by Calculated Risk on 3/22/2025 02:11:00 PM

Saturday, March 22, 2025

Real Estate Newsletter Articles this Week: Existing-Home Sales Increased to 4.26 million SAAR

At the Calculated Risk Real Estate Newsletter this week:

• NAR: Existing-Home Sales Increased to 4.26 million SAAR in February; Down 1.2% YoY

• Housing Starts Increased to 1.501 million Annual Rate in February

• Lennar: "Didn't see typical seasonal pickup after February"

• Lawler: Early Read on Existing Home Sales in February

• California Home Sales Up 2.6% YoY in February; 4th Look at Local Housing Markets

• 3rd Look at Local Housing Markets in February

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

Schedule for Week of March 23, 2025

by Calculated Risk on 3/22/2025 08:11:00 AM

The key reports scheduled for this week include February New Home sales, the 3rd estimate of Q4 GDP, February Personal Income & Outlays, and January Case-Shiller house prices.

For manufacturing, the March Richmond and Kansas City Fed surveys will be released.

8:30 AM ET: Chicago Fed National Activity Index for February. This is a composite index of other data.

9:00 AM: S&P/Case-Shiller House Price Index for January.

9:00 AM: S&P/Case-Shiller House Price Index for January.This graph shows the year-over-year change for the Case-Shiller National, Composite 10 and Composite 20 indexes, through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 4.6% year-over-year increase in the 20-city index for January, up from 4.5% YoY in December.

9:00 AM: FHFA House Price Index for January. This was originally a GSE only repeat sales, however there is also an expanded index.

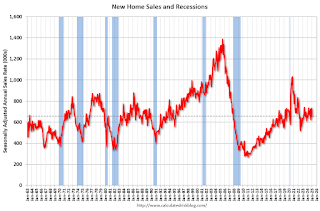

10:00 AM: New Home Sales for February from the Census Bureau.

10:00 AM: New Home Sales for February from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 680 thousand SAAR, up from 657 thousand in January.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for March.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Durable Goods Orders for February from the Census Bureau. The consensus is for a 0.7% decrease in durable goods orders.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 225 initial claims up from 223 thousand last week.

8:30 AM, Gross Domestic Product, 4th Quarter and Year 2024 (Third Estimate), GDP by Industry, and Corporate Profits. The consensus is that real GDP increased 2.3% annualized in Q4, unchanged from 2.3% in the second estimate.

10:00 AM: Pending Home Sales Index for February.

11:00 AM: the Kansas City Fed manufacturing survey for March.

8:30 AM: Personal Income and Outlays for February. The consensus is for a 0.4% increase in personal income, and for a 0.6% increase in personal spending. And for the Core PCE price index to increase 0.3%. PCE prices are expected to be up 2.5% YoY, and core PCE prices up 2.7% YoY.

10:00 AM: University of Michigan's Consumer sentiment index (Final for March). The consensus is for a reading of 57.9.

10:00 AM: State Employment and Unemployment (Monthly) for February 2025

Friday, March 21, 2025

March 21st COVID Update: COVID Deaths Continue Declining

by Calculated Risk on 3/21/2025 07:28:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Deaths per Week | 635 | 692 | ≤3501 | |

| 1my goals to stop weekly posts. 🚩 Increasing number weekly for Deaths. ✅ Goal met. | ||||

Click on graph for larger image.

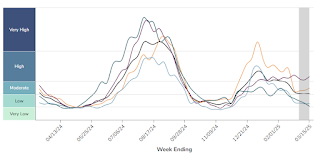

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported since Jan 2023.

This appears to be a leading indicator for COVID hospitalizations and deaths. This has mostly moved sideways nationally over the last several weeks. This measure has ticked up in the South and Midwest regions.

This appears to be a leading indicator for COVID hospitalizations and deaths. This has mostly moved sideways nationally over the last several weeks. This measure has ticked up in the South and Midwest regions.Lennar: "Didn't see typical seasonal pickup after February"

by Calculated Risk on 3/21/2025 02:31:00 PM

Today, in the CalculatedRisk Real Estate Newsletter: Lennar: "Didn't see typical seasonal pickup after February"

Full text:

This is a short note …

The Lennar headline is from a comment this morning. This is just one anecdote, but I believe the housing market will be impacted by policy.

I started the year taking Fed Chair Jerome Powell’s approach to the impact of policy: I’d wait to see what was implemented before changing my outlook. Here is my outlook at the start of 2025:

How much will Residential investment change in 2025? How about housing starts and new home sales in 2025?

What will happen with house prices in 2025?

Will inventory increase further in 2025?

Next week I’ll update my outlook for housing starts, home sales, house prices and more based on the policy changes.

Hotels: Occupancy Rate Decreased 3.5% Year-over-year

by Calculated Risk on 3/21/2025 01:07:00 PM

From the WaPo: Nervous about Trump, international tourists scrap their U.S. travel plans

International travel to the United States is expected to slide by 5 percent this year, contributing to a $64 billion shortfall for the travel industry, according to Tourism Economics. The research firm had originally forecast a 9 percent increase in foreign travel, but revised its estimate late last month to reflect “polarizing Trump Administration policies and rhetoric.”

“There’s been a dramatic shift in our outlook,” said Adam Sacks, president of Tourism Economics. “You’re looking at a much weaker economic engine than what otherwise would’ve been, not just because of tariffs, but the rhetoric and condescending tone around it.”

1) Canada 31% in 2023

2) Mexico 22% in 2023

3) UK 6% in 2023

This could impact hotel occupancy in the U.S.

The U.S. hotel industry reported negative year-over-year comparisons, according to CoStar’s latest data through 15 March. ...The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

9-15 March 2025 (percentage change from comparable week in 2024):

• Occupancy: 64.2% (-3.5%)

• Average daily rate (ADR): US$162.49 (-0.7%)

• Revenue per available room (RevPAR): US$104.36 (-4.2%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2025, blue is the median, and dashed light blue is for 2024. Dashed purple is for 2018, the record year for hotel occupancy.

Q1 GDP Tracking: Wide Range

by Calculated Risk on 3/21/2025 10:15:00 AM

NOTE: An update to the gold adjusted GDPNow will be released on March 26th. Based on the previous adjustment, it appears GDPNow (adjusted) is slightly positive for Q1. (For more on the gold adjustment, see For GDP Forecasters, Some Gold Doesn't Glitter

From BofA:

Our 1Q GDP tracking remains unchanged at 1.9% q/q saar and our 4Q GDP tracking also remained at 2.3% q/q saar since our last weekly publication. [Mar 21st estimate]From Goldman:

emphasis added

We left our Q1 GDP tracking and domestic final sales estimates unchanged at +1.3% (quarter-over-quarter annualized) and +2.0%, respectively. [Mar 20th estimate]

And from the Atlanta Fed: GDPNow

And from the Atlanta Fed: GDPNowThe GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2025 is -1.8 percent on March 18, up from -2.1 percent on March 17. After this morning’s releases from the US Census Bureau, the US Bureau of Labor Statistics, and the Federal Reserve Board of Governors, the nowcast for first-quarter real gross private domestic investment growth increased from 7.2 percent to 9.1 percent. Due to FOMC blackout policy, today’s post does not include an update of the version of the model described here that adjusts the standard GDPNow model forecast for foreign trade in gold. That adjusted model will again be updated after our first scheduled post-blackout update on March 26. [Mar 18th estimate]

Intercontinental Exchange: Mortgage Delinquency Rate Increased in February

by Calculated Risk on 3/21/2025 08:11:00 AM

• The national delinquency rate edged up 5 basis points (bps) to 3.53% in February; that’s up 19 bps from a year ago but still 32 bps below where it was entering the pandemic

• FHA mortgages accounted for 90% of the 131K rise in the number of delinquencies, despite making up less than 15% of all active mortgages

• 4,100 homeowners in Los Angeles are now past due as a result of the wildfires, up from 700 in January, with daily performance data suggesting that number could edge higher in March

• Foreclosure starts (-17%) and sales (-11%) eased in February, but are up (+34%/+7%) from the same time last year as VA foreclosure activity resumed after a year-long moratorium

• Prepayment activity (SMM) fell to 0.46% in February, the lowest level in a year, on higher rates and a seasonal dip in home sales

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a table from ICE.

Thursday, March 20, 2025

Realtor.com Reports Active Inventory Up 28.5% YoY

by Calculated Risk on 3/20/2025 01:47:00 PM

What this means: On a weekly basis, Realtor.com reports the year-over-year change in active inventory and new listings. On a monthly basis, they report total inventory. For February, Realtor.com reported inventory was up 27.5% YoY, but still down 22.9% compared to the 2017 to 2019 same month levels.

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report: Weekly Housing Trends View—Data for Week Ending March 15, 2025

• Active inventory increased, with for-sale homes 28.5% above year-ago levels

The number of homes for sale has now been higher than the previous year for 71 consecutive weeks. This continued rise in active inventory is in part due to less active buyers. With more choices available, buyers can afford to be more selective, putting pressure on sellers to price competitively.

• New listings—a measure of sellers putting homes up for sale—increased 10.4%

Newly listed inventory grew for the 10th consecutive week, signaling that sellers are gaining confidence in listing their homes despite persistently high mortgage rates. This week’s annual growth picked up compared with last week.

• The median list price was flat year over year

This marks the 42nd consecutive week that the national median home list price has either remained steady or declined compared with the same week last year. Importantly, the annual difference narrowed for the third consecutive week and prices measured flat year over year for the first time since last fall. Controlling for the size of the home, the median list price per square foot increased by 1.3% annually, suggesting there are more smaller homes on the market compared with last year. The share of homes with a price reduction increased by 0.8% this week, pointing to more seller adjustments in light of growing inventory and a slowing market pace.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory was up year-over-year for the 71st consecutive week.

Newsletter: NAR: Existing-Home Sales Increased to 4.26 million SAAR in February

by Calculated Risk on 3/20/2025 10:51:00 AM

Today, in the CalculatedRisk Real Estate Newsletter: NAR: Existing-Home Sales Increased to 4.26 million SAAR in February; Down 1.2% YoY

Excerpt:

Sales in February (4.26 million SAAR) were up 4.2% from the previous month and were 1.2% below the February 2024 sales rate. This breaks the streak of fourth consecutive year-over-year increases in sales.There is much more in the article.

...

Sales Year-over-Year and Not Seasonally Adjusted (NSA)

The fourth graph shows existing home sales by month for 2024 and 2025.

Sales decreased 1.2% year-over-year compared to February 2024.

NAR: Existing-Home Sales Increased to 4.26 million SAAR in February; Down 1.2% YoY

by Calculated Risk on 3/20/2025 10:00:00 AM

From the NAR: Existing-Home Sales Accelerated 4.2% in February

Existing-home sales ascended in February, according to the National Association of REALTORS®. For both monthly and year-over-year sales, two major U.S. regions experienced growth, one region remained stable and the other registered a decline.

Total existing-home sales – completed transactions that include single-family homes, townhomes, condominiums and co-ops – progressed 4.2% from January to a seasonally adjusted annual rate of 4.26 million in February. Year-over-year, sales slid 1.2% (down from 4.31 million in February 2024).

...

Total housing inventory registered at the end of February was 1.24 million units, up 5.1% from January and 17% from one year ago (1.06 million). Unsold inventory sits at a 3.5-month supply at the current sales pace, identical to January and up from 3.0 months in February 2024.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1994.

Sales in February (4.26 million SAAR) were up 4.2% from the previous month and were 1.2% below the February 2024 sales rate. This breaks the streak of fourth consecutive year-over-year increases in sales.

According to the NAR, inventory increased to 1.24 million in February from 1.18 million the previous month.

According to the NAR, inventory increased to 1.24 million in February from 1.18 million the previous month.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was up 17.0% year-over-year (blue) in February compared to February 2024.

Inventory was up 17.0% year-over-year (blue) in February compared to February 2024. Months of supply (red) was unchanged at 3.5 months in February from 3.5 months the previous month.

As expected, the sales rate was above the consensus forecast. I'll have more later.