by Calculated Risk on 11/01/2021 03:52:00 PM

Monday, November 01, 2021

November 1st COVID-19: New Cases per Day Increasing

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 58.0% | 57.4% | ≥70.0%1 | |

| Fully Vaccinated (millions) | 192.5 | 190.6 | ≥2321 | |

| New Cases per Day3🚩 | 71,207 | 62,858 | ≤5,0002 | |

| Hospitalized3 | 41,287 | 47,878 | ≤3,0002 | |

| Deaths per Day3 | 1,151 | 1,196 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID). Note: COVID will probably stay endemic (at least for some time).

The following 22 states have between 50% and 59.9% fully vaccinated: Minnesota at 59.9%, Delaware, Hawaii, Florida, Wisconsin, Nebraska, Iowa, Illinois, Michigan, Kentucky, South Dakota, Texas, Arizona, Kansas, Nevada, Alaska, Utah, North Carolina, Ohio, Montana, Oklahoma, and South Carolina at 50.0%.

Next up (total population, fully vaccinated according to CDC) are Indiana at 49.9%, Missouri at 49.8%, Georgia at 48.2%, and Arkansas at 48.0%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

The Rapid Increase in Rents Continues

by Calculated Risk on 11/01/2021 02:31:00 PM

Today, in the Real Estate Newsletter: The Rapid Increase in Rents Continues New Leases up Sharply year-over-year in September

Excerpt:

The Zillow measure is up 9.2% YoY in September, up from 8.4% YoY in August. And the ApartmentList measure is up 15.1% as of September, up from 12.5% in August. Both the Zillow measure (a repeat rent index), and ApartmentList are showing a sharp increase in rents.

...

Clearly rents are increasing sharply, and we should expect this to spill over into measures of inflation in 2022. The Owners Equivalent Rent (OER) was up 2.9% YoY in September, from 2.6% in August - and will increase further in the coming months.

Housing Inventory Nov 1st Update: Inventory Down 2.2% Week-over-week

by Calculated Risk on 11/01/2021 11:17:00 AM

Tracking existing home inventory will be very important this year.

This inventory graph is courtesy of Altos Research.

Construction Spending Decreased in September

by Calculated Risk on 11/01/2021 10:21:00 AM

From the Census Bureau reported that overall construction spending was "virtually unchanged":

Construction spending during September 2021 was estimated at a seasonally adjusted annual rate of $1,573.6 billion, 0.5 percent below the revised August estimate of $1,582.0 billion. The September figure is 7.8 percent above the September 2020 estimate of $1,459.3 billion.Both private and public spending decreased:

emphasis added

Spending on private construction was at a seasonally adjusted annual rate of $1,229.9 billion, 0.5 percent below the revised August estimate of $1,236.1 billion. ...

In September, the estimated seasonally adjusted annual rate of public construction spending was $343.7 billion, 0.7 percent below the revised August estimate of $345.9 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Residential spending is 14% above the bubble peak (in nominal terms - not adjusted for inflation).

Non-residential spending is 10% above the bubble era peak in January 2008 (nominal dollars), but has been weak recently.

Public construction spending is 6% above the peak in March 2009, but weak recently.

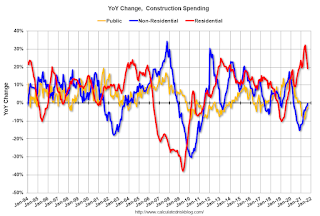

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 19.3%. Non-residential spending is down 0.5% year-over-year. Public spending is down 2.4% year-over-year.

Construction was considered an essential service during the early months of the pandemic in most areas, and did not decline sharply like many other sectors. However, some sectors of non-residential have been under pressure. For example, lodging is down 32.8% YoY, and office down 2.9% YoY.

ISM® Manufacturing index decreased to 60.8% in October

by Calculated Risk on 11/01/2021 10:07:00 AM

(Posted with permission). The ISM manufacturing index indicated expansion in September. The PMI® was at 60.8% in October, down from 61.1% in September. The employment index was at 52.0%, up from 50.2% last month, and the new orders index was at 59.8%, down from 66.7%.

From ISM: Manufacturing PMI® at 61.1% October 2021 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector grew in October, with the overall economy achieving a 17th consecutive month of growth, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®.This was at expectations, and this suggests manufacturing expanded at a slightly slower pace in October than in September.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee:

“The October Manufacturing PMI® registered 60.8 percent, a decrease of 0.3 percentage point from the September reading of 61.1 percent. This figure indicates expansion in the overall economy for the 17th month in a row after a contraction in April 2020. The New Orders Index registered 59.8 percent, down 6.9 percentage points compared to the September reading of 66.7 percent. The Production Index registered 59.3 percent, a decrease of 0.1 percentage point compared to the September reading of 59.4 percent. The Prices Index registered 85.7 percent, up 4.5 percentage points compared to the September figure of 81.2 percent. The Backlog of Orders Index registered 63.6 percent, 1.2 percentage points lower than the September reading of 64.8 percent. The Employment Index registered 52 percent, 1.8 percentage points higher compared to the September reading of 50.2 percent. The Supplier Deliveries Index registered 75.6 percent, up 2.2 percentage points from the September figure of 73.4 percent. The Inventories Index registered 57 percent, 1.4 percentage points higher than the September reading of 55.6 percent. The New Export Orders Index registered 54.6 percent, an increase of 1.2 percentage points compared to the September reading of 53.4 percent. The Imports Index registered 49.1 percent, a 5.8-percentage point decrease from the September reading of 54.9 percent.”

emphasis added

Seven High Frequency Indicators for the Economy

by Calculated Risk on 11/01/2021 08:17:00 AM

These indicators are mostly for travel and entertainment. It will interesting to watch these sectors recover as the pandemic subsides.

The TSA is providing daily travel numbers.

This data is as of October 31st.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Blue) and 2021 (Red).

The dashed line is the percent of 2019 for the seven day average.

The 7-day average is down 17.8% from the same day in 2019 (82.2% of 2019). (Dashed line)

The second graph shows the 7-day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through October 30, 2021.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Note that this data is for "only the restaurants that have chosen to reopen in a given market". Since some restaurants have not reopened, the actual year-over-year decline is worse than shown.

Dining picked up for the Labor Day weekend, but declined after the holiday - but might be picking up a little again. The 7-day average for the US is down 4% compared to 2019.

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $112 million last week, down about 25% from the median for the week.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The red line is for 2021, black is 2020, blue is the median, dashed purple is 2019, and dashed light blue is for 2009 (the worst year on record for hotels prior to 2020).

This data is through October 23rd. The occupancy rate was down 9.1% compared to the same week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.Blue is for 2020. Red is for 2021.

As of October 22nd, gasoline supplied was down 4.7% compared to the same week in 2019.

There have been seven weeks so far this year when gasoline supplied was up compared to the same week in 2019 - and consumption is running close to 2019 levels now.

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

There is also some great data on mobility from the Dallas Fed Mobility and Engagement Index. However the index is set "relative to its weekday-specific average over January–February", and is not seasonally adjusted, so we can't tell if an increase in mobility is due to recovery or just the normal increase in the Spring and Summer.

This data is through October 28th

This data is through October 28th The graph is the running 7-day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7 day average for the US is at 114% of the January 2020 level.

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider.

This graph is from Todd W Schneider. This data is through Friday, October 29th.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Sunday, October 31, 2021

Monday: ISM Mfg, Construction Spending

by Calculated Risk on 10/31/2021 07:25:00 PM

Weekend:

• Schedule for Week of October 31, 2021

• FOMC Preview: Taper Announcement Expected

• 2022 Housing Forecasts: First Look Optimism on New Home Sales in 2022

Monday:

• At 10:00 AM ET, ISM Manufacturing Index for October. The consensus is for 60.5%, down from 61.1%.

• At 10:00 AM, Construction Spending for September. The consensus is for 0.4% increase in spending.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 6 and DOW futures are up 59 (fair value).

Oil prices were down over the last week with WTI futures at $82.84 per barrel and Brent at $83.05 per barrel. A year ago, WTI was at $36, and Brent was at $36 - so WTI oil prices are up more than double year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.38 per gallon. A year ago prices were at $2.10 per gallon, so gasoline prices are up $1.28 per gallon year-over-year.

2022 Housing Forecasts: First Look

by Calculated Risk on 10/31/2021 05:05:00 PM

Today, in the Newsletter: 2022 Housing Forecasts: First Look

Excerpt (there is much more):

The key in 2022 will be inventory. If inventory stays extremely low, there will be more housing starts and a larger increase in prices. However, if inventory increases significantly, there will be fewer starts and less price appreciation.

Towards the end of each year I collect some housing forecasts for the following year.

FOMC Preview: Taper Announcement Expected

by Calculated Risk on 10/31/2021 08:11:00 AM

Expectations are the FOMC will announce the tapering of assets purchases at the meeting this week.

From Goldman Sachs:

"The FOMC will announce the start of tapering next week, presumably at the $15bn per month pace noted in the September minutes. If implementation begins in mid-November, the last taper would come in June 2022. Large surprises on the virus, inflation, wage growth, or inflation expectations could prompt a revision, but we think the hurdle for a change in either direction is high."Analysts will also be looking for comments on inflation and possible rate hikes in 2022. Goldman Sachs now expects two rates hikes next year:

"We are pulling forward our forecast for the Fed’s first rate hike by one full year to July 2022, shortly after tapering is scheduled to conclude. We expect a second hike in November 2022 and two hikes per year after that."

Early Wall Street forecasts are for GDP to increase at a 5% to 6% annual rate in Q4 that would put Q4-over-Q4 at around 5.0% to 5.2% - so the FOMC projections for 2021 are now a little on the high side compared to Wall Street.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents, Change in Real GDP1 | ||||

|---|---|---|---|---|

| Projection Date | 2021 | 2022 | 2023 | 2024 |

| Sept 2021 | 5.8 to 6.0 | 3.4 to 4.5 | 2.2 to 2.5 | 2.0 to 2.2 |

| June 2021 | 6.8 to 7.3 | 2.8 to 3.8 | 2.0 to 2.5 | |

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents, Unemployment Rate2 | ||||

|---|---|---|---|---|

| Projection Date | 2021 | 2022 | 2023 | 2024 |

| Sept 2021 | 4.6 to 4.8 | 3.6 to 4.0 | 3.3 to 3.7 | 3.3 to 3.6 |

| June 2021 | 4.4 to 4.8 | 3.5 to 4.0 | 3.2 to 3.8 | |

The decline in the unemployment rate depends on both job growth, and the participation rate. A strong labor market will probably encourage people to return to the labor force, and the improvements in the unemployment rate might be slower than some expect.

As of September 2021, PCE inflation was up 4.4% from September 2020. This is just above the top end of the projected range for Q4.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents, PCE Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2021 | 2022 | 2023 | 2024 |

| Sept 2021 | 4.0 to 4.3 | 2.0 to 2.5 | 2.0 to 2.3 | 2.0 to 2.2 |

| June 2021 | 3.1 to 3.5 | 1.9 to 2.3 | 2.0 to 2.2 | |

PCE core inflation was up 3.6% in September year-over-year.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents, Core Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2021 | 2022 | 2023 | 2024 |

| Sept 2021 | 3.6 to 3.8 | 2.0 to 2.5 | 2.0 to 2.3 | 2.0 to 2.2 |

| June 2021 | 2.9 to 3.1 | 1.9 to 2.3 | 2.0 to 2.2 | |

Saturday, October 30, 2021

Real Estate Newsletter Articles this Week

by Calculated Risk on 10/30/2021 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Final Look: Local Housing Markets in September

• New Home Sales: Record 106 thousand homes have not been started

• Case-Shiller National Index up Record 19.8% Year-over-year in August The Deceleration is coming

• Real House Prices, Price-to-Rent Ratio and Price-to-Median Income in August And a look at "Affordability"

• Mortgage Rates Slowly Increasing The Fed is Expected to "Taper" Asset Purchases Starting Next Week

This will usually be published several times a week, and will provide more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/ Currently all content is available for free - and some will always be free - but please subscribe!.