by Calculated Risk on 2/25/2025 09:00:00 AM

Tuesday, February 25, 2025

Case-Shiller: National House Price Index Up 3.9% year-over-year in December

S&P/Case-Shiller released the monthly Home Price Indices for December ("December" is a 3-month average of October, November and December closing prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

From S&P S&P CoreLogic Case-Shiller Index Records 3.9% Annual Gain in December 2024

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 3.9% annual return for December, up from a 3.7% annual gain in the previous month. The 10-City Composite saw an annual increase of 5.1%, up from a 5% annual increase in the previous month. The 20-City Composite posted a year-over-year increase of 4.5%, up from a 4.3% increase in the previous month. New York again reported the highest annual gain among the 20 cities with a 7.2% increase in December, followed by Chicago and Boston with annual increases of 6.6% and 6.3%, respectively. Tampa posted the lowest return, falling 1.1%.

...

The pre-seasonally adjusted U.S. National and 20-City Composite Indices’ upward trends continued to reverse in December, with both posting a -0.1% drop. The 10-City Composite’s monthly return dropped 0.04%.

After seasonal adjustment, the U.S. National, 20-City, and 10-City Composite Indices all posted a month-over-month increase of 0.5%.

“It has been five years since the Covid-19 outbreak took hold of the global economy, sparking unprecedented volatility, massive fiscal and monetary stimulus, and a housing market that responded to national migratory changes in how we work and where we live,” says Brian D. Luke, CFA, Head of Commodities, Real & Digital Assets at S&P Dow Jones Indices. “National home prices have risen by 8.8% annually since 2020, led by markets in Florida, North Carolina, Southern California, and Arizona. While our National Index continues to trend above inflation, we are a few years removed from peak home price appreciation of 18.9% observed in 2021 and are seeing below-trend growth over the history of the index.

“Home prices stalled during the second half of the year with markets in the West dropping the fastest. San Francisco, the worst performing market since 2020, dropped 4.5% during the last six months of the year, followed by Seattle with a 3.0% decline. San Francisco is now 11.0% lower than its post-pandemic peak reached in May 2022. Previous strongholds like San Diego and Tampa experienced declines of 2.9% and 2.7%, respectively, during the second half of the year. After accounting for seasonal adjustments, our National Index pushed forward to achieve a 19th consecutive all-time high,” Luke continued. “The longest such streak occurred for over 12-years, notching 153 consecutive all-time highs from July 1993 to March 2006.

“The Northeast continues to lead all regions with above-trend growth, led by New York for the eighth consecutive time. Boston reached an all-time high, the only market to do so for the period ended December 2024."

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index was up 0.5% in December (SA). The Composite 20 index was up 0.5% (SA) in December.

The National index was up 0.5% (SA) in December.

The second graph shows the year-over-year change in all three indices.

The second graph shows the year-over-year change in all three indices.The Composite 10 NSA was up 5.1% year-over-year. The Composite 20 NSA was up 4.5% year-over-year.

The National index NSA was up 3.9% year-over-year.

Annual price changes were close to expectations. I'll have more later.

Monday, February 24, 2025

Tuesday: Case-Shiller House Prices, Richmond Fed Mfg

by Calculated Risk on 2/24/2025 07:06:00 PM

Mortgage rates were already in line with the lowest levels since December 18th by last Thursday. They dropped to the best levels since December 12th a day later. end of last week.Tuesday:

...

The bond market (which underlies and dictates interest rate movement) was very calm today after early gains. Investors are waiting to see Friday's PCE inflation data before making any big moves in either direction ... [30 year fixed 6.87%]

emphasis added

• At 9:00 AM ET, FHFA House Price Index for December 2024. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 9:00 AM, S&P/Case-Shiller House Price Index for December. The consensus is for a 4.5% year-over-year increase in the Comp 20 index for December, up from 4.3% in November.

• At 10:00 AM, Richmond Fed Survey of Manufacturing Activity for February.

February Vehicle Forecast: Sales Increase to 15.9 million SAAR, Up 1.5% YoY

by Calculated Risk on 2/24/2025 12:56:00 PM

From WardsAuto: February U.S. Light-Vehicle Sales Maintain Growth; Inventory Resumes Gains (pay content). Brief excerpt:

Sales are recording solid gains, but production slowdowns capping dealer stock in a growth market – a market that ostensibly still is climbing out of the trough caused by the pandemic and supply-chain issues - suggest the industry overall wants to maintain profit margins but also has a high level of uncertainty about 2025 and does not want to be in a position of having to make sudden, bigger cuts if the market weakens at some point this year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows actual sales from the BEA (Blue), and Wards forecast for February (Red).

On a seasonally adjusted annual rate basis, the Wards forecast of 15.9 million SAAR, would be up 1.9% from last month, and up 1.5% from a year ago.

The Normal Seasonal Change for Median House Prices

by Calculated Risk on 2/24/2025 10:51:00 AM

Earlier, in the CalculatedRisk Real Estate Newsletter on January existing home sales, NAR: Existing-Home Sales Decreased to 4.08 million SAAR in January, I mentioned that the median price typically bottoms seasonally in January (contracts signed mostly in November and December) and peaks in June (April and May contracts).

Below is a table of the seasonal changes from January to June (all median prices Not Seasonally Adjusted, NSA).

Note: In 2020, prices increased late into the year and peaked in October, but prices peaked in June for all the other years.

| Change in Median House Price from January to June | ||||||

|---|---|---|---|---|---|---|

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

| January to June | 13.7% | 14.4% | 10.6% | 20.8% | 16.8% | 12.8% |

The NAR reported the median price was $396,900 in January 2025, down 7.0% from $426,900 in June 2024.

Housing Feb 24th Weekly Update: Inventory Up 0.3% Week-over-week, Up 28.7% Year-over-year

by Calculated Risk on 2/24/2025 08:11:00 AM

Click on graph for larger image.

Click on graph for larger image. This second inventory graph is courtesy of Altos Research.

This second inventory graph is courtesy of Altos Research.Sunday, February 23, 2025

Sunday Night Futures

by Calculated Risk on 2/23/2025 06:17:00 PM

Weekend:

• Schedule for Week of February 23, 2025

• Housing Starts and Recessions

Monday:

• At 8:30 AM ET, Chicago Fed National Activity Index for January. This is a composite index of other data.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for February.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 13 and DOW futures are up 67 (fair value).

Oil prices were down over the last week with WTI futures at $70.40 per barrel and Brent at $74.43 per barrel. A year ago, WTI was at $78, and Brent was at $84 - so WTI oil prices are down about 10% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.11 per gallon. A year ago, prices were at $3.26 per gallon, so gasoline prices are down $0.15 year-over-year.

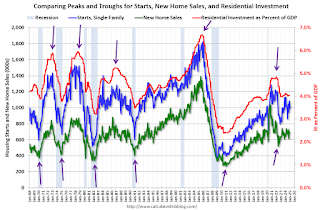

Housing Starts and Recessions

by Calculated Risk on 2/23/2025 11:04:00 AM

This morning, Carl Quintanilla posted a graph on Bluesky from BESPOKE suggesting the US is heading towards a recession.

Quintanilla quoted BESPOKE:

Quintanilla quoted BESPOKE:

“On a 12-month average basis, .. Housing Starts have completely rolled over from their peak ..Housing is the basis of one of my favorite models for business cycle forecasting. And policy changes will clearly have a negative impact on homebuilders. Early in February, I expressed my "increasing concern" about the negative economic impact of "executive / fiscal policy errors", however, I concluded that post by noting that I was not currently on recession watch.

“.. Recessions have always followed a rollover in Housing Starts, and the only question is timing.”

The arrows point to some of the earlier peaks and troughs for these three measures - and the most recent peak.

The arrows point to some of the earlier peaks and troughs for these three measures - and the most recent peak.New home sales peaked in 2020 as pandemic buying soared. Then new home sales and single-family starts turned down in 2021, but that was partly due to the huge surge in sales during the pandemic. In 2022, both new home sales and single-family starts turned down in response to higher mortgage rates.

This second graph shows the YoY change in New Home Sales from the Census Bureau. Currently new home sales (based on 3-month average) are down 1% year-over-year!

This second graph shows the YoY change in New Home Sales from the Census Bureau. Currently new home sales (based on 3-month average) are down 1% year-over-year!

Saturday, February 22, 2025

Real Estate Newsletter Articles this Week: Mortgage Delinquencies Increase, Foreclosures Remain Low

by Calculated Risk on 2/22/2025 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• NAR: Existing-Home Sales Decreased to 4.08 million SAAR in January

• Housing Starts Decreased to 1.366 million Annual Rate in January

• The "Neutral" Rate and Implications for 30-year Mortgage Rates

• California Home Sales Down 1.9% YoY in January; 4th Look at Local Housing Markets

• Lawler: Early Read on Existing Home Sales in January

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

Schedule for Week of February 23, 2025

by Calculated Risk on 2/22/2025 08:11:00 AM

The key reports this week are January New Home sales, the second estimate of Q4 GDP, Personal Income and Outlays for January, and Case-Shiller house prices.

For manufacturing, the February Dallas, Kansas City, and Richmond Fed manufacturing surveys will be released.

8:30 AM ET: Chicago Fed National Activity Index for January. This is a composite index of other data.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for February.

9:00 AM: FHFA House Price Index for December 2024. This was originally a GSE only repeat sales, however there is also an expanded index.

9:00 AM: S&P/Case-Shiller House Price Index for December.

9:00 AM: S&P/Case-Shiller House Price Index for December.This graph shows the year-over-year change for the Case-Shiller National, Composite 10 and Composite 20 indexes, through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 4.5% year-over-year increase in the Comp 20 index for December, up from 4.3% in November.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for February.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index.

10:00 AM: New Home Sales for January from the Census Bureau.

10:00 AM: New Home Sales for January from the Census Bureau. This graph shows New Home Sales since 1963.

The dashed line is the sales rate for last month.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for an increase to 225 thousand from 219 thousand last week.

8:30 AM: Gross Domestic Product, 4th Quarter and Year 2024 (Second Estimate) The consensus is that real GDP increased 2.3% annualized in Q4, unchanged from the advance estimate of 2.3%.

8:30 AM: Durable Goods Orders for January from the Census Bureau. The consensus is for a 1.8% increase in durable goods orders.

10:00 AM: Pending Home Sales Index for January. The consensus is for a 1.2% decrease in the index.

11:00 AM: the Kansas City Fed manufacturing survey for February.

8:30 AM ET: Personal Income and Outlays for January. The consensus is for a 0.3% increase in personal income, and for a 0.2% increase in personal spending. And for the Core PCE price index to increase 0.2%. PCE prices are expected to be up 2.5% YoY, and core PCE prices up 2.6% YoY.

9:45 AM: Chicago Purchasing Managers Index for February.

Friday, February 21, 2025

February 21st COVID Update: COVID in Wastewater Declining

by Calculated Risk on 2/21/2025 07:03:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Deaths per Week | 859 | 953 | ≤3501 | |

| 1my goals to stop weekly posts. 🚩 Increasing number weekly for Deaths. ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported since Jan 2023.

This appears to be a leading indicator for COVID hospitalizations and deaths. This has moving down recently.

This appears to be a leading indicator for COVID hospitalizations and deaths. This has moving down recently.