by Calculated Risk on 5/31/2023 02:06:00 PM

Wednesday, May 31, 2023

Fed's Beige Book: "Economic activity was little changed ... Residential real estate activity picked up"

Fed's Beige Book "This report was prepared at the Federal Reserve Bank of Chicago based on information collected on or before May 22, 2023."

Economic activity was little changed overall in April and early May. Four Districts reported small increases in activity, six no change, and two slight to moderate declines. Expectations for future growth deteriorated a little, though contacts still largely expected a further expansion in activity. Consumer expenditures were steady or higher in most Districts, with many noting growth in spending on leisure and hospitality. Education and healthcare organizations saw steady activity on balance. Manufacturing activity was flat to up in most Districts, and supply chain issues continued to improve. Demand for transportation services was down, especially in trucking, where contacts reported there was a "freight recession." Residential real estate activity picked up in most Districts despite continued low inventories of homes for sale. Commercial construction and real estate activity decreased overall, with the office segment continuing to be a weak spot. Outlooks for farm income fell in most districts, and energy activity was flat to down amidst lower natural gas prices. Financial conditions were stable or somewhat tighter in most Districts. Contacts in several Districts noted a rise in consumer loan delinquencies, which were returning closer to pre-pandemic levels. High inflation and the end of Covid-19 benefits continued to stress the budgets of low- and moderate-income households, driving increased demand for social services, including food and housing.

Employment increased in most Districts, though at a slower pace than in previous reports. Overall, the labor market continued to be strong, with contacts reporting difficulty finding workers across a wide range of skill levels and industries. That said, contacts across Districts also noted that the labor market had cooled some, highlighting easier hiring in construction, transportation, and finance. Many contacts said they were fully staffed, and some reported they were pausing hiring or reducing headcounts due to weaker actual or prospective demand or to greater uncertainty about the economic outlook. Staffing firms reported slower growth in demand. As in the last report, wages grew modestly.

emphasis added

BLS: Job Openings Increased to 10.1 million in April

by Calculated Risk on 5/31/2023 10:05:00 AM

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings edged up to 10.1 million on the last business day of April, the U.S. Bureau of Labor Statistics reported today. Over the month, the number of hires changed little at 6.1 million. Total separations decreased to 5.7 million. Within separations, quits (3.8 million) changed little, while layoffs and discharges (1.6 million) decreased.The following graph shows job openings (black line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for April the employment report this Friday will be for May.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are usually pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

The spike in layoffs and discharges in March 2020 is labeled, but off the chart to better show the usual data.

Jobs openings increased in April to 10.1 million from 9.7 million in March.

The number of job openings (black) were down 14% year-over-year.

Quits were down 16% year-over-year. These are voluntary separations. (See light blue columns at bottom of graph for trend for "quits").

Lawler: Census Finally Releases 2020 Census Demographic Profile and Demographic and Housing Characteristics File

by Calculated Risk on 5/31/2023 08:32:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Lawler: Census Finally Releases 2020 Census Demographic Profile and Demographic and Housing Characteristics File

Excerpt:

From housing economist Tom Lawler:

After an unusually long delay related to the challenges associated with conducting a Census during a nationwide pandemic, last week Census finally released the 2020 Census Demographic Profile and Demographic and Housing Characteristics File. ... The table below focuses on housing/household related data.

In a report later this week I will discuss some of the issues associated with the Census population numbers with respect to age distribution and discuss how that impacts folks trying to project the population by age.

MBA: Mortgage Applications Decreased in Weekly Survey

by Calculated Risk on 5/31/2023 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 3.7 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending May 26, 2023.

The Market Composite Index, a measure of mortgage loan application volume, decreased 3.7 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 5 percent compared with the previous week. The Refinance Index decreased 7 percent from the previous week and was 45 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 3 percent from one week earlier. The unadjusted Purchase Index decreased 4 percent compared with the previous week and was 31 percent lower than the same week one year ago.

“Inflation is still running too high, and recent economic data is beginning to convince investors that the Federal Reserve will not be cutting rates anytime soon. Mortgage rates for conforming balance 30-year loans were being quoted above 7 percent by some lenders last week, and the weekly average at 6.9 percent reached the highest level since last November,” said Mike Fratantoni, MBA’s SVP and Chief Economist. “Application volumes for both purchase and refinance loans decreased last week due to these higher rates. While refinance demand is almost entirely driven by the level of rates, purchase volume continues to be constrained by the lack of homes on the market.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($726,200 or less) increased to 6.91 percent from 6.69 percent, with points increasing to 0.83 from 0.66 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans. The effective rate increased from last week.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is down 31% year-over-year unadjusted.

Tuesday, May 30, 2023

Wednesday: Job Openings, Chicago PMI, Fed's Beige Book

by Calculated Risk on 5/30/2023 08:47:00 PM

The past 2 weeks were fairly rough for fans of low mortgage rates. The average lender moved higher at the fastest pace since February over that time. By the end of last week, the average lender was back above 7% for a top tier 30yr fixed scenario (and "well above" on Friday).Wednesday:

What a difference a weekend makes. While we're nowhere near the lower levels seen several weeks ago, the bond market (which underlies rates) was able to recover all of the losses seen on Thursday and Friday as well as a small portion of Wednesday's to boot. [30 year fixed 6.96%]

emphasis added

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 9:45 AM, Chicago Purchasing Managers Index for May.

• At 10:00 AM, Job Openings and Labor Turnover Survey for April from the BLS.

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 5/30/2023 02:41:00 PM

Two key points:

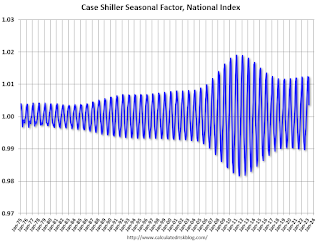

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern.

For in depth description of these issues, see Jed Kolko's article from 2014 "Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data"

Note: I was one of several people to question the change in the seasonal factor (here is a post in 2009) - and this led to S&P Case-Shiller questioning the seasonal factor too (from April 2010). I still use the seasonal factor (I think it is better than using the NSA data).

This graph shows the month-to-month change in the NSA Case-Shiller National index since 1987 (through March 2023). The seasonal pattern was smaller back in the '90s and early '00s and increased once the bubble burst.

The seasonal swings declined following the bust, however the price surge changed the month-over-month pattern.

The swings in the seasonal factors have decreased, and the seasonal factors had been moving back towards more normal levels.

Comments on March Case-Shiller and FHFA House Prices

by Calculated Risk on 5/30/2023 10:30:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Case-Shiller: National House Price Index Increased 0.7% year-over-year in March

Excerpt:

The recent increase in mortgage rates to over 7% will not impact the Case-Shiller index until reports released in the Fall.

...

Here is a comparison of year-over-year change in median house prices from the NAR and the year-over-year change in the Case-Shiller index. Median prices are distorted by the mix and repeat sales indexes like Case-Shiller and FHFA are probably better for measuring prices. However, in general, the Case-Shiller index follows the median price.

The median price was down 1.7% year-over-year in April, and the Case-Shiller National Index will likely be down year-over-year in the April report.

Note: I’ll have more on real prices, price-to-rent and affordability later this week.

Case-Shiller: National House Price Index increased 0.7% year-over-year in March

by Calculated Risk on 5/30/2023 09:30:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for March ("March" is a 3-month average of January, February and March closing prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

From CNBC Home price declines may be over, S&P Case-Shiller says

Nationally, home prices in March were 0.7% higher than March 2022, the S&P CoreLogic Case-Shiller Indices said Tuesday.

“The modest increases in home prices we saw a month ago accelerated in March 2023,” said Craig J. Lazzara, managing director at S&P DJI in a release. “Two months of increasing prices do not a definitive recovery make, but March’s results suggest that the decline in home prices that began in June 2022 may have come to an end.”

The 10-city composite, which includes the Los Angeles and New York metropolitian areas, dropped 0.8% year over year, compared with a 0.5% increase in the previous month. The 20-city composite, which includes Dallas-Fort Worth and the Detroit area, fell 1.1%, down from a 0.4% annual gain in the previous month.

emphasis added

Click on graph for larger image.

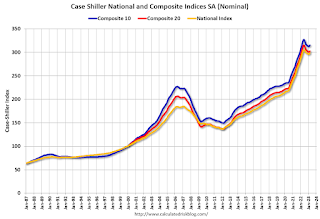

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is up 0.6% in March (SA) and down 3.6% from the recent peak in June 2022.

The Composite 20 index is up 0.5% (SA) in March and down 4.0% from the recent peak in June 2022.

The National index is up 0.4% (SA) in March and is down 2.2% from the peak in June 2022.

The second graph shows the year-over-year change in all three indices.

The second graph shows the year-over-year change in all three indices.The Composite 10 SA is down 0.8% year-over-year. The Composite 20 SA is down 1.1% year-over-year.

The National index SA is up 0.7% year-over-year.

Annual price increases were below expectations. I'll have more later.

Monday, May 29, 2023

Tuesday: Case-Shiller House Prices

by Calculated Risk on 5/29/2023 08:13:00 PM

Hanging out with my 101 years young data at a Memorial Day Ceremony in San Diego.

Hanging out with my 101 years young data at a Memorial Day Ceremony in San Diego.

Weekend:

• Schedule for Week of May 28, 2023

Monday:

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for March.

• Also at 9:00 AM, FHFA House Price Index for March 2022. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 10:00 AM, Dallas Fed Survey of Manufacturing Activity for May.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 9 and DOW futures are up 42 (fair value).

Oil prices were up over the last week with WTI futures at $72.51 per barrel and Brent at $76.57 per barrel. A year ago, WTI was at $115, and Brent was at $123 - so WTI oil prices are down about 37% year-over-year.

Oil prices were up over the last week with WTI futures at $72.51 per barrel and Brent at $76.57 per barrel. A year ago, WTI was at $115, and Brent was at $123 - so WTI oil prices are down about 37% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.54 per gallon. A year ago, prices were at $4.60 per gallon, so gasoline prices are down $1.06 per gallon year-over-year.

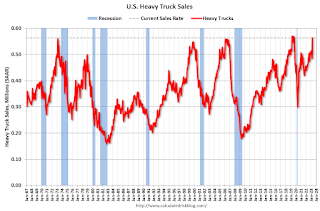

Recession Watch Update

by Calculated Risk on 5/29/2023 12:06:00 PM

Way back in 2013, I wrote a post "Predicting the Next Recession. In that 2013 post, I wrote:

The next recession will probably be caused by one of the following (from least likely to most likely):Unfortunately, in 2020, one of those low probability events happened (pandemic), and that led to a recession in 2020.

3) An exogenous event such as a pandemic, significant military conflict, disruption of energy supplies for any reason, a major natural disaster (meteor strike, super volcano, etc), and a number of other low probability reasons. All of these events are possible, but they are unpredictable, and the probabilities are low that they will happen in the next few years or even decades.

emphasis added

2) Significant policy error. Two examples: not reaching a fiscal agreement and going off the "fiscal cliff" probably would have led to a recession, and Congress refusing to "pay the bills" would have been a policy error that would have taken the economy into recession.That was written in 2013, and it appears once again that we've avoided the "default" policy error.

1) Most of the post-WWII recessions were caused by the Fed tightening monetary policy to slow inflation. I think this is the most likely cause of the next recession. Usually, when inflation starts to become a concern, the Fed tries to engineer a "soft landing", and frequently the result is a recession.And this most common cause of a recession is the current concern.

The economic forecast prepared by the staff for the May FOMC meeting continued to assume that the effects of the expected further tightening in bank credit conditions, amid already tight financial conditions, would lead to a mild recession starting later this year, followed by a moderately paced recovery. Real GDP was projected to decelerate over the next two quarters before declining modestly in both the fourth quarter of this year and the first quarter of next year.And the FOMC members have been essentially projecting a recession for some time (although they avoid using the word "recession"). Here are their March projections for GDP and unemployment.

emphasis added

| GDP projections of Federal Reserve Governors and Reserve Bank presidents, Change in Real GDP1 | ||||

|---|---|---|---|---|

| Projection Date | 2023 | 2024 | 2025 | |

| Mar 2023 | 0.0 to 0.8 | 1.0 to 1.5 | 1.7 to 2.1 | |

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents, Unemployment Rate2 | ||||

|---|---|---|---|---|

| Projection Date | 2023 | 2024 | 2025 | |

| Mar 2023 | 4.0 to 4.7 | 4.3 to 4.9 | 4.3 to 4.8 | |

Since the unemployment rate was at 3.4% in April and depending on the growth of the civilian labor force in 2023, the FOMC is projecting between 800 thousand and 2 million jobs lost over the last two quarters of 2023. That is a clear employment recession.

One of the leading indicators for recessions is the yield curve. Here is a graph of 10-Year Treasury Constant Maturity Minus 2-Year Treasury Constant Maturity from FRED.

One of the leading indicators for recessions is the yield curve. Here is a graph of 10-Year Treasury Constant Maturity Minus 2-Year Treasury Constant Maturity from FRED.Click here for interactive graph at FRED.

My yield-curve indicator has gone Code Red. It is 8 for 8 in forecasting recessions since 1968 —with no false alarms. I have reasons to believe, however, that it is flashing a false signal.

...

The yield curve has now inverted for a ninth time since 1968. Does it spell doom? I am not so sure.

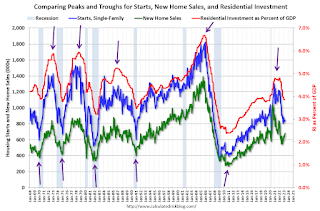

The arrows point to some of the earlier peaks and troughs for these three measures - and the most recent peak.

The arrows point to some of the earlier peaks and troughs for these three measures - and the most recent peak.New home sales peaked in 2020 as pandemic buying soared. Then new home sales and single-family starts turned down in 2021, but that was partly due to the huge surge in sales during the pandemic. In 2022, both new home sales and single-family starts turned down in response to higher mortgage rates. Residential investment has also peaked.

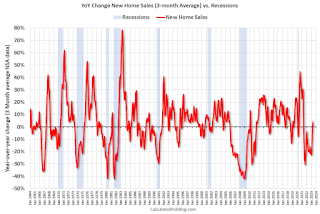

This third graph shows the YoY change in New Home Sales from the Census Bureau. Currently new home sales (based on 3-month average) are up 4% year-over-year!

This third graph shows the YoY change in New Home Sales from the Census Bureau. Currently new home sales (based on 3-month average) are up 4% year-over-year!

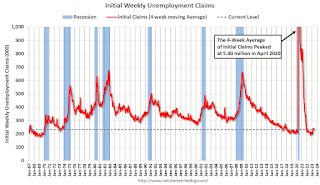

A short term leading indicator I'll be watching is the 4-week average of unemployment claims.

A short term leading indicator I'll be watching is the 4-week average of unemployment claims.