by Calculated Risk on 3/31/2025 07:17:00 PM

Monday, March 31, 2025

Tuesday: Job Openings, ISM Mfg, Construction Spending, Vehicle Sales

Sideways" has been the dominant theme for mortgage rates for well over a month now. The average top tier 30yr fixed rate fell below 6.82% on February 25th, and moved down to 6.70% the following week. We haven't been outside of that range since then.Tuesday:

Today was just another day in that regard, or perhaps even a prime example considering it was smack dab in the middle of that range. [30 year fixed 6.74%]

emphasis added

• At 10:00 AM ET, Job Openings and Labor Turnover Survey for February from the BLS.

• Also at 10:00 AM, ISM Manufacturing Index for March. The consensus is for the ISM to be at 50.3, unchanged from 50.3 in February.

• Also at 10:00 AM, Construction Spending for February. The consensus is for 0.2% increase in construction spending.

• All Day: Light vehicle sales for March.

FHFA’s National Mortgage Database: Outstanding Mortgage Rates, LTV and Credit Scores

by Calculated Risk on 3/31/2025 02:36:00 PM

Today, in the Calculated Risk Real Estate Newsletter: FHFA’s National Mortgage Database: Outstanding Mortgage Rates, LTV and Credit Scores

A brief excerpt:

Here are some graphs on outstanding mortgages by interest rate, the average mortgage interest rate, borrowers’ credit scores and current loan-to-value (LTV) from the FHFA’s National Mortgage Database through Q4 2024 (just released).There is much more in the article.

...

Here is some data showing the distribution of interest rates on closed-end, fixed-rate 1-4 family mortgages outstanding at the end of each quarter since Q1 2013 through Q4 2024.

This shows the surge in the percent of loans under 3%, and also under 4%, starting in early 2020 as mortgage rates declined sharply during the pandemic. The percent of outstanding loans under 4% peaked in Q1 2022 at 65.1% (now at 54.1%), and the percent under 5% peaked at 85.6% (now at 72.1%). These low existing mortgage rates makes it difficult for homeowners to sell their homes and buy a new home since their monthly payments would increase sharply. This was a key reason existing home inventory levels were so low.

Time is slowly eroding this lock-in effect.

Freddie Mac House Price Index Increased in February; Up 3.4% Year-over-year

by Calculated Risk on 3/31/2025 10:34:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Freddie Mac House Price Index Increased in February; Up 3.4% Year-over-year

A brief excerpt:

Freddie Mac reported that its “National” Home Price Index (FMHPI) increased 0.18% month-over-month on a seasonally adjusted (SA) basis in February. On a year-over-year basis, the National FMHPI was up 3.4% in February, down from up 3.6% YoY in January. The YoY increase peaked at 19.0% in July 2021, and for this cycle, bottomed at up 0.9% YoY in May 2023. ...There is much more in the article!

For cities (Core-based Statistical Areas, CBSA), here are the 30 cities with the largest declines from the peak, seasonally adjusted. Austin continues to be the worst performing city. However, 7 of the 10 cities with the largest price declines are in Florida.

Housing March 31st Weekly Update: Inventory up 1.1% Week-over-week, Up 30.6% Year-over-year

by Calculated Risk on 3/31/2025 08:11:00 AM

Click on graph for larger image.

Click on graph for larger image. This second inventory graph is courtesy of Altos Research.

This second inventory graph is courtesy of Altos Research.Sunday, March 30, 2025

Sunday Night Futures

by Calculated Risk on 3/30/2025 07:11:00 PM

Weekend:

• Schedule for Week of March 30, 2025

Monday:

• At 9:45 AM ET, Chicago Purchasing Managers Index for March. The consensus is for a reading of 45.5, unchanged from 45.5 in February.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for March. This is the last of the regional surveys for March.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are down 31 and DOW futures are down 192 (fair value).

Oil prices were up over the last week with WTI futures at $69.36 per barrel and Brent at $73.63 per barrel. A year ago, WTI was at $85, and Brent was at $87 - so WTI oil prices are down about 18% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.12 per gallon. A year ago, prices were at $3.51 per gallon, so gasoline prices are down $0.39 year-over-year.

A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 3/30/2025 10:19:00 AM

Another update ... a few key points:

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern. This was because distressed sales (at lower price points) happened at a steady rate all year, while regular sales followed the normal seasonal pattern. This made for larger swings in the seasonal factor during the housing bust.

Click on graph for larger image.

Click on graph for larger image.This graph shows the month-to-month change in the NSA Case-Shiller National index since 1987 (through January 2025). The seasonal pattern was smaller back in the '90s and early '00s and increased once the bubble burst.

The seasonal swings declined following the bust, however the pandemic price surge changed the month-over-month pattern.

The second graph shows the seasonal factors for the Case-Shiller National index since 1987. The factors started to change near the peak of the bubble, and really increased during the bust since normal sales followed the regular seasonal pattern - and distressed sales happened all year.

The second graph shows the seasonal factors for the Case-Shiller National index since 1987. The factors started to change near the peak of the bubble, and really increased during the bust since normal sales followed the regular seasonal pattern - and distressed sales happened all year. The swings in the seasonal factors were decreasing following the bust but have increased again recently - this time without a surge in distressed sales.

Saturday, March 29, 2025

Real Estate Newsletter Articles this Week: New Home Sales Increase to 676,000 Annual Rate in February

by Calculated Risk on 3/29/2025 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• New Home Sales Increase to 676,000 Annual Rate in February

• Case-Shiller: National House Price Index Up 4.1% year-over-year in January

• Policy and 2025 Housing Outlook

• Fannie and Freddie: Single Family Serious Delinquency Rates Unchanged in February

• Final Look at Local Housing Markets in February and a Look Ahead to March Sales

• Inflation Adjusted House Prices 0.8% Below 2022 Peak

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

Schedule for Week of March 30, 2025

by Calculated Risk on 3/29/2025 08:11:00 AM

The key report scheduled for this week is the March employment report on Friday.

Other key reports include the February Trade Deficit and March Auto Sales.

For manufacturing, the March ISM Manufacturing and Dallas Fed surveys will be released.

9:45 AM: Chicago Purchasing Managers Index for March. The consensus is for a reading of 45.5, unchanged from 45.5 in February.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for March. This is the last of the regional surveys for March.

10:00 AM ET: Job Openings and Labor Turnover Survey for February from the BLS.

10:00 AM ET: Job Openings and Labor Turnover Survey for February from the BLS. This graph shows job openings (black line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in January to 7.74 million from 7.51 million in December.

The number of job openings (black) were down 9% year-over-year. Quits were down 3% year-over-year.

10:00 AM: ISM Manufacturing Index for March. The consensus is for the ISM to be at 50.3, unchanged from 50.3 in February.

10:00 AM: Construction Spending for February. The consensus is for 0.2% increase in construction spending.

All Day: Light vehicle sales for March. The consensus is for light vehicle sales to be 16.6 million SAAR in March, up from 16.0 million in February (Seasonally Adjusted Annual Rate).

All Day: Light vehicle sales for March. The consensus is for light vehicle sales to be 16.6 million SAAR in March, up from 16.0 million in February (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the February sales rate.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for March. This report is for private payrolls only (no government). The consensus is for 119,000 payroll jobs added in March, up from 77,000 added in February.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 225 initial claims up from 224 thousand last week.

8:30 AM: Trade Balance report for February from the Census Bureau.

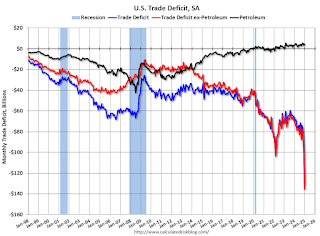

8:30 AM: Trade Balance report for February from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is the trade deficit to be $110.0 billion. The U.S. trade deficit was at $131.4 billion in January.

10:00 AM: the ISM Services Index for March.

8:30 AM: Employment Report for March. The consensus is for 135,000 jobs added, and for the unemployment rate to be unchanged at 4.1%.

8:30 AM: Employment Report for March. The consensus is for 135,000 jobs added, and for the unemployment rate to be unchanged at 4.1%.There were 151,000 jobs added in February, and the unemployment rate was at 4.1%.

This graph shows the jobs added per month since January 2021.

11:25 AM: Speech, Fed Chair Jerome Powell, Economic Outlook, At the Society for Advancing Business Editing and Writing (SABEW) Annual Conference, Arlington, Virginia

Friday, March 28, 2025

March 28th COVID Update: COVID Deaths Continue Declining

by Calculated Risk on 3/28/2025 07:15:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Deaths per Week | 602 | 658 | ≤3501 | |

| 1my goals to stop weekly posts. 🚩 Increasing number weekly for Deaths. ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported since Jan 2023.

This appears to be a leading indicator for COVID hospitalizations and deaths. This has generally been moving down.

This appears to be a leading indicator for COVID hospitalizations and deaths. This has generally been moving down.Fannie and Freddie: Single Family Serious Delinquency Rates Unchanged in February; Multi-Family Delinquency Rate Equals Highest Since 2011 (ex-Pandemic)

by Calculated Risk on 3/28/2025 04:38:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Fannie and Freddie: Single Family Serious Delinquency Rates Unchanged in February

Excerpt:

Freddie Mac reported that the Single-Family serious delinquency rate in February was 0.61%, unchanged from 0.61% January. Freddie's rate is up year-over-year from 0.54% in February 2024, however, this is close to the pre-pandemic level of 0.60%.

Some of the recent increase in the 90+ day delinquency rate is probably related to the hurricanes last year.

Freddie's serious delinquency rate peaked in February 2010 at 4.20% following the housing bubble and peaked at 3.17% in August 2020 during the pandemic.

Fannie Mae reported that the Single-Family serious delinquency rate in February was 0.57%, unchanged from 0.57% in January. The serious delinquency rate is up year-over-year from 0.53% in February 2024, however, this is below the pre-pandemic lows of 0.65%.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59% following the housing bubble and peaked at 3.32% in August 2020 during the pandemic.