by Calculated Risk on 9/29/2023 07:20:00 PM

Friday, September 29, 2023

Sept 29th COVID Update: Deaths and Hospitalizations Increased

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Hospitalized2🚩 | 16,196 | 16,139 | ≤3,0001 | |

| Deaths per Week2🚩 | 1,132 | 1,088 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Hospitalized and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

Q3 GDP Tracking: Around 3%

by Calculated Risk on 9/29/2023 03:44:00 PM

From BofA:

Overall, the data flow since our last weekly lowered our 3Q US GDP tracking estimate by a tenth to 2.8%. [Sept 29th estimate]From Goldman:

emphasis added

The foreign trade details of this morning’s report were stronger than our previous assumptions, and we boosted our Q3 GDP tracking estimate by 0.3pp to +3.5% (qoq ar). We left our domestic final sales growth forecast unchanged on a rounded basis at +2.6%. [Sept 29th estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2023 is 4.9 percent on September 29, unchanged from September 27 after rounding. After recent releases from the US Bureau of Economic Analysis and US Census Bureau, increases in the model’s nowcasts of the contributions of personal consumption expenditures and net exports to GDP growth were offset by a downward revision in the nowcast of real gross private domestic investment growth. [Sept 29th estimate]

Hotels: Occupancy Rate Decreased 1.6% Year-over-year

by Calculated Risk on 9/29/2023 02:52:00 PM

U.S. hotel performance increased from the previous week, according to CoStar’s latest data through 23 September.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

17-23 September 2023 (percentage change from comparable week in 2022):

• Occupancy: 68.5% (-1.6%)

• Average daily rate (ADR): US$164.97 (+2.9%)

• Revenue per available room (RevPAR): US$112.96 (+1.2%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2023, black is 2020, blue is the median, and dashed light blue is for 2022. Dashed purple is for 2018, the record year for hotel occupancy.

Fannie and Freddie: Single-Family Mortgage Delinquency Rate Declined, Multi-Family Increased in August

by Calculated Risk on 9/29/2023 10:57:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Fannie and Freddie: Single-Family Mortgage Delinquency Rate Declined, Multi-Family Increased in August

Brief excerpt:

I’ve argued that there would not be a huge wave of single-family foreclosures this cycle since lending standards have been solid and most homeowners have substantial equity. That means we will not see cascading price declines like following the housing bubble. Delinquencies are a trailing indicator but are something to watch.You can subscribe at https://calculatedrisk.substack.com/.

However, there is some concern about some multi-family properties.

...

Freddie Mac reports that multi-family delinquencies increased to 0.25% in August, up from 0.12% in August 2022.

This graph shows the Freddie multi-family serious delinquency rate since 2012. Delinquency rates were still high in 2012 following the housing bust and financial crisis.

The multi-family delinquency rate increased following the pandemic and has increased recently as rent growth has stalled, vacancy rates have increased, lending has tightened, and interest rates have increased sharply. This will be something to watch as rents soften.

PCE Measure of Shelter Slows to 7.4% YoY in August

by Calculated Risk on 9/29/2023 09:12:00 AM

Here is a graph of the year-over-year change in shelter from the CPI report and housing from the PCE report this morning, both through July 2023.

Since asking rents are slightly negative year-over-year, these measures will continue to slow sharply over coming months.

Personal Income increased 0.4% in August; Spending increased 0.4%

by Calculated Risk on 9/29/2023 08:30:00 AM

The BEA released the Personal Income and Outlays report for August:

Personal income increased $87.6 billion (0.4 percent at a monthly rate) in August, according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI), personal income less personal current taxes, increased $46.6 billion (0.2 percent) and personal consumption expenditures (PCE) increased $83.6 billion (0.4 percent).The August PCE price index increased 3.5 percent year-over-year (YoY), up from 3.4 percent YoY in July, and down from the recent peak of 7.1 percent in June 2022.

The PCE price index increased 0.4 percent. Excluding food and energy, the PCE price index increased 0.1 percent. Real DPI decreased 0.2 percent in August and real PCE increased 0.1 percent; goods decreased 0.2 percent and services increased 0.2 percent.

emphasis added

The following graph shows real Personal Consumption Expenditures (PCE) through August 2023 (2012 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

Personal income was slightly below expectations, and PCE was at expectations.

Using the two-month method to estimate Q3 real PCE growth, real PCE was increasing at a 4.0% annual rate in Q3 2023. (Using the mid-month method, real PCE was increasing at 3.9%). This suggests strong PCE growth in Q3.

Thursday, September 28, 2023

Friday: Personal Income and Outlays

by Calculated Risk on 9/28/2023 07:53:00 PM

Friday:

• At 8:30 AM ET, Personal Income and Outlays, August 2023. The consensus is for a 0.5% increase in personal income, and for a 0.4% increase in personal spending. And for the Core PCE price index to increase 0.2%. PCE prices are expected to be up 3.5% YoY, and core PCE prices up 3.9% YoY.

• At 9:45 AM, Chicago Purchasing Managers Index for September. The consensus is for a reading of 47.6, down from 48.7 in August.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Final for September). The consensus is for a reading of 67.7.

Asking Rents Down 1.2% Year-over-year

by Calculated Risk on 9/28/2023 02:45:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Asking Rents Down 1.2% Year-over-year

A brief excerpt:

Tracking rents is important for understanding the dynamics of the housing market. For example, the sharp increase in rents helped me deduce that there was a surge in household formation in 2021 (See from September 2021: Household Formation Drives Housing Demand).There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

The surge in household formation has been confirmed (mostly due to work-from-home), and this led to the supposition that household formation would slow sharply in 2023 (mostly confirmed) and that asking rents might decrease in 2023 on a year-over-year basis (now negative year-over-year).

Recent data suggests household formation has slowed sharply and asking rents are declining year-over-year.

...

Here is a graph of the year-over-year (YoY) change for these measures since January 2015. Most of these measures are through August 2023, except CoreLogic is through July and Apartment List is through September 2023.

...

With slow household formation, more supply coming on the market and a rising vacancy rate, rents will be under pressure all year. See: Forecast: Multifamily Starts will Decline Sharply

Realtor.com Reports Weekly Active Inventory Down 3.7% YoY; New Listings Down 7.5% YoY

by Calculated Risk on 9/28/2023 01:00:00 PM

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report from Jiayi Xu: Weekly Housing Trends View — Data Week Ending Sep 23, 2023

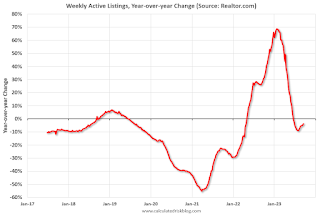

• Active inventory declined, with for-sale homes lagging behind year ago levels by 3.7%. During the past week, we observed the 14th successive drop in the number of homes available for sale when compared to the previous year. This decline showed a slight improvement compared to the previous week’s -4.4% figure.

• New listings–a measure of sellers putting homes up for sale–were down again this week, by 7.5% from one year ago. Over the past 64 weeks, we’ve consistently seen a decline in the number of newly listed homes compared to the same period one year ago. While this gap in new listings was gradually narrowed over the past few weeks, in the most recent week, the decrease in newly listed homes was -7.5% compared to the previous year, lower from the -6.0% decline in the week prior.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory was down 3.7% year-over-year - this was the fourteenth consecutive week with a YoY decrease following 58 consecutive weeks with a YoY increase in inventory.

NAR: Pending Home Sales Decrease 7.1% in August; Down 18.7% Year-over-year

by Calculated Risk on 9/28/2023 10:00:00 AM

From the NAR: Pending Home Sales Tumbled 7.1% in August

Pending home sales slid 7.1% in August, according to the National Association of REALTORS®. All four U.S. regions posted monthly losses and year-over-year declines in transactions.This was way below expectations of a 1.0% decrease for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in August and September.

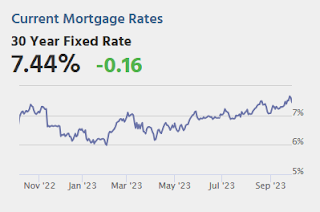

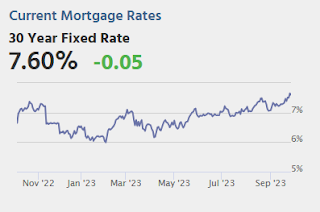

"Mortgage rates have been rising above 7% since August, which has diminished the pool of home buyers," said Lawrence Yun, NAR chief economist. "Some would-be home buyers are taking a pause and readjusting their expectations about the location and type of home to better fit their budgets."

The Pending Home Sales Index (PHSI)* – a forward-looking indicator of home sales based on contract signings – sank 7.1% to 71.8 in August. Year over year, pending transactions fell by 18.7%. An index of 100 is equal to the level of contract activity in 2001.

...

The Northeast PHSI declined 0.9% from last month to 62.6, a reduction of 18.2% from August 2022. The Midwest index dropped 7.0% to 71.3 in August, down 19.1% from one year ago.

The South PHSI fell 9.1% to 86.5 in August, dipping 17.6% from the prior year. The West index retreated 7.7% in August to 56.3, sinking 21.4% from August 2022.

emphasis added