by Calculated Risk on 5/03/2023 08:21:00 AM

Wednesday, May 03, 2023

ADP: Private Employment Increased 296,000 in April

Private sector employment increased by 296,000 jobs in April and annual pay was up 6.7 percent year-over-year, according to the April ADP® National Employment ReportTM produced by the ADP Research Institute® in collaboration with the Stanford Digital Economy Lab (“Stanford Lab”).This was way above the consensus forecast of 135,000. The BLS report will be released Friday, and the consensus is for 178 thousand non-farm payroll jobs added in April.

...

“The slowdown in pay growth gives the clearest signal of what's going on in the labor market right now,” said Nela Richardson, chief economist, ADP. “Employers are hiring aggressively while holding pay gains in check as workers come off the sidelines. Our data also shows fewer people are switching jobs.”

emphasis added

MBA: Mortgage Applications Decreased in Weekly Survey

by Calculated Risk on 5/03/2023 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 1.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending April 28, 2023.

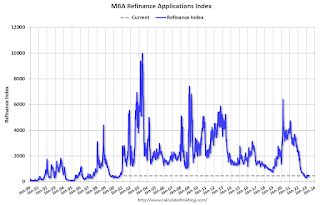

The Market Composite Index, a measure of mortgage loan application volume, decreased 1.2 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 0.4 percent compared with the previous week. The Refinance Index increased 1 percent from the previous week and was 51 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier. The unadjusted Purchase Index decreased 1 percent compared with the previous week and was 32 percent lower than the same week one year ago.

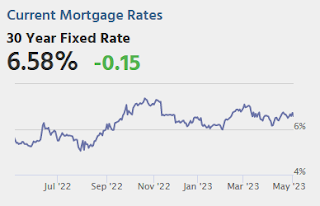

“Mortgage applications decreased last week, despite rates declining slightly for the first time in three weeks. The 30-year fixed rate decreased five basis points to 6.5 percent, which is still 114 basis points higher than a year ago,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Elevated rates continue to both impact homebuyer affordability and weaken demand for refinancing. Home purchase activity has been very sensitive to rates and local market trends, including the very low supply of existing-home inventory. However, newly constructed homes account for a growing share of inventory, giving more options for prospective buyers.”

Added Kan, “The jumbo-conforming spread continues to narrow, an indication that there is reduced lender appetite for jumbo loans following the recent turmoil in the banking sector and heightened concerns about liquidity. The spread was 13 basis points last week, after being as wide as 64 basis points in November 2022.”

..

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($726,200 or less) decreased to 6.50 percent from 6.55 percent, with points remaining at 0.63 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

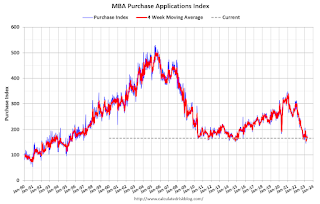

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is down 32% year-over-year unadjusted.

Tuesday, May 02, 2023

Wednesday: FOMC Statement, ISM Services, ADP Employment, HVS Vacancies and Homeownership

by Calculated Risk on 5/02/2023 09:01:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for April. This report is for private payrolls only (no government). The consensus is for 135,000 payroll jobs added in April, down from 145,000 added in March.

• At 10:00 AM, the Q1 2023 Housing Vacancies and Homeownership from the Census Bureau.

• Also at 10:00 AM, the ISM Services Index for April. The consensus is for a reading of 51.7, up from 51.2.

• At 2:00 PM, FOMC Meeting Announcement. The FOMC is expected to raise the Fed Funds rate by 25bp at this meeting and indicate a likely "pause" in June.

• At 2:30 PM, Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

Vehicles Sales at 15.91 million SAAR in April; Up 11.4% YoY

by Calculated Risk on 5/02/2023 06:17:00 PM

Wards Auto released their estimate of light vehicle sales for April: U.S. Light-Vehicle Sales Continue to Surprise on High Side (pay site).

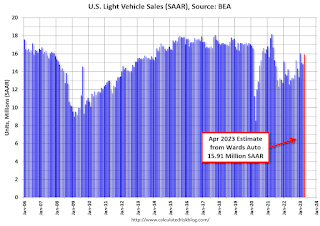

Wards Auto estimates sales of 15.91 million SAAR in April 2023 (Seasonally Adjusted Annual Rate), up 7.4% from the March sales rate, and up 11.4% from April 2022.

Click on graph for larger image.

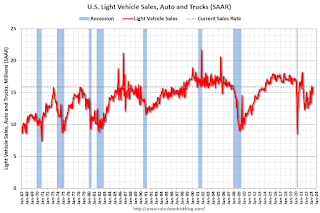

Click on graph for larger image.This graph shows light vehicle sales since 2006 from the BEA (blue) and Wards Auto's estimate for April (red).

The impact of COVID-19 was significant, and April 2020 was the worst month. After April 2020, sales increased, and were close to sales in 2019 (the year before the pandemic). However, sales decreased in 2021 due to supply issues. The "supply chain bottom" was in September 2021.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

The second graph shows light vehicle sales since the BEA started keeping data in 1967. Sales in April were well above the consensus forecast.

Lawler: Invitation Homes Net Seller of Single-Family Properties for Second Straight Quarter

by Calculated Risk on 5/02/2023 03:30:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Lawler: AMH Net Seller of Existing Single-Family Homes, “Investor” Home Purchases Plunged

Brief excerpt:

Housing economist Tom Lawler brings us some interesting data from Invitation Homes and also from several public builders:There is much more in the post. You can subscribe at https://calculatedrisk.substack.com/.

Invitation Homes Net Seller of SF Properties for Second Straight Quarter; Rent Growth Slows but Remains Elevated

Invitation Homes, the largest publicly-traded holder of single-family properties, reported that it disposed of slightly more single-family properties than it acquired last quarter, and that most of the small number of properties it acquired last quarter were from “builder partners.” According to its press release, Invitation Homes (including its joint ventures) acquired 197 SF properties in the quarter ended 3/31/2023 (of which 151 were from builder partners), and disposed of 297 SF properties. By comparison, in the previous quarter the company (including JVs) acquired 166 properties (81 from builder partners) and disposed of 199 SF properties. As a result, the company’s total SF rental property holdings declined for the second straight quarter last quarter. Here is a table showing acquisitions, dispositions, and total SF properties held by Invitation Homes (including joint ventures).

A Policy Proposal to Increase the Utilization of the Current Housing Stock

by Calculated Risk on 5/02/2023 02:04:00 PM

Today, in the Calculated Risk Real Estate Newsletter: A Policy Proposal to Increase the Utilization of the Current Housing Stock

A brief excerpt:

Here is a policy proposal that will likely help increase inventory in many areas (especially in high-cost areas) and would increase the utilization of the current housing stock.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

BLS: Job Openings Decreased to 9.6 million in March

by Calculated Risk on 5/02/2023 10:06:00 AM

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings decreased to 9.6 million on the last business day of March, the U.S. Bureau of Labor Statistics reported today. Over the month, the number of hires and total separations were little changed at 6.1 million and 5.9 million, respectively. Within separations, quits (3.9 million) changed little, while layoffs and discharges (1.8 million) increased.The following graph shows job openings (black line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for March the employment report this Friday will be for April.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are usually pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

The spike in layoffs and discharges in March 2020 is labeled, but off the chart to better show the usual data.

Jobs openings decreased in March to 9.6 million from 10.0 million in February.

The number of job openings (black) were down 20% year-over-year.

Quits were down 14% year-over-year. These are voluntary separations. (See light blue columns at bottom of graph for trend for "quits").

CoreLogic: House Prices up 3.1% YoY in March, Lowest Annual Growth Rate since early 2012

by Calculated Risk on 5/02/2023 08:38:00 AM

Notes: This CoreLogic House Price Index report is for March. The recent Case-Shiller index release was for February. The CoreLogic HPI is a three-month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic: March US Annual Home Price Growth Dips to Lowest Rate in More Than a Decade

CoreLogic® ... today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for March 2023.This index was up 4.4% YoY in February.

U.S. home price growth fell to 3.1% in March, the lowest rate of appreciation since the spring of 2012. While home price growth rose for the 134th consecutive month, it declined from one year earlier in 10 states, mostly those in the West, which partially reflects the region’s lack of affordability and continued inventory shortages. Also, demand for higher-priced homes is slowing compared with median-priced homes, thus pulling appreciation down in that region at a faster pace.

Some potential homebuyers remain hesitant due to inflation; slowing job gains and wage growth; a potential recession; and interest rates that are still elevated above a mortgage rate of 5.5% that would likely attract more buyers to the market. As a result of these conditions, CoreLogic projects that U.S. annual home price growth will continue to decline over the spring and early summer before picking back up later in 2023.

“While housing markets across the country continue to send mixed signals, prices in many large metros appeared to have turned the corner, with the U.S. recording a second month of consecutive monthly gains,” said Selma Hepp, chief economist at CoreLogic. “At 1.6%, the month-over-month increase was twice the average seen between 2015 and 2020.”

“The monthly rebound in home prices underscores the lack of inventory in this housing cycle,” Hepp continued. “In addition, while the lack of affordability generally weighs on home price growth, mobility resulting from remote working conditions appears to be a current driver of home prices in some areas of the country.”

...

U.S. home prices (including distressed sales) increased by 3.1% year over year in March 2023 compared with March 2022. On a month-over-month basis, home prices increased by 1.6% compared with February 2023.

emphasis added

Monday, May 01, 2023

Tuesday: Job Openings, Vehicle Sales

by Calculated Risk on 5/01/2023 09:01:00 PM

There are different levels of "failure" and the resolution that arrived today is one of the more palatable versions. In other words, things didn't end as poorly as they might have, so investors were able to lighten up on the bonds that were previously purchased as a safe haven.Tuesday:

That was how the day began for rates, but it got worse after a key economic report on the manufacturing sector came in stronger than expected. In general, strong economic data puts upward pressure on rates.

The average lender moved at least an eighth of a percent higher for a conventional 30yr fixed. [30 year fixed 6.73%]

emphasis added

• At 8:00 AM ET, Corelogic House Price index for March.

• At 10:00 AM, Job Openings and Labor Turnover Survey for March from the BLS.

• All day, Light vehicle sales for April. The expectation is for light vehicle sales to be 14.8 million SAAR in April, unchanged from 14.8 million in March (Seasonally Adjusted Annual Rate).

Secretary Yellen to Speaker McCarthy: "unable to continue to satisfy all of the government’s obligations by early June"

by Calculated Risk on 5/01/2023 06:12:00 PM

From Treasury Secretary Janet Yellen to Speaker McCarthy:

"After reviewing recent federal tax receipts, our best estimate is that we will be unable to continue to satisfy all of the government's obligations by early June, and potentially as early as June 1, if Congress does not raise or suspend the debt limit before that time."The following is relevant today.

From Federal Reserve Staff in 2013 on the debt ceiling debate: Possible Macroeconomic Effects of a Temporary Federal Debt Default. Excerpts:

Key considerations in evaluating the consequences of a debt defaultUsually the debt ceiling (I prefer "default ceiling") is raised with a clean bill. It is up to Congress. As Senator Mitch McConnell noted in 2011, if the debt ceiling isn't raised the "Republican brand" would become toxic and synonymous with fiscal irresponsibility.

• Such an event would be unprecedented. Although other countries have defaulted on their sovereign debt, these defaults occurred in situations where the government could not feasibly continue to service its debt. Failure to raise the U.S. federal debt ceiling, in contrast, would be a voluntary decision to stop meeting the government’s obligations even though it has no problems doing so. In addition, no other nation that defaulted on its sovereign debt ever enjoyed two key features of the U.S. economy—Treasury securities are the world’s “safe” asset and the dollar is the world’s main reserve currency. For these reasons, we have essentially no historical experience to help us predict the likely consequences of a failure by the Congress and the Administration to raise the debt ceiling.

• The financial market effects of a debt default would be highly uncertain, both because of its unprecedented nature, and because (as events in recent years have illustrated) we have only a limited understanding of the dynamics of the financial system when hit with a major shock.

o Yields on Treasury securities could rise noticeably, even if the default lasted only a day or two. And if the debt limit impasse dragged on for weeks, it could conceivably lead investors to demand a premium similar to that paid on AAA corporate bonds.

o Given that Treasury yields serve as a benchmark rate for the pricing of other securities, and given that a prolonged stand-off would probably make the general economic outlook much more uncertain, private interest rates could rise sharply. Rising interest rates and risk premiums would in turn push stock prices down appreciably.

o In some extreme scenarios with a prolonged default, financial markets could be severely impaired. For example, the functioning of the repo market could be compromised and some money market mutual funds could experience liquidity pressures.

o A debt default could also have some international repercussions. For example, a prolonged default might increase the reluctance of investors to hold Treasury securities and perhaps dollar-denominated assets more generally. Although the resulting rebalancing in portfolios might be relatively gradual, it could lead to a decline in the dollar over time (although a sudden drop could not be ruled out) and a higher “country-risk” premium on all U.S. assets.

• A debt default would also adversely affect the economy through its direct effects on aggregate income flows and government operations if the impasse in raising the debt limit lasted for several weeks.

o Currently, an extremely large portion of federal government spending is funded through borrowing (in part because tax payments are concentrated in other months). From mid-October through mid-November, for example, only 65 percent of projected spending would be covered by revenues. Thus, 35 percent of government cash outlays would need to be cut if a debt limit accord was not reached until the middle of November.

o Assuming that the Treasury prioritizes its payments to cover all scheduled net interest payments, other federal spending would be temporarily reduced by the following amounts (expressed in nominal terms at an annual rate): $340 billion in nominal federal purchases; $630 billion in Social Security, Medicare, and other transfer payments; and $150 billion in grants to state and local governments.

emphasis added