by Calculated Risk on 5/24/2021 11:33:00 AM

Monday, May 24, 2021

Lawler: Single-Family Rent Trends

CR Note: Last week, I posted a brief note from housing economist Tom Lawler: Lawler: Is the “Owners’ Equivalent Rent” Index Set to Accelerate Sharply?.

Two of the largest institutional holders of single-family rental properties recently reported that demand for single-family rentals has rebounded strongly over the past several quarters, and both reported an acceleration in rental increases.

| Rent Increase, "Same-Store" Homes | |||

|---|---|---|---|

| Invitation Homes | |||

| Renewals | New Leases | Blended | |

| Q1/2020 | 4.2% | 1.8% | 3.4% |

| Q2/2020 | 3.5% | 2.7% | 3.3% |

| Q3/2020 | 3.3% | 5.5% | 4.0% |

| Q4/2020 | 3.8% | 6.9% | 4.9% |

| Q1/2021 | 4.4% | 7.9% | 5.4% |

| Apr-21 | 5.5% | 10.8% | 7.0% |

| American Homes 4 Rent | |||

| Renewals | New Leases | Blended | |

| Q1/2020 | 4.6% | 3.4% | 4.2% |

| Q2/2020 | 1.3% | 4.4% | 2.4% |

| Q3/2020 | 1.1% | 6.0% | 2.8% |

| Q4/2020 | 4.3% | 7.6% | 5.5% |

| Q1/2021 | 5.1% | 10.0% | 6.9% |

| Apr-21 | 11.0% | ||

Invitation Homes owns about 80,330 single-family homes, while American Homes 4 Rent owns about 51,984 single-family homes.

While apartment rents in many large cities fell sharply following the pandemic (though rents have rebounded somewhat recently), the single-family rental market held up much better, as did the apartment rental markets in less-densely-populated (and less expensive) cities.

A recent report from CoreLogic also shows this to be the case. CoreLogic’s Single-Family Rent Index (SFRI), based on repeat-rent analysis of the same rental properties, increased by 4.3% YOY in March, compared to a recent YOY low of 1.4% in June. The SFRI for the “high-price” tier showed a 5.0% YOY gain in March, while the “low-price” tier showed just a 3.2% YOY increase. In terms of property type, the SFRI for SF detached properties increased by 6.9% YOY gain in March (a record high), while the SFRI for SF attached properties showed just a 1.3% YOY rise.

Here is a chart from the report, which is available here: U.S. Single-Family Rents Up 4.3% Year Over Year in March.

Click on graph for larger image.

Click on graph for larger image.From CoreLogic:

Rent prices for the low-end tier, increased 3.2% year over year in March 2021, down from 3.8% in March 2020. Meanwhile, higher-priced rentals increased 5% in March 2021, up from a gain of 2.8% in March 2020. This was the fastest increase in higher-price rents since August 2006.

Seven High Frequency Indicators for the Economy

by Calculated Risk on 5/24/2021 08:49:00 AM

These indicators are mostly for travel and entertainment. It will interesting to watch these sectors recover as the vaccine is distributed.

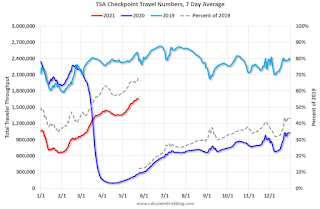

The TSA is providing daily travel numbers.

Click on graph for larger image.

Click on graph for larger image.This data shows the seven day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Blue) and 2021 (Red).

The dashed line is the percent of 2019 for the seven day average.

This data is as of May 23rd.

The seven day average is down 32.0% from the same day in 2019 (68.0% of 2019). (Dashed line)

There was a slow increase from the bottom - and TSA data has picked up in 2021.

The second graph shows the 7 day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through May 22, 2021.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Note that this data is for "only the restaurants that have chosen to reopen in a given market". Since some restaurants have not reopened, the actual year-over-year decline is worse than shown.

Dining picked up during the holidays, then slumped with the huge winter surge in cases. Dining was picking up again. Florida and Texas are above 2019 levels.

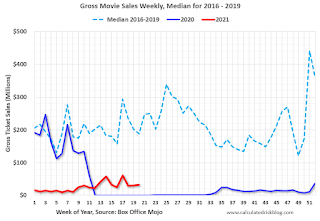

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $32 million last week, down about 83% from the median for the week.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The red line is for 2021, black is 2020, blue is the median, and dashed light blue is for 2009 (the worst year since the Great Depression for hotels - before 2020).

Occupancy is now slightly above the horrible 2009 levels.

This data is through May 15th. Hotel occupancy is currently down 16% compared to same week in 2019). Note: Occupancy was up year-over-year, since occupancy declined sharply at the onset of the pandemic. However, occupancy is still down significantly from normal levels.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

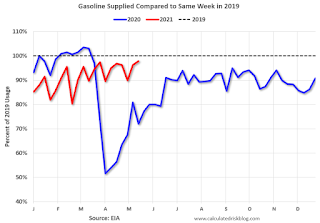

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.Blue is for 2020. Red is for 2021.

As of May 14th, gasoline supplied was off about 2.2% (about 97.8% of the same week in 2019).

Gasoline supplied was up year-over-year, since at one point, gasoline supplied was off almost 50% YoY in 2020.

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

There is also some great data on mobility from the Dallas Fed Mobility and Engagement Index. However the index is set "relative to its weekday-specific average over January–February", and is not seasonally adjusted, so we can't tell if an increase in mobility is due to recovery or just the normal increase in the Spring and Summer.

This data is through May 22nd for the United States and several selected cities.

This data is through May 22nd for the United States and several selected cities.The graph is the running 7 day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7 day average for the US is at 78% of the January 2020 level and moving up.

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider. This is weekly data since 2015.

This graph is from Todd W Schneider. This is weekly data since 2015. This data is through Friday, May 21st.

Schneider has graphs for each borough, and links to all the data sources.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Sunday, May 23, 2021

Sunday Night Futures

by Calculated Risk on 5/23/2021 07:00:00 PM

Weekend:

• Schedule for Week of May 23, 2021

Monday:

• At 8:30 AM ET, Chicago Fed National Activity Index for April. This is a composite index of other data.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 and DOW futures are mostly unchanged (fair value).

Oil prices were down over the last week with WTI futures at $63.73 per barrel and Brent at $66.55 per barrel. A year ago, WTI was at $33, and Brent was at $34 - so WTI oil prices are UP almost double year-over-year (oil prices collapsed at the beginning of the pandemic).

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.03 per gallon. A year ago prices were at $1.95 per gallon, so gasoline prices are up $1.08 per gallon year-over-year.

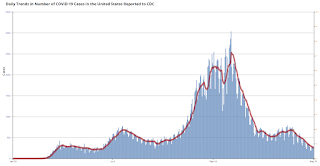

May 23rd COVID-19 New Cases, Hospitalizations, Vaccinations

by Calculated Risk on 5/23/2021 04:27:00 PM

From Dr. Bob Wachter, Chair, UCSF Dept of Medicine today:

In case anyone cares, I've started eating indoors in SF restaurants. It wasn't any one thing; the risk just fell below my personal threshold: 2/3rds of SF adults fully vaxxed; avg 16 new cases/d in SF, asymptomatic test + @UCSF now 0.16% (ie, 1/600). Plus too cold to eat outside.The economy will pick up speed as more and more people get vaccinated!

1) 61.3% of the population over 18 has had at least one dose (70% is the goal by July 4th).

2) 130.0 million Americans are fully vaccinated (160 million goal by July 4th)

Note: I'll stop posting this daily once all four of these criteria are met:

1) 70% of the population over 18 has had at least one dose of vaccine, and

2) new cases are under 5,000 per day, and

3) hospitalizations are below 3,000, and

4) average daily deaths under 50 (currently 510 per day).

And check out COVID Act Now to see how each state is doing.

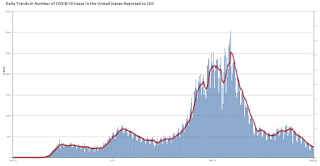

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) 7 day average (line) of positive tests reported.

This data is from the CDC.

The second graph shows the number of people hospitalized.

This data is also from the CDC.

This data is also from the CDC.The CDC cautions that due to reporting delays, the area in grey will probably increase.

The current 7-day average is 23,917, down from 24,720 reported yesterday, but still above the post-summer surge low of 23,000.

REALTORS® Confidence Index Survey April 2021

by Calculated Risk on 5/23/2021 10:41:00 AM

Some interesting information from the REALTORS® Confidence Index Survey April 2021

Several metrics indicates a very strong buyer market with short supply. The REALTORS® Buyer Traffic Index increased from 79 in March 2021 to 80 (very strong conditions) in April 2021 while the REALTORS® Seller Traffic Index remains below 50 which is “weak” traffic compared to the level one year ago. On average, a home sold had five offers. On average, REALTORS® expect home prices in the next three months to increase nearly 6% from one year ago and sales in the next three months to increase nearly 3% from last year’s sales level.

With little supply in the market, homes typically sold within 17 days (27 days one year ago), as buyer competition heats up.

The share of first-time buyers decreased to 31% (32% in the prior month, 36% one year ago).

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph, from the NAR report, shows buyer traffic is strong just about everywhere.

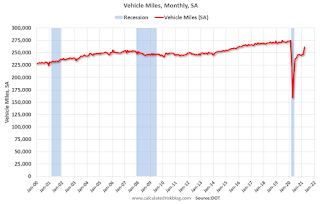

DOT: Vehicle Miles Driven Increased Sharply year-over-year in March

by Calculated Risk on 5/23/2021 08:09:00 AM

This will be something to watch as the economy recovers.

The Department of Transportation (DOT) reported:

Travel on all roads and streets changed by 19.0% (42.0 billion vehicle miles) for March 2021 as compared with March 2020. Travel for the month is estimated to be 263.0 billion vehicle miles.

The seasonally adjusted vehicle miles traveled for March 2021 is 261.1 billion miles, an 18.5% (40.7 billion vehicle miles) increase over March 2020. It also represents a 6.2% increase (15.2 billion vehicle miles) compared with February 2021.

Cumulative Travel for 2021 changed by -2.1% (-14.9 billion vehicle miles). The cumulative estimate for the year is 691.5 billion vehicle miles of travel.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the monthly total vehicle miles driven, seasonally adjusted.

Miles driven declined sharply in March 2020, and really collapsed in April. After partially recovering fairly quickly, miles driven was mostly flat for 6+ months - but really picked up in March 2021.

Saturday, May 22, 2021

May 22nd COVID-19 New Cases, Hospitalizations, Vaccinations

by Calculated Risk on 5/22/2021 07:04:00 PM

The economic recovery depends on progress against the virus, so I'm tracking the progress.

1) 61.1% of the population over 18 has had at least one dose (70% is the goal by July 4th).

2) 129.0 million Americans are fully vaccinated (160 million goal by July 4th)

Note: I'll stop posting this daily once all four of these criteria are met:

1) 70% of the population over 18 has had at least one dose of vaccine, and

2) new cases are under 5,000 per day, and

3) hospitalizations are below 3,000, and

4) average daily deaths under 50 (currently 504 per day).

And check out COVID Act Now to see how each state is doing.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) 7 day average (line) of positive tests reported.

This data is from the CDC.

The second graph shows the number of people hospitalized.

This data is also from the CDC.

This data is also from the CDC.The CDC cautions that due to reporting delays, the area in grey will probably increase.

The current 7-day average is 24,720, down from 25,313 reported yesterday, but still above the post-summer surge low of 23,000.

Schedule for Week of May 23, 2021

by Calculated Risk on 5/22/2021 08:11:00 AM

The key reports this week are the second estimate of Q1 GDP, April New Home Sales, March Case-Shiller house prices, and Personal Income and Outlays for April.

For manufacturing, the May Richmond and Kansas City Fed manufacturing surveys will be released.

8:30 AM ET: Chicago Fed National Activity Index for April. This is a composite index of other data.

9:00 AM: S&P/Case-Shiller House Price Index for March.

9:00 AM: S&P/Case-Shiller House Price Index for March.This graph shows the year-over-year change in the seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 12.3% year-over-year increase in the Comp 20 index for March.

9:00 AM: FHFA House Price Index for March 2021. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM: New Home Sales for April from the Census Bureau.

10:00 AM: New Home Sales for April from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 975 thousand SAAR, down from 1.021 million SAAR in March.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for May.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a decrease to 420 thousand from 444 thousand last week.

8:30 AM: Gross Domestic Product, 1st quarter 2021 (Second estimate). The consensus is that real GDP increased 6.5% annualized in Q1, up from the advance estimate of 6.4%.

8:30 AM: Durable Goods Orders for April from the Census Bureau. The consensus is for a 0.8% increase in durable goods orders.

10:00 AM: Pending Home Sales Index for April. The consensus is for a 1.2% increase in the index.

11:00 AM: the Kansas City Fed manufacturing survey for May.

8:30 AM ET: Personal Income and Outlays, April 2021. The consensus is for a 14.8% decrease in personal income, and for a 0.5% increase in personal spending. And for the Core PCE price index to increase 0.6%.

9:45 AM: Chicago Purchasing Managers Index for May.

10:00 AM: University of Michigan's Consumer sentiment index (Final for May). The consensus is for a reading of 83.0.

Friday, May 21, 2021

Homebuilder Comments in Mid-May: "Reducing Sales, Limiting Sales"

by Calculated Risk on 5/21/2021 02:31:00 PM

Some twitter comments from Rick Palacios Jr., Director of Research at John Burns Real Estate Consulting

Here's May mid-month home builder channel check I hinted at earlier. Builders are pushing prices w/little pushback, though some starting. Some builders are using price escalators & highest/best offer. Many limiting pre-sales, shifting to spec, & pricing home later in build cycle.

#Dallas builder: “Not selling build jobs in May, starting specs only, and not selling until drywall. Costs are too out of control for us to take the inflation risk on build jobs. So sales are way down.”

#SanAntonio builder: “Only selling specs at Sheetrock stage. Last month, it was frame stage.”

#Austin builder: “Stopped sales until we pour a foundation. Lumber too erratic to sell prior. I know others have gone to a bid process. I have heard all parties, including that people who win the bid, feel like they have lost.”

#LasVegas builder: “Reducing sales releases in attempt to moderate the impact of labor & material shortages. Homes are priced once a Truss delivery date is confirmed which triggers the lumber lock pricing. We are also considering online auctions, but appraisals are a concern.”

#Denver builder: “Limiting sales at all communities and gapping out on lots. Material availability is becoming more concerning.”

#Phoenix builder: “Metering sales. Could be higher if we released more, but construction can’t keep up & trades are raising costs post start of home, so we are delaying sales releases even further. Delaying release of to-be-built homes & selling only specs deeper in the cycle.”

#SaltLakeCity builder: “Very, very careful with home releases, generally 2 – 4 permits pulled for each subdivision each month. Those homes are not released for sale until the homes are 60-80 days into the construction schedule.”

#Charlotte builder: “No pre-sales as of now. Starting specs and will price at drywall. Sales are still strong but we are starting to see a little bit of a slowdown as we have pushed pricing considerably.”

#Nashville builder: “Prices are starting to flatten out. Sales are down by design as we are not offering presale contracts, & are not writing contracts on inventory homes until they have completed rough ins, with all remaining items confirmed as to availability."

#RaleighDurham builder: “Starting to see some reluctance/concern around home prices balance, to some extent, the buying frenzy that we have seen over the last few months. Continue to raise prices – we get material/labor cost increase notices EVERY SINGLE DAY!”

#Wilmington builder: “Presales are limited & have escalation clause. Not pricing specs until Sheetrock - then they are gone & we wait for next houses to get to drywall. Raising prices across all segments to keep up with cost until the market or appraisal stops us.”

#Atlanta builder: “Locking in costs with purchase orders at time of foundation. Cannot sell a home until foundations go in. Costs are crazy. We are hitting the top of the market in some places and can't push prices. We are seeing margin compression.”

#Birmingham builder: “We have presales turned off in about half our communities to burn through current backlog. We’re holding off sales and using escalation clauses.”

#Charleston builder: “Holding off on selling a home until framing, as that has been our most volatile cost from month to month. We aren't selling to-be-built homes in order to control costs and not commit to a sales price before some of our largest expenses are actualized.”

#Chicago builder: “Many builders are putting everything on hold or putting foundations in the ground and not going any further until they see where costs are headed. Trim, windows and doors supplier says they are starting to feel a slowdown and are preparing for a bigger one.”

#Indianapolis builder: “Not selling/pricing spec inventory until late in the construction process, to account for rising costs. We continue to raise prices on contract builds but have not added escalation clauses.”

#DC builder: “Capping sales by community with few exceptions. We cannot continue to sell further out to future. Limited sales at most communities and raised prices dramatically to keep pace with rising costs.”

#Philadelphia builder: “Holding off opening up some of the new sections until we can catch up to the sales backlog a bit.”

#Tampa builder: “We’re closed for the first half of May. Working on catching up to what we already have. We will significantly limit sales for the next several months.”

#Orlando builder: “Restricting releases to limit quantity of sales while production catches up. Increasing pricing every few sales.”

#Sarasota builder: “Everyone is starting construction on homes after permits are obtained and then quickly hitting unpredictable material shortages, masonry block as one primary example.”

#Jacksonville builder: “Revised all sales contracts, allowing us to adjust base price of home due to cost increases up until time slab is poured. Converting to spec sale program on single-family detached homes as new phases come online this summer.”

#LosAngeles builder: “Waiting to offer homes for sale until we have building permits in hand and can lock lumber pricing.”

#Riverside builder: “We sell out within a week of release. If sales volume drops it’s a result of no inventory. Banging prices each week. Scary high. Costs are stupid high. I’m not saying we’re out of buyers but sales team is telling me that their buyer list is getting smaller."

#SanJose builder: “Doing highest bidder approach at two communities. Seeing $100K over asking at one of them. Buying lumber sooner now, but may push out starting more units with the anticipation of lumber prices coming back down. Costs are eating up all price increases.”

#EastBayCA builder: “Holding back on releasing for sales until we have the phase contracted, so we know what our costs are going to be.”

#Reno builder: “We have gone to ‘Offer & Acceptance’ approach on sales releases where we are able to improve price and terms. This approach has been effective in maintaining our margins and keeping pace with all the increases we are getting." THE END

BLS: April Unemployment rates down in 12 States

by Calculated Risk on 5/21/2021 02:21:00 PM

From the BLS: Regional and State Employment and Unemployment Summary

Unemployment rates were lower in April in 12 states and the District of Columbia and stable in 38 states, the U.S. Bureau of Labor Statistics reported today. Forty-eight states and the District had jobless rate decreases from a year earlier and two states had little change. The national unemployment rate, 6.1 percent, was little changed over the month, but was 8.7 percentage points lower than in April 2020.Hawaii has been impacted by lower levels of tourism.

Nonfarm payroll employment increased in 9 states and the District of Columbia, decreased in 2 states, and was essentially unchanged in 39 states in April 2021. Over the year, nonfarm payroll employment increased in all states and the District.

...

Hawaii had the highest unemployment rate in April, 8.5 percent, followed by California, 8.3 percent, and New Mexico and New York, 8.2 percent each. Nebraska, New Hampshire, South Dakota, and Utah had the lowest rates, 2.8 percent each.