by Calculated Risk on 3/26/2025 07:00:00 AM

Wednesday, March 26, 2025

MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 2.0 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending March 21, 2025.

The Market Composite Index, a measure of mortgage loan application volume, decreased 2.0 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 2 percent compared with the previous week. The Refinance Index decreased 5 percent from the previous week and was 63 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 1 percent from one week earlier. The unadjusted Purchase Index increased 1 percent compared with the previous week and was 7 percent higher than the same week one year ago.

“Purchase applications saw the strongest weekly pace in almost two months and were 7 percent higher than a year ago. Last week’s purchase activity was driven primarily by a 6 percent increase in FHA applications, as the combination of loosening housing inventory and slowly declining mortgage rates have presented this segment of buyers with more opportunities,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Additionally, VA purchase applications saw a modest increase over the week. Overall applications declined, however, as refinance applications were down 5 percent to its lowest level in a month.”

Added Kan, “Markets remained focused on potential trade policy changes, while the Fed held the funds rate its current level, resulting in the 30-year fixed rate averaging 6.71 percent last week.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($806,500 or less) decreased to 6.71 percent from 6.72 percent, with points decreasing to 0.60 from 0.64 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is up 7% year-over-year unadjusted.

Tuesday, March 25, 2025

Wednesday: Durable Goods

by Calculated Risk on 3/25/2025 07:15:00 PM

Wednesday:

• At 7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Durable Goods Orders for February from the Census Bureau. The consensus is for a 0.7% decrease in durable goods orders.

March Vehicle Forecast: Sales Increase to 16.6 million SAAR, Up 5.9% YoY

by Calculated Risk on 3/25/2025 04:27:00 PM

From WardsAuto: U.S. Light-Vehicle Sales Heading for Long-Time-High Gain in March (pay content). Brief excerpt:

Deliveries appear to have accelerated sharply in the middle of the month, creating momentum that could cause sales to overshoot the forecast. Conversely, overall inventory is relatively lean – and could atypically decline at the end of March from February - so the acceleration could slow before the end of the month after enough stock is pulled from dealer lots.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows actual sales from the BEA (Blue), and Wards forecast for March (Red).

On a seasonally adjusted annual rate basis, the Wards forecast of 16.6 million SAAR, would be up 3.8% from last month, and up 5.9% from a year ago.

Newsletter: New Home Sales Increase to 676,000 Annual Rate in February

by Calculated Risk on 3/25/2025 11:22:00 AM

Today, in the Calculated Risk Real Estate Newsletter: New Home Sales Increase to 676,000 Annual Rate in February

Brief excerpt:

The Census Bureau reported New Home Sales in February were at a seasonally adjusted annual rate (SAAR) of 676 thousand. The previous three months were revised down, combined.There is much more in the article.

...

The next graph shows new home sales for 2024 and 2025 by month (Seasonally Adjusted Annual Rate). Sales in February 2025 were up 5.1% from February 2024.

New home sales, seasonally adjusted, have increased year-over-year in 20 of the last 23 months. This is essentially the opposite of what happened with existing home sales that had been down year-over-year every month for 3+ years (existing home sales have been up year-over-year for the last 4 or the last 5 months).

New Home Sales Increase to 676,000 Annual Rate in February

by Calculated Risk on 3/25/2025 10:00:00 AM

The Census Bureau reports New Home Sales in February were at a seasonally adjusted annual rate (SAAR) of 676 thousand.

The previous three months were revised down, combined.

Sales of new single-family houses in February 2025 were at a seasonally adjusted annual rate of 676,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 1.8 percent above the revised January rate of 664,000 and is 5.1 percent above the February 2024 estimate of 643,000.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

New home sales were slightly below pre-pandemic levels.

The second graph shows New Home Months of Supply.

The months of supply decreased in February to 8.9 months from 9.0 months in January.

The months of supply decreased in February to 8.9 months from 9.0 months in January. The all-time record high was 12.2 months of supply in January 2009. The all-time record low was 3.3 months in August 2020.

This is well above the top of the normal range (about 4 to 6 months of supply is normal).

"The seasonally-adjusted estimate of new houses for sale at the end of February was 500,000. This represents a supply of 8.9 months at the current sales rate."Sales were close to expectations of 680 thousand SAAR, however sales for the three previous months were revised down, combined. I'll have more later today.

Newsletter: Case-Shiller: National House Price Index Up 4.1% year-over-year in January

by Calculated Risk on 3/25/2025 09:41:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Case-Shiller: National House Price Index Up 4.1% year-over-year in January

Excerpt:

S&P/Case-Shiller released the monthly Home Price Indices for January ("January" is a 3-month average of November, December and January closing prices). January closing prices include some contracts signed in September, so there is a significant lag to this data. Here is a graph of the month-over-month (MoM) change in the Case-Shiller National Index Seasonally Adjusted (SA).There is much more in the article.

The MoM increase in the seasonally adjusted (SA) Case-Shiller National Index was at 0.57% (a 7.0% annual rate), This was the 24th consecutive MoM increase in the seasonally adjusted index.

On a seasonally adjusted basis, prices increased month-to-month in 19 of the 20 Case-Shiller cities (prices declined in Tampa seasonally adjusted). San Francisco has fallen 5.1% from the recent peak, Tampa is down 1.5% from the peak, and Denver down 0.7%.

Case-Shiller: National House Price Index Up 4.1% year-over-year in January

by Calculated Risk on 3/25/2025 09:00:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for January ("January" is a 3-month average of November, December and January closing prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

From S&P S&P CoreLogic Case-Shiller Index Records 4.1% Annual Gain in January 2025

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 4.1% annual return for January, up from a 4% annual gain in the previous month. The 10-City Composite saw an annual increase of 5.3%, up from a 5.2% annual increase in the previous month. The 20-City Composite posted a year-over-year increase of 4.7%, up from a 4.5% increase in the previous month. New York again reported the highest annual gain among the 20 cities with a 7.7% increase in January, followed by Chicago and Boston with annual increases of 7.5% and 6.6%, respectively. Tampa posted the lowest return, falling 1.5%.

...

The pre-seasonally adjusted U.S. National and 20-City Composite Indices presented slight upward trends in January, with both posting 0.1% increases. The 10-City Composite posted a monthly return of 0.2%.

After seasonal adjustment, the 20-City and 10-City Composite Indices posted month-over-month increases of 0.5%. The U.S National posted a month-over-month increase of 0.6%.

“Home price growth continued to moderate in January, reflecting a clear two-part story across the past year,” says Nicholas Godec, CFA, CAIA, CIPM, Head of Fixed Income Tradables & Commodities at S&P Dow Jones Indices. “The National Composite Index posted a 4.1% annual gain, with the bulk of appreciation—4.8%—occurring in the first half of the year. Prices declined 0.7% in the second half, as high mortgage rates and affordability constraints weighed on buyer demand and market activity.

“Among the 20 metro areas tracked by the Composite 20, New York City led annual gains with a 7.7% rise, followed closely by Chicago (7.5%) and Boston (6.5%). Tampa was the only market to post a year over-year decline, falling 1.5%. However, the second half of the year told a different story: San Francisco posted the largest six-month decline at 3.4%, followed by Tampa at 3.2%. Only four of the 20 cities managed to eke out price increases during this period—New York, Chicago, Phoenix, and Boston—highlighting broad-based cooling.

“Rising mortgage rates throughout the year elevated monthly payment burdens, which, combined with already high home prices, pushed affordability to multi-decade lows in many regions. This likely contributed to subdued activity in the back half of the year, with both buyers and sellers exercising caution. Inventory constraints also remain a challenge, particularly in legacy metro areas, where limited new construction continues to restrict supply.

“The strength in markets like New York and Chicago may reflect more normalized valuations relative to frothier regions, along with continued urban recovery trends post-pandemic. On the other hand, Sunbelt markets that experienced sharp run-ups earlier in the cycle—like Tampa and Phoenix—have seen the most pronounced slowdowns.

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index was up 0.5% in January (SA). The Composite 20 index was up 0.5% (SA) in January.

The National index was up 0.6% (SA) in January.

The second graph shows the year-over-year change in all three indices.

The second graph shows the year-over-year change in all three indices.The Composite 10 NSA was up 5.3% year-over-year. The Composite 20 NSA was up 4.7% year-over-year.

The National index NSA was up 4.1% year-over-year.

Annual price changes were slightly higher than expectations. I'll have more later.

Monday, March 24, 2025

Tuesday: Case-Shiller House Prices, New Home Sales

by Calculated Risk on 3/24/2025 07:34:00 PM

The average mortgage lender raised rates modestly on Monday morning--a logical move considering the weakness in the bond market over the weekend. Rates are based directly on bonds. Bond "weakness" means investors are paying less for bonds which, in turn, means that yields (aka "rates") are effectively higher.Tuesday:

...

In the bigger picture, all of this analysis is much ado about nothing. Mortgage rates continue a very flat, narrow orbit around 6.75% for top tier conventional 30yr fixed scenarios. A bigger departure from this range will require a bigger shift in several key economic reports (specifically, inflation reports and the big jobs report that typically comes out on the first Friday of the month). [30 year fixed 6.77%]

emphasis added

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for January. The consensus is for a 4.6% year-over-year increase in the 20-city index for January, up from 4.5% YoY in December.

• Also at 9:00 AM, FHFA House Price Index for January. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 10:00 AM, New Home Sales for February from the Census Bureau. The consensus is for 680 thousand SAAR, up from 657 thousand in January.

• Also at 10:00 AM, Richmond Fed Survey of Manufacturing Activity for March.

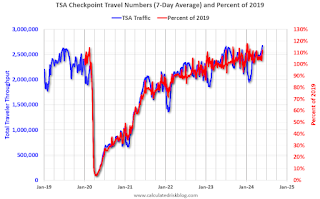

TSA: Airline Travel up 3% YoY

by Calculated Risk on 3/24/2025 02:51:00 PM

This is something to watch with less international travel.

This data is as of March 23, 2025.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA (Blue).

The red line is the percent of 2019 for the seven-day average. Air travel - as a percent of 2019 - is up about 9% from pre-pandemic levels.

Policy and 2025 Housing Outlook

by Calculated Risk on 3/24/2025 11:18:00 AM

Today, in the CalculatedRisk Real Estate Newsletter: Policy and 2025 Housing Outlook

Excerpt:

I started the year taking Fed Chair Jerome Powell’s approach to the impact of policy: I’d wait to see what was implemented before changing my outlook.

Now we know a little more. Although there is still significant uncertainty, it appears that tariffs will stay (and likely increase in early April). Deportations will likely pickup. And net legal immigration will slow sharply.

...

Altos Research put out an updated inventory projection last week showing that inventory might end the year at 2019 levels!

If inventory is close to 2019 levels by the end of 2025, and sales remain sluggish, months-of-supply will move up sharply. Sales could pick up if mortgage rates decline, however, if the decline is related to a weaker economy, the increase in unemployment might outweigh any boost from lower mortgage rates.

Note: The pickup in existing home sales in February surprised many analysts (but not readers of this newsletter!). The sales increase in February doesn’t mean sales are recovering, just that analysts underestimated the seasonal adjustment for February, especially this year since there was one fewer working day in February 2025 compared to February 2024. In fact, sales were down YoY.