by Calculated Risk on 4/09/2025 11:14:00 AM

Wednesday, April 09, 2025

Part 1: Current State of the Housing Market; Overview for mid-April 2025

Today, in the Calculated Risk Real Estate Newsletter: Part 1: Current State of the Housing Market; Overview for mid-April 2025

A brief excerpt:

This 2-part overview for mid-April provides a snapshot of the current housing market.There is much more in the article.

At this moment, we can’t talk housing without mentioning the overall economy.

Just over two weeks ago, I revised down my outlook for housing this year, see Policy and 2025 Housing Outlook. Since then, policy and the outlook have taken a turn for the worse. One point I made in March was:And another factor is the recent stock market volatility. Ten percent corrections are common, a further sell-off will have a negative wealth effect for potential home buyers.Stock markets are now down around 20% (with crazy volatility). And it is likely this will negatively impact home sales.

On my blog, I went on Recession Watch over the weekend (not predicting a recession yet because the U.S. economy is very resilient, was on solid footing at the beginning of the year, and the tariffs might be lowered or reversed). And I discussed some of the data I’ll be watching in Recession Watch Metrics.

And on housing: Inventory, inventory, inventory! Inventory is increasing sharply, and inventory usually tells the tale.

...

Since both inventory and sales have fallen significantly, a key for house prices is to watch months-of-supply. The following graph shows months-of-supply since 2017. The following graph shows months-of-supply since 2017. Note that months-of-supply is higher than 6 of the last 8 years, and at the same level as in 2017.

Months-of-supply was at 3.5 months in February compared to 3.6 months in February 2019. It appears national months-of-supply will be above pre-pandemic levels this summer, and likely above 5.0 months (putting some pressure on prices).

Inventory would probably have to increase to 5 1/2 to 6 months of supply to see national price declines again.

MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

by Calculated Risk on 4/09/2025 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 20.0 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending April 4, 2025.

The Market Composite Index, a measure of mortgage loan application volume, increased 20.0 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index increased 20 percent compared with the previous week. The Refinance Index increased 35 percent from the previous week and was 93 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 9 percent from one week earlier. The unadjusted Purchase Index increased 10 percent compared with the previous week and was 24 percent higher than the same week one year ago.

“Mortgage applications increased by 20 percent to its highest level since September 2024, driven by purchase and refinance applications picking up in a volatile week where economic uncertainty caused rates to drop across the board. The 30-year fixed mortgage rate was 6.61 percent, the lowest rate since October 2024,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Both homebuyers and refinance borrowers were quick to take advantage of this dip in rates, driving the purchase index 24 percent higher than a year ago to the strongest pace since January 2024. Refinance applications rose by 35 percent to the highest level in six months, as borrowers with larger loan sizes tend to be more sensitive to rate changes. The average refinance loan size jumped to its second highest in the survey at $399,600.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($806,500 or less) decreased to 6.61 percent from 6.70 percent, with points increasing to 0.63 from 0.62 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is up 24% year-over-year unadjusted.

Tuesday, April 08, 2025

Wednesday: FOMC Minutes

by Calculated Risk on 4/08/2025 07:19:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 2:00 PM, FOMC Minutes, Meeting of March 18-19

By Request: Public and Private Sector Payroll Jobs During Presidential Terms

by Calculated Risk on 4/08/2025 02:17:00 PM

Note: I've received a number of requests to post this again after the start of President Trump's 2nd term. So here is another update of tracking employment during Presidential terms. We frequently use Presidential terms as time markers - we could use Speaker of the House, Fed Chair, or any other marker.

Important: There are many differences between these periods. Overall employment was smaller in the '80s, however the participation rate was increasing in the '80s (younger population and women joining the labor force), and the participation rate is generally declining now. But these graphs give an overview of employment changes.

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). Presidents Carter, George H.W. Bush, and Biden only served one term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble and left during the bursting of the housing bubble. Mr. Obama (dark blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (dark red) took office.

There was a recession towards the end of President G.H.W. Bush (light purple) term, and Mr. Clinton (light blue) served for eight years without a recession. There was a pandemic related recession in 2020.

First, here is a table for private sector jobs for each term. (Blue for Democrats, Red for Republicans)

| Term | Private Sector Jobs Added (000s) |

|---|---|

| Biden | 14,327 |

| Clinton 1 | 10,875 |

| Clinton 2 | 10,104 |

| Obama 2 | 9,924 |

| Reagan 2 | 9,351 |

| Carter | 9,039 |

| Reagan 1 | 5,363 |

| Obama 1 | 1,889 |

| GHW Bush | 1,507 |

| GW Bush 2 | 453 |

| Trump 2 | 3251 |

| GW Bush 1 | -822 |

| Trump 1 | -2,178 |

| 1Through 2 months | |

Click on graph for larger image.

Click on graph for larger image.The first graph is for private employment only.

Private sector employment increased by 9,039,000 under President Carter (dashed green), by 14,714,000 under President Reagan (dark red), 1,507,000 under President G.H.W. Bush (light purple), 20,979,000 under President Clinton (light blue), lost 369,000 under President G.W. Bush, and gained 11,813,000 under President Obama (dark dashed blue). During President Trump's terms (Orange), the economy has lost 1,853,000 private sector jobs.

A big difference between the presidencies has been public sector employment. Note: the bumps in public sector employment due to the decennial Census in 1980, 1990, 2000, 2010 and 2020.

A big difference between the presidencies has been public sector employment. Note: the bumps in public sector employment due to the decennial Census in 1980, 1990, 2000, 2010 and 2020. The public sector grew during Mr. Carter's term (up 1,304,000), during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,744,000 jobs). However, the public sector declined significantly while Mr. Obama was in office (down 263,000 jobs). During Mr. Trump's terms, the economy lost 517,000 public sector jobs (mostly teachers during the pandemic).

| Term | Public Sector Jobs Added (000s) |

|---|---|

| Biden | 1,813 |

| Reagan 2 | 1,438 |

| Carter | 1,304 |

| Clinton 2 | 1,242 |

| GHW Bush | 1,127 |

| GW Bush 1 | 900 |

| GW Bush 2 | 844 |

| Clinton 1 | 692 |

| Obama 2 | 447 |

| Trump 2 | 201 |

| Reagan 1 | -24 |

| Trump | -537 |

| Obama 1 | -710 |

| 1Through 2 months | |

1st Look at Local Housing Markets in March

by Calculated Risk on 4/08/2025 10:40:00 AM

Today, in the Calculated Risk Real Estate Newsletter: 1st Look at Local Housing Markets in March

A brief excerpt:

This is the first look at several early reporting local markets in March. I’m tracking over 40 local housing markets in the US. Some of the 40 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.There is much more in the article.

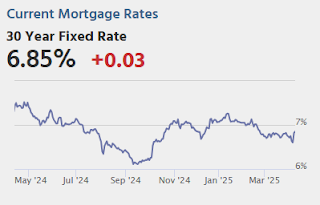

Closed sales in March were mostly for contracts signed in January and February when 30-year mortgage rates averaged 6.96% and 6.84%, respectively (Freddie Mac PMMS). This was an increase from the average rate for homes that closed in February. This was before the recent surge in economic uncertainty and stock market volatility that might impact existing home sales.

...

In March, sales in these markets were down 0.7% YoY. Last month, in February, these same markets were down 4.2% year-over-year Not Seasonally Adjusted (NSA).

Note that most of these early reporting markets have shown stronger year-over-year sales than most other markets for the last several months.

Important: There were the same number of working days in March 2025 (21) as in March 2024 (21). So, the year-over-year change in the headline SA data will be close to the change in the NSA data (there are other seasonal factors).

...

This was just several early reporting markets. Many more local markets to come!

Leading Index for Commercial Real Estate Decreased 7% in March

by Calculated Risk on 4/08/2025 08:13:00 AM

From Dodge Data Analytics: Dodge Momentum Index Declines 7% in March

The Dodge Momentum Index (DMI), issued by Dodge Construction Network, receded 6.9% in March to 205.6 (2000=100) from the revised February reading of 220.9. Over the month, commercial planning declined 7.8% while institutional planning fell 5.0%.

“Increased uncertainty around material prices and fiscal policies may have begun to factor into planning decisions throughout March,” stated Sarah Martin, associate director of forecasting at Dodge Construction Network. “While planning data has weakened across most nonresidential sectors this month, activity remains considerably higher than year-ago levels and still suggests steady construction activity in mid-2026.”

On the commercial side, weaker planning activity for warehouses, data centers and retail stores drove this month’s decline. Meanwhile, hotel and office planning continued to accelerate. On the institutional side, planning activity slowed for education, healthcare and government buildings. In March, the DMI was up 30% when compared to year-ago levels. The commercial segment was up 32% from March 2024. The institutional segment was up 27% over the same period, following a very weak March last year. The influence of data centers on the DMI this year remains substantial. If we remove all data center projects between 2023 and 2025, commercial planning would be up 4% from year-ago levels, and the entire DMI would be up 12%. While momentum decelerated for data centers this month, levels of activity remain very high.

...

The DMI is a monthly measure of the value of nonresidential building projects going into planning, shown to lead construction spending for nonresidential buildings by a full year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Dodge Momentum Index since 2002. The index was at 205.6 in March, down from 220.9 the previous month.

According to Dodge, this index leads "construction spending for nonresidential buildings by a full year". This index suggests a pickup in mid-2025, however, uncertainty might impact these projects.

Monday, April 07, 2025

Tuesday: Small Business Optimism

by Calculated Risk on 4/07/2025 07:20:00 PM

While there was certainly some volatility surrounding news headlines that were less than credible (specifically, that Trump was considering a 90 day pause on Tariffs), bonds maintained steady selling pressure all day.Tuesday:

As a result, mortgage lenders were under progressive pressure to bump today's mortgages rates higher several times. The net effect is that we've moved from 2025's lowest rates to highest since late February in the space of 24 hours. That said, today's highs are right in line with many other days from the past several weeks. [30 year fixed 6.82%]

emphasis added

• At 6:00 AM ET, NFIB Small Business Optimism Index for March.

Wholesale Used Car Prices Decreased in March; Down 0.2% Year-over-year

by Calculated Risk on 4/07/2025 03:15:00 PM

From Manheim Consulting today: Manheim Used Vehicle Value Index Shows Seasonal Decline in March Despite Strong Market Demand

Wholesale used-vehicle prices (on a mix, mileage, and seasonally adjusted basis) were lower in March compared to February. The Manheim Used Vehicle Value Index (MUVVI) declined to 202.6, which is a decrease of 0.2% from a year ago and also lower than the February levels. The seasonal adjustment caused the index to decline for the month, as non-seasonally adjusted values rose but not enough to account for the normal seasonal move. The non-adjusted price in March increased by 2.7% compared to February, moving the unadjusted average price up 0.4% year over year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This index from Manheim Consulting is based on all completed sales transactions at Manheim’s U.S. auctions.

ICE Mortgage Monitor: Home Prices Continue to Cool

by Calculated Risk on 4/07/2025 12:28:00 PM

Today, in the Real Estate Newsletter: ICE Mortgage Monitor: Home Prices Continue to Cool

Brief excerpt:

Note: I made a mistake last week and posted this prior to the embargo lifting. My apologies to Intercontinental Exchange and all my readers.There is much more in the newsletter.

House Price Growth Continues to Slow

Here is the year-over-year in house prices according to the ICE Home Price Index (HPI). The ICE HPI is a repeat sales index. ICE reports the median price change of the repeat sales. The index was up 2.7% year-over-year in February, down from 3.4% YoY in January.

• Home price growth is beginning to cool as modestly improved demand is running up against higher levels of inventory across most major marketsThere is much more in the mortgage monitor.

• The annual home price growth rate dipped to +2.7% in February from +3.4% the month prior, marking the sharpest single month of deceleration in the annual home price growth rate since early 2023, 2023, with an early look at March data via ICE's enhanced Home Price Index suggesting that price growth has cooled further to +2.2%

• On a seasonally adjusted basis, home prices rose by +0.11% in the month, equivalent to a seasonally adjusted annualized rate of +1.3%, the softest such growth in five months

• In simple terms, that means that if the current rate of monthly growth we’ve seen in recent months were to persist, it would result in annual home price growth continuing to slow as we make our way through Q1 and into Q2 2025

Recession Watch Metrics

by Calculated Risk on 4/07/2025 10:04:00 AM

Early in February, I expressed my "increasing concern" about the negative economic impact of "executive / fiscal policy errors", however, I concluded that post by noting that I was not currently on recession watch.

"If most of the April 9 tariffs do take effect, then the effective tariff rate will rise by an estimated 20pp once those increases and likely sectoral tariffs take effect, even allowing for some country-specific agreements at a later date. If so, we expect to change our forecast to a recession."

Click on graph for larger image.

Click on graph for larger image.The arrows point to some of the earlier peaks and troughs for these three measures - and the most recent peak.

New home sales peaked in 2020 as pandemic buying soared. Then new home sales and single-family starts turned down in 2021, but that was partly due to the huge surge in sales during the pandemic. In 2022, both new home sales and single-family starts turned down in response to higher mortgage rates.

This second graph shows the YoY change in New Home Sales from the Census Bureau. Currently new home sales (based on 3-month average of NSA data) are down 4% year-over-year.

This second graph shows the YoY change in New Home Sales from the Census Bureau. Currently new home sales (based on 3-month average of NSA data) are down 4% year-over-year.

On the other hand, light vehicle sales were strong in March.

On the other hand, light vehicle sales were strong in March.  Here is a graph of the Sahm rule from FRED since 1959.

Here is a graph of the Sahm rule from FRED since 1959.The rule was triggered in 2024 (slightly), but Dr. Claudia Sahm said at the time:

“I am not concerned that, at this moment, we are in a recession,” she told Fortune ... “This time really could be different,” Sahm said. “[The Sahm Rule] may not tell us what it’s told us in the past, because of these swings from labor shortages, with people dropping out of the labor force, to now having immigrants coming lately. That all can show up in changes in the unemployment rate, which is the core of the Sahm Rule.”

And weekly unemployment claims always rise sharply at the beginning of a recession (other events - like hurricane Katrina - can cause a temporary spike in weekly claims).

And weekly unemployment claims always rise sharply at the beginning of a recession (other events - like hurricane Katrina - can cause a temporary spike in weekly claims).