by Calculated Risk on 12/19/2022 04:00:00 PM

Monday, December 19, 2022

MBA Survey: "Share of Mortgage Loans in Forbearance Remains Flat at 0.70% in November"

Note: This is as of November 30th.

From the MBA: Share of Mortgage Loans in Forbearance Remains Flat at 0.70% in November

The Mortgage Bankers Association’s (MBA) monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance remained flat relative to the prior month at 0.70% as of November 30, 2022. According to MBA’s estimate, 350,000 homeowners are in forbearance plans.

The share of Fannie Mae and Freddie Mac loans in forbearance increased 1 basis point to 0.32%. Ginnie Mae loans in forbearance increased 5 basis points to 1.46%, and the forbearance share for portfolio loans and private-label securities (PLS) declined 6 basis points to 0.97%.

“There were pockets of weakness in the November data, despite the forbearance rate remaining unchanged and the overall loan performance of serviced loans staying mostly flat,” said Marina Walsh, CMB, MBA’s Vice President of Industry Analysis. “The forbearance rate for Ginnie Mae loans increased for the fourth consecutive month, and the overall performance of the portfolio declined for the third consecutive month. Furthermore, the performance of government post-forbearance workouts also weakened.”

Added Walsh, “With many indicators pointing to a recession and higher unemployment in 2023, many of the most vulnerable homeowners will be those with FHA, VA, or other government loans. Loss mitigation options may help to ease the financial hardship for these homeowners.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time.

The share of forbearance plans had been decreasing, although the percent in forbearance was unchanged in November. At the end of November, there were about 350,000 homeowners in forbearance plans.

4th Look at Local Housing Markets in November; California Sales off 48% YoY

by Calculated Risk on 12/19/2022 11:16:00 AM

Today, in the Calculated Risk Real Estate Newsletter: 4th Look at Local Housing Markets in November; California Sales off 48% YoY

A brief excerpt:

Here is a table comparing the year-over-year Not Seasonally Adjusted (NSA) declines in sales this year from the National Association of Realtors® (NAR) with the local markets I track. So far, these measures have tracked closely, and the preliminary data below suggests a sharp decline in sales in November.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

NOTE: Housing economist Tom Lawler expects the NAR to report sales of 4.16 million SAAR for November (the NAR reports this coming Wednesday). The consensus is for the NAR to report 4.20 million. (Lawler has an excellent track record).

Sales in some of the hottest markets are down around 40% YoY (all of California was down 47.7%), whereas in other markets, sales are only down in around 20% YoY.

In November, sales were down 36.3% in these markets. In October, these same markets were down 28.6% YoY Not Seasonally Adjusted (NSA).

Note that in November 2022, there were the same number of selling days as in November 2021, so the SA decline will be similar to the NSA decline. And this suggests another significant step down in sales in November!

...

More local markets to come!

NAHB: Builder Confidence Decreased Further in December

by Calculated Risk on 12/19/2022 10:06:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 31, down from 33 last month. Any number below 50 indicates that more builders view sales conditions as poor than good.

From the NAHB: Reflecting a Weakening Housing Market, Builder Confidence Declined Every Month in 2022

High mortgage rates, elevated construction costs running well above the inflation rate and flagging consumer demand due to deteriorating affordability conditions have dragged builder sentiment down every month in 2022.

Builder confidence in the market for newly built single-family homes posted its 12th straight monthly decline in December, dropping two points to 31, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI) released today. This is the lowest confidence reading since mid-2012, with the exception of the onset of the pandemic in the spring of 2020.

“In this high inflation, high mortgage rate environment, builders are struggling to keep housing affordable for home buyers,” said NAHB Chairman Jerry Konter, a home builder and developer from Savannah, Ga. “Our latest survey shows 62% of builders are using incentives to bolster sales, including providing mortgage rate buy-downs, paying points for buyers and offering price reductions. But with construction costs up more than 30% since inflation began to take off at the beginning of the year, there is little room for builders to cut prices. Only 35% of builders reduced homes prices in December, edging down from 36% in November. The average price reduction was 8%, up from 5% or 6% earlier in the year.”

“The silver lining in this HMI report is that it is the smallest drop in the index in the past six months, indicating that we are possibly nearing the bottom of the cycle for builder sentiment,” said NAHB Chief Economist Robert Dietz. “Mortgage rates are down from above 7% in recent weeks to about 6.3% today, and for the first time since April, builders registered an increase in future sales expectations.”

Dietz added that in this tenuous economic climate, builders still need to plan a year or more out when thinking about land and construction timelines.“NAHB is expecting weaker housing conditions to persist in 2023, and we forecast a recovery coming in 2024, given the existing nationwide housing deficit of 1.5 million units and future, lower mortgage rates anticipated with the Fed easing monetary policy in 2024.”

...

The HMI index gauging current sales conditions fell three points to 36 and traffic of prospective buyers held steady at 20. The component charting sales expectations in the next six months increased four points to 35.

Looking at the three-month moving averages for regional HMI scores, the Northeast fell five points to 37, the Midwest dropped four points to 34, the South fell six points to 36 and the West posted a three-point decline to 26.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the NAHB index since Jan 1985.

This was below the consensus forecast, and the lowest level since 2012 (excluding the one month low at the beginning of the pandemic).

Housing December 19th Weekly Update: Inventory Decreased 2.5% Week-over-week

by Calculated Risk on 12/19/2022 08:41:00 AM

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

1. The seasonal bottom (happened on March 4, 2022, for Altos) ✅

2. Inventory up year-over-year (happened on May 20, 2022, for Altos) ✅

3. Inventory up compared to 2020 (happened on October 7, 2022, for Altos) ✅

4. Inventory up compared to 2019 (currently down 35.0%).

Mike Simonsen discusses this data regularly on Youtube.

Four High Frequency Indicators for the Economy

by Calculated Risk on 12/19/2022 08:29:00 AM

These indicators are mostly for travel and entertainment. It was interesting to watch these sectors recover as the pandemic impact subsided.

The TSA is providing daily travel numbers.

This data is as of December 18th.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Black), 2021 (Blue) and 2022 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is 8.1% below the same week in 2019 (91.9% of 2019). (Dashed line)

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $50 million last week, down about 59% from the median for the week.

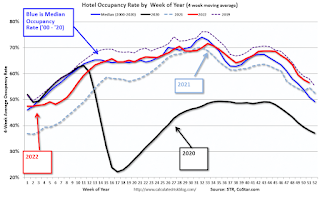

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average. The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

This data is through Dec 10th. The occupancy rate was down 1.2% compared to the same week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

Blue is for 2020. Purple is for 2021, and Red is for 2022.

As of December 9th, gasoline supplied was down 7.1% compared to the same week in 2019.

Recently gasoline supplied has been running below 2019 and 2021 levels - and sometimes below 2020.

Sunday, December 18, 2022

Sunday Night Futures

by Calculated Risk on 12/18/2022 08:28:00 PM

Weekend:

• Schedule for Week of December 18, 2022

Monday:

• At 10:00 AM ET, The December NAHB homebuilder survey. The consensus is for a reading of 33, unchanged from 33. Any number below 50 indicates that more builders view sales conditions as poor than good.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 8, and DOW futures are up 46 (fair value).

Oil prices were up over the last week with WTI futures at $74.29 per barrel and Brent at $79.04 per barrel. A year ago, WTI was at $71, and Brent was at $73 - so WTI oil prices are up 5% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.09 per gallon. A year ago, prices were at $3.28 per gallon, so gasoline prices are down $0.19 per gallon year-over-year.

Existing Home Sales: Lawler vs. the Consensus

by Calculated Risk on 12/18/2022 10:50:00 AM

Housing economist Tom Lawler has been sending me his predictions of what the NAR will report for over 12 years. And he has graciously allowed me to share his predictions with the readers of this blog.

The table below shows the consensus for each month, Lawler's predictions, and the NAR's initially reported level of sales. Lawler hasn't always been closer than the consensus, but usually when there has been a fairly large spread between Lawler's estimate and the "consensus", Lawler has been closer.

Over the last 12+ years, the consensus average miss was 145 thousand, and Lawler's average miss was 72 thousand.

| Existing Home Sales, Forecasts and NAR Report millions, seasonally adjusted annual rate basis (SAAR) | |||

|---|---|---|---|

| Month | Consensus | Lawler | NAR reported1 |

| May-10 | 6.20 | 5.83 | 5.66 |

| Jun-10 | 5.30 | 5.30 | 5.37 |

| Jul-10 | 4.66 | 3.95 | 3.83 |

| Aug-10 | 4.10 | 4.10 | 4.13 |

| Sep-10 | 4.30 | 4.50 | 4.53 |

| Oct-10 | 4.50 | 4.46 | 4.43 |

| Nov-10 | 4.85 | 4.61 | 4.68 |

| Dec-10 | 4.90 | 5.13 | 5.28 |

| Jan-11 | 5.20 | 5.17 | 5.36 |

| Feb-11 | 5.15 | 5.00 | 4.88 |

| Mar-11 | 5.00 | 5.08 | 5.10 |

| Apr-11 | 5.20 | 5.15 | 5.05 |

| May-11 | 4.75 | 4.80 | 4.81 |

| Jun-11 | 4.90 | 4.71 | 4.77 |

| Jul-11 | 4.92 | 4.69 | 4.67 |

| Aug-11 | 4.75 | 4.92 | 5.03 |

| Sep-11 | 4.93 | 4.83 | 4.91 |

| Oct-11 | 4.80 | 4.86 | 4.97 |

| Nov-11 | 5.08 | 4.40 | 4.42 |

| Dec-11 | 4.60 | 4.64 | 4.61 |

| Jan-12 | 4.69 | 4.66 | 4.57 |

| Feb-12 | 4.61 | 4.63 | 4.59 |

| Mar-12 | 4.62 | 4.59 | 4.48 |

| Apr-12 | 4.66 | 4.53 | 4.62 |

| May-12 | 4.57 | 4.66 | 4.55 |

| Jun-12 | 4.65 | 4.56 | 4.37 |

| Jul-12 | 4.50 | 4.47 | 4.47 |

| Aug-12 | 4.55 | 4.87 | 4.82 |

| Sep-12 | 4.75 | 4.70 | 4.75 |

| Oct-12 | 4.74 | 4.84 | 4.79 |

| Nov-12 | 4.90 | 5.10 | 5.04 |

| Dec-12 | 5.10 | 4.97 | 4.94 |

| Jan-13 | 4.90 | 4.94 | 4.92 |

| Feb-13 | 5.01 | 4.87 | 4.98 |

| Mar-13 | 5.03 | 4.89 | 4.92 |

| Apr-13 | 4.92 | 5.03 | 4.97 |

| May-13 | 5.00 | 5.20 | 5.18 |

| Jun-13 | 5.27 | 4.99 | 5.08 |

| Jul-13 | 5.13 | 5.33 | 5.39 |

| Aug-13 | 5.25 | 5.35 | 5.48 |

| Sep-13 | 5.30 | 5.26 | 5.29 |

| Oct-13 | 5.13 | 5.08 | 5.12 |

| Nov-13 | 5.02 | 4.98 | 4.90 |

| Dec-13 | 4.90 | 4.96 | 4.87 |

| Jan-14 | 4.70 | 4.67 | 4.62 |

| Feb-14 | 4.64 | 4.60 | 4.60 |

| Mar-14 | 4.56 | 4.64 | 4.59 |

| Apr-14 | 4.67 | 4.70 | 4.65 |

| May-14 | 4.75 | 4.81 | 4.89 |

| Jun-14 | 4.99 | 4.96 | 5.04 |

| Jul-14 | 5.00 | 5.09 | 5.15 |

| Aug-14 | 5.18 | 5.12 | 5.05 |

| Sep-14 | 5.09 | 5.14 | 5.17 |

| Oct-14 | 5.15 | 5.28 | 5.26 |

| Nov-14 | 5.20 | 4.90 | 4.93 |

| Dec-14 | 5.05 | 5.15 | 5.04 |

| Jan-15 | 5.00 | 4.90 | 4.82 |

| Feb-15 | 4.94 | 4.87 | 4.88 |

| Mar-15 | 5.04 | 5.18 | 5.19 |

| Apr-15 | 5.22 | 5.20 | 5.04 |

| May-15 | 5.25 | 5.29 | 5.35 |

| Jun-15 | 5.40 | 5.45 | 5.49 |

| Jul-15 | 5.41 | 5.64 | 5.59 |

| Aug-15 | 5.50 | 5.54 | 5.31 |

| Sep-15 | 5.35 | 5.56 | 5.55 |

| Oct-15 | 5.41 | 5.33 | 5.36 |

| Nov-15 | 5.32 | 4.97 | 4.76 |

| Dec-15 | 5.19 | 5.36 | 5.46 |

| Jan-16 | 5.32 | 5.36 | 5.47 |

| Feb-16 | 5.30 | 5.20 | 5.08 |

| Mar-16 | 5.27 | 5.27 | 5.33 |

| Apr-16 | 5.40 | 5.44 | 5.45 |

| May-16 | 5.64 | 5.55 | 5.53 |

| Jun-16 | 5.48 | 5.62 | 5.57 |

| Jul-16 | 5.52 | 5.41 | 5.39 |

| Aug-16 | 5.44 | 5.49 | 5.33 |

| Sep-16 | 5.35 | 5.55 | 5.47 |

| Oct-16 | 5.44 | 5.47 | 5.60 |

| Nov-16 | 5.54 | 5.60 | 5.61 |

| Dec-16 | 5.54 | 5.55 | 5.49 |

| Jan-17 | 5.55 | 5.60 | 5.69 |

| Feb-17 | 5.55 | 5.41 | 5.48 |

| Mar-17 | 5.61 | 5.74 | 5.71 |

| Apr-17 | 5.67 | 5.56 | 5.57 |

| May-17 | 5.55 | 5.65 | 5.62 |

| Jun-17 | 5.58 | 5.59 | 5.52 |

| Jul-17 | 5.57 | 5.38 | 5.44 |

| Aug-17 | 5.48 | 5.39 | 5.35 |

| Sep-17 | 5.30 | 5.38 | 5.39 |

| Oct-17 | 5.30 | 5.60 | 5.48 |

| Nov-17 | 5.52 | 5.77 | 5.81 |

| Dec-17 | 5.75 | 5.66 | 5.57 |

| Jan-18 | 5.65 | 5.48 | 5.38 |

| Feb-18 | 5.42 | 5.44 | 5.54 |

| Mar-18 | 5.28 | 5.51 | 5.60 |

| Apr-18 | 5.60 | 5.48 | 5.46 |

| May-18 | 5.56 | 5.47 | 5.43 |

| Jun-18 | 5.45 | 5.35 | 5.38 |

| Jul-18 | 5.43 | 5.40 | 5.34 |

| Aug-18 | 5.36 | 5.36 | 5.34 |

| Sep-18 | 5.30 | 5.20 | 5.15 |

| Oct-18 | 5.20 | 5.31 | 5.22 |

| Nov-18 | 5.19 | 5.23 | 5.32 |

| Dec-18 | 5.24 | 4.97 | 4.99 |

| Jan-19 | 5.05 | 4.92 | 4.94 |

| Feb-19 | 5.08 | 5.46 | 5.51 |

| Mar-19 | 5.30 | 5.40 | 5.21 |

| Apr-19 | 5.36 | 5.31 | 5.19 |

| May-19 | 5.29 | 5.40 | 5.34 |

| Jun-19 | 5.34 | 5.25 | 5.27 |

| Jul-19 | 5.39 | 5.40 | 5.42 |

| Aug-19 | 5.38 | 5.42 | 5.49 |

| Sep-19 | 5.45 | 5.36 | 5.38 |

| Oct-19 | 5.49 | 5.36 | 5.46 |

| Nov-19 | 5.45 | 5.43 | 5.35 |

| Dec-19 | 5.43 | 5.40 | 5.54 |

| Jan-20 | 5.45 | 5.42 | 5.46 |

| Feb-20 | 5.50 | 5.58 | 5.77 |

| Mar-20 | 5.30 | 5.25 | 5.27 |

| Apr-20 | 4.30 | 4.17 | 4.33 |

| May-20 | 4.38 | 3.80 | 3.91 |

| Jun-20 | 4.86 | 4.65 | 4.72 |

| Jul-20 | 5.39 | 5.85 | 5.86 |

| Aug-20 | 6.00 | 5.92 | 6.00 |

| Sep-20 | 6.25 | 6.38 | 6.54 |

| Oct-20 | 6.45 | 6.63 | 6.85 |

| Nov-20 | 6.70 | 6.50 | 6.69 |

| Dec-20 | 6.55 | 6.62 | 6.76 |

| Jan-21 | 6.60 | 6.48 | 6.69 |

| Feb-21 | 6.51 | 6.29 | 6.22 |

| Mar-21 | 6.17 | 6.02 | 6.01 |

| Apr-21 | 6.09 | 5.96 | 5.85 |

| May-21 | 5.74 | 5.78 | 5.80 |

| Jun-21 | 5.90 | 5.79 | 5.86 |

| Jul-21 | 5.84 | 5.86 | 5.99 |

| Aug-21 | 5.88 | 5.90 | 5.88 |

| Sep-21 | 6.06 | 6.20 | 6.29 |

| Oct-21 | 6.20 | 6.34 | 6.34 |

| Nov-21 | 6.20 | 6.45 | 6.46 |

| Dec-21 | 6.45 | 6.33 | 6.18 |

| Jan-22 | 6.12 | 6.36 | 6.50 |

| Feb-22 | 6.16 | 5.97 | 6.02 |

| Mar-22 | 5.80 | 5.74 | 5.77 |

| Apr-22 | 5.62 | 5.57 | 5.61 |

| May-22 | 5.41 | 5.35 | 5.41 |

| Jun-22 | 5.40 | 5.12 | 5.12 |

| Jul-22 | 4.88 | 4.90 | 4.81 |

| Aug-22 | 4.70 | 4.84 | 4.80 |

| Sep-22 | 4.69 | 4.82 | 4.71 |

| Oct-22 | 4.39 | 4.49 | 4.43 |

| Nov-22 | 4.20 | 4.16 | NA |

| 1NAR initially reported before revisions. | |||

Saturday, December 17, 2022

Real Estate Newsletter Articles this Week: Another Step Down for Sales in November

by Calculated Risk on 12/17/2022 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Lawler: Early Read on Existing Home Sales in November

• 3rd Look at Local Housing Markets in November

• Current State of the Housing Market; Overview for mid-December

• Housing, Inflation and Why the Fed Should Consider a Pause

• 2nd Look at Local Housing Markets in November

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Most content is available for free (and no Ads), but please subscribe!

Schedule for Week of December 18, 2022

by Calculated Risk on 12/17/2022 08:11:00 AM

The key economic reports this week are Housing Starts, New Home Sales, Existing Home Sales, the 3rd estimate of Q3 GDP, and November Personal income and outlays.

10:00 AM: The December NAHB homebuilder survey. The consensus is for a reading of 33, unchanged from 33. Any number below 50 indicates that more builders view sales conditions as poor than good.

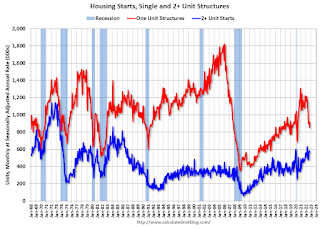

8:30 AM: Housing Starts for November.

8:30 AM: Housing Starts for November. This graph shows single and multi-family housing starts since 1968.

The consensus is for 1.400 million SAAR, down from 1.425 million SAAR.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

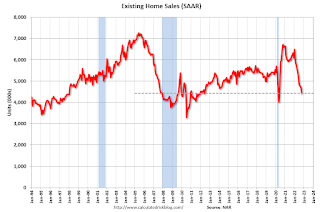

10:00 AM: Existing Home Sales for November from the National Association of Realtors (NAR). The consensus is for 4.20 million SAAR, down from 4.43 million.

10:00 AM: Existing Home Sales for November from the National Association of Realtors (NAR). The consensus is for 4.20 million SAAR, down from 4.43 million.The graph shows existing home sales from 1994 through the report last month.

Housing economist Tom Lawler expects the NAR to report sales of 4.16 million SAAR for November.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 225 thousand initial claims, up from 211 thousand last week.

8:30 AM: Gross Domestic Product, 3rd quarter 2022 (Third estimate). The consensus is for real GDP at 2.9% annualized, unchanged from the second estimate of 2.9%.

8:30 AM: Chicago Fed National Activity Index for November. This is a composite index of other data.

11:00 AM: the Kansas City Fed manufacturing survey for December.

8:30 AM: Durable Goods Orders for November. The consensus is for a 0.1% increase..

8:30 AM: Personal Income and Outlays for November. The consensus is for a 0.2% increase in personal income, and for a 0.2% increase in personal spending. And for a 0.3% increase in the PCE prices index, and the Core PCE price index to increase 0.2%. PCE prices are expected to be up 5.7% YoY, and core PCE prices up 4.7% YoY.

10:00 AM: New Home Sales for November from the Census Bureau.

10:00 AM: New Home Sales for November from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 595 thousand SAAR, down from 632 thousand in October.

10:00 AM: University of Michigan's Consumer sentiment index (Final for December).

10:00 AM: State Employment and Unemployment (Monthly) for November 2022

Friday, December 16, 2022

COVID Dec 16, 2022: Update on Cases, Hospitalizations and Deaths

by Calculated Risk on 12/16/2022 09:41:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Week2 | 455,466 | 469,240 | ≤35,0001 | |

| Hospitalized2🚩 | 31,599 | 30,000 | ≤3,0001 | |

| Deaths per Week2 | 3,115 | 2,703 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Cases, Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

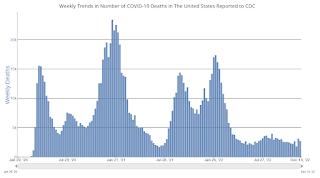

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.