by Calculated Risk on 5/20/2024 10:40:00 AM

Monday, May 20, 2024

Fed Vice Chair Philip Jefferson on Housing Dynamics

From Fed Vice Chair Philip Jefferson: U.S. Economic Outlook and Housing Price Dynamics. An excerpt on housing:

The Housing MarketAs Jefferson notes, rents for existing tenants are still increasing, even while new leases are mostly flat year-over-year. A key point is that Fed policy can not change what happened a year or two ago, and that is why we need to look at inflation ex-housing.

The Fed sets policy to promote its dual-mandate objectives of maximum employment and price stability, and employment and inflation depend on conditions in the entire economy. Still, given our gathering today, I thought it would be appropriate to dive a bit deeper into the housing and home finance markets.

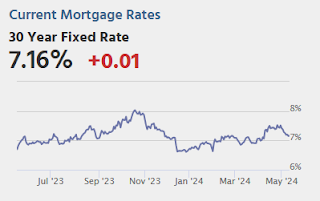

As I said earlier, the housing sector is one of the most interest rate–sensitive parts of the economy. We have seen that sensitivity in mortgage rates and mortgage originations. As shown in figure 4, 30-year fixed-rate mortgage rates were close to 3 percent when the federal funds rate was near the zero lower bound in 2020 and 2021. Rates surged in 2022 as the federal funds rate increased. Consistent with the increase in mortgage rates, mortgage origination volume has fallen significantly.

The current restrictive stance of monetary policy has weighed on the housing market. That is helping to bring supply and demand into better balance and put downward pressure on inflation. One aspect of inflation that has gotten a fair amount of attention is housing and rental costs. This is because housing costs make up such a large share of household budgets. To calculate housing services inflation, government statistics don't use home prices because a home is partly an investment. Instead, housing services inflation is computed using monthly rents that capture what tenants pay to rent a house or apartment and what homeowners would, in theory, pay to rent their own home. The way this calculation is derived means changes in market rents—or what a new tenant pays to rent—take a long time to pass through to PCE housing services prices, as shown in figure 5. In this figure, notice that increases in market rents, the blue and red lines, peaked in 2022, and PCE housing services inflation, the black line, lagged market rents and peaked in 2023.

Lags in Housing Services Inflation

The primary reason for this lag is that market rents adjust more quickly to economic conditions than what landlords charge their existing tenants. This lag suggests that the large increase in market rents during the pandemic is still being passed through to existing rents and may keep housing services inflation elevated for a while longer. This observation is important because it is an example of one of the underlying sources of lags with which monetary policy affects inflation.

Another factor affecting pass-through of restrictive monetary policy is that fixed-rate mortgages are common in the U.S. It is often argued that this loan structure dampens the effect of monetary policy. Figure 6 shows that the 30-year fixed mortgage rate is about 7 percent, while the average outstanding mortgage rate is about 4 percent. This lower outstanding mortgage rate is due to households who locked in rates during lower-interest periods, including when the Fed cut the target range for the federal funds rate to near zero shortly after the pandemic took hold. Fixed-rate mortgages do dampen the effect of monetary policy, but, according to recent research, not as much as previously thought.

There is a delay between when mortgage rates go up and when household mortgage payments go up, as shown in figure 7. Board staff research documents that mortgage payments go up over time because many households continue to refinance their mortgage or move. Despite higher rates, households in the U.S. borrowed over $1.5 trillion in new mortgage loans in 2023. These borrowers include first-time homebuyers, existing homeowners moving between homes, and homeowners obtaining cash-out refinances. The payment they owe on that recently obtained mortgage is higher than it would have been had lower rates been maintained, and their consumption may be correspondingly lower. The cumulative effect of a higher interest rate on aggregate mortgage payments grows over time as more new loans are originated at the higher rate. The staff's research documents that, historically, borrowers like these who are not deterred by higher rates are responsible for a little over half of the pass-through of interest rates to mortgage payments.

Conclusion

In closing, let me reiterate why we care about housing. The housing sector is where many households have made, or will make, their largest investment. Therefore, the prices that families pay for that housing can affect their overall well-being. The work you do to make housing accessible is an important part of the economy. The housing sector is also a key part of the transmission mechanism of monetary policy. That is one reason why policymakers will continue to pay close attention to this vital sector.

emphasis added

Housing May 20th Weekly Update: Inventory up 1.7% Week-over-week, Up 36.0% Year-over-year

by Calculated Risk on 5/20/2024 08:11:00 AM

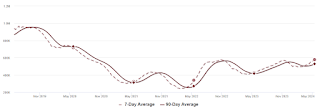

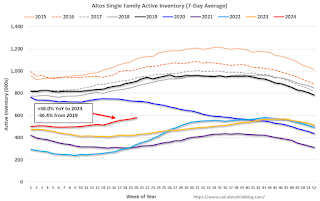

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Sunday, May 19, 2024

Sunday Night Futures

by Calculated Risk on 5/19/2024 06:14:00 PM

Weekend:

• Schedule for Week of May 19, 2024

Monday:

• At 10:30 AM ET, Speech, Fed Vice Chair Philip Jefferson, U.S. Economic Outlook and Housing Price Dynamics, At the Mortgage Bankers Association (MBA) Secondary and Capital Markets Conference, New York, N.Y.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 6 and DOW futures are up 39 (fair value).

Oil prices were up over the last week with WTI futures at $80.06 per barrel and Brent at $83.98 per barrel. A year ago, WTI was at $72, and Brent was at $75 - so WTI oil prices are up about 10% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.57 per gallon. A year ago, prices were at $3.53 per gallon, so gasoline prices are up $0.04 year-over-year.

The Top Ten Job Streaks: Current Streak is in 5th Place

by Calculated Risk on 5/19/2024 09:50:00 AM

For fun:

| Headline Jobs, Top 10 Streaks | ||

|---|---|---|

| Year Ended | Streak, Months | |

| 1 | 2020 | 113 |

| 2 | 1990 | 48 |

| 3 | 2007 | 46 |

| 4 | 1979 | 45 |

| 5 | 20241 | 40 |

| 6 tie | 1943 | 33 |

| 6 tie | 1986 | 33 |

| 6 tie | 2000 | 33 |

| 9 | 1967 | 29 |

| 10 | 1995 | 25 |

| 1Currrent Streak | ||

Saturday, May 18, 2024

Real Estate Newsletter Articles this Week: Housing Starts Increased to 1.360 million Annual Rate in April

by Calculated Risk on 5/18/2024 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

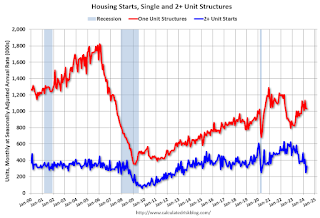

• Single Family Starts Up 18% Year-over-year in March; Multi-Family Starts Down Sharply YoY

• Lawler: Early Read on Existing Home Sales in April & 3rd Look at Local Housing Markets

• Part 2: Current State of the Housing Market; Overview for mid-May 2024

• MBA: Mortgage Delinquencies Increased Slightly in Q1 2024

• 2nd Look at Local Housing Markets in April

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

Schedule for Week of May 19, 2024

by Calculated Risk on 5/18/2024 08:11:00 AM

The key reports this week are April New and Existing Home Sales.

10:30 AM: Speech, Fed Vice Chair Philip Jefferson, U.S. Economic Outlook and Housing Price Dynamics, At the Mortgage Bankers Association (MBA) Secondary and Capital Markets Conference, New York, N.Y.

No major economic releases scheduled.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

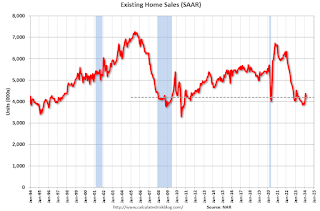

10:00 AM: Existing Home Sales for April from the National Association of Realtors (NAR). The consensus is for 4.18 million SAAR, down from 4.19 million.

10:00 AM: Existing Home Sales for April from the National Association of Realtors (NAR). The consensus is for 4.18 million SAAR, down from 4.19 million.The graph shows existing home sales from 1994 through the report last month.

Housing economist Tom Lawler expects the NAR to report sales of 4.23 million SAAR.

During the day: The AIA's Architecture Billings Index for April (a leading indicator for commercial real estate).

2:00 PM: FOMC Minutes, Minutes Meeting of April 30-May 1, 2024

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 220 thousand initial claims, down from 222 thousand last week.

8:30 AM ET: Chicago Fed National Activity Index for April. This is a composite index of other data.

10:00 AM: New Home Sales for April from the Census Bureau.

10:00 AM: New Home Sales for April from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 680 thousand SAAR, down from 693 thousand SAAR in March.

11:00 AM: the Kansas City Fed manufacturing survey for May.

8:30 AM: Durable Goods Orders for April from the Census Bureau. The consensus is for a 0.6% decrease in durable goods orders.

10:00 AM: University of Michigan's Consumer sentiment index (Final for May). The consensus is for a reading of 67.4.

Friday, May 17, 2024

May 17th COVID Update: Weekly Deaths at New Pandemic Low!

by Calculated Risk on 5/17/2024 07:13:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Deaths per Week | 443 | 532 | ≤3501 | |

| 1my goals to stop weekly posts, 🚩 Increasing number weekly for Deaths ✅ Goal met. | ||||

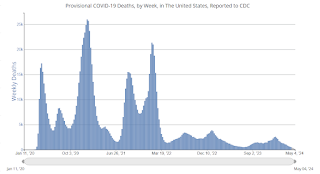

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

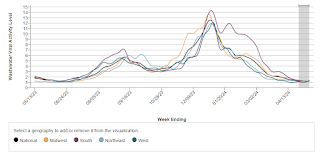

This appears to be a leading indicator for COVID hospitalizations and deaths.

This appears to be a leading indicator for COVID hospitalizations and deaths.Hotels: Occupancy Rate Increased 2.1% Year-over-year

by Calculated Risk on 5/17/2024 01:12:00 PM

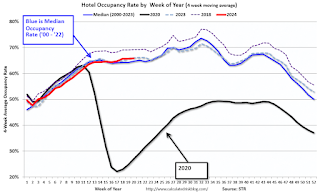

The U.S. hotel industry reported higher performance from the previous week and positive comparisons year over year, according to CoStar’s latest data through 11 May. ...The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

5-11 May 2024 (percentage change from comparable week in 2023):

• Occupancy: 66.1% (+2.1%)

• Average daily rate (ADR): US$162.14 (+4.4%)

• Revenue per available room (RevPAR): US$107.24 (+6.6%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2024, black is 2020, blue is the median, and dashed light blue is for 2023. Dashed purple is for 2018, the record year for hotel occupancy.

Lawler: Early Read on Existing Home Sales in April & 3rd Look at Local Housing Markets

by Calculated Risk on 5/17/2024 09:43:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Lawler: Early Read on Existing Home Sales in April & 3rd Look at Local Housing Markets

A brief excerpt:

From housing economist Tom Lawler:There is much more in the article.

Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 4.23 million in April, up 1.0% from March’s preliminary pace and up 0.2% from last April’s seasonally adjusted pace. Unadjusted sales should show a significantly larger YOY % increase, as there were two more business days this April compared to last April.

Local realtor/MLS reports suggest that the median existing single-family home sales price last month was up by about 6% from last April.

CR Note: The NAR is scheduled to release April existing home sales on Wednesday, May 22nd. The consensus is for 4.18 million SAAR, down from 4.19 million in March.

...

This is a year-over-year increase NSA for these markets. However, there were two more working days in April 2024 compared to April 2023, so sales Seasonally Adjusted will be lower year-over-year than Not Seasonally Adjusted sales.

If sales increased YoY in April, this will be the first YoY increase since August 2021, following 31 consecutive months with a YoY decline in sales.

Early Q2 GDP Tracking: 1.9% to 3.6%

by Calculated Risk on 5/17/2024 08:23:00 AM

From BofA:

2Q US GDP tracking is down a tenth from our official forecast of 2.0% q/q saar to 1.9% q/q saar [May 17th estimate]From Goldman:

emphasis added

We raised our Q2 GDP tracking estimate by 0.2pp to +3.2% (qoq ar) and our domestic final sales estimate by 0.1pp to +2.5%, but we lowered our past-quarter GDP tracking estimate for Q1 by 0.1pp to +1.2% (vs. +1.6% originally reported). [May 16th estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2024 is 3.6 percent on May 16, down from 3.8 percent on May 15. [May 16th estimate]