by Calculated Risk on 1/02/2025 07:21:00 PM

Thursday, January 02, 2025

Friday: ISM Mfg, Vehicle Sales

Friday:

• At 10:00 AM: ISM Manufacturing Index for December. The consensus is for the ISM to be at 48.3, down from 48.4 in November.

All day: Light vehicle sales for December. The Wards forecast is for 16.7 million SAAR in December, up from the BEA estimate of 16.50 million SAAR in November (Seasonally Adjusted Annual Rate).

Freddie Mac House Price Index Increased in November; Up 4.0% Year-over-year

by Calculated Risk on 1/02/2025 12:43:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Freddie Mac House Price Index Increased in November; Up 4.0% Year-over-year

A brief excerpt:

Freddie Mac reported that its “National” Home Price Index (FMHPI) increased 0.56% month-over-month on a seasonally adjusted (SA) basis in November. On a year-over-year basis, the National FMHPI was up 4.0% in November, up from up 3.9% YoY in October. The YoY increase peaked at 19.1% in July 2021, and for this cycle, bottomed at up 0.9% YoY in May 2023. ...There is much more in the article!

For cities (Core-based Statistical Areas, CBSA), here are the 35 cities with the largest declines from the peak, seasonally adjusted. Austin continues to be the worst performing city. However, 15 of the 30 cities with the largest price declines are in Florida!

Construction Spending Mostly Unchanged in November

by Calculated Risk on 1/02/2025 10:00:00 AM

From the Census Bureau reported that overall construction spending increased:

Construction spending during November 2024 was estimated at a seasonally adjusted annual rate of $2,152.6 billion, virtually unchanged from the revised October estimate of $2,152.3 billion. The November figure is 3.0 percent above the November 2023 estimate of $2,090.7 billion.Private spending increased and public spending decreased:

emphasis added

Spending on private construction was at a seasonally adjusted annual rate of $1,650.7 billion, 0.1 percent above the revised October estimate of $1,649.8 billion. ...

In November, the estimated seasonally adjusted annual rate of public construction spending was $501.9 billion, 0.1 percent below the revised October estimate of $502.5 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Residential (red) spending is 7.6% below the peak in 2022.

Non-residential (blue) spending is 0.4% below the peak in June 2024.

Public construction spending is 0.2% below the peak in September 2024.

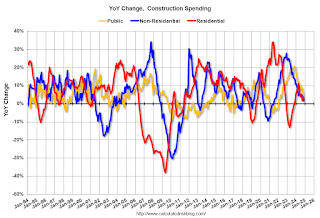

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 3.1%. Non-residential spending is up 1.7% year-over-year. Public spending is up 4.6% year-over-year.

Weekly Initial Unemployment Claims Decrease to 211,000

by Calculated Risk on 1/02/2025 08:30:00 AM

The DOL reported:

In the week ending December 28, the advance figure for seasonally adjusted initial claims was 211,000, a decrease of 9,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 219,000 to 220,000. The 4-week moving average was 223,250, a decrease of 3,500 from the previous week's revised average. The previous week's average was revised up by 250 from 226,500 to 226,750.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 223,250.

The previous week was revised up.

Weekly claims were lower than the consensus forecast.

MBA: Mortgage Applications Decreased Over a Two-Week Period in Weekly Survey

by Calculated Risk on 1/02/2025 07:00:00 AM

From the MBA: Mortgage Applications Decreased Over a Two-Week Period in Latest MBA Weekly Survey

Mortgage applications decreased 21.9 percent from two weeks earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending December 27, 2024. The results include an adjustment to account for the Christmas holiday.

The Market Composite Index, a measure of mortgage loan application volume, decreased 21.9 percent on a seasonally adjusted basis from two weeks earlier. On an unadjusted basis, the Index decreased 55 percent compared with two weeks ago. The holiday adjusted Refinance Index decreased 36 percent from two weeks ago and was 10 percent higher than the same week one year ago. The unadjusted Refinance Index decreased 62 percent from two weeks ago and was 6 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 13 percent compared with two weeks ago. The unadjusted Purchase Index decreased 48 percent compared with two weeks ago and was 17 percent lower than the same week one year ago.

“Mortgage rates moved higher through the last full week of 2024, reaching almost 7 percent for 30-year fixed-rate loans,” said Mike Fratantoni, MBA’s SVP and Chief Economist. “Not surprisingly, this increase in rates – at a time when housing activity typically grinds to a halt – resulted in declines in both refinance and purchase applications.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($766,550 or less) increased to 6.97 percent from 6.89 percent, with points increasing to 0.72 from 0.67 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans. The effective rate increased from last week.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is down 17% year-over-year unadjusted.

Wednesday, January 01, 2025

Thursday: Unemployment Claims, Construction Spending

by Calculated Risk on 1/01/2025 08:18:00 PM

Thursday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release two weeks of results for the mortgage purchase applications index.

• At 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for an increase to 223 thousand from 219 thousand last week.

• At 10:00 AM, Construction Spending for November. The consensus is for a 0.3% increase in construction spending.

Question #3 for 2025: What will the unemployment rate be in December 2025?

by Calculated Risk on 1/01/2025 12:40:00 PM

Earlier I posted some questions on my blog for next year: Ten Economic Questions for 2025. Some of these questions concern real estate (inventory, house prices, housing starts, new home sales), and I posted thoughts on those in the newsletter (others like GDP and employment will be on this blog).

I'm adding some thoughts and predictions for each question.

Here is a review of the Ten Economic Questions for 2024.

3) Unemployment Rate: The unemployment rate was at 4.2% in November, up from 3.7% in November 2023. Currently the FOMC is projecting the unemployment rate will increase to the 4.2% to 4.5% range in Q4 2025. What will the unemployment rate be in December 2025?

Click on graph for larger image.

Click on graph for larger image.The unemployment rate is from the household survey (CPS), and the rate increased in November to 4.2%, up from 3.7% in November 2023.

Forecasting the unemployment rate includes forecasts for economic and payroll growth, and also for changes in the participation rate (previous question).

My guess is the unemployment rate will decline to 4% or so by December 2025. (Lower than the FOMC forecast of 4.2% to 4.5%).

• Question #1 for 2025: How much will the economy grow in 2025? Will there be a recession in 2025?

• Question #2 for 2025: How much will job growth slow in 2025? Or will the economy lose jobs?

• Question #3 for 2025: What will the unemployment rate be in December 2025?

• Question #4 for 2025: What will the participation rate be in December 2025?

• Question #5 for 2025: What will the YoY core inflation rate be in December 2025?

• Question #6 for 2025: What will the Fed Funds rate be in December 2025?

• Question #7 for 2025: How much will wages increase in 2025?

• Question #8 for 2025: How much will Residential investment change in 2025? How about housing starts and new home sales in 2025?

• Question #9 for 2025: What will happen with house prices in 2025?

• Question #10 for 2025: Will inventory increase further in 2025?

Tuesday, December 31, 2024

Fannie and Freddie: Single Family and Multi-Family Serious Delinquency Rates Increased in November

by Calculated Risk on 12/31/2024 05:07:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Fannie and Freddie: Single Family and Multi-Family Serious Delinquency Rates Increased in November

Excerpt:

Happy New Year! Best wishes for 2025, Bill

Single-family and multi-family serious delinquencies increased in November.

...

Here are the multi-family 60+ day delinquency rate since 2006.

Freddie Mac (blue) reports that the multi-family delinquencies rate increased to 0.40% in November, up from 0.40% in October, and down from the recent peak of 0.44% in January 2024.

Fannie Mae (red) reports that the multi-family delinquencies rate increased to 0.61% in November, up from 0.57% in October, and is at the highest rate since 2011 (excluding pandemic).

Question #4 for 2025: What will the participation rate be in December 2025?

by Calculated Risk on 12/31/2024 01:13:00 PM

Earlier I posted some questions on my blog for next year: Ten Economic Questions for 2025. Some of these questions concern real estate (inventory, house prices, housing starts, new home sales), and I posted thoughts on those in the newsletter (others like GDP and employment will be on this blog).

I'm adding some thoughts and predictions for each question.

Here is a review of the Ten Economic Questions for 2024.

4) Participation Rate: In November 2024, the overall participation rate was at 62.5%, down year-over-year from 62.8% in November 2023, and below the pre-pandemic level of 63.3% in February 2020. Long term, the BLS is projecting the overall participation rate will decline to 61.2% by 2033 due to demographics. What will the participation rate be in December 2025?

The overall labor force participation rate is the percentage of the working age population (16 + years old) in the labor force. A large portion of the decline in the participation rate since 2000 was due to demographics and long-term trends.

For those who follow the household survey employment number along with the nonfarm payroll survey numbers, it is worth noting that the housing survey numbers are “controlled” to the latest Census population estimates and one-year ahead projections. As such, the 2024 household employment numbers are “controlled” to the Vintage 2023 employment projections for 2024. The Vintage 2023 projection for YOY resident population growth from December 2023 to December 2024 was 1,724,847, compared to the Vintage 2024 projection over this period of 2,745,741. As such, when the household survey employment estimates for the end of this year are revised in January to reflect population benchmark revisions, one should expect a sizable upward revision.

The second graph shows the participation rate for "prime age" workers (25 to 54 years old). The 25 to 54 participation rate was at 83.5% in November 2024 Red), above the pre-pandemic level of 83.0%. This suggests all of the prime age workers have returned to the labor force.

The second graph shows the participation rate for "prime age" workers (25 to 54 years old). The 25 to 54 participation rate was at 83.5% in November 2024 Red), above the pre-pandemic level of 83.0%. This suggests all of the prime age workers have returned to the labor force.Here are the Ten Economic Questions for 2025 and a few predictions:

• Question #1 for 2025: How much will the economy grow in 2025? Will there be a recession in 2025?

• Question #2 for 2025: How much will job growth slow in 2025? Or will the economy lose jobs?

• Question #3 for 2025: What will the unemployment rate be in December 2025?

• Question #4 for 2025: What will the participation rate be in December 2025?

• Question #5 for 2025: What will the YoY core inflation rate be in December 2025?

• Question #6 for 2025: What will the Fed Funds rate be in December 2025?

• Question #7 for 2025: How much will wages increase in 2025?

• Question #8 for 2025: How much will Residential investment change in 2025? How about housing starts and new home sales in 2025?

• Question #9 for 2025: What will happen with house prices in 2025?

• Question #10 for 2025: Will inventory increase further in 2025?

Case-Shiller: National House Price Index Up 3.6% year-over-year in October

by Calculated Risk on 12/31/2024 09:52:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Case-Shiller: National House Price Index Up 3.6% year-over-year in October

Excerpt:

S&P/Case-Shiller released the monthly Home Price Indices for October ("October" is a 3-month average of August, September and October closing prices). October closing prices include some contracts signed in June, so there is a significant lag to this data. Here is a graph of the month-over-month (MoM) change in the Case-Shiller National Index Seasonally Adjusted (SA).There is much more in the article.

The MoM increase in the seasonally adjusted (SA) Case-Shiller National Index was at 0.35% (a 4.2% annual rate), This was the 21st consecutive MoM increase in the seasonally adjusted index.

On a seasonally adjusted basis, prices increased month-to-month in 18 of the 20 Case-Shiller cities (prices declined in Cleveland and Tampa seasonally adjusted). San Francisco has fallen 6.4% from the recent peak, Phoenix is down 3.0% from the peak, and Denver down 2.0%.

Last 10 Posts

In Memoriam: Doris "Tanta" Dungey

Archive

Econbrowser

Pettis: China Financial Markets

NY Times Upshot

The Big Picture

| Privacy Policy |

| Copyright © 2007 - 2025 CR4RE LLC |

| Excerpts NOT allowed on x.com |