by Calculated Risk on 9/24/2020 10:14:00 AM

Thursday, September 24, 2020

New Home Sales increased to 1,011,000 Annual Rate in August

The Census Bureau reports New Home Sales in August were at a seasonally adjusted annual rate (SAAR) of 1.011 million.

The previous three months were revised up significantly.

Sales of new single-family houses in August 2020 were at a seasonally adjusted annual rate of 1,011,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 4.8 percent above the revised July rate of 965,000 and is 43.2 percent above the August 2019 estimate of 706,000.

emphasis added

Click on graph for larger image.

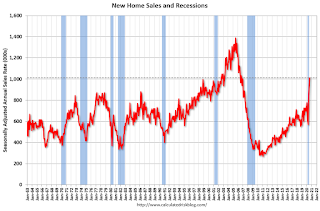

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

This is the highest sales rate since 2006.

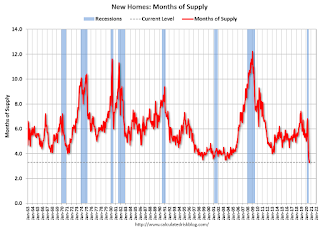

The second graph shows New Home Months of Supply.

The months of supply decreased in August to 3.3 months from 3.6 months in July.

The months of supply decreased in August to 3.3 months from 3.6 months in July. This is the all time record low months of supply.

The all time record high was 12.1 months of supply in January 2009.

This is below the normal range (about 4 to 6 months supply is normal).

"The seasonally-adjusted estimate of new houses for sale at the end of August was 282,000. This represents a supply of 3.3 months at the current sales rate. "

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is low, and the combined total of completed and under construction is lower than normal.

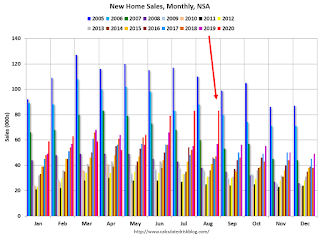

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In August 2020 (red column), 83 thousand new homes were sold (NSA). Last year, 57 thousand homes were sold in August.

The all time high for August was 110 thousand in 2005, and the all time low for August was 23 thousand in 2010.

This was well above expectations of 900 thousand sales SAAR, and sales in the three previous months were revised up significantly. I'll have more later today.

Weekly Initial Unemployment Claims increased to 870,000

by Calculated Risk on 9/24/2020 08:37:00 AM

The DOL reported:

In the week ending September 19, the advance figure for seasonally adjusted initial claims was 870,000, an increase of 4,000 from the previous week's revised level. The previous week's level was revised up by 6,000 from 860,000 to 866,000. The 4-week moving average was 878,250, a decrease of 35,250 from the previous week's revised average. The previous week's average was revised up by 1,500 from 912,000 to 913,500.This does not include the 630,080 initial claims for Pandemic Unemployment Assistance (PUA) that was down from 675,154 the previous week. (There are some questions on PUA numbers).

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 878,250.

The previous week was revised up.

The second graph shows seasonally adjust continued claims since 1967 (lags initial by one week).

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.Continued claims decreased to 12,580,000 (SA) from 12,747,000 (SA) last week and will likely stay at a high level until the crisis abates.

Note: There are an additional 11,510,888 receiving Pandemic Unemployment Assistance (PUA) that decreased from 14,467,064 the previous week (there are questions about these numbers). This is a special program for business owners, self-employed, independent contractors or gig workers not receiving other unemployment insurance.

Wednesday, September 23, 2020

Thursday: New Home Sales, Unemployment Claims

by Calculated Risk on 9/23/2020 09:00:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 840 thousand, down from 860 thousand the previous week.

• At 10:00 AM, New Home Sales for August from the Census Bureau. The consensus is for 900 thousand SAAR, essentially unchanged from 901 thousand in July.

• At 10:00 AM, Testimony, Fed Chair Jerome Powell, Coronavirus Aid, Relief, and Economic Security Act, Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate

• At 11:00 AM, the Kansas City Fed manufacturing survey for September.

September 23 COVID-19 Test Results

by Calculated Risk on 9/23/2020 07:24:00 PM

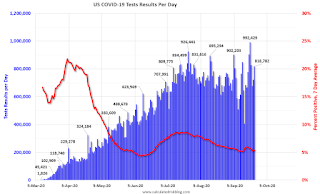

The US is now mostly reporting over 700,000 tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 818,782 test results reported over the last 24 hours.

There were 38,024 positive tests.

Over 18,000 Americans have died from COVID so far in September. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 4.6% (red line is 7 day average).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

The dashed line is the June low.

Note that there were very few tests available in March and April, and many cases were missed (the percent positive was very high - see first graph). By June, the percent positive had dropped below 5%.

If people stay vigilant, the number of cases might drop to the June low some time in October (that would still be a large number of new cases, but progress).

NMHC: Rent Payment Tracker Shows Decline in Households Paying Rent in September

by Calculated Risk on 9/23/2020 12:26:00 PM

From the NMHC: NMHC Rent Payment Tracker Finds 90.1 Percent of Apartment Households Paid Rent as of September 20

he National Multifamily Housing Council (NMHC)’s Rent Payment Tracker found 90.1 percent of apartment households made a full or partial rent payment by September 20 in its survey of 11.4 million units of professionally managed apartment units across the country.

This is a 1.7-percentage point, or 192,936-household decrease from the share who paid rent through September 20, 2019 and compares to 90.0 percent that had paid by August 20, 2020. These data encompass a wide variety of market-rate rental properties across the United States, which can vary by size, type and average rental price.

“This morning’s results show the real-world impact of lawmakers failing in their responsibilities to their constituents,” said Doug Bibby, NMHC President. “Almost 200,000 households have been unable to pay their September rent. Congress and the Trump administration have a proven model in the CARES Act that supported apartment residents through the early months of the pandemic. Now is the time for them to show leadership by once again supporting the millions of Americans who call an apartment home by enacting meaningful rental assistance and mitigating, to some degree, the negative consequences of the nationwide eviction moratorium which jeopardizes the stability of the nation’s housing finance system.”

emphasis added

This graph from the NMHC Rent Payment Tracker shows the percent of household making full or partial rent payments by the 20th of the month.

CR Note: This is mostly for large, professionally managed properties. It appears fewer people are paying their rent this year compared to last year - down 1.7 percentage points from a year ago.

Declining, but not falling off a cliff.

AIA: "Architectural billings in August still show little sign of improvement"

by Calculated Risk on 9/23/2020 11:21:00 AM

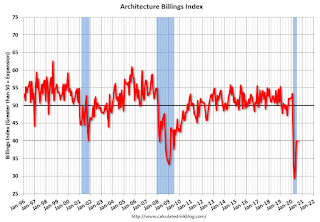

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architectural billings in August still show little sign of improvement

Business conditions remained stalled at architecture firms during August as demand for design services continued to decline, according to a new report from the American Institute of Architects (AIA).

The pace of decline during August remained at about the same level as in July and June, posting an Architecture Billings Index (ABI) score of 40.0 (any score below 50 indicates a decline in firm billings). Inquiries into new projects during August grew for the first time since February, and the value of new design contracts increased to a score of 46.0. As a result, fewer firms reported a decline in August, despite the fact that they remained negative overall.

“Unfortunately, since the start of the COVID-19 pandemic, many architecture firms are finding fewer inquiries that convert to billable projects,” said AIA Chief Economist, Kermit Baker, Hon. AIA, PhD. “While fewer firms reported declining billings in August than during the early months of the COVID-19 pandemic, the fact that the score has been unchanged for the last three months shows that the recovery from this downturn is not progressing at the pace we had hoped to see.”

...

• Regional averages: Midwest (41.7); South (41.6); West (41.3); Northeast (33.9)

• Sector index breakdown: multi-family residential (49.4); mixed practice (41.9); institutional (40.2); commercial/industrial (35.5)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 40.0 in August, unchanged from 40.0 in July. Anything below 50 indicates contraction in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

This index has been below 50 for six consecutive months. This represents a significant decrease in design services, and suggests a decline in CRE investment through the first half of 2021 (This usually leads CRE investment by 9 to 12 months).

This weakness is not surprising since certain segments of CRE are struggling, especially offices and retail.

FHFA: House Prices up 6.5% YoY in July

by Calculated Risk on 9/23/2020 09:30:00 AM

From the FHFA: FHFA House Price Index Up 1.0 Percent in July; Up 6.5 Percent from Last Year

House prices rose nationwide in July, up 1.0 percent from the previous month, according to the latest Federal Housing Finance Agency House Price Index (FHFA HPI). House prices rose 6.5 percent from July 2019 to July 2020. FHFA also revised its previously reported 0.9 percent price change for June 2020 to 1.0 percent.This is a sharp increase in house prices.

For the nine census divisions, seasonally adjusted monthly house price changes from June 2020 to July 2020 ranged from +0.6 percent in the West North Central division to +2.0 percent in the New England division. The 12-month changes ranged from +5.4 percent in the West South Central division to +7.7 percent in both the Mountain and the East South Central divisions.

“U.S. house prices posted a strong increase in July," said Dr. Lynn Fisher, FHFA's Deputy Director of the Division of Research and Statistics. “Between May and July 2020, national prices increased by over 2 percent, which represents the largest two-month price increase observed since the start of the index in 1991. The dramatic increase in prices this summer can be attributed to the historically low interest rate environment and rebounding housing demand even as the supply of homes for sale remains constrained."

emphasis added

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 9/23/2020 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 6.8 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending September 18, 2020. The previous week’s results included an adjustment for the Labor Day holiday.

... The Refinance Index increased 9 percent from the previous week and was 86 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 3 percent from one week earlier. The unadjusted Purchase Index increased 13 percent compared with the previous week and was 25 percent higher than the same week one year ago.

“Mortgage applications activity remained strong last week, even as the 30-year fixed-rate mortgage and 15-year fixed-rate mortgage increased to their highest levels since late August. Purchase applications were up over 25 percent from a year ago, and the demand for higher-balance loans pushed the average purchase loan size to another record high. The strong interest in homebuying observed this summer has carried over to the fall,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Despite the uptick in rates, refinance applications increased around 9 percent and were almost 86 percent higher than last year. Both conventional and government refinance activity, and in particular FHA refinances, picked up last week.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) increased to 3.10 percent from 3.07 percent, with points increasing to 0.46 from 0.32 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

The refinance index has been very volatile recently depending on rates and liquidity.

But with record low rates, the index is up significantly from last year.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 25% year-over-year unadjusted.

Note: Red is a four-week average (blue is weekly).

Tuesday, September 22, 2020

Wednesday: MBA Purchase Index, Fed Chair Powell

by Calculated Risk on 9/22/2020 09:00:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 9:00 AM, FHFA House Price Index for July. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 10:00 AM, Testimony, Fed Chair Jerome Powell, Coronavirus Response, Before the Select Subcommittee on Coronavirus Crisis, U.S. House of Representatives

• During the day, The AIA's Architecture Billings Index for August (a leading indicator for commercial real estate).

September 22 COVID-19 Test Results

by Calculated Risk on 9/22/2020 06:54:00 PM

The US is now mostly reporting over 700,000 tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 717,737 test results reported over the last 24 hours.

There were 48,794 positive tests.

Over 17,000 Americans have died from COVID so far in September. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 6.8% (red line is 7 day average).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

The dashed line is the June low.

Note that there were very few tests available in March and April, and many cases were missed (the percent positive was very high - see first graph). By June, the percent positive had dropped below 5%.

If people stay vigilant, the number of cases might drop to the June low some time in October (that would still be a large number of new cases, but progress).