by Calculated Risk on 7/26/2012 10:02:00 PM

Thursday, July 26, 2012

Friday: GDP, Consumer Sentiment

On Friday ...

• At 8:30 AM ET, the Q2 advance GDP will be released. The consensus is that real GDP increased 1.2% annualized in Q2. The BEA will also release the revised estimates for 2009 through First Quarter 2012. If GDP is revised significantly up or down, this might be part of the FOMC discussion next week.

The BEA put out an excellent note on revisions this week: Revising Economic Indicators: Here’s Why the Numbers Can Change

The public wants accurate data and wants it as soon as possible. To meet that need, BEA publishes early estimates that are based on partial data. Even though these data aren’t complete, they do provide an accurate general picture of economic activity. ...• At 9:55 AM, the final Reuter's/University of Michigan's Consumer sentiment index for July will be released. The consensus is for no change from the preliminary reading of 72.0.

BEA produces three estimates of gross domestic product (GDP) for a given quarter. Each includes updated, more complete, and more accurate information as it becomes available. The first, called the “advance” estimate, typically receives the most attention and is released roughly 4 weeks after the end of a quarter. ...

When BEA calculates the advance estimate, the Bureau doesn’t yet have complete source data, with the largest gaps in data related to the third month of the quarter. In particular, the advance estimate is lacking complete source data on inventories, trade, and consumer spending on services. Therefore, BEA must make assumptions for these missing pieces based in part on past trends. ...

As new and more complete data become available, that information is incorporated into the second and third GDP estimates. About 45 percent of the advance estimate is based on initial or early estimates from various monthly and quarterly surveys that are subject to revision for various reasons, including late respondents that are eventually incorporated into the survey results. Another roughly 14 percent of the advance estimate is based on historical trends.

For the monthly economic question contest:

• And at 10:00 AM, the Q2 Housing Vacancies and Homeownership report from the Census Bureau will be released. This data might indicate the trend, but there are serious questions about the accuracy of this survey.

Record Low Mortgage Rates and Increasing Refinance Activity

by Calculated Risk on 7/26/2012 06:33:00 PM

Another month, another record ...

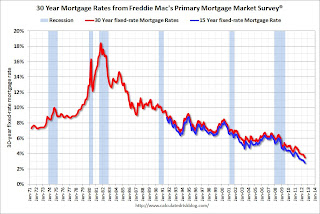

Below is a graph comparing mortgage rates from the Freddie Mac Primary Mortgage Market Survey® (PMMS®) and the refinance index from the Mortgage Bankers Association (MBA).

The the MBA reported yesterday that refinance activity was at the highest level since 2009.

And from Freddie Mac today: 30-Year Fixed-Rate Mortgage Averages a Record-Breaking 3.49 Percent

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing fixed mortgages rates continuing their streak of record-breaking lows. The 30-year fixed rate mortgage averaged 3.49 percent, more than a full percentage point lower than a year ago when it averaged 4.55 percent. Meanwhile, the 15-year fixed-rate mortgage, a popular choice for those looking to refinance, also set another record low at 2.80 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows the MBA's refinance index (monthly average) and the the 30 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey®.

The Freddie Mac survey started in 1971 and mortgage rates are currently at the record low for the last 40 years.

It usually takes around a 50 bps decline from the previous mortgage rate low to get a significant refinance boom, and rates have fallen about 75 bps from the 4.23% low in October 2010 - and refinance activity is picking up.

There has also been an increase in refinance activity due to HARP.

The second graph shows the 15 and 30 year fixed rates from the Freddie Mac survey. The Primary Mortgage Market Survey® started in 1971 (15 year in 1991). Both rates are at record lows for the Freddie Mac survey. Rates for 15 year fixed loans are now at 2.8%.

The second graph shows the 15 and 30 year fixed rates from the Freddie Mac survey. The Primary Mortgage Market Survey® started in 1971 (15 year in 1991). Both rates are at record lows for the Freddie Mac survey. Rates for 15 year fixed loans are now at 2.8%.Note: The Ten Year treasury yield is just off the record low at 1.43% (the record low was earlier this week at 1.39%), so rates will probably fall a little more next week.

Tim Duy: Draghi finds the panic button. Maybe.

by Calculated Risk on 7/26/2012 03:35:00 PM

From Professor Tim Duy at EconomistView: Draghi Blinks. Maybe.. A few excerpts:

It looks like Draghi finally found that panic button. This is crucial, as the ECB is the only institution that can bring sufficient firepower to the table in a timely fashion. His specific reference to the disruption in policy transmission appears to be a clear signal that the ECB will resume purchases of periphery debt, presumably that of Spain and possibly Italy. The ECB will - rightly, in my opinion - justify the purchases as easing financial conditions not monetizing deficit spending.As Duy noted, Spanish 10 year bond yields have only fallen to 6.93% - not a huge vote of confidence.

So far, so good. But there is enough in these statements to leave me very unsettled. First, the claim that the Euro is "irreversible" should send a shiver down everyone's backs. Sounds just a little too much like "the crisis is contained to subprime" and "Spain will not need a bailout." Second, the bluster that "believe me, it will be enough" is suspect. The ECB always thinks they have done enough, but so far this has not been the case. Moreover, he is setting some pretty high expectations, and had better be prepared to meet them with something more than half-hearted bond purchases.

Also, note that despite Draghi's bluster, the rally in Spanish debt send yields just barely below the 7% mark.

...

More distressing to me was Draghi's clearly defiant tone, reminiscent of comments earlier this week from German Finance Minister Wolfgang Schäuble. The message is that Europe has done all the right things, it is financial market participants that are doing the wrong things.

Usually - whenever a European policymakers sounds like they have found the "panic button" - Schäuble speaks up and squashes all hope. Luckily Schäuble is going on vacation ...

Lawler on Builder Results

by Calculated Risk on 7/26/2012 11:58:00 AM

From economist Tom Lawler:

The Ryland Group, the 8th largest US home builder in 2011, reported that net home orders in the quarter ended June 30th, 2012 (including discontinued operations) totaled 1,415, up 32.9% from the comparable quarter of 2011. The company’s sales cancellation rate, expressed as a % of gross orders, was 20.0% last quarter, down from 20.7% a year ago. Home deliveries totaled 1,149, up 30.0% from the comparable quarter of last year, at an average sales price of $253,000, up 3.3% from a year ago. The company’s order backlog at the end of June was 2,289, up 39.1% from last June.

Pulte Group, the 2nd largest US home builder in 2011, reported that net home orders in the quarter ended June 30th, 2012 totaled 5,578, up 32.1% from the comparable quarter of 2011. Home deliveries last quarter totaled 3,816, up 5.0% from the comparable quarter of last year, at an average sales price of $268,000, up 8.1% from a year ago. The company’s order backlog at the end of June was 7,560, up 30.9% from last June. The company attributed the increase in average sales prices to a favorable mix of home closings, improved pricing, and “value creation efforts.”

Meritage Homes, the 10th largest US home builder in 2011, reported that net home orders in the quarter ended June 30th, 2012 totaled 1,353, up 48.7% from the comparable quarter of 2011. The company’s sales cancellation rate, expressed as a % of gross orders, was 13% last quarter, down from 15% a year ago. Home deliveries last quarter totaled 1,042, up 21.7% from the comparable quarter of last year, at an average sales price of $270,000, up 5.0% from a year ago. The company’s order backlog at the end of June was 1,611, up 62.1% from last June.

M/I Homes, the 16th largest US home builder in 2011, reported that net home orders in the quarter ended June 30th, 2012 totaled 826, up 30.1% from the comparable quarter of 2011. The company’s sales cancellation rate, expressed as a % of gross orders, was 16% last quarter, down from 20% a year ago. Home deliveries last quarter totaled 625, up 5.9% from the comparable quarter of last year, at an average sales price of $259,000, up 14.1% from a year ago. The company’s order backlog at the end of June was 1,168, up 40.2% from last June.

So far five large public home builders have reported results for the quarter ended 6/30/2012, and with the exception of NVR net orders were above “consensus” and sales cancellation rates were down. In addition, all builders reporting so far have reported increases in average sales prices and higher margins from a year ago. While part of the sales price gains are probably “mix” related, in general it appears as if in most parts of the country home builders last quarter were able to sell comparable-type homes at “effective” (including sales incentives/discounts) prices higher than a year ago. This jives with other “incoming” home price index data.

CR Note: Here is a summary from Lawler of some stats reported by publicly traded home builders for last quarter.

| Settlements | Net Orders | Backlog | |||||||

|---|---|---|---|---|---|---|---|---|---|

| 6/12 | 6/11 | 6/10 | 6/12 | 6/11 | 6/10 | 6/12 | 6/11 | 6/10 | |

| PulteGroup | 3,816 | 3,633 | 5,030 | 5,578 | 4,222 | 4,218 | 7,560 | 5,777 | 5,644 |

| NVR | 2,475 | 2,207 | 3,354 | 2,614 | 2,468 | 2,559 | 5,048 | 3,946 | 3,766 |

| The Ryland Group | 1,149 | 885 | 1,505 | 1,415 | 1,065 | 959 | 2,289 | 1,646 | 1,368 |

| Meritage Homes | 1,042 | 856 | 1,207 | 1,353 | 910 | 900 | 1,611 | 994 | 1,044 |

| M/I Homes | 625 | 590 | 790 | 826 | 635 | 602 | 1,168 | 833 | 748 |

| Total | 9,107 | 8,171 | 11,886 | 11,786 | 9,300 | 9,238 | 17,676 | 13,196 | 12,570 |

| YoY % Change | 11.5% | -31.3% | 26.7% | 0.7% | 33.9% | 5.0% | |||

Note the large YOY change in order backlog, which is likely to translate into solid gains in SF housing starts and overall SF construction spending in the third quarter of this year.

Standard Pacific Homes, the 13th largest US home builder in 2011, reports results after the market close today. D.R. Horton, the largest US home builder in 2011, reports results tomorrow. MDC Holdings, the 11th largest US home builder in 2011, reports results on July 31st. And Beazer Homes, the 9th largest US home builder in 2011, reports results on August 3rd.

Results reported by home builders so far, however, suggest that the new SF housing market last quarter was considerably stronger than “consensus,” and right now I expect that the eight-month string of upward revisions to Census’ preliminary estimates for new SF home sales will continue in next month’s report.

CR Note: This was from housing economist Tom Lawler.

Kansas City Fed: "Modest" Growth in Regional Manufacturing Activity in July

by Calculated Risk on 7/26/2012 11:00:00 AM

From the Kansas City Fed: Growth in Tenth District Manufacturing Remained Modest

Growth in Tenth District manufacturing activity remained modest in July, and producers were slightly more optimistic than a month ago.. ...The regional manufacturing surveys have been mixed in July, although the Richmond Fed survey was especially weak.

The month-over-month composite index was 5 in July, up from 3 in June but down from 9 in May ... The production index fell further from 12 to 2, and the shipments index dipped into negative territory. The new orders for export index dropped from -7 to -13, almost matching the all-time low of -14 in early 2009. However, the new orders index edged up from -7 to -4, and the employment and order backlog indexes also improved over last month.

The future composite index climbed from 8 to 13, and future new orders and order backlog indexes also rose after decreasing in June. The future employment index edged higher from 13 to 16, while the future production, shipments, and employee workweek indexes were unchanged. The future capital expenditures index increased from 17 to 20, and the future new orders for exports index improved slightly.

The last of the regional surveys will be released next week (Dallas Fed).

NAR: Pending home sales index decreased 1.4% in June

by Calculated Risk on 7/26/2012 10:00:00 AM

From the NAR: Pending Home Sales Slip in June, Remain Above a Year Ago

The Pending Home Sales Index, a forward-looking indicator based on contract signings, slipped 1.4 percent to 99.3 in June from a downwardly revised 100.7 in May but is 9.5 percent higher than June 2011 when it was 90.7. The data reflect contracts but not closings.This was below the consensus forecast of a 0.9% increase for this index.

The PHSI in the Northeast fell 7.6 percent to 76.6 in June but is 12.2 percent higher than a year ago. In the Midwest the index slipped 0.4 percent to 94.4 in June but is 17.3 percent above June 2011. Pending home sales in the South declined 2.0 percent to an index of 106.2 in June but are 8.8 percent above a year earlier. In the West the index rose 2.6 percent in June to 111.5 and is 3.0 percent higher than June 2011.

Contract signings usually lead sales by about 45 to 60 days, so this is for sales in July and August.

Weekly Initial Unemployment Claims decline to 353,000

by Calculated Risk on 7/26/2012 08:30:00 AM

The DOL reports:

In the week ending July 21, the advance figure for seasonally adjusted initial claims was 353,000, a decrease of 35,000 from the previous week's revised figure of 388,000.(Revised up from 386,000). The 4-week moving average was 367,250, a decrease of 8,750 from the previous week's revised average of 376,000.The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims declined to 367,250.

The sharp swings over the last few weeks are apparently related to difficulty adjusting for auto plant shutdowns.

And here is a long term graph of weekly claims:

This was well below the consensus forecast of 380,000 and is the lowest level for the four week average since March.

This was well below the consensus forecast of 380,000 and is the lowest level for the four week average since March.Wednesday, July 25, 2012

Thursday: Weekly Unemployment Claims, Durable Goods, Pending Home Sales, KC Manufacturing Index

by Calculated Risk on 7/25/2012 09:15:00 PM

First, a nice review of the FOMC options next week: An early FOMC preview: the menu of options

And another edition of "unexpected" declines ...

From the Financial Times: UK economy smaller than when Cameron took office

The UK’s double-dip recession has deepened sharply and unexpectedly, leaving the economy smaller than it was when the coalition government took office two years ago.From the WSJ: U.K. Stumbles, Fueling Austerity Debate

The U.K.'s economy suffered a much larger contraction than expected in the second quarter ... The economy shrank 0.7% between April and June ... double-dip recession that is the worst in 50 yearsAusterity and a depressed economy leading to a severe recession ... hoocoodanode? (sorry for sarcasm).

Here is one guy who has been consistently wrong, from Bloomberg: Schaeuble Declares Markets Wrong as Europe Heads to Vacation

Oh my. "The markets are wrong and I'm going on vacation."

On Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 380 thousand from 386 thousand.

• Also at 8:30 AM, the Durable Goods Orders for June will be released. The consensus is for a 0.6% increase in durable goods orders.

• At 10:00 AM, the NAR will release the Pending Home Sales Index for June. The consensus is for a 0.9% increase in the index.

• And at 11:00 AM, the Kansas City Fed regional Manufacturing Survey for July will be released. The consensus is for an increase to 4 from 3 in June (above zero is expansion). These regional manufacturing surveys have been disappointing in July.

Earlier on New Home Sales:

• New Home Sales declined in June to 350,000 Annual Rate

• Some comments on New Home Sales and Distressing Gap

• Lawler on New Home Sales and Revisions

• New Home Sales graphs

LPS: Mortgage delinquencies increased in June

by Calculated Risk on 7/25/2012 04:46:00 PM

Note: "LPS has updated its extrapolation methodology. This improves estimates of market size (and includes wider coverage of both government and subprime products) and increases LPS' estimate of the total first lien residential mortgage market by three percent to 50.4 million." LPS has kindly provided me with some updated historical data for the table below.

LPS released their First Look report for June today. LPS reported that the percent of loans delinquent increased in June from May, and declined year-over-year. The percent of loans in the foreclosure process decreased in June, but remains at a very high level.

LPS reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) increased to 7.14% from 6.91% in May. The percent of delinquent loans is still significantly above the normal rate of around 4.5% to 5%. The percent of delinquent loans peaked at 10.57%, so delinquencies have fallen over half way back to normal. The increase was mostly in the less than 90 days delinquent category.

The following table shows the LPS numbers for June 2012, and also for last month (May 2012) and one year ago (June 2011).

| LPS: Percent Loans Delinquent and in Foreclosure Process | |||

|---|---|---|---|

| 12-Jun | 12-May | 11-Jun | |

| Delinquent | 7.14% | 6.91% | 7.71% |

| In Foreclosure | 4.09% | 4.17% | 4.13% |

| Number of loans: | |||

| Loans Less Than 90 Days | 2,012,000 | 1,923,000 | 2,229,000 |

| Loans 90 Days or more | 1,590,000 | 1,571,000 | 1,752,000 |

| Loans In Foreclosure | 2,061,000 | 2,110,000 | 2,133,000 |

| Total | 5,663,000 | 5,604,000 | 6,114,000 |

The number of delinquent loans, but not in foreclosure, is down about 10% year-over-year (379,000 fewer mortgages delinquent), and the number of loans in the foreclosure process is down 3% or 70,000 year-over-year.

The percent of loans less than 90 days delinquent is close to normal, but the percent (and number) of loans 90+ days delinquent and in the foreclosure process are still very high.

ATA Trucking index increased in June

by Calculated Risk on 7/25/2012 03:54:00 PM

From ATA: ATA Truck Tonnage Jumped 1.2% in June

The American Trucking Associations’ advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index increased 1.2% in June after falling 1.0% in May. (May’s loss was larger than the 0.7% drop ATA reported on June 19.) June’s increase was the largest month-to-month gain in 2012. However, the index contracted a total of 2.1% in April and May. The latest gain increased the SA index to 119.0 (2000=100), up from May’s level of 117.5. Compared with June 2011, the SA index was 3.2% higher, the smallest year-over-year increase since March 2012. Year-to-date, compared with the same period last year, tonnage was up 3.7%.

...

“June’s increase was a pleasant surprise, but the lower year-over-year gain fits with an economy that has slowed,” ATA Chief Economist Bob Costello said. “Manufacturing output was strong in June, which helped tonnage levels.” ... Costello lowered his tonnage outlook for 2012 to the 3% to 3.5% range due to recent economic weakness.

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index. The index is above the pre-recession level and still up 3.7% year-over-year - but has been moving mostly sideways in 2012.

From ATA:

Trucking serves as a barometer of the U.S. economy, representing 67% of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled 9.2 billion tons of freight in 2011. Motor carriers collected $603.9 billion, or 80.9% of total revenue earned by all transport modes.Earlier on New Home Sales:

• New Home Sales declined in June to 350,000 Annual Rate

• Some comments on New Home Sales and Distressing Gap

• Lawler on New Home Sales and Revisions

• New Home Sales graphs