by Calculated Risk on 4/25/2025 01:00:00 PM

Friday, April 25, 2025

The Normal Seasonal Pattern for Median House Prices

Yesterday, in the CalculatedRisk Real Estate Newsletter on March existing home sales, NAR: Existing-Home Sales Decreased to 4.02 million SAAR in March; Down 2.4% YoY, I noted:

On a month-over-month basis, median prices increased 1.7% from February and are now down 5.4% from the June 2024 peak. This is less than the normal seasonal increase in the median price for March. Typically, the NAR median price increases in the Spring, and tends to peak seasonally in the June report.Seasonally, median prices typically peak in June (closed sales are mostly for contracts signed in April and May).

And seasonally, prices usually bottom the following January (contracts signed in November and December).

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|---|---|---|

| Jan to Mar | 3.7% | 4.1% | 5.4% | 7.5% | 7.1% | 4.0% | 3.8% | 2.6% |

| Mar to Jun | 9.6% | 9.9% | 4.9% | 12.4% | 9.1% | 9.3% | 8.7% | NA |

| Jan to Jun | 13.7% | 14.4% | 10.6% | 20.8% | 16.8% | 13.7% | 12.8% | NA |

| Jun to Jan | -8.9% | -6.7% | 3.1% | -3.4% | -12.8% | -7.7% | -7.8% | NA |

The 2025 increase in median prices from January to March was less than the normal seasonal increase.

Q1 GDP Tracking: No Growth

by Calculated Risk on 4/25/2025 10:13:00 AM

The advance estimate of Q1 GDP is scheduled to be released on Wednesday, April 30th. The consensus is for a 0.2% increase in real GDP, quarter-over-quarter annualized - or essentially no growth in Q1.

From BofA:

We expect 1Q advance GDP to print at a weak 0.4% q/q saar, largely on the back of an import surge driven by front loading ahead of the tariffs. We look for a rise in 1Q inventory accumulation as well, but not enough to offset higher imports. The risks to our inventory tracking and 1Q GDP print are to the downside, since inventories are susceptible to measurement issues. [Apr 17th estimate]From Goldman:

emphasis added

we lowered our Q1 GDP tracking estimate by 0.3pp to -0.2% (quarter-over-quarter annualized). [Apr 24th estimate]And from the Atlanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2025 is -2.5 percent on April 24, down from -2.2 percent on April 17. The alternative model forecast, which adjusts for imports and exports of gold as described here, is -0.4 percent. After recent releases from the US Census Bureau and the National Association of Realtors, both the standard model’s and the alternative model’s nowcasts of first-quarter real gross private domestic investment growth decreased from 8.9 percent to 7.1 percent. [Apr 24th estimate]

Intercontinental Exchange: Mortgage Delinquency Rate Increased in March

by Calculated Risk on 4/25/2025 08:11:00 AM

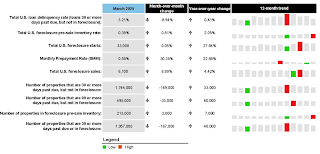

Intercontinental Exchange, Inc. (NYSE:ICE) ... today released its March 2025 First Look, which reveals that while delinquency rates edged up slightly year over year (YoY), they remain below pre-pandemic levels.

The ICE First Look reports on month-end delinquency, foreclosure and prepayment statistics sourced from its loan-level database, which covers a majority of the U.S. mortgage market.

Key takeaways from this month’s findings include:

• While serious delinquencies (SDQs) also improved seasonally, they are up 14% (+60K) YoY, with the rise driven entirely by FHA delinquencies, which increased by +63K YoY.

• Higher SDQs, along with the lifting of a VA foreclosure moratorium, fueled a modest bump in foreclosure inventory and sales, which both rose annually for the first time in nearly two years.

• Disaster events, such as hurricanes and wildfires, have led to YoY delinquency increases across several states, including Florida (+44 bps), South Carolina (+17 bps), Georgia (+14 bps) and California (+10 bps).

• Monthly prepayment activity, measured by single-month mortality, jumped to 0.59% – a +30.4% increase over February and the highest level of prepayment activity since November.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a table from ICE.

Thursday, April 24, 2025

Friday: Consumer Sentiment

by Calculated Risk on 4/24/2025 08:46:00 PM

Friday:

• AT 10:00 AM ET, University of Michigan's Consumer sentiment index (Final for April). The consensus is for a reading of 50.8.

Realtor.com Reports Active Inventory Up 30.0% YoY

by Calculated Risk on 4/24/2025 04:48:00 PM

What this means: On a weekly basis, Realtor.com reports the year-over-year change in active inventory and new listings. On a monthly basis, they report total inventory. For March, Realtor.com reported inventory was up 28.5% YoY, but still down 20.2% compared to the 2017 to 2019 same month levels.

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report: Weekly Housing Trends View—Data for Week Ending April 19, 2025

• Active inventory climbed 30.0% from a year ago

The number of homes actively for sale remains significantly higher than last year, continuing a 76-week streak of annual gains.

• New listings—a measure of sellers putting homes up for sale—fell this week due to the Easter holiday, by 1.6% from a year ago

After 14 consecutive weeks of growth, the number of newly listed homes has dipped below last year’s level. However, this decline is largely attributed to the timing of the Easter holiday, which fell later this year than last. Looking ahead, we expect new listings to rebound in the coming week—a typical pattern that follows the end of a holiday. In fact, the recent momentum in listings made this March the most active March for new inventory in three years.

• The median list price was up 0.6% year-over-year

The national median list price rose by 0.6% year-over-year, marking the first notable price increase after a stretch of declining or flat trends since last June. While this uptick may signal a warming trend at the national level, local markets may tell a different story. In areas where home shoppers rely on stock market funds for down payments, ongoing uncertainty and volatility in the financial market could tighten buyer budgets, dampen demand, and potentially put downward pressure on prices.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory was up year-over-year for the 76th consecutive week.

Hotels: Occupancy Rate Decreased 8.1% Year-over-year due to Easter Timing

by Calculated Risk on 4/24/2025 01:55:00 PM

As expected due to the Easter and Passover holidays, the U.S. hotel industry reported negative year-over-year comparisons, according to CoStar’s latest data through 19 April. ...The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

13-19 April 2025 (percentage change from comparable week in 2024):

• Occupancy: 61.4% (-8.1%)

• Average daily rate (ADR): US$158.00 (-1.3%)

• Revenue per available room (RevPAR): US$97.06 (-9.3%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2025, blue is the median, and dashed light blue is for 2024. Dashed purple is for 2018, the record year for hotel occupancy.

Newsletter: NAR: Existing-Home Sales Decreased to 4.02 million SAAR in March; Down 2.4% YoY

by Calculated Risk on 4/24/2025 10:50:00 AM

Today, in the CalculatedRisk Real Estate Newsletter: NAR: Existing-Home Sales Decreased to 4.02 million SAAR in March; Down 2.4% YoY

Excerpt:

Sales in March (4.02 million SAAR) were down 5.9% from the previous month and were 2.4% below the February 2024 sales rate. This was the 2nd consecutive month with a year-over-year decline, following four consecutive months with a year-over-year increases in sales.There is much more in the article.

...

Sales Year-over-Year and Not Seasonally Adjusted (NSA)

The fourth graph shows existing home sales by month for 2024 and 2025.

Sales decreased 2.4% year-over-year compared to March 2024.

NAR: Existing-Home Sales Decreased to 4.02 million SAAR in March; Down 2.4% YoY

by Calculated Risk on 4/24/2025 10:00:00 AM

From the NAR: Existing-Home Sales Receded 5.9% in March

Existing-home sales descended in March, according to the National Association of REALTORS®. Sales slid in all four major U.S. regions. Year-over-year, sales dropped in the Midwest and South, increased in the West and were unchanged in the Northeast.

Total existing-home sales – completed transactions that include single-family homes, townhomes, condominiums and co-ops – fell 5.9% from February to a seasonally adjusted annual rate of 4.02 million in March. Year-over-year, sales drew back 2.4% (down from 4.12 million in March 2024).

...

Total housing inventory registered at the end of March was 1.33 million units, up 8.1% from February and 19.8% from one year ago (1.11 million). Unsold inventory sits at a 4.0-month supply at the current sales pace, up from 3.5 months in February and 3.2 months in March 2024.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1994.

Sales in March (4.02 million SAAR) were down 5.9% from the previous month and were 2.4% below the February 2024 sales rate. This was the 2nd consecutive month with a year--over-year decline, following four consecutive months with a year-over-year increases in sales.

According to the NAR, inventory increased to 1.33 million in March from 1.23 million the previous month.

According to the NAR, inventory increased to 1.33 million in March from 1.23 million the previous month.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was up 19.8% year-over-year (blue) in March compared to March 2024.

Inventory was up 19.8% year-over-year (blue) in March compared to March 2024. Months of supply (red) increased to 4.0 months in March from 3.5 months the previous month.

As expected, the sales rate was below the consensus forecast. I'll have more later.

Weekly Initial Unemployment Claims Increase to 222,000

by Calculated Risk on 4/24/2025 08:30:00 AM

The DOL reported:

In the week ending April 19, the advance figure for seasonally adjusted initial claims was 222,000, an increase of 6,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 215,000 to 216,000. The 4-week moving average was 220,250, a decrease of 750 from the previous week's revised average. The previous week's average was revised up by 250 from 220,750 to 221,000.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 220,250.

The previous week was revised up.

Weekly claims were close to the consensus forecast.

Wednesday, April 23, 2025

Thursday: Unemployment Claims, Durable Goods, Existing Home Sales

by Calculated Risk on 4/23/2025 08:36:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. Initial claims were at 215 thousand last week.

• Also at 8:30 AM, Durable Goods Orders for March from the Census Bureau. The consensus is for a 0.8% increase in durable goods orders.

• Also at 8:30 AM, Chicago Fed National Activity Index for March. This is a composite index of other data.

• At 10:00 AM, Existing Home Sales for March from the National Association of Realtors (NAR). The consensus is for 4.14 million SAAR, down from 4.26 million.

• At 11:00 AM, the Kansas City Fed manufacturing survey for April.