by Calculated Risk on 3/24/2025 08:11:00 AM

Monday, March 24, 2025

Housing March 24th Weekly Update: Inventory up 1.9% Week-over-week, Up 30.3% Year-over-year

Click on graph for larger image.

Click on graph for larger image. This second inventory graph is courtesy of Altos Research.

This second inventory graph is courtesy of Altos Research.Sunday, March 23, 2025

Sunday Night Futures

by Calculated Risk on 3/23/2025 06:51:00 PM

Weekend:

• Schedule for Week of March 23, 2025

Monday:

• At 8:30 AM ET, Chicago Fed National Activity Index for February. This is a composite index of other data.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 25 and DOW futures are up 160 (fair value).

Oil prices were up over the last week with WTI futures at $68.28 per barrel and Brent at $72.16 per barrel. A year ago, WTI was at $81, and Brent was at $85 - so WTI oil prices are down about 15% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.10 per gallon. A year ago, prices were at $3.50 per gallon, so gasoline prices are down $0.40 year-over-year.

The Normal Seasonal Pattern for Median House Prices

by Calculated Risk on 3/23/2025 10:05:00 AM

Last week, in the CalculatedRisk Real Estate Newsletter on March existing home sales, NAR: Existing-Home Sales Increased to 4.26 million SAAR in February; Down 1.2% YoY, I noted:

On a month-over-month basis, median prices increased 1.3% from January and are now down 6.7% from the June 2024 peak. This is about the normal seasonal increase in the median price. Typically, the NAR median price increases in the Spring, and tends to peak seasonally in the June report.Seasonally, median prices typically peak in June (closed sales are mostly for contracts signed in April and May).

And seasonally, prices usually bottom the following January (contracts signed in November and December).

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|---|---|---|

| Jan to Feb | 0.0% | 0.3% | 1.5% | 2.3% | 2.7% | 0.8% | 1.4% | 1.3% |

| Jan to Jun | 13.7% | 14.4% | 10.6% | 20.8% | 16.8% | 13.7% | 12.8% | NA |

| Jun to Jan | -8.9% | -6.7% | 3.1% | -3.4% | -12.8% | -7.7% | -7.8% | NA |

The 2025 increase in median prices from January to February was about the normal seasonal increase.

Saturday, March 22, 2025

Real Estate Newsletter Articles this Week: Existing-Home Sales Increased to 4.26 million SAAR

by Calculated Risk on 3/22/2025 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• NAR: Existing-Home Sales Increased to 4.26 million SAAR in February; Down 1.2% YoY

• Housing Starts Increased to 1.501 million Annual Rate in February

• Lennar: "Didn't see typical seasonal pickup after February"

• Lawler: Early Read on Existing Home Sales in February

• California Home Sales Up 2.6% YoY in February; 4th Look at Local Housing Markets

• 3rd Look at Local Housing Markets in February

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

Schedule for Week of March 23, 2025

by Calculated Risk on 3/22/2025 08:11:00 AM

The key reports scheduled for this week include February New Home sales, the 3rd estimate of Q4 GDP, February Personal Income & Outlays, and January Case-Shiller house prices.

For manufacturing, the March Richmond and Kansas City Fed surveys will be released.

8:30 AM ET: Chicago Fed National Activity Index for February. This is a composite index of other data.

9:00 AM: S&P/Case-Shiller House Price Index for January.

9:00 AM: S&P/Case-Shiller House Price Index for January.This graph shows the year-over-year change for the Case-Shiller National, Composite 10 and Composite 20 indexes, through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 4.6% year-over-year increase in the 20-city index for January, up from 4.5% YoY in December.

9:00 AM: FHFA House Price Index for January. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM: New Home Sales for February from the Census Bureau.

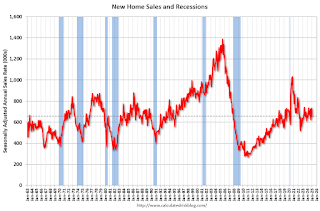

10:00 AM: New Home Sales for February from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 680 thousand SAAR, up from 657 thousand in January.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for March.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Durable Goods Orders for February from the Census Bureau. The consensus is for a 0.7% decrease in durable goods orders.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 225 initial claims up from 223 thousand last week.

8:30 AM, Gross Domestic Product, 4th Quarter and Year 2024 (Third Estimate), GDP by Industry, and Corporate Profits. The consensus is that real GDP increased 2.3% annualized in Q4, unchanged from 2.3% in the second estimate.

10:00 AM: Pending Home Sales Index for February.

11:00 AM: the Kansas City Fed manufacturing survey for March.

8:30 AM: Personal Income and Outlays for February. The consensus is for a 0.4% increase in personal income, and for a 0.6% increase in personal spending. And for the Core PCE price index to increase 0.3%. PCE prices are expected to be up 2.5% YoY, and core PCE prices up 2.7% YoY.

10:00 AM: University of Michigan's Consumer sentiment index (Final for March). The consensus is for a reading of 57.9.

10:00 AM: State Employment and Unemployment (Monthly) for February 2025

Friday, March 21, 2025

March 21st COVID Update: COVID Deaths Continue Declining

by Calculated Risk on 3/21/2025 07:28:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Deaths per Week | 635 | 692 | ≤3501 | |

| 1my goals to stop weekly posts. 🚩 Increasing number weekly for Deaths. ✅ Goal met. | ||||

Click on graph for larger image.

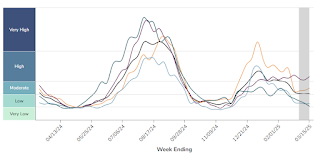

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported since Jan 2023.

This appears to be a leading indicator for COVID hospitalizations and deaths. This has mostly moved sideways nationally over the last several weeks. This measure has ticked up in the South and Midwest regions.

This appears to be a leading indicator for COVID hospitalizations and deaths. This has mostly moved sideways nationally over the last several weeks. This measure has ticked up in the South and Midwest regions.Lennar: "Didn't see typical seasonal pickup after February"

by Calculated Risk on 3/21/2025 02:31:00 PM

Today, in the CalculatedRisk Real Estate Newsletter: Lennar: "Didn't see typical seasonal pickup after February"

Full text:

This is a short note …

The Lennar headline is from a comment this morning. This is just one anecdote, but I believe the housing market will be impacted by policy.

I started the year taking Fed Chair Jerome Powell’s approach to the impact of policy: I’d wait to see what was implemented before changing my outlook. Here is my outlook at the start of 2025:

How much will Residential investment change in 2025? How about housing starts and new home sales in 2025?

What will happen with house prices in 2025?

Will inventory increase further in 2025?

Next week I’ll update my outlook for housing starts, home sales, house prices and more based on the policy changes.

Hotels: Occupancy Rate Decreased 3.5% Year-over-year

by Calculated Risk on 3/21/2025 01:07:00 PM

From the WaPo: Nervous about Trump, international tourists scrap their U.S. travel plans

International travel to the United States is expected to slide by 5 percent this year, contributing to a $64 billion shortfall for the travel industry, according to Tourism Economics. The research firm had originally forecast a 9 percent increase in foreign travel, but revised its estimate late last month to reflect “polarizing Trump Administration policies and rhetoric.”

“There’s been a dramatic shift in our outlook,” said Adam Sacks, president of Tourism Economics. “You’re looking at a much weaker economic engine than what otherwise would’ve been, not just because of tariffs, but the rhetoric and condescending tone around it.”

1) Canada 31% in 2023

2) Mexico 22% in 2023

3) UK 6% in 2023

This could impact hotel occupancy in the U.S.

The U.S. hotel industry reported negative year-over-year comparisons, according to CoStar’s latest data through 15 March. ...The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

9-15 March 2025 (percentage change from comparable week in 2024):

• Occupancy: 64.2% (-3.5%)

• Average daily rate (ADR): US$162.49 (-0.7%)

• Revenue per available room (RevPAR): US$104.36 (-4.2%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2025, blue is the median, and dashed light blue is for 2024. Dashed purple is for 2018, the record year for hotel occupancy.

Q1 GDP Tracking: Wide Range

by Calculated Risk on 3/21/2025 10:15:00 AM

NOTE: An update to the gold adjusted GDPNow will be released on March 26th. Based on the previous adjustment, it appears GDPNow (adjusted) is slightly positive for Q1. (For more on the gold adjustment, see For GDP Forecasters, Some Gold Doesn't Glitter

From BofA:

Our 1Q GDP tracking remains unchanged at 1.9% q/q saar and our 4Q GDP tracking also remained at 2.3% q/q saar since our last weekly publication. [Mar 21st estimate]From Goldman:

emphasis added

We left our Q1 GDP tracking and domestic final sales estimates unchanged at +1.3% (quarter-over-quarter annualized) and +2.0%, respectively. [Mar 20th estimate]

And from the Atlanta Fed: GDPNow

And from the Atlanta Fed: GDPNowThe GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2025 is -1.8 percent on March 18, up from -2.1 percent on March 17. After this morning’s releases from the US Census Bureau, the US Bureau of Labor Statistics, and the Federal Reserve Board of Governors, the nowcast for first-quarter real gross private domestic investment growth increased from 7.2 percent to 9.1 percent. Due to FOMC blackout policy, today’s post does not include an update of the version of the model described here that adjusts the standard GDPNow model forecast for foreign trade in gold. That adjusted model will again be updated after our first scheduled post-blackout update on March 26. [Mar 18th estimate]

Intercontinental Exchange: Mortgage Delinquency Rate Increased in February

by Calculated Risk on 3/21/2025 08:11:00 AM

• The national delinquency rate edged up 5 basis points (bps) to 3.53% in February; that’s up 19 bps from a year ago but still 32 bps below where it was entering the pandemic

• FHA mortgages accounted for 90% of the 131K rise in the number of delinquencies, despite making up less than 15% of all active mortgages

• 4,100 homeowners in Los Angeles are now past due as a result of the wildfires, up from 700 in January, with daily performance data suggesting that number could edge higher in March

• Foreclosure starts (-17%) and sales (-11%) eased in February, but are up (+34%/+7%) from the same time last year as VA foreclosure activity resumed after a year-long moratorium

• Prepayment activity (SMM) fell to 0.46% in February, the lowest level in a year, on higher rates and a seasonal dip in home sales

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a table from ICE.