by Calculated Risk on 12/19/2022 08:41:00 AM

Monday, December 19, 2022

Housing December 19th Weekly Update: Inventory Decreased 2.5% Week-over-week

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

1. The seasonal bottom (happened on March 4, 2022, for Altos) ✅

2. Inventory up year-over-year (happened on May 20, 2022, for Altos) ✅

3. Inventory up compared to 2020 (happened on October 7, 2022, for Altos) ✅

4. Inventory up compared to 2019 (currently down 35.0%).

Mike Simonsen discusses this data regularly on Youtube.

Four High Frequency Indicators for the Economy

by Calculated Risk on 12/19/2022 08:29:00 AM

These indicators are mostly for travel and entertainment. It was interesting to watch these sectors recover as the pandemic impact subsided.

The TSA is providing daily travel numbers.

This data is as of December 18th.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Black), 2021 (Blue) and 2022 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is 8.1% below the same week in 2019 (91.9% of 2019). (Dashed line)

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $50 million last week, down about 59% from the median for the week.

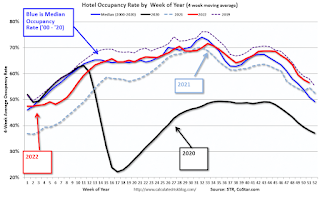

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average. The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

This data is through Dec 10th. The occupancy rate was down 1.2% compared to the same week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

Blue is for 2020. Purple is for 2021, and Red is for 2022.

As of December 9th, gasoline supplied was down 7.1% compared to the same week in 2019.

Recently gasoline supplied has been running below 2019 and 2021 levels - and sometimes below 2020.

Sunday, December 18, 2022

Sunday Night Futures

by Calculated Risk on 12/18/2022 08:28:00 PM

Weekend:

• Schedule for Week of December 18, 2022

Monday:

• At 10:00 AM ET, The December NAHB homebuilder survey. The consensus is for a reading of 33, unchanged from 33. Any number below 50 indicates that more builders view sales conditions as poor than good.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 8, and DOW futures are up 46 (fair value).

Oil prices were up over the last week with WTI futures at $74.29 per barrel and Brent at $79.04 per barrel. A year ago, WTI was at $71, and Brent was at $73 - so WTI oil prices are up 5% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.09 per gallon. A year ago, prices were at $3.28 per gallon, so gasoline prices are down $0.19 per gallon year-over-year.

Existing Home Sales: Lawler vs. the Consensus

by Calculated Risk on 12/18/2022 10:50:00 AM

Housing economist Tom Lawler has been sending me his predictions of what the NAR will report for over 12 years. And he has graciously allowed me to share his predictions with the readers of this blog.

The table below shows the consensus for each month, Lawler's predictions, and the NAR's initially reported level of sales. Lawler hasn't always been closer than the consensus, but usually when there has been a fairly large spread between Lawler's estimate and the "consensus", Lawler has been closer.

Over the last 12+ years, the consensus average miss was 145 thousand, and Lawler's average miss was 72 thousand.

| Existing Home Sales, Forecasts and NAR Report millions, seasonally adjusted annual rate basis (SAAR) | |||

|---|---|---|---|

| Month | Consensus | Lawler | NAR reported1 |

| May-10 | 6.20 | 5.83 | 5.66 |

| Jun-10 | 5.30 | 5.30 | 5.37 |

| Jul-10 | 4.66 | 3.95 | 3.83 |

| Aug-10 | 4.10 | 4.10 | 4.13 |

| Sep-10 | 4.30 | 4.50 | 4.53 |

| Oct-10 | 4.50 | 4.46 | 4.43 |

| Nov-10 | 4.85 | 4.61 | 4.68 |

| Dec-10 | 4.90 | 5.13 | 5.28 |

| Jan-11 | 5.20 | 5.17 | 5.36 |

| Feb-11 | 5.15 | 5.00 | 4.88 |

| Mar-11 | 5.00 | 5.08 | 5.10 |

| Apr-11 | 5.20 | 5.15 | 5.05 |

| May-11 | 4.75 | 4.80 | 4.81 |

| Jun-11 | 4.90 | 4.71 | 4.77 |

| Jul-11 | 4.92 | 4.69 | 4.67 |

| Aug-11 | 4.75 | 4.92 | 5.03 |

| Sep-11 | 4.93 | 4.83 | 4.91 |

| Oct-11 | 4.80 | 4.86 | 4.97 |

| Nov-11 | 5.08 | 4.40 | 4.42 |

| Dec-11 | 4.60 | 4.64 | 4.61 |

| Jan-12 | 4.69 | 4.66 | 4.57 |

| Feb-12 | 4.61 | 4.63 | 4.59 |

| Mar-12 | 4.62 | 4.59 | 4.48 |

| Apr-12 | 4.66 | 4.53 | 4.62 |

| May-12 | 4.57 | 4.66 | 4.55 |

| Jun-12 | 4.65 | 4.56 | 4.37 |

| Jul-12 | 4.50 | 4.47 | 4.47 |

| Aug-12 | 4.55 | 4.87 | 4.82 |

| Sep-12 | 4.75 | 4.70 | 4.75 |

| Oct-12 | 4.74 | 4.84 | 4.79 |

| Nov-12 | 4.90 | 5.10 | 5.04 |

| Dec-12 | 5.10 | 4.97 | 4.94 |

| Jan-13 | 4.90 | 4.94 | 4.92 |

| Feb-13 | 5.01 | 4.87 | 4.98 |

| Mar-13 | 5.03 | 4.89 | 4.92 |

| Apr-13 | 4.92 | 5.03 | 4.97 |

| May-13 | 5.00 | 5.20 | 5.18 |

| Jun-13 | 5.27 | 4.99 | 5.08 |

| Jul-13 | 5.13 | 5.33 | 5.39 |

| Aug-13 | 5.25 | 5.35 | 5.48 |

| Sep-13 | 5.30 | 5.26 | 5.29 |

| Oct-13 | 5.13 | 5.08 | 5.12 |

| Nov-13 | 5.02 | 4.98 | 4.90 |

| Dec-13 | 4.90 | 4.96 | 4.87 |

| Jan-14 | 4.70 | 4.67 | 4.62 |

| Feb-14 | 4.64 | 4.60 | 4.60 |

| Mar-14 | 4.56 | 4.64 | 4.59 |

| Apr-14 | 4.67 | 4.70 | 4.65 |

| May-14 | 4.75 | 4.81 | 4.89 |

| Jun-14 | 4.99 | 4.96 | 5.04 |

| Jul-14 | 5.00 | 5.09 | 5.15 |

| Aug-14 | 5.18 | 5.12 | 5.05 |

| Sep-14 | 5.09 | 5.14 | 5.17 |

| Oct-14 | 5.15 | 5.28 | 5.26 |

| Nov-14 | 5.20 | 4.90 | 4.93 |

| Dec-14 | 5.05 | 5.15 | 5.04 |

| Jan-15 | 5.00 | 4.90 | 4.82 |

| Feb-15 | 4.94 | 4.87 | 4.88 |

| Mar-15 | 5.04 | 5.18 | 5.19 |

| Apr-15 | 5.22 | 5.20 | 5.04 |

| May-15 | 5.25 | 5.29 | 5.35 |

| Jun-15 | 5.40 | 5.45 | 5.49 |

| Jul-15 | 5.41 | 5.64 | 5.59 |

| Aug-15 | 5.50 | 5.54 | 5.31 |

| Sep-15 | 5.35 | 5.56 | 5.55 |

| Oct-15 | 5.41 | 5.33 | 5.36 |

| Nov-15 | 5.32 | 4.97 | 4.76 |

| Dec-15 | 5.19 | 5.36 | 5.46 |

| Jan-16 | 5.32 | 5.36 | 5.47 |

| Feb-16 | 5.30 | 5.20 | 5.08 |

| Mar-16 | 5.27 | 5.27 | 5.33 |

| Apr-16 | 5.40 | 5.44 | 5.45 |

| May-16 | 5.64 | 5.55 | 5.53 |

| Jun-16 | 5.48 | 5.62 | 5.57 |

| Jul-16 | 5.52 | 5.41 | 5.39 |

| Aug-16 | 5.44 | 5.49 | 5.33 |

| Sep-16 | 5.35 | 5.55 | 5.47 |

| Oct-16 | 5.44 | 5.47 | 5.60 |

| Nov-16 | 5.54 | 5.60 | 5.61 |

| Dec-16 | 5.54 | 5.55 | 5.49 |

| Jan-17 | 5.55 | 5.60 | 5.69 |

| Feb-17 | 5.55 | 5.41 | 5.48 |

| Mar-17 | 5.61 | 5.74 | 5.71 |

| Apr-17 | 5.67 | 5.56 | 5.57 |

| May-17 | 5.55 | 5.65 | 5.62 |

| Jun-17 | 5.58 | 5.59 | 5.52 |

| Jul-17 | 5.57 | 5.38 | 5.44 |

| Aug-17 | 5.48 | 5.39 | 5.35 |

| Sep-17 | 5.30 | 5.38 | 5.39 |

| Oct-17 | 5.30 | 5.60 | 5.48 |

| Nov-17 | 5.52 | 5.77 | 5.81 |

| Dec-17 | 5.75 | 5.66 | 5.57 |

| Jan-18 | 5.65 | 5.48 | 5.38 |

| Feb-18 | 5.42 | 5.44 | 5.54 |

| Mar-18 | 5.28 | 5.51 | 5.60 |

| Apr-18 | 5.60 | 5.48 | 5.46 |

| May-18 | 5.56 | 5.47 | 5.43 |

| Jun-18 | 5.45 | 5.35 | 5.38 |

| Jul-18 | 5.43 | 5.40 | 5.34 |

| Aug-18 | 5.36 | 5.36 | 5.34 |

| Sep-18 | 5.30 | 5.20 | 5.15 |

| Oct-18 | 5.20 | 5.31 | 5.22 |

| Nov-18 | 5.19 | 5.23 | 5.32 |

| Dec-18 | 5.24 | 4.97 | 4.99 |

| Jan-19 | 5.05 | 4.92 | 4.94 |

| Feb-19 | 5.08 | 5.46 | 5.51 |

| Mar-19 | 5.30 | 5.40 | 5.21 |

| Apr-19 | 5.36 | 5.31 | 5.19 |

| May-19 | 5.29 | 5.40 | 5.34 |

| Jun-19 | 5.34 | 5.25 | 5.27 |

| Jul-19 | 5.39 | 5.40 | 5.42 |

| Aug-19 | 5.38 | 5.42 | 5.49 |

| Sep-19 | 5.45 | 5.36 | 5.38 |

| Oct-19 | 5.49 | 5.36 | 5.46 |

| Nov-19 | 5.45 | 5.43 | 5.35 |

| Dec-19 | 5.43 | 5.40 | 5.54 |

| Jan-20 | 5.45 | 5.42 | 5.46 |

| Feb-20 | 5.50 | 5.58 | 5.77 |

| Mar-20 | 5.30 | 5.25 | 5.27 |

| Apr-20 | 4.30 | 4.17 | 4.33 |

| May-20 | 4.38 | 3.80 | 3.91 |

| Jun-20 | 4.86 | 4.65 | 4.72 |

| Jul-20 | 5.39 | 5.85 | 5.86 |

| Aug-20 | 6.00 | 5.92 | 6.00 |

| Sep-20 | 6.25 | 6.38 | 6.54 |

| Oct-20 | 6.45 | 6.63 | 6.85 |

| Nov-20 | 6.70 | 6.50 | 6.69 |

| Dec-20 | 6.55 | 6.62 | 6.76 |

| Jan-21 | 6.60 | 6.48 | 6.69 |

| Feb-21 | 6.51 | 6.29 | 6.22 |

| Mar-21 | 6.17 | 6.02 | 6.01 |

| Apr-21 | 6.09 | 5.96 | 5.85 |

| May-21 | 5.74 | 5.78 | 5.80 |

| Jun-21 | 5.90 | 5.79 | 5.86 |

| Jul-21 | 5.84 | 5.86 | 5.99 |

| Aug-21 | 5.88 | 5.90 | 5.88 |

| Sep-21 | 6.06 | 6.20 | 6.29 |

| Oct-21 | 6.20 | 6.34 | 6.34 |

| Nov-21 | 6.20 | 6.45 | 6.46 |

| Dec-21 | 6.45 | 6.33 | 6.18 |

| Jan-22 | 6.12 | 6.36 | 6.50 |

| Feb-22 | 6.16 | 5.97 | 6.02 |

| Mar-22 | 5.80 | 5.74 | 5.77 |

| Apr-22 | 5.62 | 5.57 | 5.61 |

| May-22 | 5.41 | 5.35 | 5.41 |

| Jun-22 | 5.40 | 5.12 | 5.12 |

| Jul-22 | 4.88 | 4.90 | 4.81 |

| Aug-22 | 4.70 | 4.84 | 4.80 |

| Sep-22 | 4.69 | 4.82 | 4.71 |

| Oct-22 | 4.39 | 4.49 | 4.43 |

| Nov-22 | 4.20 | 4.16 | NA |

| 1NAR initially reported before revisions. | |||

Saturday, December 17, 2022

Real Estate Newsletter Articles this Week: Another Step Down for Sales in November

by Calculated Risk on 12/17/2022 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Lawler: Early Read on Existing Home Sales in November

• 3rd Look at Local Housing Markets in November

• Current State of the Housing Market; Overview for mid-December

• Housing, Inflation and Why the Fed Should Consider a Pause

• 2nd Look at Local Housing Markets in November

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Most content is available for free (and no Ads), but please subscribe!

Schedule for Week of December 18, 2022

by Calculated Risk on 12/17/2022 08:11:00 AM

The key economic reports this week are Housing Starts, New Home Sales, Existing Home Sales, the 3rd estimate of Q3 GDP, and November Personal income and outlays.

10:00 AM: The December NAHB homebuilder survey. The consensus is for a reading of 33, unchanged from 33. Any number below 50 indicates that more builders view sales conditions as poor than good.

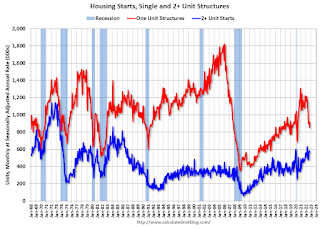

8:30 AM: Housing Starts for November.

8:30 AM: Housing Starts for November. This graph shows single and multi-family housing starts since 1968.

The consensus is for 1.400 million SAAR, down from 1.425 million SAAR.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

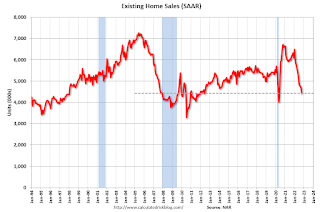

10:00 AM: Existing Home Sales for November from the National Association of Realtors (NAR). The consensus is for 4.20 million SAAR, down from 4.43 million.

10:00 AM: Existing Home Sales for November from the National Association of Realtors (NAR). The consensus is for 4.20 million SAAR, down from 4.43 million.The graph shows existing home sales from 1994 through the report last month.

Housing economist Tom Lawler expects the NAR to report sales of 4.16 million SAAR for November.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 225 thousand initial claims, up from 211 thousand last week.

8:30 AM: Gross Domestic Product, 3rd quarter 2022 (Third estimate). The consensus is for real GDP at 2.9% annualized, unchanged from the second estimate of 2.9%.

8:30 AM: Chicago Fed National Activity Index for November. This is a composite index of other data.

11:00 AM: the Kansas City Fed manufacturing survey for December.

8:30 AM: Durable Goods Orders for November. The consensus is for a 0.1% increase..

8:30 AM: Personal Income and Outlays for November. The consensus is for a 0.2% increase in personal income, and for a 0.2% increase in personal spending. And for a 0.3% increase in the PCE prices index, and the Core PCE price index to increase 0.2%. PCE prices are expected to be up 5.7% YoY, and core PCE prices up 4.7% YoY.

10:00 AM: New Home Sales for November from the Census Bureau.

10:00 AM: New Home Sales for November from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 595 thousand SAAR, down from 632 thousand in October.

10:00 AM: University of Michigan's Consumer sentiment index (Final for December).

10:00 AM: State Employment and Unemployment (Monthly) for November 2022

Friday, December 16, 2022

COVID Dec 16, 2022: Update on Cases, Hospitalizations and Deaths

by Calculated Risk on 12/16/2022 09:41:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Week2 | 455,466 | 469,240 | ≤35,0001 | |

| Hospitalized2🚩 | 31,599 | 30,000 | ≤3,0001 | |

| Deaths per Week2 | 3,115 | 2,703 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Cases, Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

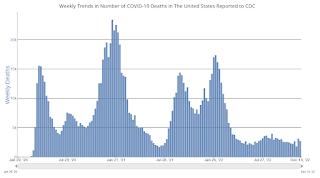

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

California November Existing Home Sales Down Almost 50% YoY, Prices Down YoY

by Calculated Risk on 12/16/2022 03:59:00 PM

From the California Association of Realtors®: Rapid interest rate increases continue to depress California home sales and prices in November, C.A.R. reports

• Existing, single-family home sales totaled 237,740 in November on a seasonally adjusted annualized rate, down 13.2 percent from October and down 47.7 percent from November 2021.

• November’s statewide median home price was $777,500, down 3.0 percent from October and down 0.6 percent from November 2021.

...

Housing demand in California continued to fall as rising interest rates further dampened the state’s housing market in November as home sales registered the lowest annualized pace since October 2007 and the largest year-over-year sales drop in at least the past four decades, the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.) said today.

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 237,740 in November, according to information collected by C.A.R. from more than 90 local REALTOR® associations and MLSs statewide. The statewide annualized sales figure represents what would be the total number of homes sold during 2022 if sales maintained the November pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales. November’s sales pace was down 13.2 percent on a monthly basis from 274,040 in October and down 47.7 percent from a year ago, when 454,450 homes were sold on an annualized basis. The year-to-year sales decline was the biggest since 1980.

Home sales have been on a downward trend for 17 straight months on a year-over-year basis. It was the fourth time in the last five months that sales dropped more than 30 percent from the year-ago level. The monthly 13.2 percent sales decline was worse than the long-run average of -0.5 percent change recorded between an October and a November in the past 43 years. Sales in all price segments dropped more than 40 percent year-over-year, with the $2 million plus price segment falling the most at 47.7percent. The most affordable market (sub-$300,000) experienced the smallest sales drop at 41.4 percent.

...

California’s median home price declined for the third straight month, dropping 3.0 percent in November to $777,500 from the $801,190 recorded in October. November’s price was 0.6 percent lower than the $782,480 recorded last November and marked the first year-over-year price decline in 30 months. The November 2022 price was also the lowest since February 2022.

...

• Housing inventory in California continued to rise both month-to-month and year-to-year as the market entered its holiday season and home sellers remained on the sideline. The statewide unsold inventory index (UII) was unchanged from the prior month at 3.3 months in November, but it was more than doubled the level of 1.6 months recorded in the same month of last year.

emphasis added

LA Port Inbound Traffic Down Sharply in November

by Calculated Risk on 12/16/2022 11:38:00 AM

Notes: The expansion to the Panama Canal was completed in 2016 (As I noted a few years ago), and some of the traffic that used the ports of Los Angeles and Long Beach is probably going through the canal. This might be impacting TEUs on the West Coast.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

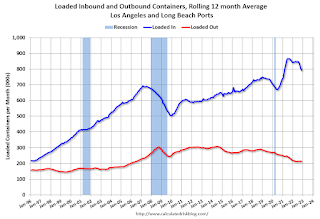

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12-month average.

On a rolling 12-month basis, inbound traffic decreased 2.1% in November compared to the rolling 12 months ending in October. Outbound traffic increased 0.9% compared to the rolling 12 months ending the previous month.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Lawler: Early Read on Existing Home Sales in November

by Calculated Risk on 12/16/2022 09:44:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Lawler: Early Read on Existing Home Sales in November

A brief excerpt:

From housing economist Tom Lawler:There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

Based on publicly available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 4.16 million in November, down 6.1% from October’s preliminary pace and down 34.3%% from last November’s seasonally adjusted pace. On an unadjusted basis the YOY % decline in sales was largest in the West, and smallest in the Northeast and Midwest.