by Calculated Risk on 3/31/2025 08:11:00 AM

Monday, March 31, 2025

Housing March 31st Weekly Update: Inventory up 1.1% Week-over-week, Up 30.6% Year-over-year

Click on graph for larger image.

Click on graph for larger image. This second inventory graph is courtesy of Altos Research.

This second inventory graph is courtesy of Altos Research.Sunday, March 30, 2025

Sunday Night Futures

by Calculated Risk on 3/30/2025 07:11:00 PM

Weekend:

• Schedule for Week of March 30, 2025

Monday:

• At 9:45 AM ET, Chicago Purchasing Managers Index for March. The consensus is for a reading of 45.5, unchanged from 45.5 in February.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for March. This is the last of the regional surveys for March.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are down 31 and DOW futures are down 192 (fair value).

Oil prices were up over the last week with WTI futures at $69.36 per barrel and Brent at $73.63 per barrel. A year ago, WTI was at $85, and Brent was at $87 - so WTI oil prices are down about 18% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.12 per gallon. A year ago, prices were at $3.51 per gallon, so gasoline prices are down $0.39 year-over-year.

A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 3/30/2025 10:19:00 AM

Another update ... a few key points:

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern. This was because distressed sales (at lower price points) happened at a steady rate all year, while regular sales followed the normal seasonal pattern. This made for larger swings in the seasonal factor during the housing bust.

Click on graph for larger image.

Click on graph for larger image.This graph shows the month-to-month change in the NSA Case-Shiller National index since 1987 (through January 2025). The seasonal pattern was smaller back in the '90s and early '00s and increased once the bubble burst.

The seasonal swings declined following the bust, however the pandemic price surge changed the month-over-month pattern.

The second graph shows the seasonal factors for the Case-Shiller National index since 1987. The factors started to change near the peak of the bubble, and really increased during the bust since normal sales followed the regular seasonal pattern - and distressed sales happened all year.

The second graph shows the seasonal factors for the Case-Shiller National index since 1987. The factors started to change near the peak of the bubble, and really increased during the bust since normal sales followed the regular seasonal pattern - and distressed sales happened all year. The swings in the seasonal factors were decreasing following the bust but have increased again recently - this time without a surge in distressed sales.

Saturday, March 29, 2025

Real Estate Newsletter Articles this Week: New Home Sales Increase to 676,000 Annual Rate in February

by Calculated Risk on 3/29/2025 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• New Home Sales Increase to 676,000 Annual Rate in February

• Case-Shiller: National House Price Index Up 4.1% year-over-year in January

• Policy and 2025 Housing Outlook

• Fannie and Freddie: Single Family Serious Delinquency Rates Unchanged in February

• Final Look at Local Housing Markets in February and a Look Ahead to March Sales

• Inflation Adjusted House Prices 0.8% Below 2022 Peak

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

Schedule for Week of March 30, 2025

by Calculated Risk on 3/29/2025 08:11:00 AM

The key report scheduled for this week is the March employment report on Friday.

Other key reports include the February Trade Deficit and March Auto Sales.

For manufacturing, the March ISM Manufacturing and Dallas Fed surveys will be released.

9:45 AM: Chicago Purchasing Managers Index for March. The consensus is for a reading of 45.5, unchanged from 45.5 in February.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for March. This is the last of the regional surveys for March.

10:00 AM ET: Job Openings and Labor Turnover Survey for February from the BLS.

10:00 AM ET: Job Openings and Labor Turnover Survey for February from the BLS. This graph shows job openings (black line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in January to 7.74 million from 7.51 million in December.

The number of job openings (black) were down 9% year-over-year. Quits were down 3% year-over-year.

10:00 AM: ISM Manufacturing Index for March. The consensus is for the ISM to be at 50.3, unchanged from 50.3 in February.

10:00 AM: Construction Spending for February. The consensus is for 0.2% increase in construction spending.

All Day: Light vehicle sales for March. The consensus is for light vehicle sales to be 16.6 million SAAR in March, up from 16.0 million in February (Seasonally Adjusted Annual Rate).

All Day: Light vehicle sales for March. The consensus is for light vehicle sales to be 16.6 million SAAR in March, up from 16.0 million in February (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the February sales rate.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for March. This report is for private payrolls only (no government). The consensus is for 119,000 payroll jobs added in March, up from 77,000 added in February.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 225 initial claims up from 224 thousand last week.

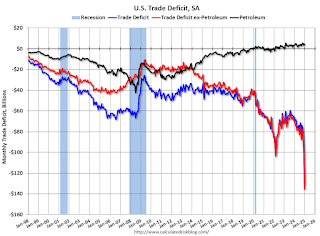

8:30 AM: Trade Balance report for February from the Census Bureau.

8:30 AM: Trade Balance report for February from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is the trade deficit to be $110.0 billion. The U.S. trade deficit was at $131.4 billion in January.

10:00 AM: the ISM Services Index for March.

8:30 AM: Employment Report for March. The consensus is for 135,000 jobs added, and for the unemployment rate to be unchanged at 4.1%.

8:30 AM: Employment Report for March. The consensus is for 135,000 jobs added, and for the unemployment rate to be unchanged at 4.1%.There were 151,000 jobs added in February, and the unemployment rate was at 4.1%.

This graph shows the jobs added per month since January 2021.

11:25 AM: Speech, Fed Chair Jerome Powell, Economic Outlook, At the Society for Advancing Business Editing and Writing (SABEW) Annual Conference, Arlington, Virginia

Friday, March 28, 2025

March 28th COVID Update: COVID Deaths Continue Declining

by Calculated Risk on 3/28/2025 07:15:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Deaths per Week | 602 | 658 | ≤3501 | |

| 1my goals to stop weekly posts. 🚩 Increasing number weekly for Deaths. ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported since Jan 2023.

This appears to be a leading indicator for COVID hospitalizations and deaths. This has generally been moving down.

This appears to be a leading indicator for COVID hospitalizations and deaths. This has generally been moving down.Fannie and Freddie: Single Family Serious Delinquency Rates Unchanged in February; Multi-Family Delinquency Rate Equals Highest Since 2011 (ex-Pandemic)

by Calculated Risk on 3/28/2025 04:38:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Fannie and Freddie: Single Family Serious Delinquency Rates Unchanged in February

Excerpt:

Freddie Mac reported that the Single-Family serious delinquency rate in February was 0.61%, unchanged from 0.61% January. Freddie's rate is up year-over-year from 0.54% in February 2024, however, this is close to the pre-pandemic level of 0.60%.

Some of the recent increase in the 90+ day delinquency rate is probably related to the hurricanes last year.

Freddie's serious delinquency rate peaked in February 2010 at 4.20% following the housing bubble and peaked at 3.17% in August 2020 during the pandemic.

Fannie Mae reported that the Single-Family serious delinquency rate in February was 0.57%, unchanged from 0.57% in January. The serious delinquency rate is up year-over-year from 0.53% in February 2024, however, this is below the pre-pandemic lows of 0.65%.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59% following the housing bubble and peaked at 3.32% in August 2020 during the pandemic.

Q1 GDP Tracking: -0.5% to 1%

by Calculated Risk on 3/28/2025 11:20:00 AM

UPDATE: Updated Goldman tracking this morning.

From BofA:

1Q GDP tracking is down from our recently updated official forecast of 1.5% q/q saar to 1.0% q/q saar. [Mar 28th estimate]From Goldman:

emphasis added

We lowered our Q1 GDP tracking estimate by 0.4pp to +0.6% (quarter-over-quarter annualized). [Mar 28th estimate]

And from the Atlanta Fed: GDPNow

And from the Atlanta Fed: GDPNowThe GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2025 is -2.8 percent on March 28, down from -1.8 percent on March 26. The alternative model forecast, which adjusts for imports and exports of gold as described here, is -0.5 percent. [Mar 28th estimate]

PCE Measure of Shelter Decreases to 4.3% YoY in February

by Calculated Risk on 3/28/2025 08:56:00 AM

Here is a graph of the year-over-year change in shelter from the CPI report and housing from the PCE report this morning, both through February 2025.

Since asking rents are mostly flat year-over-year, these measures will slowly continue to decline over the next year as rents for existing tenants continue to increase.

The second graph shows PCE prices, Core PCE prices and Core ex-housing over the last 3 months (annualized):

The second graph shows PCE prices, Core PCE prices and Core ex-housing over the last 3 months (annualized):Key measures are well above the Fed's target on a 3-month basis. Note: There is possibly some residual seasonality distorting PCE prices in Q1, especially in January.

3-month annualized change:

Core PCE Prices: 3.6%

Core minus Housing: 3.5%

Personal Income increased 0.8% in February; Spending increased 0.4%

by Calculated Risk on 3/28/2025 08:30:00 AM

The BEA released the Personal Income and Outlays report for February:

Personal income increased $194.7 billion (0.8 percent at a monthly rate) in February, according to estimates released today by the U.S. Bureau of Economic Analysis. Disposable personal income (DPI)—personal income less personal current taxes—increased $191.6 billion (0.9 percent) and personal consumption expenditures (PCE) increased $87.8 billion (0.4 percent).The February PCE price index increased 2.5 percent year-over-year (YoY), unchanged from 2.5 percent YoY in January, and down from the recent peak of 7.2 percent in June 2022.

Personal outlays—the sum of PCE, personal interest payments, and personal current transfer payments—increased $118.4 billion in February. Personal saving was $1.02 trillion in February and the personal saving rate—personal saving as a percentage of disposable personal income—was 4.6 percent.

From the preceding month, the PCE price index for February increased 0.3 percent. Excluding food and energy, the PCE price index increased 0.4 percent.

From the same month one year ago, the PCE price index for February increased 2.5 percent. Excluding food and energy, the PCE price index increased 2.8 percent from one year ago.

emphasis added

The following graph shows real Personal Consumption Expenditures (PCE) through February 2025 (2017 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

Personal income was above expectations. PCE was at expectations.

Using the two-month method to estimate Q1 real PCE growth, real PCE was increasing at a 0.9% annual rate in Q1 2024. (Using the mid-month method, real PCE was increasing at 0.2%). This suggests weak PCE growth in Q1.