with very strong labor demand and continued progress on vaccinations and reopening, we believe job growth probably picked up further in the month. ... We estimate a two-tenths drop in the unemployment rate to 5.6%, reflecting a strong household employment gain but a further rise in the participation rate.CR Note: The consensus is for 675 thousand jobs added, and for the unemployment rate to decrease to 5.6%.

emphasis added

July 1st COVID-19 New Cases, Vaccinations, Hospitalizations

by Calculated Risk on 7/01/2021 04:19:00 PM

Congratulations to the residents of Delaware and Minnesota on joining the 70% club! Go for 80%!!!

This data is from the CDC.

According to the CDC, on Vaccinations.

Total doses administered: 328,152,304, as of a week ago 320,687,205. Average doses last week: 1.07 million per day.

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Yesterday | Week Ago | Goal | |

| Percent over 18, One Dose | 66.7% | 66.5% | 65.7% | ≥70.0%1,2 |

| Fully Vaccinated (millions) | 155.9 | 154.9 | 151.3 | ≥1601 |

| New Cases per Day3,4🚩 | 12,514 | 12,504 | 11,472 | ≤5,0002 |

| Hospitalized3 | 11,974 | 11,948 | 12,329 | ≤3,0002 |

| Deaths per Day3,4 | 206 | 213 | 233 | ≤502 |

| 1 America's Goal by July 4th, 2my goals to stop daily posts, 37 day average for Cases, Hospitalized, and Deaths 4Cases and Deaths updated Mon - Fri 🚩 Increasing week-over-week | ||||

KUDOS to the residents of the 18 states and D.C. that have already achieved the 70% goal: Vermont, Hawaii and Massachusetts are at 80%+, and Connecticut, Maine, New Jersey, Rhode Island, Pennsylvania, New Mexico, Maryland, California, Washington, New Hampshire, New York, Illinois, Virginia, Delaware, Minnesota and D.C. are all over 70%.

Next up are Colorado at 69.8%, Oregon at 69.8%, Wisconsin at 65.4%, Nebraska at 65.3%, and Florida at 64.6%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

This data is from the CDC.

Hotels: Occupancy Rate Down 7% Compared to Same Week in 2019

by Calculated Risk on 7/01/2021 12:38:00 PM

Note: The year-over-year occupancy comparisons are easy, since occupancy declined sharply at the onset of the pandemic. So STR is comparing to the same week in 2019.

The occupancy rate is down 7.3% compared to the same week in 2019. Leisure (weekend) occupancy has recovered, but weekday (more business) is still down double digits.

U.S. weekly hotel occupancy hit its highest level since late October 2019, according to STR‘s latest data through June 26.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

June 20-26, 2021 (percentage change from comparable week in 2019*):

• Occupancy: 69.9% (-7.3%)

• Average daily rate (ADR): US$133.36 (-0.5%)

• Revenue per available room (RevPAR): US$93.19 (-7.8%)

In addition to occupancy reaching its highest point since the week ending 26 October 2019, ADR and RevPAR were the highest of the pandemic-era. Weekend occupancy surpassed the 2019 comparable for the second time in three weeks, while ADR was 13% higher than the corresponding weekend from June 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2021, black is 2020, blue is the median, dashed purple is 2019, and dashed light blue is for 2009 (the worst year on record for hotels prior to 2020).

Note: Y-axis doesn't start at zero to better show the seasonal change.