by Calculated Risk on 10/15/2021 08:38:00 AM

Friday, October 15, 2021

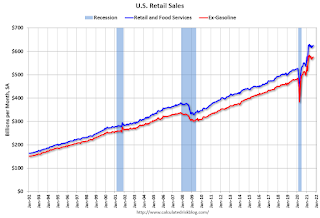

Retail Sales Increased 0.7% in September

On a monthly basis, retail sales were increased 0.7% from August to September (seasonally adjusted), and sales were up 13.9 percent from September 2020.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for September 2021, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $625.4 billion, an increase of 0.7 percent from the previous month, and 13.9 percent above September 2020. ... The July 2021 to August 2021 percent change was revised from up 0.7 percent to up 0.9 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 0.6% in September.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 12.1% on a YoY basis.

Retail and Food service sales, ex-gasoline, increased by 12.1% on a YoY basis.Sales in September were above expectations, and sales in July and August were revised up.

Thursday, October 14, 2021

Friday: Retail Sales, NY Fed Mfg

by Calculated Risk on 10/14/2021 08:01:00 PM

Friday:

• At 8:30 AM ET, Retail sales for September will be released. The consensus is for a 0.2% decrease in retail sales.

• Also at 8:30 AM, The New York Fed Empire State manufacturing survey for October. The consensus is for a reading of 27.0, down from 34.3.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Preliminary for October).

October 14th COVID-19: 42 Days till Thanksgiving; Need to Get Daily Cases Down Before Holidays

by Calculated Risk on 10/14/2021 07:08:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 56.7% | 56.1% | ≥70.0%1 | |

| Fully Vaccinated (millions) | 188.3 | 186.4 | ≥2321 | |

| New Cases per Day3 | 84,555 | 96,666 | ≤5,0002 | |

| Hospitalized3 | 56,817 | 64,388 | ≤3,0002 | |

| Deaths per Day3 | 1,241 | 1,434 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID).

The following 20 states have between 50% and 59.9% fully vaccinated: Minnesota at 59.0%, Pennsylvania, Hawaii, Delaware, Florida, Wisconsin, Nebraska, Iowa, Illinois, Michigan, Kentucky, South Dakota, Texas, Arizona, Kansas, Nevada, Alaska, Utah, North Carolina and Ohio at 51.0%.

Next up (total population, fully vaccinated according to CDC) are Montana at 49.3%, Indiana at 49.1%, Missouri at 48.9%, Oklahoma at 48.8% and South Carolina at 48.7%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

House Prices to National Average Wage Index

by Calculated Risk on 10/14/2021 01:07:00 PM

Today, in the Newsletter: House Prices to National Average Wage Index

Excerpt:

This graph shows the ratio of house price indexes divided by the National Average Wage Index (the Wage index for 2020 was released yesterday). This uses the annual average National Case-Shiller index since 1976 (and an estimate for 2021). ...Please subscribe!

As of 2021, house prices were well above the median historical ratio - and not far below the bubble peak.

Hotels: Occupancy Rate Down 9.6% Compared to Same Week in 2019

by Calculated Risk on 10/14/2021 10:40:00 AM

Note: Since occupancy declined sharply at the onset of the pandemic, CoStar is comparing to 2019.

Lifted by the long Columbus Day weekend, U.S. hotel performance rose to a level similar to late summer, according to STR‘s latest data through October 9.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

October 3-9, 2021 (percentage change from comparable week in 2019*):

• Occupancy: 63.9% (-9.6%)

• Average daily rate (ADR): US$134.63 (+2.4%)

• Revenue per available room (RevPAR): US$86.02 (-7.4%)

*Due to the steep, pandemic-driven performance declines of 2020, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2021, black is 2020, blue is the median, dashed purple is 2019, and dashed light blue is for 2009 (the worst year on record for hotels prior to 2020).

Weekly Initial Unemployment Claims Decrease to 293,000

by Calculated Risk on 10/14/2021 08:36:00 AM

The DOL reported:

In the week ending October 9, the advance figure for seasonally adjusted initial claims was 293,000, a decrease of 36,000 from the previous week's revised level. This is the lowest level for initial claims since March 14, 2020 when it was 256,000. The previous week's level was revised up by 3,000 from 326,000 to 329,000. The 4-week moving average was 334,250, a decrease of 10,500 from the previous week's revised average. This is the lowest level for this average since March 14, 2020 when it was 225,500. The previous week's average was revised up by 750 from 344,000 to 344,750.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 334,250.

The previous week was revised up.

Regular state continued claims decreased to 2,593,000 (SA) from 2,727,000 (SA) the previous week.

Weekly claims were lower than the consensus forecast.

Wednesday, October 13, 2021

Thursday: Unemployment Claims, PPI

by Calculated Risk on 10/13/2021 08:14:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 315 thousand initial claims, down from 326 thousand last week.

• Also at 8:30 AM, The Producer Price Index for September from the BLS. The consensus is for a 0.6% increase in PPI, and a 0.5% increase in core PPI.

October 13th COVID-19: Progress

by Calculated Risk on 10/13/2021 05:09:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 56.6% | 56.1% | ≥70.0%1 | |

| Fully Vaccinated (millions) | 187.9 | 186.4 | ≥2321 | |

| New Cases per Day3 | 86,181 | 97,773 | ≤5,0002 | |

| Hospitalized3 | 57,734 | 65,668 | ≤3,0002 | |

| Deaths per Day3 | 1,252 | 1,452 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID).

The following 20 states have between 50% and 59.9% fully vaccinated: Minnesota at 58.9%, Pennsylvania, Hawaii, Delaware, Florida, Wisconsin, Nebraska, Iowa, Illinois, Michigan, Kentucky, South Dakota, Texas, Arizona, Kansas, Nevada, Alaska, Utah, North Carolina and Ohio at 51.0%.

Next up (total population, fully vaccinated according to CDC) are Montana at 49.3%, Indiana at 49.1%, Missouri at 48.7%, Oklahoma at 48.6% and South Carolina at 48.5%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

FOMC Minutes: "the process of tapering could commence ... in either mid-November or mid-December"

by Calculated Risk on 10/13/2021 02:05:00 PM

From the Fed: FOMC Minutes, Minutes of the Federal Open Market Committee, September 21–22, 2021. Excerpt on asset purchases:

A number of participants assessed that the standard of substantial further progress toward the goal of maximum employment had not yet been attained but that, if the economy proceeded roughly as they anticipated, it may soon be reached. On the basis of the cumulative performance of the labor market since December 2020, a number of other participants indicated that they believed that the test of "substantial further progress" toward maximum employment had been met. Some of these participants also suggested that labor supply constraints were the main impediments to further improvement in labor market conditions rather than lack of demand. They noted that adding monetary policy accommodation at this time would not address such constraints or that the costs of continuing asset purchases might be beginning to exceed their benefits. All participants agreed that it would be appropriate for the current meeting's postmeeting statement to relay the Committee's judgment that, if progress continued broadly as expected, a moderation in the pace of asset purchases may soon be warranted.

Participants also expressed their views on how slowing in the pace of purchases might proceed. In particular, participants commented on an illustrative path, developed by the staff and reflecting participants' discussions at the Committee's July meeting, that gave the speed and composition associated with a tapering of asset purchases. The illustrative tapering path was designed to be simple to communicate and entailed a gradual reduction in the pace of net asset purchases that, if begun later this year, would lead the Federal Reserve to end purchases around the middle of next year. The path featured monthly reductions in the pace of asset purchases, by $10 billion in the case of Treasury securities and $5 billion in the case of agency mortgage-backed securities (MBS). Participants generally commented that the illustrative path provided a straightforward and appropriate template that policymakers might follow, and a couple of participants observed that giving advance notice to the general public of a plan along these lines may reduce the risk of an adverse market reaction to a moderation in asset purchases. Participants noted that, in keeping with the outcome-based standard for initiating a tapering of asset purchases, the Committee could adjust the pace of the moderation of its purchases if economic developments were to differ substantially from what they expected. Several participants indicated that they preferred to proceed with a more rapid moderation of purchases than described in the illustrative examples.

No decision to proceed with a moderation of asset purchases was made at the meeting, but participants generally assessed that, provided that the economic recovery remained broadly on track, a gradual tapering process that concluded around the middle of next year would likely be appropriate. Participants noted that if a decision to begin tapering purchases occurred at the next meeting, the process of tapering could commence with the monthly purchase calendars beginning in either mid-November or mid-December.

emphasis added

3rd Look at Local Housing Markets in September

by Calculated Risk on 10/13/2021 01:18:00 PM

Today, in the Newsletter: 3rd Look at Local Housing Markets in September

This update adds data for Albuquerque, Atlanta, Colorado, Georgia, Jacksonville, Minnesota, New Hampshire, Portland, and South Carolina (Bold in tables).

Excerpt:

One of the key factors for house prices is supply, and tracking local inventory reports will help us understand what is happening with supply.Please subscribe!

...

Here is a summary of active listings for these housing markets in September. For the these markets, inventory was down 1.7% in September MoM from August, and down 27.8% YoY.