by Calculated Risk on 3/05/2025 07:00:00 AM

Wednesday, March 05, 2025

MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 20.4 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending February 28, 2025.

The Market Composite Index, a measure of mortgage loan application volume, increased 20.4 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index increased 22 percent compared with the previous week. The Refinance Index increased 37 percent from the previous week and was 83 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 9 percent from one week earlier. The unadjusted Purchase Index increased 12 percent compared with the previous week and was 2 percent higher than the same week one year ago.

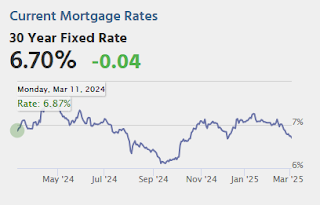

“Mortgage rates declined last week on souring consumer sentiment regarding the economy and increasing uncertainty over the impact of new tariffs levied on imported goods into the U.S. Those factors resulted in the largest weekly decline in the 30-year fixed rate since November 2024. At 6.73 percent, the rate is now at its lowest level since December 2024,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Additionally, the FHA rate dipped to 6.42 percent. Refinance activity was at its fastest pace since October 2024, as conventional refinance applications rose 34 percent and government refinance applications increased by 42 percent over the week. The move in government refinances was driven by a 75 percent increase in VA loans, which have been prone to large changes in recent months.”

Added Kan, “This is a period where we typically see purchase activity ramp up and purchase applications were up over the week and continued to run ahead of last year’s pace, more green shoots as we head into the spring homebuying season."

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($806,500 or less) decreased to 6.73 percent from 6.88 percent, with points decreasing to 0.60 from 0.61 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is up 2% year-over-year unadjusted.

Tuesday, March 04, 2025

Wednesday: ADP Employment, ISM Services, Beige Book

by Calculated Risk on 3/04/2025 07:18:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for February. This report is for private payrolls only (no government). The consensus is for 140,000 payroll jobs added in February, down from 183,000 added in January.

• At 10:00 AM, the ISM Services Index for February.

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

Update: Lumber Prices Up 7% YoY

by Calculated Risk on 3/04/2025 02:49:00 PM

This is something to watch again. Here is another monthly update on lumber prices.

SPECIAL NOTE: The CME group discontinued the Random Length Lumber Futures contract on May 16, 2023. I switched to a physically-delivered Lumber Futures contract that was started in August 2022. Unfortunately, this impacts long term price comparisons since the new contract was priced about 24% higher than the old random length contract for the period when both contracts were available.

This graph shows CME random length framing futures through August 2022 (blue), and the new physically-delivered Lumber Futures (LBR) contract starting in August 2022 (Red).

Heavy Truck Sales Decreased 9% YoY in February

by Calculated Risk on 3/04/2025 12:57:00 PM

This graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is the February 2025 seasonally adjusted annual sales rate (SAAR) of 460 thousand.

Heavy truck sales really collapsed during the great recession, falling to a low of 180 thousand SAAR in May 2009. Then heavy truck sales increased to a new record high of 570 thousand SAAR in April 2019.

Note: "Heavy trucks - trucks more than 14,000 pounds gross vehicle weight."

Heavy truck sales declined sharply at the beginning of the pandemic, falling to a low of 288 thousand SAAR in May 2020.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

The second graph shows light vehicle sales since the BEA started keeping data in 1967. Fannie and Freddie: Single Family Serious Delinquency Rates Increased in January; Fannie Mae Multi-Family Delinquency Rate Highest Since 2011 (ex-Pandemic)

by Calculated Risk on 3/04/2025 09:38:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Fannie and Freddie: Single Family Serious Delinquency Rates Increased in January

Excerpt:

Freddie Mac reported that the Single-Family serious delinquency rate in January was 0.61%, up from 0.59% December. Freddie's rate is up year-over-year from 0.55% in January 2024, however, this is close to the pre-pandemic level of 0.60%.

Some of the recent increase in the 90+ day delinquency rate is probably related to the hurricanes last year.

Freddie's serious delinquency rate peaked in February 2010 at 4.20% following the housing bubble and peaked at 3.17% in August 2020 during the pandemic.

Fannie Mae reported that the Single-Family serious delinquency rate in January was 0.57%, up from 0.56% in December. The serious delinquency rate is up year-over-year from 0.54% in January 2024, however, this is below the pre-pandemic lows of 0.65%.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59% following the housing bubble and peaked at 3.32% in August 2020 during the pandemic.

Lawler: Federal Reserve Earnings Still Running Negative; No Remittances to Treasury for a While

by Calculated Risk on 3/04/2025 08:28:00 AM

From housing economist Tom Lawler: Federal Reserve Earnings Still Running Negative; No Remittances to Treasury for a While

The sharp runup in short-term interest rates over the last few years that followed the Federal Reserve’s huge purchases of long-term Treasuries and MBS at extremely low interest rates has resulted in negative earnings at the Federal Reserve since the latter part of 2022. The reason, of course, is that the Federal Reserve “funded” the bulk of these long-term fixed rate assets with increases in interest-bearing very short-term liabilities – mainly depository institution deposits (reserves) and repos --with interest rates tied to the federal funds rate. While the Fed has more interest earning assets than interest-bearing liabilities – with the “gap” mainly reflecting Federal Reserve Notes outstanding (currency) and Treasury general account deposits – the sharp increase the federal funds rate resulted in interest expense surging relative to the interest income on the Fed’s long duration assets.

Below is a table showing Federal Reserve net income – the vast bulk of which reflects net interest income – from 2008 to 2024 (2024 is my estimate), as well as Fed remittances to the Treasury as shown in the Fed’s financials (more on this later).

At first glance one might think that this table suggests the Treasury remitted almost $200 billion to the Federal Reserve over the last two years. That is not, however, the case. If the Federal Reserve books a net loss, then it “books” a negative remittance to the Treasury but it also “books” an increase in its “deferred asset – remittance to Treasury.” This deferred asset reflects the fact that the Treasury does not in fact remit any funds to the Fed when the Fed books a loss. Rather, the deferred asset balance reflects the amount of positive net income the Fed would earn in the future without remitting any funds to the Treasury. For example, if this deferred asset balance were $200 billion and over the next four years the Fed’s net income totaled $200 billion, then the Fed would not remit any funds to the Treasury over those four years.

Weekly data on this deferred asset balance is from the Fed’s H4.1 release, and is available in the FRED database. Here is a chart from 9/7/22 to 2/26/25.

Trying to predict Fed net income over the next year of two depends very heavily on projections of the federal funds rate, and depends somewhat on the pace of balance sheet reduction and the Fed’s reinvestment strategy. However, it is highly likely that the Fed will not be remitting any funds to Treasury anytime soon.

Chart of the Day: When Will Quantitative Tightening Begin?

Monday, March 03, 2025

Tuesday: Tariffs!

by Calculated Risk on 3/03/2025 07:41:00 PM

Mortgage rates faced a very small threat of a very small increase this morning. The underlying bond market was in weaker territory to start the day and that typically means mortgage lenders raise rates. Indeed, many lenders were slightly higher at first.Tuesday:

But just as the first lenders were publishing rates for the day, the ISM Manufacturing Index (an important economic report that often causes a reaction in bonds) was released. The results were good for bonds, thus allowing mortgage lenders to set rates in line with Friday's latest levels, on average.... [30 year fixed 6.74%]

emphasis added

• No major economic releases scheduled.

Vehicles Sales Increase to 16.00 million SAAR in February

by Calculated Risk on 3/03/2025 06:18:00 PM

Wards Auto released their estimate of light vehicle sales for January: Despite Affordability Headwind, U.S. Light-Vehicle Sales Rise 3.4% in February (pay site).

Continuing January’s trend, market strength was at the two far ends of the affordability scale, as entry-price cars and lower-cost CUVs posted big gains, while the same was true in most premium-price segments. The range of vehicles generally thought of as the bread-and-butter of the market, non-luxury compact and midsize cars, CUVs and SUVs, all recorded big declines. However, even when including lower-price vehicles, sales of non-luxury sedans and compact/midsize CUVs and SUVs were down 3.8% in January-February, which really is indicating a continued affordability issue – at least compared with pre-2020 (pandemic) history.

Click on graph for larger image.

Click on graph for larger image.This graph shows light vehicle sales since 2006 from the BEA (blue) and Wards' estimate for February (red).

Sales in February were slightly above the consensus forecast.

A Comment on GDPNow

by Calculated Risk on 3/03/2025 01:59:00 PM

On Friday, I noted: Q1 GDP Tracking: Wide Range, GDPNow Goes Negative

GDPNow from the Atlanta Fed went strongly negative in the most recent reading: "The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2025 is -1.5 percent on February 28".

GDPNow is an excellent tracking model, however, the January surge in imports - especially for gold - caused the model to move negative. As the Atlanta Fed noted: "the contribution of net exports to first-quarter real GDP growth fell from -0.41 percentage points to -3.70 percentage points".

Usually there would be an offsetting increase in inventories, but that is a lagging indicator. This is a short-term distortion and will balance out over the next month or so. I don't expect negative GDP in Q1.

Final Look at Local Housing Markets in January and a Look Ahead to February Sales

by Calculated Risk on 3/03/2025 11:10:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Final Look at Local Housing Markets in January and a Look Ahead to February Sales

A brief excerpt:

After the National Association of Realtors® (NAR) releases the monthly existing home sales report, I pick up additional local market data that is reported after the NAR. This is the final look at local markets in January.There is much more in the article.

The big story for January was that existing home sales increased year-over-year (YoY) for the fourth consecutive month following year-over-year declines every month since July 2021. However, sales in January, at 4.08 million on a seasonally adjusted annual rate basis (SAAR) were down from December and still historically low. Sales averaged almost 5.5 million SAAR in the January 2017-2020 period. So, sales were still about 25% below pre-pandemic levels.

...

Here is a look at months-of-supply using NSA sales. Since this is NSA data, it is likely this is close to the seasonal low for months-of-supply.

Miami is off the charts!

...

More local data coming in March for activity in February!