by Calculated Risk on 10/13/2021 11:18:00 AM

Wednesday, October 13, 2021

Cleveland Fed: Median CPI and Trimmed-mean CPI both increased 0.5% in September

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.5% in September. The 16% trimmed-mean Consumer Price Index also increased 0.5% in September. "The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report".

Note: The Cleveland Fed released the median CPI details for September here. "Fuel oil and other fuels" were up 44% annualized.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation.

Cost of Living Adjustment increases 5.9% in 2022, Contribution Base increased to $147,000

by Calculated Risk on 10/13/2021 08:55:00 AM

With the release of the CPI report this morning, we now know the Cost of Living Adjustment (COLA), and the contribution base for 2022.

From Social Security: Social Security Announces 5.9 Percent Benefit Increase for 2022

Social Security and Supplemental Security Income (SSI) benefits for approximately 70 million Americans will increase 5.9 percent in 2022, the Social Security Administration announced today.Currently CPI-W is the index that is used to calculate the Cost-Of-Living Adjustments (COLA). Here is a discussion from Social Security on the current calculation (5.9% increase) and a list of previous Cost-of-Living Adjustments.

The 5.9 percent cost-of-living adjustment (COLA) will begin with benefits payable to more than 64 million Social Security beneficiaries in January 2022. Increased payments to approximately 8 million SSI beneficiaries will begin on December 30, 2021. (Note: some people receive both Social Security and SSI benefits). The Social Security Act ties the annual COLA to the increase in the Consumer Price Index as determined by the Department of Labor’s Bureau of Labor Statistics.

Some other adjustments that take effect in January of each year are based on the increase in average wages. Based on that increase, the maximum amount of earnings subject to the Social Security tax (taxable maximum) will increase to $147,000 from $142,800.

The contribution and benefit base will be $147,000 in 2022.

The National Average Wage Index increased to $55,628.60 in 2020, up 2.83% from $54,099.99 in 2019 (used to calculate contribution base).

BLS: CPI increased 0.4% in September, Core CPI increased 0.2%

by Calculated Risk on 10/13/2021 08:31:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.4 percent in September on a seasonally adjusted basis after rising 0.3 percent in August, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 5.4 percent before seasonal adjustment.CPI was above expectations, and core CPI was below expectations. I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

The indexes for food and shelter rose in September and together contributed more than half of the monthly all items seasonally adjusted increase. The index for food rose 0.9 percent, with the index for food at home increasing 1.2 percent. The energy index increased 1.3 percent, with the gasoline index rising 1.2 percent.

The index for all items less food and energy rose 0.2 percent in September, after increasing 0.1 percent in August. Along with the index for shelter, the indexes for new vehicles, household furnishings and operations, and motor vehicle insurance also rose in September. The indexes for airline fares, apparel, and used cars and trucks all declined over the month.

The all items index rose 5.4 percent for the 12 months ending September, compared to a 5.3-percent rise for the period ending August. The index for all items less food and energy rose 4.0 percent over the last 12 months, the same increase as the period ending August. The energy index rose 24.8 percent over the last 12 months, and the food index increased 4.6 percent over that period.

emphasis added

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 10/13/2021 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 0.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending October 8, 2021.

... The Refinance Index decreased 1 percent from the previous week and was 16 percent lower than the same week one year ago. The seasonally adjusted Purchase Index increased 2 percent from one week earlier. The unadjusted Purchase Index increased 2 percent compared with the previous week and was 10 percent lower than the same week one year ago.

“Mortgage rates reached their highest level since June 2021, but application activity changed little this week. An increase in home purchase applications offset a slight decline in refinances,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “The increase in purchase applications was welcome news, but was primarily driven by a 2 percent gain in conventional purchase applications, which kept the average loan size elevated.”

Added Kan, “The 30-year fixed rate reached 3.18 percent last week and has risen 15 basis points over the past month, resulting in an 11 percent drop in refinance applications during this time. Government refinance applications fell over 3 percent last week, driven by a decline in FHA refinances and an 8-basis point increase in the average FHA mortgage rate. We continue to expect weakening refinance activity as rates move higher and borrowers see less of a rate incentive.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($548,250 or less) increased to 3.18 percent from 3.14 percent, with points increasing to 0.37 from 0.35 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

With low rates, the index remains elevated - but the recent bump in rates has slowed activity.

The second graph shows the MBA mortgage purchase index

According to the MBA, purchase activity is down 10% year-over-year unadjusted.

According to the MBA, purchase activity is down 10% year-over-year unadjusted.Note: The year ago comparisons for the unadjusted purchase index are now difficult since purchase activity was strong in the second half of 2020.

Note: Red is a four-week average (blue is weekly).

Tuesday, October 12, 2021

Wednesday: CPI, FOMC Minutes

by Calculated Risk on 10/12/2021 08:00:00 PM

From Matthew Graham at Mortgage News Daily: MBS RECAP: Bonds Improve After Treasury Auction; Why MBS Are Lagging

Bonds began the day weaker, but improved steadily after the 10yr Treasury auction. MBS underperformed--partly because the Treasury auction brings more direct benefit for Treasuries, but for a few other reasons as well. [30 year fixed 3.20%]Wednesday:

emphasis added

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, The Consumer Price Index for September from the BLS. The consensus is for a 0.3% increase in CPI, and a 0.3% increase in core CPI.

• At 2:00 PM, FOMC Minutes, Meeting of September 21-22, 2021

October 12th COVID-19: 7-Day Average Cases Down Almost 50% from Recent Peak

by Calculated Risk on 10/12/2021 03:57:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 56.5% | 56.0% | ≥70.0%1 | |

| Fully Vaccinated (millions) | 187.7 | 186.1 | ≥2321 | |

| New Cases per Day3 | 85,196 | 99,238 | ≤5,0002 | |

| Hospitalized3 | 58,573 | 66,984 | ≤3,0002 | |

| Deaths per Day3 | 1,293 | 1,453 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID).

The following 21 states have between 50% and 59.9% fully vaccinated: California at 59.9%, Minnesota, Hawaii, Pennsylvania, Delaware, Florida, Wisconsin, Texas, Nebraska, Iowa, Illinois, Michigan, Kentucky, South Dakota, Arizona, Kansas, Nevada, Alaska, Utah, North Carolina and Ohio at 50.9%.

Next up (total population, fully vaccinated according to CDC) are Montana at 49.1%, Indiana at 49.0%, Missouri at 48.7%, Oklahoma at 48.6% and South Carolina at 48.5%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

Second Home Market: South Lake Tahoe in September

by Calculated Risk on 10/12/2021 02:31:00 PM

Early this year, from Jann Swanson at MortgageNewsDaily: Fannie Warns Lenders on Investment Properties and 2nd Homes.

I'm looking at data for some second home markets - and will track those markets to see if there is an impact from the lending changes.

This graph is for South Lake Tahoe since 2004 through September 2021, and shows inventory (blue), and the year-over-year (YoY) change in the median price (12 month average).

Note: The median price is distorted by the mix, but this is the available data.

Following the housing bubble, prices declined for several years in South Lake Tahoe, with the median price falling about 50% from the bubble peak.

Currently inventory is still very low, but solidly above the record low set six months ago, and prices are up sharply YoY.

Will House Prices Increase "a further 16% by the end of 2022"?

by Calculated Risk on 10/12/2021 12:27:00 PM

Today, in the Newsletter: Will House Prices Increase "a further 16% by the end of 2022"?

Excerpt:

Yesterday, Goldman Sachs economist Ronnie Walker wrote a research note forecasting US house prices would increase a further 16% by the end of 2022: The Housing Shortage: Prices, Rents, and Deregulation. This caused quite a stir on twitter.Please subscribe!

...

First, this is a projection for the end of next year. The most recent Case-Shiller report was for July, so this projection is for 17 months. This forecast is for an average of about 0.9% per month, well below the 1.5% per month average over the last year.

Here is what the forecast would look like:

BLS: Job Openings Decrease to 10.4 Million in August

by Calculated Risk on 10/12/2021 10:07:00 AM

From the BLS: Job Openings and Labor Turnover Summary

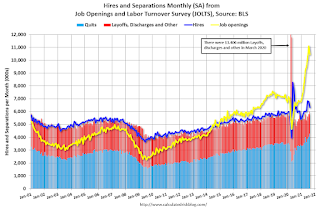

The number of job openings declined to 10.4 million on the last business day of August following a series high in July, the U.S. Bureau of Labor Statistics reported today. Hires decreased to 6.3 million while total separations were little changed at 6.0 million. Within separations, the quits rate increased to a series high of 2.9 percent while the layoffs and discharges rate was little changed at 0.9 percent.The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for August, the most recent employment report was for September.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are usually pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

The huge spike in layoffs and discharges in March 2020 are labeled, but off the chart to better show the usual data.

Jobs openings decreased in August to 10.439 million from 11.098 million in July.

The number of job openings (yellow) were up 62% year-over-year.

Quits were up 43% year-over-year to a new record high. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Monday, October 11, 2021

Tuesday: Job Openings

by Calculated Risk on 10/11/2021 06:52:00 PM

Tuesday:

• At 6:00 AM ET, NFIB Small Business Optimism Index for September.

• At 10:00 AM, Job Openings and Labor Turnover Survey for August from the BLS.