by Calculated Risk on 12/28/2021 09:11:00 AM

Tuesday, December 28, 2021

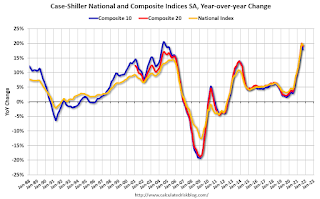

Case-Shiller: National House Price Index increased 19.1% year-over-year in October

S&P/Case-Shiller released the monthly Home Price Indices for October ("October" is a 3-month average of August, September and October prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

From S&P: S&P Corelogic Case-Shiller Index Reports 19.1% Annual Home Price Gain in October

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 19.1% annual gain in October, down from 19.7% in the previous month. The 10- City Composite annual increase came in at 17.1%, down from 17.9% in the previous month. The 20- City Composite posted an 18.4% year-over-year gain, down from 19.1% in the previous month.

Phoenix, Tampa, and Miami reported the highest year-over-year gains among the 20 cities in October. Phoenix led the way with a 32.3% year-over-year price increase, followed by Tampa with a 28.1% increase and Miami with a 25.7% increase. Six of the 20 cities reported higher price increases in the year ending October 2021 versus the year ending September 2021.

...

Before seasonal adjustment, the U.S. National Index posted a 0.8% month-over-month increase in October, while the 10-City and 20-City Composites both posted increases of 0.8%.

After seasonal adjustment, the U.S. National Index posted a month-over-month increase of 1.0%, and the 10-City and 20-City Composites posted increases of 0.8% and 0.9%, respectively.

In October, 18 of the 20 cities reported increases before seasonal adjustments while all 20 cities reported increases after seasonal adjustments

““In October 2021, U.S. home prices moved substantially higher, but at a decelerating rate,” says Craig J. Lazzara, Managing Director at S&P DJI. “The National Composite Index rose 19.1% from year-ago levels, and the 10- and 20-City Composites gained 17.1% and 18.4%, respectively. In all three cases, October’s gains were below September’s, and September’s gains were below August’s. That said, October’s 19.1% gain in the National Composite is the fourth-highest reading in the 34 years covered by our data. (The top three were the three months immediately preceding October.)”

emphasis added

Click on graph for larger image.

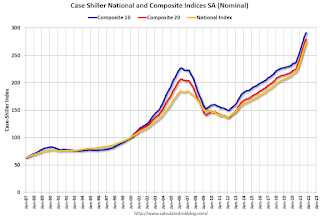

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is up 0.8% in October (SA).

The Composite 20 index is up 0.9% (SA) in October.

The National index is 48% above the bubble peak (SA), and up 1.0% (SA) in October. The National index is up 100% from the post-bubble low set in February 2012 (SA).

The second graph shows the year-over-year change in all three indices.

The second graph shows the year-over-year change in all three indices.The Composite 10 SA is up 17.1% year-over-year. The Composite 20 SA is up 18.4% year-over-year.

The National index SA is up 19.1% year-over-year.

Price increases were close to expectations. I'll have more later.

Monday, December 27, 2021

Tuesday: Case-Shiller and FHFA House Prices, Richmond Fed Mfg

by Calculated Risk on 12/27/2021 07:25:00 PM

From Matthew Graham at Mortgage News Daily: MBS RECAP: Bonds Sticking to Uneventful Script

Domestic traders were slightly better buyers despite another run to record highs in stocks. 10yr yields hit the 3pm close down just over 1bp (1.482). MBS were sideways at modestly stronger levels as well. [30 year fixed 3.27%]Tuesday:

emphasis added

• At 9:00 AM ET, FHFA House Price Index for October. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 9:00 AM, S&P/Case-Shiller House Price Index for October. The consensus is for a 18.5% year-over-year increase in the Composite 20 index for October.

• At 10:00 AM, Richmond Fed Survey of Manufacturing Activity for December. This is the last of regional manufacturing surveys for December.

And on COVID:

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 60.9% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 202.2 | --- | ≥2321 | |

| New Cases per Day3🚩 | 206,577 | 136,450 | ≤5,0002 | |

| Hospitalized3 | 56,466 | 61,362 | ≤3,0002 | |

| Deaths per Day3 | 1,041 | 1,164 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of positive tests reported.

Final Look at Local Housing Markets in November

by Calculated Risk on 12/27/2021 12:00:00 PM

Today, in the CalculatedRisk Real Estate Newsletter: Final Look at Local Housing Markets in November

Excerpt:

This update adds Charlotte, Columbus, Miami, New York, and Phoenix.You can subscribe at https://calculatedrisk.substack.com/ (Currently all content is available for free, but please subscribe).

...

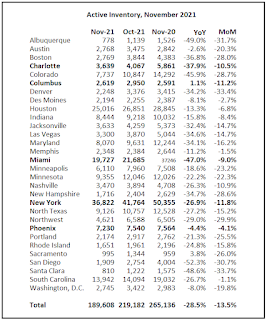

Here is a summary of active listings for these housing markets in November. Inventory was down 13.5% in November month-over-month (MoM) from October, and down 28.5% year-over-year (YoY).

Inventory almost always declines seasonally in November, so the MoM decline is not a surprise. Last month, these markets were down 25.5% YoY, so the YoY decline in November is larger than in October. This isn’t indicating a slowing market and suggests we will see new record low inventory levels this Winter.

Housing Inventory December 27th Update: Inventory Down 4.8% Week-over-week; Near Record Low

by Calculated Risk on 12/27/2021 09:49:00 AM

Tracking existing home inventory is very important in 2022.

Inventory usually declines sharply over the holidays - so we will likely see new record lows next week.

This inventory graph is courtesy of Altos Research.

Seven High Frequency Indicators for the Economy

by Calculated Risk on 12/27/2021 08:23:00 AM

These indicators are mostly for travel and entertainment. It is interesting to watch these sectors recover as the pandemic subsides.

The TSA is providing daily travel numbers.

This data is as of December 25th.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Blue) and 2021 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is down 17.1% from the same day in 2019 (82.9% of 2019). (Dashed line)

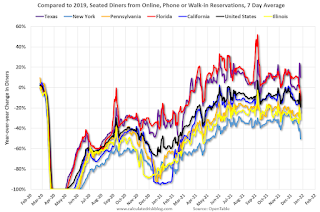

The second graph shows the 7-day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through December 25, 2021.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Note that this data is for "only the restaurants that have chosen to reopen in a given market". Since some restaurants have not reopened, the actual year-over-year decline is worse than shown.

Dining was mostly moving sideways, but there has been a significant decline recently, probably due to the winter wave of COVID. The 7-day average for the US is down 19% compared to 2019.

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $418 million last week, down about 5% from the median for the week.

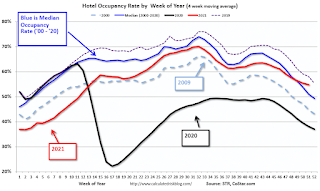

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average. The red line is for 2021, black is 2020, blue is the median, dashed purple is 2019, and dashed light blue is for 2009 (the worst year on record for hotels prior to 2020).

This data is through December 18th. The occupancy rate was up 8.0% compared to the same week in 2019. Although down compared to 2019, the 4-week average of the occupancy rate is now above the median rate for the previous 20 years (Blue).

Notes: Y-axis doesn't start at zero to better show the seasonal change.

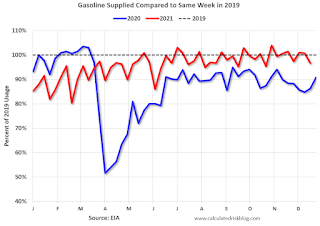

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.Blue is for 2020. Red is for 2021.

As of December 17th, gasoline supplied was down 3.4% compared to the same week in 2019.

There have been 12 weeks this year that gasoline supplied was up compared to the same week in 2019 - so consumption is running close to 2019 levels now.

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

There is also some great data on mobility from the Dallas Fed Mobility and Engagement Index. However the index is set "relative to its weekday-specific average over January–February", and is not seasonally adjusted, so we can't tell if an increase in mobility is due to recovery or just the normal increase in the Spring and Summer.

This data is through December 25th

This data is through December 25th The graph is the running 7-day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7-day average for the US is at 83% of the January 2020 level.

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider.

This graph is from Todd W Schneider. This data is through Friday, December 24th.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Sunday, December 26, 2021

Sunday Night Futures

by Calculated Risk on 12/26/2021 06:13:00 PM

Weekend:

• Schedule for Week of December 26, 2021

Monday:

• At 10:30 AM ET, Dallas Fed Survey of Manufacturing Activity for December.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 and DOW futures are up slightly (fair value).

Oil prices were up over the last week with WTI futures at $73.79 per barrel and Brent at $76.14 per barrel. A year ago, WTI was at $48, and Brent was at $51 - so WTI oil prices are up 50% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.25 per gallon. A year ago prices were at $2.24 per gallon, so gasoline prices are up $1.01 per gallon year-over-year.

Question #10 for 2022: Will inventory increase as the pandemic subsides, or will inventory decrease further in 2022?

by Calculated Risk on 12/26/2021 11:59:00 AM

Today, in the Real Estate Newsletter: Question #10 for 2022: Will inventory increase as the pandemic subsides, or will inventory decrease further in 2022?

Brief excerpt:

Earlier I posted some questions on my blog for next year: Ten Economic Questions for 2022. Some of these questions concern real estate (inventory, house prices, housing credit, housing starts, new home sales), and I’ll post those in the newsletter (others like GDP and employment will be on my blog).There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

I'm adding some thoughts, and maybe some predictions for each question.

...

And the sharp decline in inventory during the pandemic (green arrow) was an indicator that price appreciation would increase. Inventory declined due to a combination of potential sellers keeping their properties off the market during a pandemic, and a pickup in buying due to record low mortgage rates, a move away from multi-family rentals and strong second home buying (to escape the high-density cities). And at the same time, demographics were favorable for home buying (a large cohort has moved into the peak home buying years).

...

First, it appears we will see record low inventories over the next few months. This suggests we will see further strong price gains over the next several months (with low inventories).

In 2021, the NAR showed inventory bottomed in January and (inventory bottoms in December), however the local MLS data, and the Altos Research data, showed inventory bottomed even later than usual - in March or early April 2021. If 2022 follows the normal seasonal pattern, we will see inventory increasing by February (and maybe even in January).

The timing of the seasonal bottom will be important this year. If inventory bottoms seasonally in December, we might see inventory increase YoY later in 2022. However, if inventory doesn't bottom until March or April, we will probably see another crazy year with little inventory.

Saturday, December 25, 2021

Real Estate Newsletter Articles this Week

by Calculated Risk on 12/25/2021 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

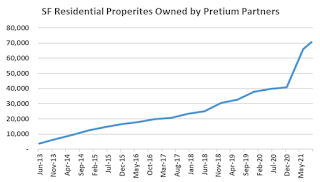

• Lawler: More on Investor Purchases of Residential Homes: Pretium

• New Home Sales: Record 110 thousand homes have not been started New Home Prices Are Up 20% Year-over-year

• Existing-Home Sales Increased to 6.46 million in November Inventory down 13.3% year-over-year

• 5th Look at Local Housing Markets in November

• Supply Chain Disruptions and Housing Inventory

This is usually published several times a week, and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/ Currently all content is available for free - and some will always be free - but please subscribe!.

Schedule for Week of December 26, 2021

by Calculated Risk on 12/25/2021 08:11:00 AM

Merry Christmas and Happy New Year! Wishing you all the best in 2022.

The key indicator this week is Case-Shiller House Prices for October.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for December.

9:00 AM: FHFA House Price Index for October. This was originally a GSE only repeat sales, however there is also an expanded index.

9:00 AM ET: S&P/Case-Shiller House Price Index for October.

9:00 AM ET: S&P/Case-Shiller House Price Index for October.This graph shows graph shows the Year over year change in the seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 18.5% year-over-year increase in the Composite 20 index for October.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for December. This is the last of regional manufacturing surveys for December.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: Pending Home Sales Index for November. The consensus is for a 0.6% increase in the index.

8:30 AM: The initial weekly unemployment claims report will be released. Initial claims were 205 thousand last week.

9:45 AM: Chicago Purchasing Managers Index for December.

No major economic releases scheduled. Markets will be open.

Friday, December 24, 2021

Lawler: More on Investor Purchases of Residential Homes: Pretium

by Calculated Risk on 12/24/2021 01:33:00 PM

Today, in the Real Estate Newsletter: Lawler: More on Investor Purchases of Residential Homes: Pretium

Brief excerpt:

“In a report last month, I wrote about how data from Redfin and CoreLogic indicated that there had been a surge in investor buying of SF homes in the second and third quarters of this year, with some of the biggest increases coming from “large” investors.You can subscribe at https://calculatedrisk.substack.com/

One private company that has massively increased its holdings of SF residential properties is Pretium Partners, a “specialized investment manager” with a huge portfolio of SF residential properties for rent. (Pretium owns Progress Residential, which has recently gotten some negative press.)

According to Pretium’s website, Pretium has increased the number of SF properties it owns from 41,000 at the end of 2020 to 70,700 at the end of September 2021.